Syria Officially Adopts New Currency: Syria has officially adopted a new national currency starting January 1, 2026, replacing its heavily devalued Syrian pound with a redenominated version that removes two zeros. This marks one of the country’s most significant financial reforms in decades. Beyond a monetary makeover, it reflects Syria’s attempt to reestablish political and economic stability after the fall of the Assad regime. The move comes as Syrians try to navigate soaring prices, a broken banking system, and one of the worst humanitarian crises in modern history. The new currency promises simplified accounting, increased financial trust, and a break from political symbolism—replacing Assad’s portraits with national icons like wheat, roses, and ancient ruins.

Table of Contents

Syria Officially Adopts New Currency

The goodbye to the old Syrian pound is more than a technical shift—it’s a symbol of national reset. With a redesigned currency, simplified math, and a push toward digital finance, Syria is stepping cautiously into a new era. But the road ahead is long. Currency alone doesn’t rebuild nations—people, policies, and perseverance do. This bold move could spark a turnaround, or become another lost opportunity in a region that’s seen too many. One thing’s clear: the era of the bloated, broken pound is over—and Syria has turned the page.

| Feature | Details |

|---|---|

| Policy Change | Syria launched a new currency on January 1, 2026 |

| Redenomination | 100 old pounds = 1 new pound |

| New Banknotes | Assad-era imagery removed; nature and heritage symbols introduced |

| Transition Period | 90 days: old and new currency to circulate together |

| Symbolism | Represents a post-Assad national identity |

| Economic Goal | Restore monetary trust, simplify pricing, attract investment |

| Black Market Impact | Expected to shrink if reforms hold |

| Digital Push | Early steps toward mobile payments and QR-code systems |

| Official Source | Central Bank of Syria |

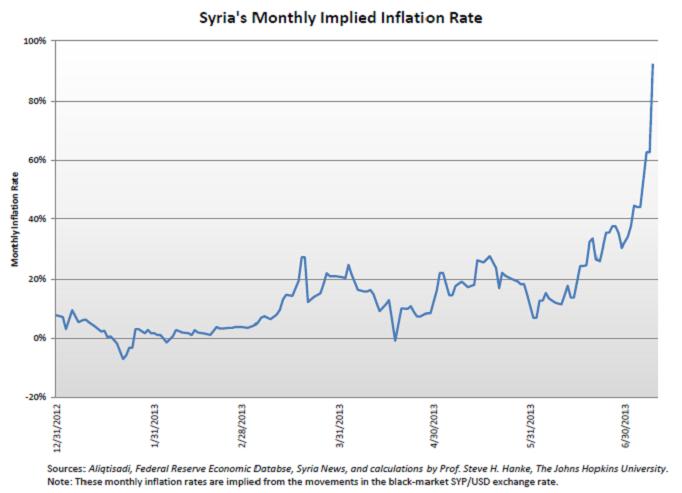

A Currency Collapse Years in the Making

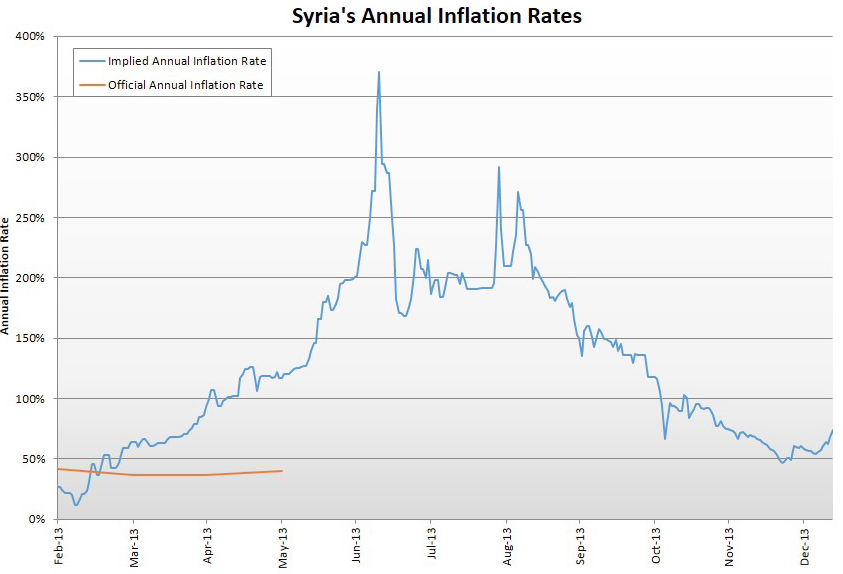

Let’s back up. The Syrian pound (SYP) wasn’t always worthless. In the 1990s, it was relatively stable, trading at around 47 SYP per USD. However, with the eruption of the civil war in 2011, the pound began its nosedive. By late 2025, it had fallen to over 15,000 SYP per USD in the black market, making it one of the most devalued currencies in the world.

Daily life became impossible. A middle-class salary barely covered a few days of groceries. School fees, medical supplies, and rent were priced in foreign currency, and everyday items were being bought using U.S. dollars or Turkish lira in border areas. The economy had become informal, unstable, and increasingly dollarized.

Out With the Old: From Dictators to National Symbols

The old currency carried with it more than economic baggage—it bore the face of Bashar al-Assad and his father, Hafez al-Assad, reinforcing decades of authoritarian rule. In a post-Assad era, those banknotes became unwelcome reminders of oppression.

The newly issued notes celebrate a different Syria. Instead of authoritarian faces, the new designs feature:

- Wheat fields and mulberry trees symbolizing agriculture

- Roman ruins and Islamic mosaics from Palmyra and Damascus

- Syria’s Mediterranean coastline and national birds

This rebranding of the currency serves a deeper purpose: to unify the population under shared heritage rather than political allegiance.

“Currency isn’t just a financial tool—it’s a message. And Syria is sending a message of renewal,” said Dr. Nour al-Azmeh, an economist and cultural historian based in Amman.

How Redenomination Works?

So, what does dropping two zeros mean?

100 old Syrian pounds = 1 new Syrian pound. This means if you had 1,000,000 old pounds, you now have 10,000 in the new system.

The goal of redenomination is to:

- Make transactions more manageable

- Reduce confusion in daily pricing

- Increase international confidence

But a critical caveat: this is not a revaluation. The new pound is not stronger; it’s just easier to count and more presentable on the world stage.

Conversion Table: Old vs. New Syrian Pound

| Old SYP | New SYP |

|---|---|

| 1,000 | 10 |

| 10,000 | 100 |

| 100,000 | 1,000 |

| 1,000,000 | 10,000 |

Syria Officially Adopts New Currency: Lessons from Other Countries

Syria’s move mirrors other currency overhauls around the world:

- Turkey (2005): Removed six zeros from the Turkish lira after years of hyperinflation. The reform was successful because it was followed by economic growth and tighter fiscal controls.

- Brazil (1986-1994): Underwent several redenominations before stabilizing with the real.

- Zimbabwe (2000s): Infamously printed trillion-dollar bills before abandoning its currency entirely.

These examples underline an important point: redenomination works best when it’s part of broader economic reform. Cosmetic changes without structural improvements tend to fail.

Transition Timeline & Logistics of Syria Officially Adopts New Currency

The Syrian government has outlined a 90-day transition window, during which both the old and new currencies are considered legal tender. Here’s what the public and businesses need to know:

For Individuals:

- Old currency can be exchanged at banks, post offices, and licensed money changers

- Mobile banking apps are being updated to reflect the new values

- Education campaigns on TV and radio aim to prevent confusion or fraud

For Businesses:

- Price tags and receipts must show both old and new denominations during the transition

- Accountants and finance teams must update systems and payroll structures

- Small businesses must reconfigure POS terminals and online stores

For the Diaspora and Remittance Senders:

- Money transfer services like Western Union will auto-convert into the new currency

- Syrians abroad are advised to check with local banks and exchange services for accurate rates

Reactions from the Global Community As Syria Officially Adopts New Currency

The international response has been cautiously optimistic.

The World Bank acknowledged the reform as “a step toward monetary normalization,” while noting that long-term success will depend on fiscal transparency, investment in production, and anti-corruption efforts.

The International Monetary Fund (IMF) has offered to assist Syria with technical advice, particularly in the area of central banking policy.

Meanwhile, financial institutions in Turkey and Lebanon are reportedly watching closely, as their economies are intertwined with Syrian cross-border trade and migration.

Black Market & Exchange Rate Impacts

The currency overhaul is also a move to weaken Syria’s black market, which has dominated currency exchange since the start of the war. For years, Syria had a dual system: an official rate and a much higher unofficial rate.

By resetting the system, the Central Bank hopes to narrow the gap between these rates. New anti-money laundering laws and customs reforms are being introduced alongside the currency to support this effort.

But skeptics argue that unless enforcement is rigorous, the black market will adapt quickly.

Early Push Toward Digital Payments

Another often overlooked angle: this change lays the groundwork for modernizing Syria’s financial infrastructure.

- The new notes are compatible with cashless systems

- Banks are launching QR-code payments for small transactions

- Pilot programs for government salary payments via mobile wallets are underway

Although still early, this signals an intention to reduce cash dependency, promote traceability, and bring more citizens into the formal economy.

What Comes Next?

This currency shift is just step one. To build real economic momentum, Syria must:

- Rehabilitate its industrial sector

- Reopen trade with neighbors

- Reform property rights and investment laws

- Rebuild public trust in institutions

There are early signs of interest from regional players. Turkey’s Ziraat Bank and Russia’s VTB have reportedly discussed opening operations in Damascus—pending regulatory conditions.

Whether Syria can seize this momentum and deliver real, lasting reform remains to be seen.