Why Your Paper Logbook Isn’t Enough: In today’s rapidly evolving and tech-driven world, relying on paper logbooks for AIS (Accounting Information System) compliance is a serious disadvantage. Whether you’re in finance, healthcare, manufacturing, or any highly regulated industry, sticking to paper slows things down, creates errors, and puts your organization at risk of penalties. Switching to a digital AIS compliance audit trail isn’t just a handy upgrade—it’s a critical move for staying efficient, accurate, and compliant. This article breaks down why paper logbooks fall short, and how digital audit trails provide a smarter, more secure, and faster way to manage compliance. It’s written plainly enough for a 10-year-old to understand, yet rich enough with expert insights for professionals aiming to master compliance in today’s digital age.

Table of Contents

Why Your Paper Logbook Isn’t Enough

The bottom line: paper logbooks no longer meet modern AIS compliance demands. Digital audit trails are faster, more accurate, secure, and cost-effective—making it easier to stay compliant, avoid fines, and adapt quickly to evolving regulations. The time to ditch paper and embrace digital compliance is now. Your auditors, your team, and your bottom line will feel the difference.

| Topic | Details |

|---|---|

| Paper Logbook Problems | Prone to human error, lost records, slow audits, expensive storage |

| Digital Audit Trail Benefits | Real-time updates, accuracy, security, audit readiness |

| Efficiency Improvements | Up to 75% reduction in audit prep time; 60% lower penalties |

| Compliance Statistics | Digital systems reduce errors by 75%, speed up data retrieval |

| Implementation Tips | Set policies, automate data capture, train teams, review regularly |

Why Your Paper Logbook Isn’t Enough?

Slow, Error-Prone, and Vulnerable

Paper logbooks have long been a mainstay. But the truth is, they come with major drawbacks. Writing by hand invites skipped information, illegible entries, and lost records. For auditors, deciphering this mess drains time and creates doubt about compliance. Worse, paper documents are easy to lose, damage, or alter—sometimes intentionally, which undermines trust and opens organizations to penalties. The FDA and other regulators keep calling out paper records for these exact reasons, often issuing warning letters that lead to heavy fines. When your compliance team is stuck rifling through binders looking for data, it can delay big decisions and put your operation at risk.

Hidden and Ongoing Costs

While paper may seem cheap upfront, the reality is quite different. Printing, physical storage, filing, and administrative labor add up quickly. Studies by TrailApp reveal companies waste thousands of productive hours annually simply managing paper-based audits. Plus, the more dispersed and complex your operation, the harder and costlier these paper logs become—jeopardizing deadlines, and costing you more in compliance struggles and penalties over time.

What Is a Digital AIS Compliance Audit Trail?

At its core, a digital AIS audit trail is an automated, electronic system that captures every detail of your compliance activities. Every form filled, document uploaded, approval given, and change made is logged automatically with a timestamp, user info, and action details. This audit trail is stored securely — typically in the cloud or protected internal servers — and can’t be altered without leaving visible records. The result? A transparent, trustworthy, and searchable history that helps your team quickly demonstrate compliance and spot issues proactively.

The Top Benefits of Going Digital

Instant Alerts and Real-Time Visibility

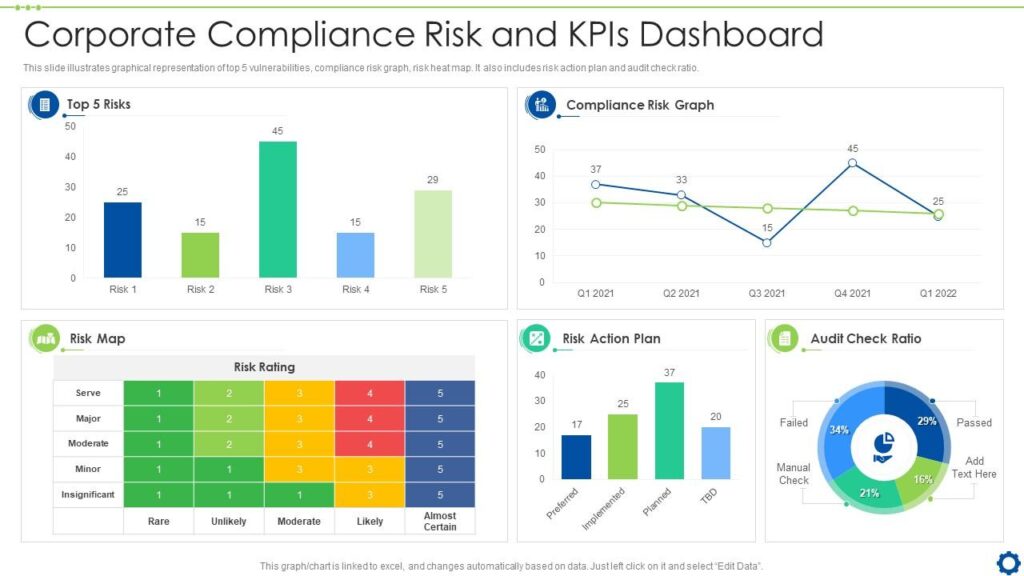

One of the biggest perks is real-time monitoring. Digital audit systems watch your compliance activities live, so if something strange or unauthorized pops up, you’ll be notified immediately. This means issues can be stopped before turning into costly fines or operational shutdowns. AI-driven compliance tools reduce response times by up to 50% and detect fraud 40% faster compared to manual processes.

Reduced Errors, Better Data Quality

Manual data entry always invites mistakes: typos, missing fields, or overwritten data. Digital audit logs auto-validate entries, flag missing information, and enforce standardized formats, reducing errors by up to 85%. Plus, features like mandatory fields and drop-down options make capturing consistent, complete data easier for every user.

Faster, More Efficient Audits

When the auditors show up, digital records simplify and shorten the process. Automated reports with easy-to-search dashboards can cut audit preparations by up to 75%, drastically reducing the workload on your compliance team. This means more time for strategic tasks, and less time buried in paperwork.

Enhanced Regulatory Compliance

Regulators increasingly expect electronic, tamper-proof records. Digital trails provide irrefutable proof of policy adherence, shielding you from legal risks and hefty fines. They also help you comply with multiple frameworks like SOX, HIPAA, or GDPR, often exceeding manual process standards.

Cost Savings and Sustainability

Going digital sharply cuts printing and filing costs. It also cuts down on physical storage space and protects you from loss during disasters. Last but not least, it’s a greener solution, reducing paper consumption and supporting corporate environmental goals.

Stronger Security and Data Integrity

With digital audit trails, security features like encryption, role-based access, and tamper-evident logging protect your data. Unlike paper records, which can be altered without trace, digital tools ensure every change is recorded with proof of who made it—building trust in your compliance records.

How to Implement a Digital AIS Audit Trail Like a Pro?

Shifting from paper to digital requires planning and discipline—but success is easier than you think.

Step 1: Create Clear Policies and Define Scope

Identify exactly which compliance activities need to be tracked digitally. Set detailed policies around who can access or modify audit data, how long records are retained, and clearly define what constitutes a reportable event. Align these policies carefully with industry regulations such as SOX, HIPAA, or FDA requirements.

Step 2: Choose the Right Technology Platform

Look for solutions that automate data capture, enforce role-based security, integrate with your existing systems, and provide real-time monitoring. Consider cloud-based platforms for scalability and disaster recovery. Features like automatic timestamps and electronic signatures are essential.

Step 3: Train Your Team Thoroughly

Your compliance tools are only as good as your team’s proficiency. Deliver comprehensive, ongoing training on the importance of audit trails, system use, and regulatory standards. Promote a compliance-first culture where digital logging is viewed as part of day-to-day work, not an extra chore.

Step 4: Conduct Regular Reviews and Monitoring

Implement routine analysis of your audit trails to detect unusual activity and continuous improvement opportunities. Most digital systems offer dashboards and AI-powered anomaly detection. Use these insights to tighten procedures and strengthen controls proactively.

Step 5: Stay Updated on Regulatory Changes

Compliance is a moving target. Regularly review industry regulations and update your digital audit policies and technology settings accordingly to avoid becoming non-compliant.

Real-World Success: JPMorgan Chase’s Digital Transformation

JPMorgan Chase revolutionized compliance with its COin platform, digitizing audits and cutting legal review time by over 360,000 hours annually. The switch generated massive operational savings, rapid audit completion, and increased credibility with regulators—showing how powerful a digital audit trail can be for enterprise-grade compliance.

Bonus: Best Practices for Maximum Impact

- Immutable Logs: Use technologies like write-once-read-many (WORM) storage or cryptographic chaining to ensure logs can’t be deleted or altered undetectably.

- Standardized Timekeeping: Use consistent timestamps (UTC) across systems to avoid confusion during multi-site audits.

- Strict Role-Based Permissions: Limit log access and editing rights to authorized users only. This minimizes insider risks.

- Automated Retention Management: Automatically archive or delete records per policy schedules, cutting storage costs and ensuring compliance.

- Integrate with Security Operations: Align audit logs with overall cybersecurity frameworks for unified risk management and fast incident response.

The Digital Logbook: How to Create a Verifiable Audit Trail for AIS Compliance

State-by-State AIS Regulations: A Seaplane Pilot’s Compliance Guide

What is “AIS for AIS”? Fusing Compliance Tech and Aircraft Tracking