Tax Refunds Could Be Bigger in 2026: Tax season in 2026 isn’t your average year of forms and formulas — it’s a major opportunity for millions of Americans to bring home bigger refunds than usual. Why? Because new tax laws kicked in retroactively for 2025 income, and most folks overpaid. If you’re someone who loves seeing a fat refund check or just wants to stay ahead of the game, this guide is for you. We’ll break it all down with practical steps, real examples, and clear answers — no jargon, no stress. Whether you’re 10 or 60, this article will make taxes make sense.

Table of Contents

Tax Refunds Could Be Bigger in 2026

The 2026 tax season is a rare opportunity to score a bigger refund, reduce your taxable income, and make smart moves for your financial future. Thanks to retroactive tax law changes and new deductions, Americans who prepare ahead of time stand to benefit big. But don’t wait till April. Start now — gather your docs, log into your IRS account, and get familiar with the new rules. Filing early, opting for direct deposit, and protecting your identity with an IP PIN can make all the difference between a smooth season or a stressful one. This isn’t just about numbers — it’s about making your money work smarter. You earned it. Now make sure you get it back.

| Topic | Quick Takeaway |

|---|---|

| Why 2026 Refunds Could Be Bigger | Retroactive tax law changes caused over-withholding in 2025. Refunds expected to increase significantly. |

| Estimated Refund Boost | Households may receive $1,000–$2,000 more than usual. |

| IRS Filing Window | Returns expected to be accepted from late January to mid‑February 2026. |

| New Tax Breaks | Includes tip and overtime deductions, senior bonuses, auto loan interest, and expanded credits. |

| Direct Deposit | Recommended by the IRS for faster and safer refunds. |

| Identity Protection | IRS suggests using an IP PIN to reduce tax fraud risk. |

| Official Resource | IRS website: irs.gov |

Why Tax Refunds Could Be Bigger in 2026?

Let’s get right to the root of it: The One Big Beautiful Bill Act (OBBBA) was signed into law in mid‑2025. It made sweeping changes to the tax code — but the real kicker is that most of those changes apply retroactively to all of 2025. That means for the whole year, workers had more taxes withheld from their paychecks than they likely needed to.

The IRS didn’t update withholding tables fast enough, and most employers didn’t make payroll changes. So, come refund season in early 2026, many taxpayers will be in for a surprise — and a potentially big one.

How Much More Are We Talking?

Financial analysts at Piper Sandler and H&R Block project that average refunds could jump by $1,000 or more for many Americans. For middle-income families, that could even reach $2,000 depending on tax bracket, number of dependents, and other factors.

And unlike stimulus checks that were sent out automatically in previous years, these higher refunds will come only if you file your 2025 return correctly.

Key New Tax Breaks Helping Americans

Here’s what’s new — and potentially valuable — under the tax updates baked into the One Big Beautiful Bill Act:

1. Expanded Standard Deduction

The standard deduction — the amount you can subtract from your income before tax is applied — has been significantly increased. That means more of your earnings are tax-free.

- Single filers: Jumped from $13,850 to approximately $17,000

- Married filing jointly: Increased to around $34,000

2. ‘No Tax on Tips’ Deduction

If you work in hospitality or service and rely on tips, there’s big news: you can now deduct up to $25,000 of earned tip income from your taxable earnings. This means less tax owed and potentially a higher refund for servers, bartenders, valets, and others in tipped roles.

3. Overtime Pay Deduction

Overtime hours put in during 2025 may now qualify for a partial deduction. The IRS is expected to cap this deduction based on total hours and income thresholds, but the deduction is a first-of-its-kind benefit for hourly workers who hustle beyond 40 hours a week.

4. Senior Tax Bonus

If you’re 65 or older, you qualify for a Senior Deduction Bonus. This is on top of the standard deduction and is designed to help seniors keep more of their retirement and fixed-income dollars.

5. Auto Loan Interest Deduction

This one raised eyebrows: you may now deduct up to $10,000 in interest paid on a qualifying auto loan if the car is used for commuting or business-related purposes. This deduction is expected to benefit gig workers, delivery drivers, and commuters.

Tax Refunds Could Be Bigger in 2026 — Here’s Why That Matters

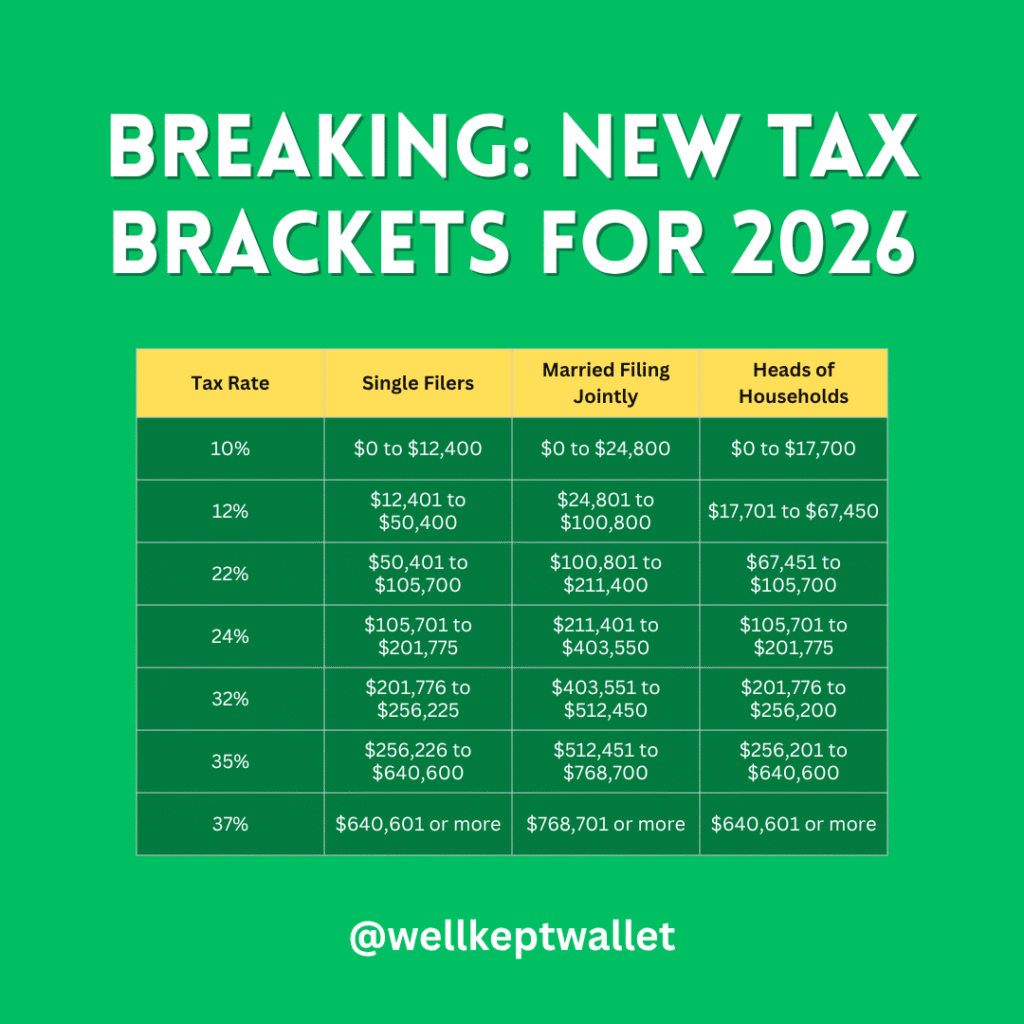

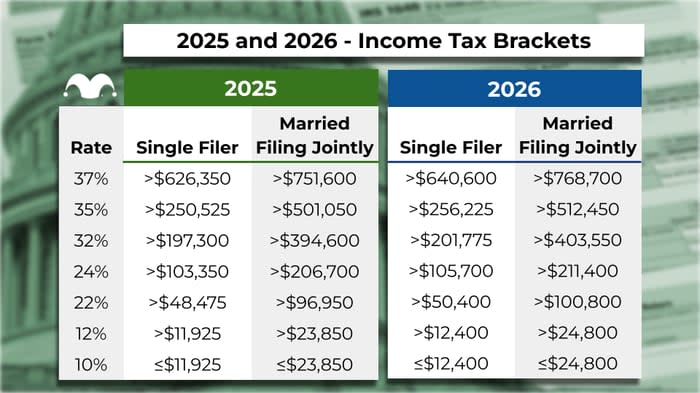

In addition to new deductions, the 2026 tax brackets — which determine how much tax you pay on different portions of your income — have also moved.

Here’s a simplified example of how it works:

- First $11,000 taxed at 10%

- Income from $11,001 to $44,725 taxed at 12%

- Income from $44,726 to $95,375 taxed at 22%

- And so on…

Because of inflation adjustments, more of your income falls into lower tax brackets, which means you’ll owe less overall and keep more money.

When Will the IRS Start Accepting 2026 Returns?

While the IRS hasn’t made an official announcement yet, tax experts predict the opening dates will mirror previous years:

- Late January 2026 – IRS begins accepting e‑filed returns

- Mid‑February 2026 – Refunds begin being issued for early filers

- April 15, 2026 – Standard filing deadline (unless extended)

To get your refund fast, file electronically and opt for direct deposit. The IRS reports that 9 out of 10 e‑filers with direct deposit receive refunds within 21 days.

How to Prepare for the Tax Refunds Could Be Bigger in 2026?

1. Gather the Right Documents Early

- W‑2 forms from all employers

- 1099 forms for freelance, dividends, or side gigs

- Bank interest statements, investment earnings

- Receipts for charitable donations

- Mortgage interest and student loan interest statements

- Proof of health insurance (Form 1095)

2. Set Up or Verify Your IRS Account

Creating an IRS.gov account gives you access to:

- Prior year AGI

- Your IRS payment history

- IP PIN setup (see below)

- IRS secure messaging

3. Protect Yourself With an Identity Protection PIN

Fraud is a growing issue during tax season. The IRS encourages all filers to apply for a six-digit IP PIN, which ensures no one can file a return using your identity.

4. Use IRS Withholding Estimator

If you don’t want a huge refund — or want to avoid owing — use the IRS Withholding Estimator to adjust your W‑4 for next year. This helps you get your paycheck dialed in just right.

5. Check for Charitable Giving Rules

Charitable deduction rules have changed too. You must now itemize to deduct charitable gifts — the $300 standard deduction addition for donations has expired. Make sure to keep records and donation receipts.

IRS Confirms $1,390 Direct Deposit Relief Payments – Check Eligibility Now

$1,800 IRS Direct Deposit in January 2026 – Who Is Eligible This Time

U.S. Minimum Wage Rises In 2026: Updated Hourly Pay From January 1