Quebec Tax Credits: If you live in Québec and haven’t claimed every refundable tax credit or benefit you’re entitled to, you might be leaving hundreds or thousands of dollars on the table. In this clear, experience‑based guide — written in a friendly, conversational style that’s easy enough for a 10‑year‑old to follow but packed with value for professionals — we break down 9 refundable tax credits and benefits that residents can still claim this month. You’ll learn what they are, who qualifies, how they’re paid, real filing tips, and how to avoid common tax mistakes. Whether you’re a first‑time filer, a seasoned tax pro, a parent, a caregiver, or someone helping a senior, this article arms you with practical steps and trusted links so you never leave money behind.

Table of Contents

Quebec Tax Credits

Quebec’s tax system offers many refundable credits and benefits designed to support residents with the cost of living, childcare, work, health expenses, and caregiving responsibilities. By taking the time to understand and claim 9 refundable credits and benefits, you might significantly increase your refund or ongoing payments this month.

Remember:

• File your Québec tax return every year — even if you owe $0

• Keep all eligible receipts and slips

• Register for direct deposit

• Amend past returns if you missed credits

These steps can help ensure you receive every dollar you’re entitled to — with clear, official guidance and a system that rewards timely filing and accurate information.

| Credit / Benefit | Purpose | Who Qualifies | When / How Paid |

|---|---|---|---|

| Solidarity Tax Credit | Helps with living & housing costs | Low & middle‑income residents | Monthly/Quarterly/Lump |

| Work Premium Tax Credits | Supports workers | Low‑income workers | Annual refundable |

| Childcare Expenses Credit | Helps pay childcare costs | Families with kids | Annual refund |

| Children’s Activities Credit | Refund for kids’ activities | Families with qualifying receipts | Annual refund |

| Home Support for Seniors Credit | Helps seniors stay at home | Age 70+ with eligible services | Monthly / annual |

| Refundable Medical Expenses Credit | Offsets medical costs | Residents with eligible expenses | Annual refund |

| Family Allowance | Monthly child benefit | Families with kids | Monthly / quarterly |

| Tax Shield | Protects refundable credits | Working earners | Refundable via tax return |

| Caregiver & Dependant Credits | Supports caregivers | Caregivers of dependants | Refundable / non‑refundable |

Understanding Quebec Tax Credits and Benefits

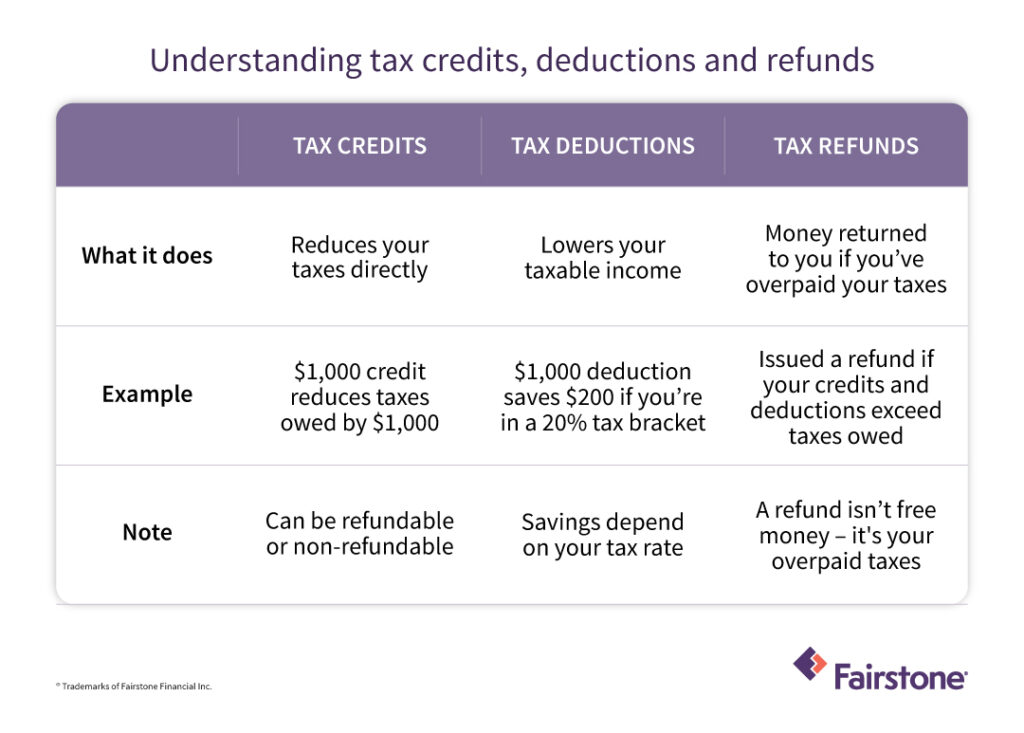

Quebec’s tax system offers both non‑refundable and refundable credits. Non‑refundable credits only reduce what you owe; refundable credits can actually put money back into your pocket — even if your tax owed is zero. Combined with benefits like the Family Allowance, these programs are designed to help residents manage everyday costs.

Refundable tax credits are sometimes paid as:

- Monthly instalments

- Quarterly instalments

- A lump‑sum refund at tax time

They’re usually tied to key life factors like employment, income, family size, children, disability status, or senior care responsibilities.

1. Solidarity Tax Credit — Your Most Important Refund

What It Is

The Solidarity Tax Credit helps offset:

- High housing costs

- Quebec Sales Tax (QST)

- Cost of living pressures

Québec residents with low‑to‑middle incomes can qualify. It’s one of the most valuable refundable credits available in the province.

How It Works

Quebec calculates your amount based on:

- Household income

- Housing situation (renter/owner)

- Family composition

The amount can change each tax year. Eligible residents receive payments based on their filing.

Payment Structure

If your credit is:

- Over a certain threshold — monthly payments

- Mid‑range — quarterly payments

- Smaller — one‑time payment

This flexibility helps many households receive timely support instead of waiting for tax season.

Who Qualifies

To qualify for 2025‑related credits received in 2026:

- You must have lived in Québec on December 31 of the tax year.

- You must file your income tax return (TP‑1).

- You must complete Schedule D with your return.

- Direct deposit registration ensures faster payment.

Real Example

If you’re single, renting, and have a modest income, you might receive more Solidarity Credit than someone with the same income but living alone with no dependants. Québec’s formula adjusts for living costs and household size.

2. Work Premium Tax Credits — Money For Getting Paid

This refundable credit helps low‑income workers keep more of what they earn.

Why It Exists

The Work Premium Tax Credits reward:

- Work effort

- Labor force participation

- Transition back into the workforce

Even if you don’t owe tax, you may still get this credit as a refund.

Workers who qualify include:

- Minimum wage earners

- Students with part‑time jobs

- Seasonal workers

How to Claim

Include Schedule P with your Quebec tax return, and Québec’s system calculates your refund based on earned income.

3. Childcare Expenses Credit — Big Help for Parents

Childcare is expensive, and Québec recognizes that. This refundable credit can cover a portion of your childcare expenses.

What Counts

Eligible childcare receipts typically include:

- Licensed daycare

- Before/after school programs

- Licensed camps or activity programs

You must receive an RL‑24 slip from your childcare provider to claim it.

Who Qualifies

Families with children under 14 years old (2026 tax year, with exceptions for children with disabilities) can claim this credit.

Filing Tip

Organize your RL‑24 slips before filing to ensure you don’t miss eligible amounts.

4. Tax Credit for Children’s Activities — Refund on Fun

Québec encourages kids to stay active and learn new skills. If you paid for qualifying activities — like sports leagues or cultural programs — you might be eligible.

Eligible Activities

Qualifying activities often must:

- Last a minimum number of weeks

- Be supervised by qualified instructors

- Include a fee paid during the tax year

Receipts must clearly show the cost and duration for Quebec to accept them

5. Tax Credit for Home Support Services for Seniors — Help at Home

Seniors who prefer to age in place can use this credit to offset the cost of:

- Household chores linked to care

- Personal support services

- Aids and adaptations that help maintain independence

Advance Payments

If you elect advance payments before tax season, you may receive monthly support throughout the year rather than waiting for a refund at the end. This can help with regular expenses like weekly housekeeping or daily care assistance.

Families often combine this with other credits like caregiver credits for even stronger support.

6. Refundable Tax Credit for Medical Expenses

Medical costs that exceed a certain percentage of your income may qualify for a refund. Expenses that may be eligible include:

- Prescription medication not covered by insurance

- Dental or vision costs not reimbursed

- Medical equipment

- Specialized treatment costs

Claiming Tips

- Organize medical receipts throughout the year

- Review Québec’s eligible expense list before filing

- Keep insurance reimbursement records

7. Family Allowance — Monthly Support For Kids

The Family Allowance isn’t a tax credit — it’s a monthly benefit designed to help families raise children.

Who Gets It

Families living in Québec with children under 18 can receive quarterly or monthly payments that provide ongoing support.

Filing Requirement

To trigger Family Allowance payments, you must file your income tax return every year, even if you owe no tax.

If your family situation changes (new child, separated parent, etc.), update Retraite Québec promptly.

8. Tax Shield — Protecting Your Credits

The Tax Shield helps protect other refundable credits as your income rises. If your income increases moderately, the Tax Shield prevents a proportional loss of credit benefits.

This can mean a bigger refund overall, especially if you received multiple refundable credits in prior years.

9. Caregiver & Dependants Credits — Support for Supporting Others

If you’re supporting:

- A disabled family member

- A dependent adult

- A child with special needs

Québec provides credits to recognize the financial responsibilities involved.

Some of these credits are refundable, while others may reduce your net tax owing. Either way, they reduce financial stress for caregiving households.

Timing, Filing, and Deadlines — What You Must Know

File Early

Filing early:

- Gets your refunds faster

- Helps avoid processing delays

- Helps you qualify for advance monthly payments (for items like senior support)

File Every Year

Even if you owe $0, file your tax return. Most refundable credits and benefit eligibility start with a filed return.

Go Back If You Missed Credits

You can amend up to FOUR years of past returns with Revenu Québec to claim missed refundable credits. That’s money you may still be able to collect.

Quebec Tax Credits: Common Mistakes to Avoid

- Not Filing a Return Because You Owe Nothing

You must file to claim refundable credits. - Missing Receipts

Especially for childcare, children’s activities, and medical expenses — no receipts, no claim. - Not Registering for Direct Deposit

Direct deposit speeds up refunds. - Not Updating Personal Information

If you move, add dependents, or change marital status — update your info. - Confusing Federal and Provincial Credits

Québec credits are separate from Canada Revenue Agency credits (like GST/HST credit or Canada Workers Benefit).

4 CRA Benefits Payments in January 2026 – Check Eligibility Criteria & Payment Date

Canada Quietly Raises Medical Inadmissibility Cost Threshold for 2026