Social Security Payment Pause January 2026: Why No Checks Are Being Sent This Week is a phrase many Americans never expected to Google, but here we are. From elders living on fixed incomes to families helping parents manage retirement money, people across the country are noticing the same thing: a week in January 2026 where no Social Security payments appear to be sent at all. That silence can feel loud. When your check is how you keep the lights on, buy groceries, or help your grandchildren, even a few days without clarity can cause worry. Let me be clear from the beginning: this is not a delay, not a cut, and not a government failure. It is a normal and predictable outcome of the way Social Security has always been scheduled.

I’ve worked with Social Security rules, benefit coordination, and public assistance timelines for years. I’ve seen this same confusion pop up again and again, especially after New Year’s. This article explains what’s really happening, why it happens, and how to plan around it—without panic, rumors, or misleading headlines.

Table of Contents

Social Security Payment Pause

The Social Security Payment Pause January 2026 is not a warning sign or system failure. It is a predictable result of how the Social Security payment calendar works around Wednesdays and federal holidays. Benefits are not lost, delayed, or reduced. Once you understand the timing, you can plan confidently and avoid unnecessary stress.

| Category | Details |

|---|---|

| Main Topic | Social Security Payment Pause January 2026 |

| What’s Happening | No payments scheduled during one early-January week |

| Reason | SSA Wednesday schedule combined with New Year’s Day |

| Is It a Delay or Cut? | No |

| SSI January Payment | Paid early on December 31, 2025 |

| Retirement & SSDI Payments | Begin mid-January 2026 |

| Official Reference | https://www.ssa.gov |

What the Social Security Payment Pause January 2026 Really Means?

The Social Security Payment Pause January 2026 refers to a short stretch of time in early January when no Social Security payments are scheduled to be issued. That wording matters. Payments are not “paused” because of a problem. They are not “withheld.” They simply were never scheduled for that particular week under the existing payment calendar.

The payment system is managed by the Social Security Administration (SSA), and it follows a strict, rules-based schedule that has been in place for decades. The schedule is built around:

- Monthly benefit cycles

- Birthdate-based Wednesdays

- Federal holidays

When those three things line up in a certain way, as they do in January 2026, it creates a short gap that feels unusual but is completely normal.

How Social Security Payments Are Scheduled (Historical Context)

To really understand why this happens, it helps to look at how and why the Social Security payment system was designed this way.

Originally, Social Security checks were mailed on the same day each month. Over time, as the number of beneficiaries grew into the tens of millions, that system became inefficient and risky. In the late 1990s, the SSA shifted to a staggered Wednesday payment system to reduce strain on banks and improve reliability.

That system works like this:

- Payments are spread across multiple Wednesdays

- Your birthdate determines which Wednesday you’re assigned

- This prevents overload and reduces errors

This system is one of the reasons Social Security remains one of the most reliable federal benefit programs in the country.

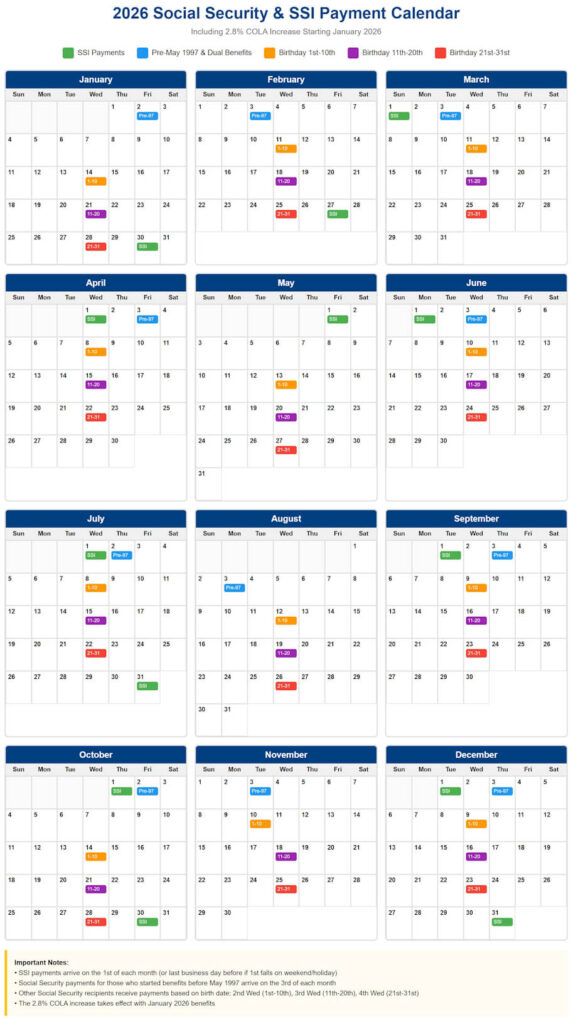

The Wednesday Birthdate Rule Explained Simply

For most people receiving Social Security retirement or disability benefits:

- If you were born between the 1st and 10th, you are paid on the second Wednesday

- If you were born between the 11th and 20th, you are paid on the third Wednesday

- If you were born between the 21st and 31st, you are paid on the fourth Wednesday

In January 2026, the second Wednesday falls later than many people expect. That creates a stretch early in the month where no one’s scheduled payment date arrives.

Why SSI Is Different and Why January Confuses People?

Supplemental Security Income (SSI) follows a different rule. SSI is usually paid on the first of the month. When the first of the month lands on a weekend or federal holiday, SSI is paid early.

January 1, 2026, is a federal holiday. Because of that:

- January 2026 SSI payments are sent on December 31, 2025

- This is not a bonus or extra payment

- It is simply January’s payment arriving early

This early payment is one of the biggest reasons January feels financially tight. You receive the money earlier, but you still have to make it last the same amount of time

A Real-World Budget Scenario

Consider this real-life example.

An elder receives:

- SSI for basic needs

- Social Security retirement benefits based on work history

In December 2025:

- SSI for January arrives on December 31

- Retirement benefits arrive mid-January

From January 1 to mid-January, there is no new deposit. The money hasn’t disappeared. It has already arrived. But if it was spent early, January becomes stressful.

This is not a mistake by the SSA. It’s a planning challenge created by timing.

Why January Is Financially Hard Even Without a Payment Gap?

January has always been one of the toughest months for fixed-income households, even in years without a payment gap. Several factors come together:

- Higher heating and utility bills

- Increased food costs after the holidays

- Medical expenses resetting with the new year

- Property taxes and insurance renewals

- One Social Security payment already received early

When you combine these realities with a week where no payment is scheduled, it can feel like something is wrong—even when everything is working as designed.

Clearing Up Dangerous Myths and Online Rumors

Every January, misinformation spreads fast. Some of the most common false claims include:

- “Social Security ran out of money”

- “Payments were frozen by Congress”

- “Checks are being delayed because of fraud”

- “You need to call immediately or lose benefits”

None of these are true.

Social Security funding challenges are long-term issues discussed openly by policymakers and analysts. They do not affect monthly payment schedules like this one.

Cost-of-Living Adjustment (COLA) and Why It Matters in 2026

Another important detail often overlooked is the Cost-of-Living Adjustment (COLA). In 2026, benefits reflect a COLA increase designed to help keep up with inflation.

While COLA increases help, they do not change payment timing. That means:

- You may receive slightly more money

- But you still need to budget carefully around January’s schedule

Understanding both amount and timing is essential for financial stability.

Practical Planning Strategies for the Social Security Payment Pause

Experienced benefit counselors often recommend the following strategies:

- Treat early payments as future income

Money received at the end of December is meant for January. - Build a January buffer when possible

Even a small reserve helps reduce stress. - Track payments using a calendar

Mark payment dates at the start of the year. - Avoid short-term high-interest loans

Payday loans often create long-term harm. - Use official SSA tools

https://www.ssa.gov/myaccount/

Scam Activity Increases During Payment Confusion

Whenever there is uncertainty, scammers take advantage. During payment gaps, fraud attempts increase.

Be cautious of:

- Calls claiming your benefits are “paused”

- Requests for personal or banking information

- Threats of suspension or arrest

Why Clear Communication Matters for Communities?

In many Native, rural, and underserved communities, Social Security is more than a retirement check. It supports entire households. Elders often help raise grandchildren, cover shared housing costs, and stabilize families.

Confusing or misleading headlines cause unnecessary fear. Clear, accurate information strengthens trust and helps communities plan instead of panic.

$2000 Stimulus Check in January 2026: Check Eligibility, and Payment Status

New SNAP Rules Start January 2026 – Are You Still Eligible Under the Updated Guidelines?

Federal $2000 Deposits Coming in January 2026: Guide for Eligible Beneficiaries