VA COLA Increase 2026: The VA COLA Increase 2026 is officially set, and for veterans, surviving spouses, dependents, and others receiving VA benefits, this means one thing: a bit more money in your pocket every month. If you’re living on a fixed income, managing household bills, or helping a loved one navigate the VA system, understanding what this increase means — and how it affects you — is essential. In this guide, you’ll find everything you need to know about the 2026 VA cost-of-living adjustment (COLA) — including how much more you’ll receive, when payments start, who qualifies, and how it compares to previous years. We’ve also added practical tools to help you calculate your new payment and prepare your budget like a pro. Whether you’re a veteran or someone helping one, this article breaks down complex info into plain English, with plenty of real-life examples and trusted sources.

Table of Contents

VA COLA Increase 2026

The VA COLA Increase 2026 delivers a 2.8% boost in monthly compensation for millions of veterans and their families. It’s not just a number — it’s a lifeline to help offset the rising cost of food, gas, housing, and healthcare. This automatic increase ensures your benefits don’t fall behind as prices go up. If you’re receiving disability pay, survivor benefits, or VA pension — your new rate kicks in starting January 2026, and you won’t need to lift a finger to get it. Just be sure to check your bank account and confirm your information with the VA. Stay informed. Plan ahead. And make your benefits work for you.

| Topic | Details |

|---|---|

| COLA Rate (2026) | 2.8% |

| Effective Date | December 1, 2025 |

| First Payment With Increase | January 2026 |

| Who’s Eligible | Veterans receiving disability (10%+), TDIU, SMC, DIC, and VA pensions |

| Is Application Needed? | No — benefits are updated automatically |

| Why It Matters | Offsets inflation and rising cost of living |

| Official Info Source | www.va.gov |

What Is the COLA Increase and Why Is It Important?

The Cost-of-Living Adjustment (COLA) is a yearly increase in benefits meant to keep up with inflation. Prices for everyday things — like food, housing, gas, and healthcare — tend to rise year after year. If benefit payments stayed the same, they’d slowly lose value. That’s where COLA comes in.

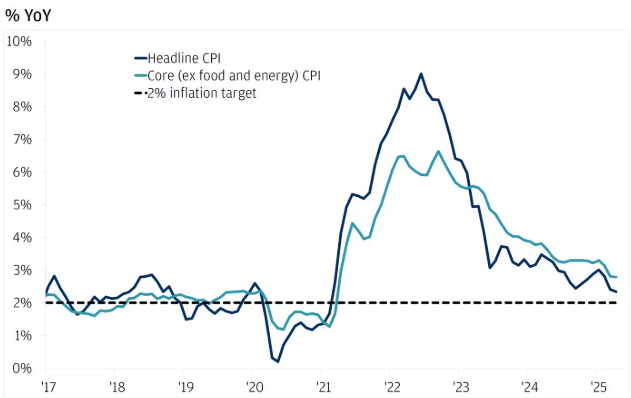

Each year, the Social Security Administration (SSA) calculates how much inflation has increased based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The VA then applies that same percentage increase to veterans’ benefits.

In 2026, the COLA increase is 2.8% — slightly higher than last year’s 2.6% but lower than the record-setting 8.7% increase in 2023.

If you’re receiving monthly benefits from the VA, this means you’ll see a 2.8% bump in your check starting January 2026, covering the December 2025 pay period.

Who Qualifies for the 2026 VA COLA Increase?

Here’s the good news: most veterans and beneficiaries don’t need to do anything to receive the COLA increase. The VA applies it automatically if you’re already receiving a qualifying benefit.

You’re eligible if you receive:

- VA Disability Compensation (rated 10% or higher)

- Special Monthly Compensation (SMC)

- Total Disability Individual Unemployability (TDIU)

- Dependency and Indemnity Compensation (DIC) for survivors

- VA Pension (income-based retirement benefit)

Even if you’re receiving multiple benefits, such as Social Security and VA disability, both will see the COLA increase applied.

Not eligible if:

- You have a 0% disability rating (which means you qualify for care but not monthly payments).

- You’ve not yet been awarded VA benefits. (Once approved, COLA increases will apply.)

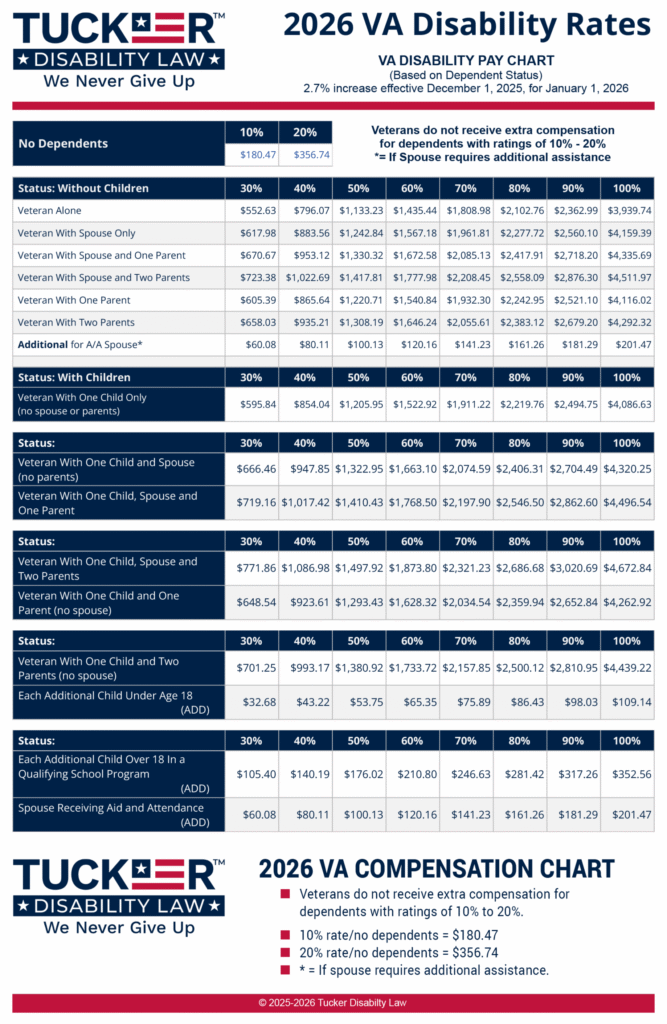

How Much More Will You Get?

Let’s look at how much more you’ll receive monthly with the 2.8% COLA increase.

| Disability Rating | 2025 Monthly Rate | 2026 Monthly Rate (Est.) |

|---|---|---|

| 10% | $175.42 | $180.34 |

| 30% | $524.31 | $539.99 |

| 50% | $1,041.82 | $1,070.99 |

| 70% | $1,716.28 | $1,764.34 |

| 90% | $2,172.39 | $2,233.23 |

| 100% | $3,737.85 | $3,842.52 |

These are estimates for single veterans with no dependents. If you have a spouse, children, or dependent parents, your monthly benefit will be higher. You can use the VA’s official calculator to see exact figures based on your situation at www.va.gov.

How to Calculate Your VA COLA Increase 2026? (Step-by-Step)

Want to know your exact payment? Use this simple formula:

Your Current Payment × 1.028 = New Payment (2026)

Example:

If your current payment is $1,800/month:

- $1,800 × 1.028 = $1,850.40

- Your new monthly amount will be approximately $1,850.40

This formula works for all types of VA monthly payments.

When Will You See the VA COLA Increase 2026?

The COLA increase is effective December 1, 2025, but you won’t see it until the January 2026 VA check, which pays out for the previous month.

VA Pay Schedule Example:

- December 2025 check (paid Jan 1, 2026) → reflects 2.8% increase

- February 2026 check → reflects new amount going forward

VA compensation is usually paid on the first business day of the month. If that day is a weekend or federal holiday, it may be paid the prior business day.

How Does This Compare to Previous Years?

| Year | COLA Rate |

|---|---|

| 2023 | 8.7% |

| 2024 | 3.2% |

| 2025 | 2.6% |

| 2026 | 2.8% |

The 2026 COLA is modest, but it’s still an important step in protecting your benefits from inflation. While 2023 saw a huge bump due to record-high inflation, recent years have returned to more typical increases in the 2–3% range.

How COLA Affects Other Benefits?

COLA isn’t just for VA disability payments — it affects many federal and military benefits, including:

- Social Security

- Military retirement pensions

- Civil Service Retirement (CSRS and FERS)

- Railroad Retirement

- SSI benefits

If you’re drawing from multiple programs (for example, VA disability + Social Security), you’ll see COLA increases across the board. Each program will apply the 2.8% increase independently.

VA COLA and Taxes

One of the best things about VA benefits is that they are not taxable. That includes:

- VA disability compensation

- Special Monthly Compensation (SMC)

- TDIU

- DIC for survivors

- VA pensions

So when your check goes up in 2026, you won’t owe Uncle Sam a dime of it.

Planning Ahead – Tips for Veterans and Families

A few smart moves can help you make the most of your 2026 COLA increase:

1. Update Your Direct Deposit Info

Make sure your payment details are current in your VA.gov account. Outdated banking info can delay your payments.

2. Download the Official 2026 VA Pay Chart

Use it for budgeting, tax planning, and explaining benefits to your spouse or caregiver. View the chart here

3. Check for Other Benefit Updates

Some veterans might be eligible for additional compensation for dependents or Aid & Attendance (A&A) benefits — which also get COLA bumps.

4. Reassess Your Disability Rating

Has your condition worsened? You may qualify for a higher disability rating, which means even more compensation on top of the COLA increase.

5. Create a Financial Safety Net

Even a modest monthly increase can help you start a small emergency fund, cover insurance premiums, or plan for medical expenses.

$1,800 IRS Direct Deposit in January 2026 – Who Is Eligible This Time

U.S. Minimum Wage Rises In 2026: Updated Hourly Pay From January 1