Stimulus Payment January 2026: When people search for Stimulus Payment January 2026, they’re usually looking for clarity — maybe even hope. The idea of a new check hitting your account sounds like good news, right? Especially in uncertain economic times. But while the buzz is strong, the facts tell a different story. This article breaks everything down: What’s true, what’s rumor, and what might happen next. Written in a plainspoken, trustworthy tone rooted in years of experience — this guide aims to help everyone from students and parents to tax professionals and policy nerds. Let’s walk through the facts step-by-step, covering proposals, legal processes, tax implications, and how to protect yourself from scams and misinformation.

Table of Contents

Stimulus Payment January 2026

As of early 2026, there is no approved federal stimulus payment, no IRS direct deposit relief check, and no active tariff dividend program. What exists are discussions, proposals, and hopes — but no laws backing them up yet. Meanwhile, taxpayers should focus on what’s real and available:

- Larger tax refunds due to new credits

- Faster payments via direct deposit

- Legal tools to boost take-home income through planning

Don’t fall for hype. Trust only official sources, and stay alert to misinformation that looks too good to be true — because often, it is.

| Topic | Current Status |

|---|---|

| Stimulus Payment January 2026 | Not scheduled or approved |

| IRS Direct Deposit Relief | No such official payment exists |

| Tariff Dividend Proposal | Proposed by Trump; not passed |

| Tax Refunds in 2026 | Yes, via credits and deductions |

| Direct Deposit Method | Still the fastest refund option |

What’s the Real Deal with Stimulus Payment January 2026?

Let’s start with the facts: there is no federal stimulus payment authorized, approved, or scheduled for January 2026 as of this writing.

No law has been passed in Congress to send out such payments. No official announcement has come from the IRS or U.S. Treasury. And yet, social media platforms and some low-quality blogs continue to share viral claims about $1,390 or $2,000 checks being “on the way.”

These are false, misleading, or purely speculative.

The confusion often stems from previous stimulus payments during the COVID-19 pandemic (2020–2021). Millions received three rounds of payments, and many still refer to those as “free government money.” But in reality, those payments were passed into law after major debate and compromise in Congress, not just announced out of the blue.

To repeat: Congress must pass new legislation to approve any future stimulus check. And that has not happened.

The IRS Direct Deposit Relief Payment — A Myth Busted

Some viral posts claim that Americans will receive “IRS direct deposit relief payments” in early 2026. These posts often feature photoshopped screenshots or misleading text suggesting that a payment is scheduled on a specific date.

None of this is supported by any IRS communication.

The IRS’s official communication channel is their newsroom at irs.gov. The agency never announces payments via private text messages or emails. If you’ve seen one of those, it’s either a scam or a misinterpretation of routine tax refunds.

There are no relief payments planned by the IRS — unless you’re referring to regular tax refunds based on your 2025 tax filing.

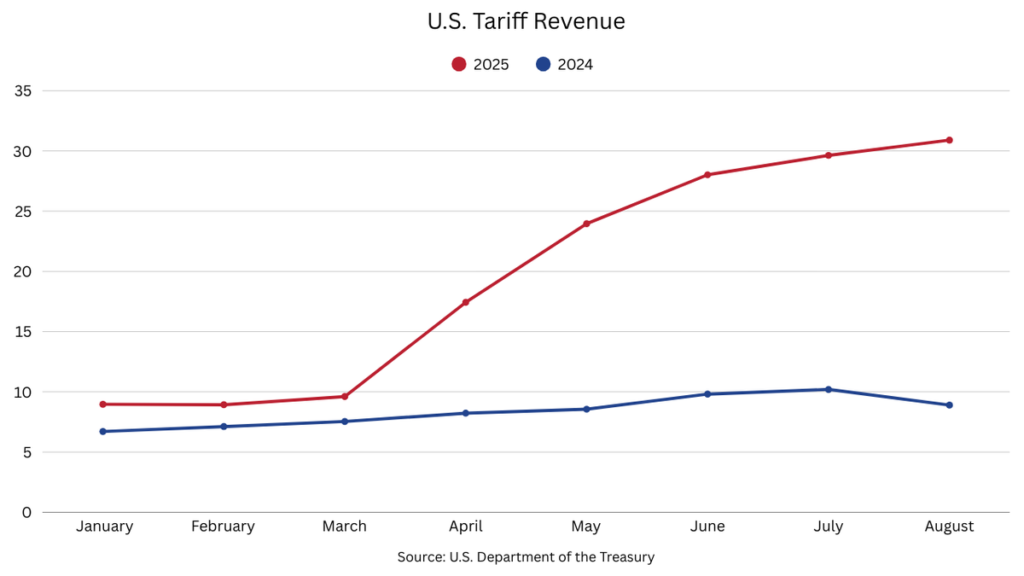

The Tariff Dividend Proposal — What It Is, and Isn’t

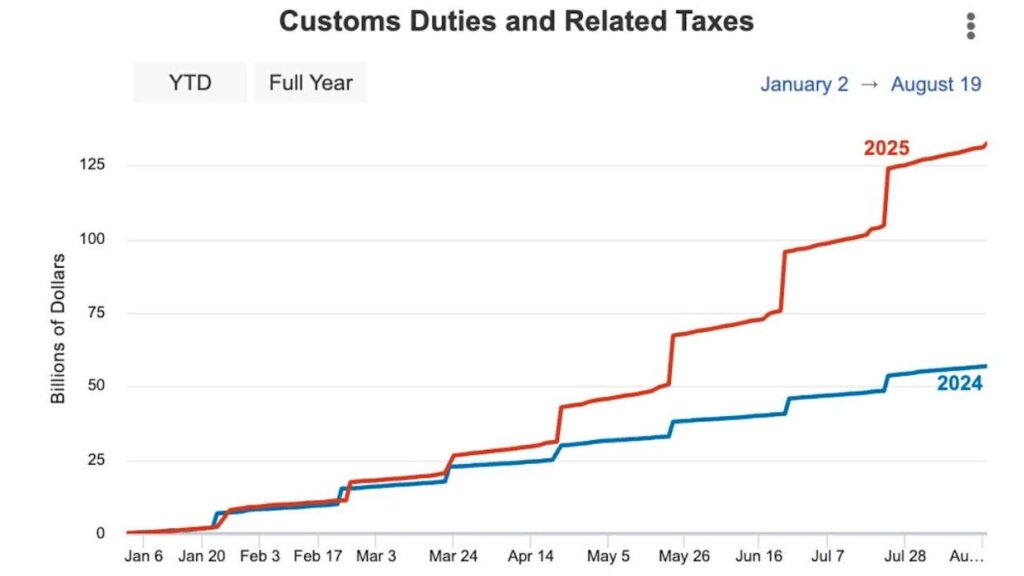

Former President Donald Trump has floated an idea known as the “Tariff Dividend” — a program that would use money collected from foreign import tariffs to fund direct payments to American citizens, such as $2,000 per household.

While the proposal made headlines, it is not law. It is not part of any budget. It hasn’t passed Congress.

To understand this better, let’s unpack it in simple terms.

What is a tariff?

A tariff is a tax on goods imported from another country. The idea is to protect U.S. industries and generate government revenue. Since 2018, the U.S. has collected billions in tariffs, particularly targeting imports from China.

How would a “tariff dividend” work?

In theory, if tariffs bring in enough revenue, the government could redistribute some of that income directly to U.S. citizens. But in practice, things get complicated:

- The federal government uses tariff revenue to fund a wide range of services and programs.

- Diverting those funds for direct payments would require changes to the federal budget.

- There’s no existing legal framework or payment system for it.

Expert Opinions

According to FactCheck.org, economic experts have raised concerns that tariff revenues alone wouldn’t be enough to fund a program of this scale without increasing deficits or cutting spending elsewhere.

Even if the idea gained support, it would still require:

- Drafting a bill in Congress

- Passing both the House and Senate

- The President’s signature

Until all that happens, it’s just an idea.

Tax Refunds in Early 2026 — What’s Actually Coming

What most people can count on in 2026 is a tax refund, especially if you file early, claim eligible deductions, or qualify for certain credits.

Some of the benefits that may affect your 2025 taxes (filed in early 2026) include:

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- Education Credits (like American Opportunity Credit)

- Standard Deduction increases (especially for inflation)

These are real money — but they aren’t stimulus checks. You’ll only get them if:

- You qualify based on income and family size

- You file your 2025 tax return correctly

- You choose direct deposit

Also, note that new tax legislation passed in 2025 expanded some of these credits under what was referred to as the One Big Beautiful Bill Act. Details vary by income bracket and filing status.

Understanding the Legal Process — Why Stimulus Payment January 2026 Isn’t Simple

Let’s take a quick look at what it takes to actually get a stimulus check passed in the U.S.

Here’s a simplified version of the process:

- A member of Congress (House or Senate) drafts a stimulus proposal.

- The bill must go through committees, amendments, and votes in both chambers.

- If both the House and Senate pass the bill, it goes to the President’s desk.

- The President can then sign it into law or veto it.

- Only after passage and funding does the IRS begin the process of payments.

This is not a one-week turnaround. During the pandemic, Congress acted under emergency powers and still took weeks or months to coordinate relief efforts.

Right now, no such process has begun for January 2026 payments.

Red Flags and Scams to Watch Out For

Here are some classic signs of a scam when it comes to false stimulus payment claims:

- Messages asking you to “claim your payment” by entering personal details

- Promises of guaranteed payments within 24 hours

- Requests to pay a small “processing fee” to receive your check

- Fake IRS phone calls asking for Social Security numbers

The IRS never contacts taxpayers via text or social media and will never ask for payment to send you money.

Financial Planning Tips for Stimulus Payment January 2026

Even if stimulus checks don’t arrive, you can still improve your financial outlook with smart planning:

- File taxes early: Filing in January or February can get you your refund faster.

- Track deductions: Use tax software or a CPA to ensure you’re maximizing credits.

- Use direct deposit: It’s faster and more secure than paper checks.

- Watch the news: Stay updated with reliable outlets — avoid sensational blogs or YouTube rumors.

- Save your refund: Treat tax refunds as an opportunity to build emergency savings.

$1,800 IRS Direct Deposit in January 2026 – Who Is Eligible This Time

U.S. Minimum Wage Rises In 2026: Updated Hourly Pay From January 1

IRS Confirms $1,390 Direct Deposit Relief Payments – Check Eligibility Now