State Pension Age Row: The State Pension Age Row: One Group May Be Spared After DWP Faces Fresh Demands is causing a stir in UK policy circles. With retirement plans hanging in the balance, women born in the 1950s are demanding justice after unexpected delays in their pension age left many struggling. At the center of the controversy is the Department for Work and Pensions (DWP) and the way it handled — or mishandled — the rollout of pension reforms. Let’s break this down like a conversation with a trusted friend — but with data, official sources, expert insight, and real-world advice you can act on.

Table of Contents

State Pension Age Row

The State Pension Age row is more than a policy issue — it’s a personal and national reckoning. Women who spent decades working, caregiving, and planning for retirement feel let down by a system that moved the goalposts without telling them. While compensation is still uncertain, what’s clear is this: the public is watching, the pressure is growing, and the government can’t ignore this issue much longer. If you’re planning your retirement, don’t wait for the next review. Take steps now to understand your options, build your savings, and advocate for fair and transparent policy.

| Topic | Key Point |

|---|---|

| Current State Pension Age | 66 for men and women, increasing to 67 by 2028 and 68 by 2046 |

| Affected Group | Women born 1950–1960 saw their pension age rise rapidly with limited notice |

| Campaign Group | WASPI – Women Against State Pension Inequality |

| Government Review | DWP’s third statutory review is currently underway |

| Ombudsman Findings | DWP guilty of “maladministration” in notifying women |

| Compensation Possible? | Under active investigation; political and legal challenges ongoing |

| Retirement Savings Crisis | Over 19 million Brits at risk of retirement shortfalls |

| Official Tool | Check your pension age here |

What is the State Pension Age Row and Why It Matters?

The State Pension Age is when people in the UK become eligible to receive government pension benefits. It’s not just a date on the calendar — it marks the transition into retirement for millions. Historically, men could retire at 65 and women at 60. But that changed in the name of gender equality and economic necessity.

Starting in 2010, the UK began phasing in equalisation and raising the pension age:

- 2010–2020: Women’s retirement age rose from 60 to 65.

- By 2020: Equal age of 66 for both sexes.

- 2026–2028: Scheduled to rise again to 67.

- Future rises to 68 are proposed, though delayed as of now.

These changes affect not only individual retirement plans but also the broader economy, workplace planning, and social welfare systems.

![State Pension Age Review]=](https://seaplanesandais.com/wp-content/uploads/2025/12/State-Pension-Age-Review-1024x541.jpg)

Who Are the Women at the Center of the State Pension Age Row?

The group at the core of this debate is women born between 1950 and 1960, who expected to retire at 60. Many of them had no idea the rules had changed — until it was too late. Some had left jobs, downsized homes, or taken on caregiving roles expecting financial security from the State Pension.

But due to inadequate notification, they had to wait until 66 to receive benefits. That’s six years of lost income — a critical blow for people with limited savings.

This led to the rise of WASPI – Women Against State Pension Inequality, a grassroots campaign seeking compensation — not to roll back the policy, but to address the poor communication and impact on people’s lives.

Their slogan: “We’re not going away!”

What Did the Ombudsman Say?

The Parliamentary and Health Service Ombudsman (PHSO) investigated the DWP’s actions and delivered a strong verdict: maladministration.

Key findings from the PHSO:

- The DWP failed to effectively inform women of changes made under the 1995 and 2011 Pensions Acts.

- The lack of proper communication denied women time to make informed decisions about their finances.

- Thousands suffered financially and emotionally due to lack of preparation time.

The PHSO is now considering how to recommend compensation, though the legal path is complex, and ministers have not yet committed to a payout.

What the DWP Is Doing Now?

Under law, the UK government must conduct a review of the State Pension age every six years. The current Third State Pension Age Review is underway, and the DWP is collecting evidence on:

- Life expectancy trends

- Employment data for older workers

- Financial sustainability of the pension system

While the official line is “no decisions made yet,” the pressure from campaigners and the public could tip the scales — especially in light of the Ombudsman’s ruling.

Political Reaction On State Pension Age Row: Split Across the Aisle

There’s no political consensus on how to resolve the issue.

- Labour and SNP MPs have supported WASPI and pushed for compensation.

- Some Conservative MPs argue compensation would be too expensive and set a precedent.

- A cross-party group is urging mediation rather than drawn-out court battles.

The issue is now politically sensitive. With a general election on the horizon, public opinion could shape whether this group is finally “spared” the financial consequences they say were unfairly imposed on them.

Economic Context: The Big Picture

Pension reforms were introduced in part due to rising life expectancy and strained public finances. However, the assumptions behind those reforms are now under review.

- In 2014, the government estimated that a 65-year-old woman would live to 89.

- By 2023, that projection had dropped to 87.1 years, according to the Office for National Statistics.

This has sparked calls to slow or pause further increases in the pension age — especially when life expectancy is plateauing or declining.

Meanwhile, the UK’s retirement savings gap is growing:

- A study by Scottish Widows found that 1 in 5 people (over 10 million) aren’t saving enough to maintain their lifestyle in retirement.

- The Resolution Foundation estimates that 25% of working-age people could see hardship in old age unless reforms are introduced.

That means the State Pension — once seen as supplemental — is now the backbone of retirement security for many.

How Does the UK Compare to Other Countries?

The UK is not alone in raising the pension age, but other countries have taken a more gradual or flexible approach.

- France recently faced mass protests after raising the retirement age from 62 to 64.

- Germany is increasing its retirement age to 67 by 2029 — but with significant lead time and support programs.

- Sweden links pension eligibility to life expectancy, using an automatic adjustment mechanism.

Critics argue that the UK’s rollout lacked transparency and compassion, especially for women who faced the steepest and fastest changes.

What State Pension Age Row Means for You: Practical Advice

No matter your age, gender, or profession — you should take these steps right now to stay in control of your financial future.

1. Check Your State Pension Age

Use the government’s tool to see when you can claim:

https://www.gov.uk/state-pension-age

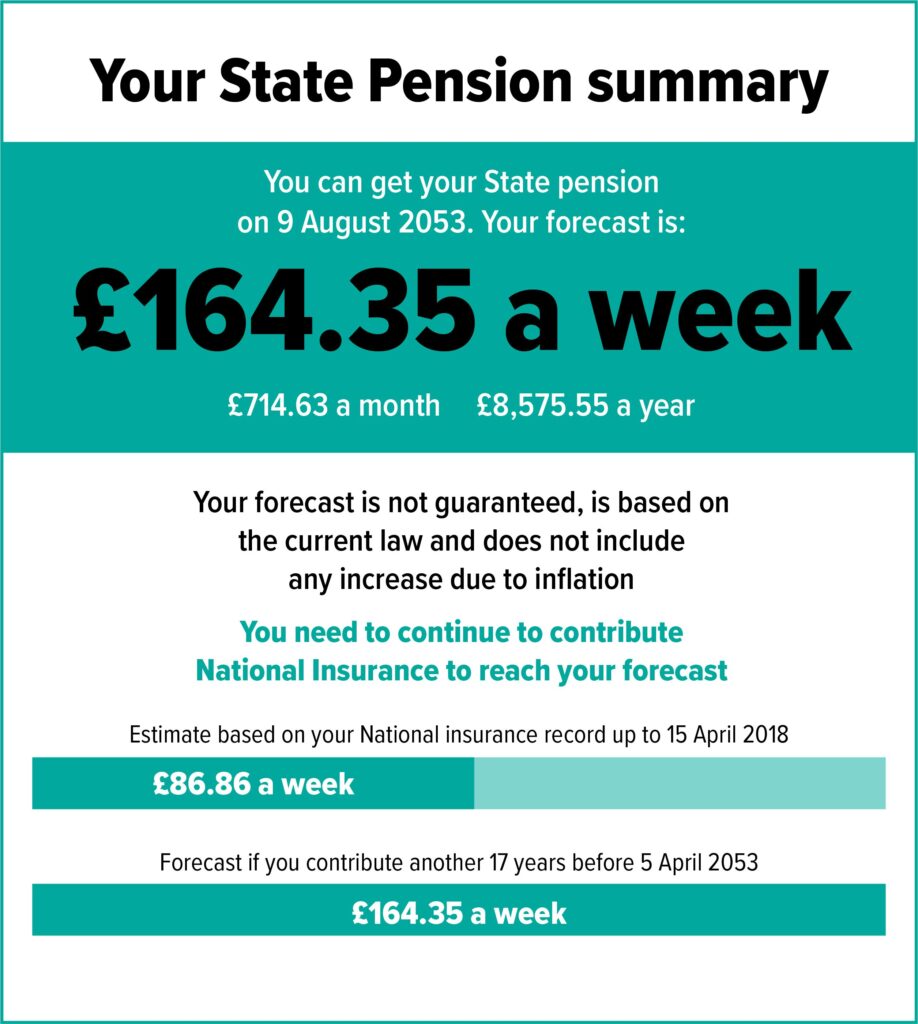

2. Get a Forecast

Find out how much you’re likely to get and whether you need to top up your National Insurance record:

https://www.gov.uk/check-state-pension

3. Maximize Private Savings

The earlier you start, the better. Look into:

- Auto-enrolled workplace pensions

- Lifetime ISAs (for under 40s)

- Self-Invested Personal Pensions (SIPPs)

4. Diversify Retirement Income

Don’t rely solely on the State Pension. Consider rental income, dividends, freelance work, or annuities as supplementary income streams.