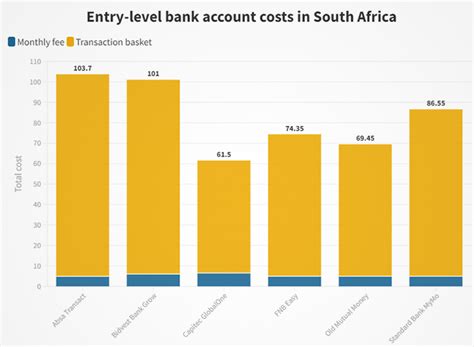

R50 Fee Increase for Account Holders: R50 Fee Increase for Account Holders Starts 15 January is trending across South Africa, and rightfully so. It’s causing stress, confusion, and frustration — especially for millions of grant recipients who are just trying to stretch every rand. Whether you’re receiving an Old Age Grant, Disability Grant, or Child Support Grant, the last thing you need is surprise deductions on your account.

Let’s be real — for many South Africans, R50 isn’t just pocket change. That’s a couple loaves of bread, a taxi ride to school, or prepaid electricity. So, when warnings started flying about new deductions hitting on January 15, folks were understandably anxious. In this deep-dive, we break down the facts, provide practical steps, debunk myths, and give you a guide that even a 10-year-old can understand — but with insights a financial analyst would respect.

Table of Contents

R50 Fee Increase for Account Holders

The R50 fee increase starting 15 January isn’t a SASSA deduction — it’s the result of bank pricing changes. For vulnerable grant recipients, even small fees can add up fast. But there are ways to take back control of your money. By using low-fee accounts, choosing fee-free retail withdrawals, and keeping tabs on your statements, you can protect every cent of your grant. Knowledge is power, and in today’s economy, every rand counts. Help your family, your neighbors, and your community understand what’s really going on — and take action.

| Topic | Details |

|---|---|

| Fee Increase Starts | Around 15 January 2026 |

| Monthly Deduction Amount | Approximately R45–R50, depending on bank and service provider |

| Who’s Affected | SASSA grant recipients using private bank accounts for payouts |

| Is SASSA Charging This? | No — the fee comes from your bank, not from SASSA |

| Free Withdrawal Options | At Shoprite, Checkers, Pick n Pay, Boxer, USave and other SASSA partners |

| How to Reduce Costs | Use low-cost grant accounts, plan ATM withdrawals, check fees |

| Watch for Scams | SASSA will never charge to access your grant — beware of fraud |

| SASSA Website | www.sassa.gov.za |

Understanding the R50 Fee Increase for Account Holders — What’s Really Going On?

Let’s get the truth out there: SASSA is not deducting R50 from your grant.

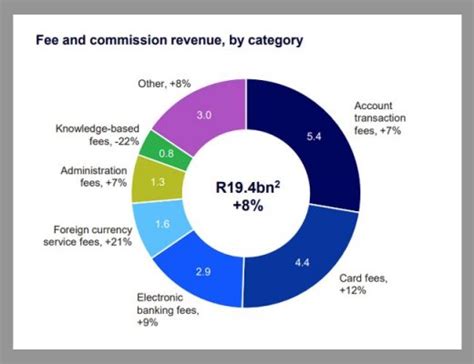

The R50 figure is a monthly account maintenance fee or withdrawal-related fee charged by banks. In 2026, several major South African banks revised their pricing models. These changes impact many account holders — especially grant recipients who use private bank accounts to receive their money.

In many cases, beneficiaries only find out when less money lands in their account, or they’re charged R5–R10 just to withdraw at an ATM.

These bank charges can include:

- Monthly account maintenance fees (R30–R50)

- ATM withdrawal charges (R6–R15 depending on ATM)

- Balance enquiry fees (R1–R5 per check)

- Debit order fees

That’s how a person expecting R2,180 might only see R2,125 hit their wallet.

What Caused R50 Fee Increase for Account Holders?

Banks argue that with rising costs of operations, security upgrades, and inflation, they’ve had to adjust account fee structures across the board. These fees are often applied across all personal banking accounts — unless you’re using a grant-specific account, which some banks still offer at low or zero cost.

Unfortunately, these increases aren’t always clearly communicated — and many beneficiaries are caught off guard. That’s why this SASSA-related warning is trending now — and why we’re breaking it all down for you.

Why This Matters for Grant Beneficiaries?

Let’s be honest. For someone surviving on a R2,000 monthly grant, R50 is a serious loss.

This isn’t just an abstract bank fee — it’s money that’s meant for basic needs. Families use grants to pay for:

- Groceries

- School transport

- Electricity

- Rent

- Medical care

The math doesn’t lie:

R50 × 12 months = R600 per year.

That’s more than a month’s worth of food for many households.

In a country where over 18 million South Africans receive social grants, the total lost to banking fees can be staggering — in the hundreds of millions of rands annually.

Practical Ways to Reduce or Avoid These Fees

1. Use SASSA-Partnered Stores for Free Withdrawals

Many major retailers like Pick n Pay, Shoprite, Boxer, and Checkers allow free withdrawals when you swipe your card at the till. This is often cheaper than an ATM and safer too.

Instead of making multiple small withdrawals, do one monthly withdrawal if possible. That minimizes costs and reduces ATM risk.

2. Ask About a Grant-Friendly Bank Account

Some banks (such as Postbank and Capitec) offer zero-fee or low-fee accounts designed for social grant recipients.

Ask your bank:

- “Do you have a zero-fee SASSA grant account?”

- “Can I change my account without losing my benefits?”

Switching to the right account type can save you R600+ per year.

3. Use Mobile Banking or Bank Apps

Bank apps and USSD mobile banking services are usually cheaper than ATM withdrawals. You can:

- Check balances

- Pay bills

- Transfer funds

…without leaving your home.

Most apps are free or cost less than R1 per transaction.

4. Review Your Bank Statement Every Month

Look out for:

- Unauthorized debit orders

- Airtime or insurance deductions

- Funeral plans or subscriptions you didn’t request

If you see anything strange, call your bank immediately and dispute the charges. You’re entitled to protect your grant.

Debunking Common Myths About the R50 Deduction

“SASSA is stealing our money!”

False. SASSA is not authorized to take money from your grant.

“You have to pay R50 to keep receiving grants.”

False. There is no mandatory SASSA fee — the deduction is banking-related.

“If I complain, I’ll lose my grant.”

False. You have a right to complain, report issues, and get help without fear.

“Only old people are charged.”

False. Any account holder can be affected — including child support grant beneficiaries or foster parents.

SASSA’s Official Position

According to SASSA, they continue to:

- Pay grants free of charge

- Encourage beneficiaries to use Postbank cards or partnered retailers

- Warn the public about fraud and scams linked to false fee claims

SASSA recommends that beneficiaries do not switch accounts hastily, especially close to payment dates, as it can delay deposits.

They also state that only the account holder should access or make changes to their SASSA-linked account.

Real-Life Testimonials

“I thought I lost my grant. Turns out, my bank charged me R48 for something I didn’t even know about. I switched to another account — now I pay zero.”

– Thandi, Soweto

“My mom gets her pension through SASSA. She lost R120 in three months and had no idea why. We asked the bank — it was withdrawal fees.”

– Lunga, Durban

“Thank God for the lady at SASSA who told us to withdraw at Shoprite. We were losing R100 a month at ATMs!”

– Themba, Cape Town

What To Do If You Feel You’re Being Overcharged

- Visit your bank branch with your ID and SASSA card

- Request a detailed transaction history

- File a dispute form if deductions are unauthorized

- Contact SASSA support if the issue involves your grant being delayed or misrouted

In some cases, you may be entitled to a refund.

Scams to Watch Out For

- SMSes or WhatsApps that say:

“Pay R50 to activate your grant”

“Click here to confirm your SASSA status”

“Update your account details now or lose your grant”

These are fraudulent schemes. SASSA will never ask for payment to process a grant.

If you receive suspicious messages:

- Do not click links

- Report them to the SASSA fraud line

- Call 0800 60 10 11

R50 Fee Increase for Account Holders: What Should You Do Today?

| Step | Action Item |

|---|---|

| Step 1 | Visit or call your bank to confirm monthly fees |

| Step 2 | Ask about switching to a grant-friendly account |

| Step 3 | Limit ATM use and use retail stores for free withdrawals |

| Step 4 | Track your monthly statement for suspicious charges |

| Step 5 | Bookmark and use www.sassa.gov.za for official updates |

Official SASSA Contact Information

- Call Centre: 0800 60 10 11 (Free)

- Head Office Address: SASSA House, 501 Prodinsa Building, Pretoria

- Website: www.sassa.gov.za

- Grants Status Check: srd.sassa.gov.za