Visa & Mastercard Hit with Billion-Dollar Settlement: are you owed $2,000 or more? That question is lighting up inboxes and headlines across the country, especially for American small business owners who accepted card payments between 2004 and 2019. This settlement isn’t hype or a scam — it’s a legitimate, court-approved class action settlement involving some of the largest financial institutions in the world. And for merchants, it could mean a windfall of anywhere from a few hundred bucks to thousands — even $10,000 or more. This article breaks it all down in simple, actionable terms. Whether you’re a first-time entrepreneur, a seasoned operator, or a CPA trying to help your clients understand the situation, this guide gives you the full picture — with real facts, legal context, practical examples, and expert advice.

Table of Contents

Visa & Mastercard Hit with Billion-Dollar Settlement

The Visa and Mastercard swipe fee settlement was a major win for American businesses — especially small merchants who’ve long paid hidden costs just to accept payments. If your business processed credit card transactions from 2004 to 2019, you were likely entitled to a slice of this $5.54 billion pie — but only if you filed your claim in time. Whether you received $200 or $10,000+, this case highlights how understanding payment processing fees is no longer optional — it’s essential for business success. From this point forward, smart merchants will demand transparency, audit their payment terms, and stay alert for future legal developments. Even if the claim window has closed, the lessons remain crystal clear: what you don’t know about fees can hurt you — and cost you thousands.

| Topic | Details |

|---|---|

| Settlement Name | In re Payment Card Interchange Fee and Merchant Discount Antitrust Litigation |

| Total Settlement Amount | $5.54 billion (net minimum) to $6.24 billion (maximum) |

| Eligible Period | January 1, 2004 – January 25, 2019 |

| Eligible Parties | U.S. merchants that accepted Visa/Mastercard |

| Claim Deadline | February 4, 2025 (now closed) |

| Estimated Payments | $200 to $10,000+ depending on transaction volume |

| Official Website | www.paymentcardsettlement.com |

What Is the Visa & Mastercard Hit with Billion-Dollar Settlement About?

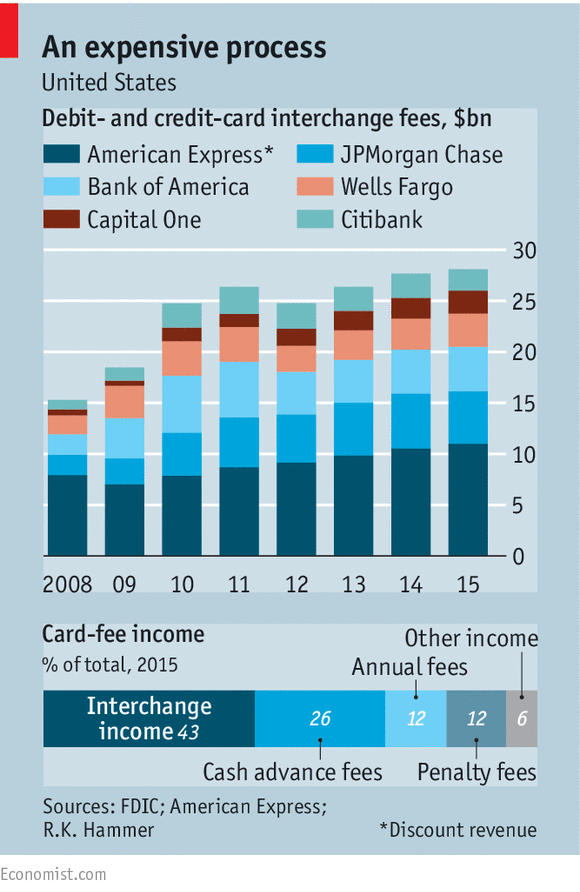

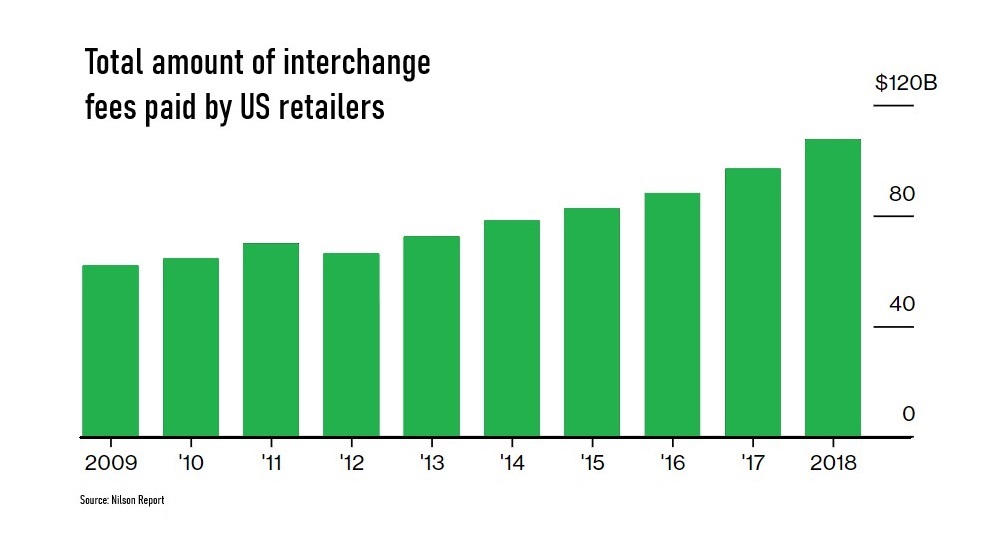

At the center of this landmark settlement is a long-running legal battle over interchange fees — also known as “swipe fees.” These are fees charged to merchants whenever a customer pays with a credit or debit card.

When you swipe a card at a register, a small percentage (often between 1.5% and 3%) is taken by the issuing bank and the card network (Visa or Mastercard). While this fee seems small, it adds up quickly — especially for high-volume businesses.

Back in 2005, a coalition of U.S. merchants filed a lawsuit against Visa, Mastercard, and several major banks (including JPMorgan Chase, Citigroup, and Bank of America). The plaintiffs alleged that these financial giants conspired to fix swipe fees, preventing merchants from negotiating better terms or using cheaper processing alternatives.

The lawsuit claimed this behavior violated U.S. antitrust laws, particularly the Sherman Antitrust Act, and unfairly inflated costs for millions of businesses across the country.

How the Visa & Mastercard Hit with Billion-Dollar Settlement Came to Be?

After nearly 15 years of litigation, hearings, and appeals, a settlement agreement was reached and finally approved in 2019 by the U.S. District Court for the Eastern District of New York. The result?

A massive $5.54 billion cash settlement, with potential to reach $6.24 billion based on reductions for merchants who opted out.

This made it one of the largest private antitrust class action settlements in U.S. history. The case has also led to further reforms and scrutiny of credit card industry practices, including additional regulatory review by the Department of Justice and the Federal Trade Commission.

Who Qualified for the Visa & Mastercard Hit with Billion-Dollar Settlement?

Merchants who accepted Visa or Mastercard between January 1, 2004, and January 25, 2019, were automatically included in the settlement class. That includes:

- Brick-and-mortar retailers

- Online sellers (eCommerce)

- Service-based businesses (law firms, contractors, consultants)

- Restaurants and cafes

- Freelancers and sole proprietors using mobile payment processors

- Nonprofits and religious organizations that processed donations via card

Even if your business is no longer active, you were still eligible to file a claim as long as you had transaction records from the eligible period.

The key requirement was filing a claim by the deadline: February 4, 2025. This could be done online through the official settlement portal.

How Much Could You Receive? A Deeper Look

There was no set amount — each merchant’s payout was determined proportionally based on the total dollar value of their Visa and Mastercard transactions during the class period. Here’s a rough breakdown:

- Businesses that processed under $100,000 total in card transactions: $200–$500

- Those processing $250,000–$500,000: $1,000–$3,000

- Businesses with $1 million or more in transactions: $5,000–$10,000+

- Large-scale enterprises: six-figure settlements were possible

Real Example:

A small family-owned grocery store in the Midwest that processed around $2 million in card transactions from 2005 to 2017 received $6,200 in settlement funds.

These funds were distributed pro rata — meaning if more merchants filed claims, the pot was divided among more parties, lowering individual payouts.

What About Businesses That Use Third-Party Processors?

Good news: businesses that accepted payments through Square, Stripe, Clover, PayPal, Toast, or Shopify Payments were also eligible — as long as they could access their processing records. In most cases, these platforms provided downloadable annual summaries that merchants used to file claims.

Even mobile-only operations or businesses that used manual card entry systems through phone apps could qualify, provided they had historical statements.

Where Did the Money Come From?

The payout fund was created from settlements with multiple defendants, including:

- Visa and Mastercard: the primary networks accused of fixing fees

- Major banks like JPMorgan, Bank of America, and Citigroup

- Card-issuing institutions that collaborated on fee standards

The fund was managed by a court-appointed claims administrator, and overseen by legal firms including Robbins Geller Rudman & Dowd LLP and Berger Montague PC, which represented the class of merchants.

The administrators reviewed claim forms, verified processing records, and determined final payout amounts based on available transaction history.

What If You Received the Money – Now What?

For those who successfully filed claims and received funds, here’s what to consider:

- Tax Reporting

Settlement payments are typically considered taxable income under IRS guidelines. Depending on your business structure, it should be reported under ordinary business income on your tax return. - Use the Funds Wisely

Many small businesses used the payout to offset:- Rising credit card processing fees

- Technology upgrades

- Short-term cash flow issues

- Debt repayment

- Keep a Paper Trail

Always maintain copies of your claim form, confirmation receipt, and payout statement. These may be needed for tax purposes or future legal questions.

Common Mistakes Merchants Made

Thousands of eligible merchants may have missed out due to:

- Ignoring or deleting official claim notices thinking they were spam

- Losing historical transaction records

- Believing their business was too small to qualify

- Missing the deadline

It’s estimated that tens of thousands of small businesses left money on the table due to lack of awareness.

How to Avoid Overpaying Swipe Fees in the Future?

This settlement brought national attention to just how much processing fees hurt business profitability. Here’s how you can protect yourself moving forward:

- Know your effective rate — that’s your total processing fees divided by gross card sales. Aim for below 2.5%.

- Request interchange-plus pricing — it’s more transparent than tiered pricing models.

- Avoid auto-renewing contracts with early termination penalties.

- Use flat-fee providers like Square or Stripe if you run a small or seasonal business.

- Negotiate with processors annually — especially if your volume increases.

Legal and Industry Impact of Visa & Mastercard Hit with Billion-Dollar Settlement

This case has already had ripple effects:

- Some banks have restructured fee agreements for enterprise clients.

- New merchant rights clauses are being added to processor contracts.

- The Durbin Amendment and ongoing legislative pressure in Congress aim to further limit excessive swipe fees on both credit and debit cards.

In the future, new class actions or regulatory caps on interchange fees may emerge — especially as card usage continues to rise post-COVID.

$2,000 Refunds Coming? Visa-Mastercard Class Action Settlement 2026 Explained

23andMe Data Breach Class Action Settlement – Apply to Claim $100-$10,000, Check Eligibility