Payment Hike for Pensioners: If you’ve come across headlines claiming “DWP Confirms £114 Payment Boost for Pensioners”, you’re probably wondering: Is this real? Is there a new benefit on the way? Should I be checking my bank account? Well, you’re not alone — and you’re in the right place. As someone who’s spent years demystifying pensions and government benefits for everyday folks and financial professionals alike, let me guide you through what’s really going on. Spoiler: There is good news for pensioners — but the “£114” claim needs unpacking. Let’s separate the facts from the clickbait.

Table of Contents

Payment Hike for Pensioners

The DWP isn’t giving out a standalone £114 payment, but State Pensions are rising, thanks to the Triple Lock. That means real, automatic increases that help retirees keep up with inflation. Whether you’re receiving the New or Basic State Pension, this is good news — especially if you also claim Winter Fuel Payments or Pension Credit. But don’t rely on viral headlines. Rely on gov.uk and verified sources like this one.

| Topic | Details |

|---|---|

| New State Pension Rate (2025/26) | £230.25/week |

| Basic State Pension Rate (2025/26) | £176.45/week |

| Estimated 2026 Increase | ~4.8% based on average earnings |

| Winter Fuel Payment | £100–£300 depending on age/income |

| Pension Credit | Income top-up for low-income pensioners |

| Pension Eligibility | 10–35 years NI record |

What’s the Story Behind the “£114 Payment Hike for Pensioners”?

Let’s clear this up straight away:

There is no official DWP policy stating that pensioners will receive a single £114 payment as a one-off boost. No lump sum. No bonus. No surprise direct deposit.

What is happening — and what’s very real — is that the UK State Pension is rising again in April 2026. The increase is due to the Triple Lock system, which ensures pensions rise in line with the cost of living.

In some interpretations, that increase over a quarter (three months) may total something in the neighborhood of £114, depending on your weekly pension amount. But it’s a regular indexed rise, not a special payout.

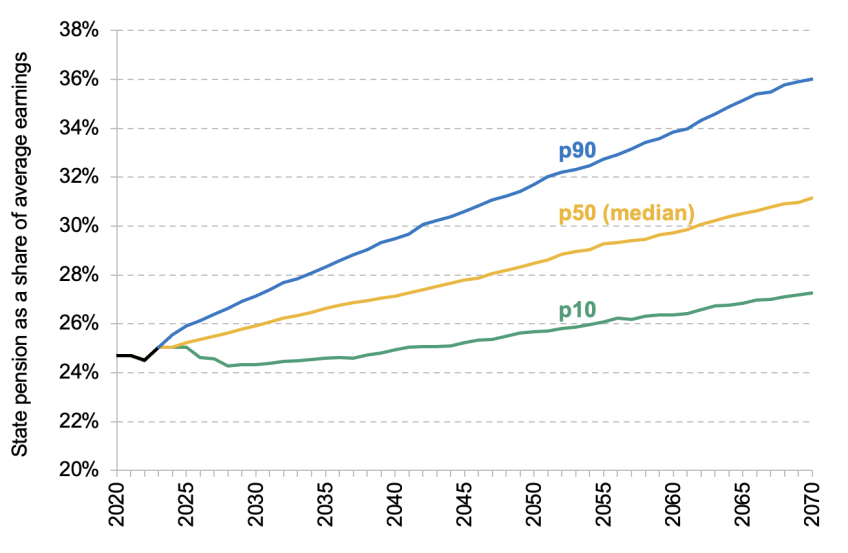

Understanding the Triple Lock — How Pensions Rise Every Year

The Triple Lock is a guarantee from the UK government that the State Pension will increase every April by the highest of:

- Consumer Price Index (CPI) inflation

- Average wage growth across the UK

- 2.5% minimum increase

This system protects pensioners from inflation eroding their retirement income. In 2026, average earnings growth (around 4.8%) has outpaced inflation and the floor, so State Pensions are rising by 4.8%.

Let’s do the math:

- If you currently receive £230.25/week (New State Pension), a 4.8% increase means you’ll soon get about £241.30/week.

- That’s £11.05 more per week, or roughly £143.65 more over 13 weeks (a quarter) — which could explain where the “£114 boost” figure came from.

So yes — your pension will grow, but it’s not a separate “bonus.”

Weekly and Yearly Pension Values: Side-by-Side

New State Pension (for those retiring on or after 6 April 2016):

- 2025/26 Weekly Rate: £230.25

- Estimated 2026/27 Weekly Rate: £241.30

- Estimated Annual Total: £12,547 → £13,147.60

Basic State Pension (retired before 6 April 2016):

- 2025/26 Weekly Rate: £176.45

- Estimated 2026/27 Weekly Rate: £184.90

- Annual Total: £9,180 → £9,614.80

These changes apply automatically — no action needed from the pensioner.

The Real Impact: How Much Extra Do Pensioners Actually Get?

You might be wondering:

“Is this increase really meaningful?”

Yes, especially when you factor in other benefits.

Let’s break it down:

- Over a year, a pensioner on the New State Pension will receive £600+ more in 2026.

- Quarterly, that adds up to more than £140 in additional payments.

- This doesn’t include Winter Fuel Payments, Pension Credit, or any other Council Tax or housing support.

In today’s economic climate — with higher energy costs, food inflation, and rising rents — every pound counts. And while the increase may not feel life-changing, it can ease pressure for those on fixed incomes.

Additional Help for Pensioners

Aside from the State Pension increase, there are several government programs that could put more money in your pocket:

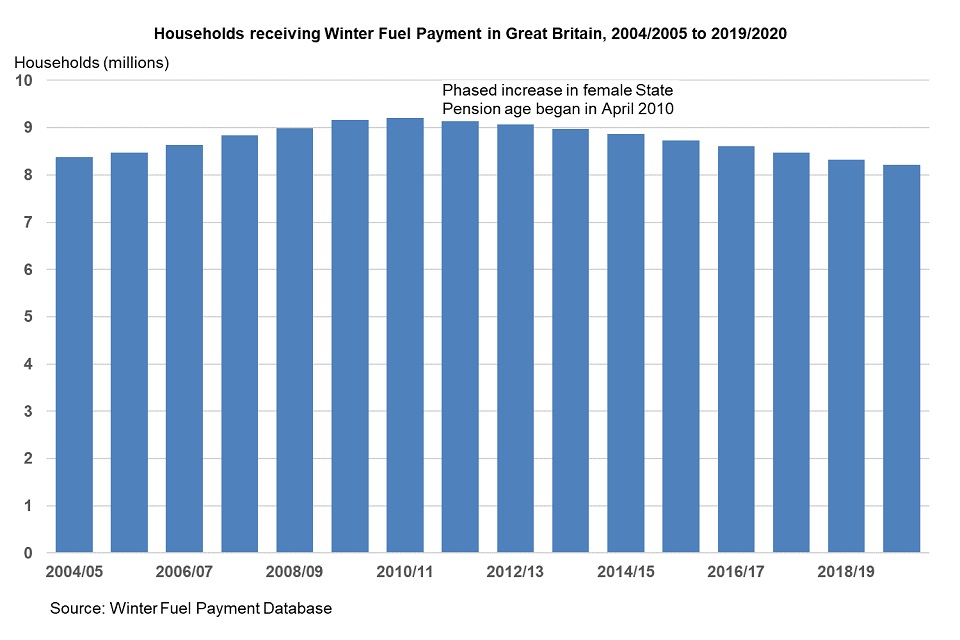

Winter Fuel Payment

- For those born before 25 September 1957

- Pays £100 to £300 to help with heating bills

- Usually paid between November and December

- Tax-free and doesn’t affect other benefits

Pension Credit

- Designed for low-income pensioners

- Tops up weekly income to at least:

- £201.05 (single person)

- £306.85 (couple)

- Can unlock extra support, including:

- Free TV licence (over 75)

- Cold Weather Payments

- Council Tax discounts

New vs Basic State Pension: What’s the Difference?

| Feature | New State Pension | Basic State Pension |

|---|---|---|

| Applies to | Retired after 6 Apr 2016 | Retired before 6 Apr 2016 |

| Max weekly (2025/26) | £230.25 | £176.45 |

| Years of NI required | 35 years | 30 years |

| Pension Credit eligibility | Yes | Yes |

Eligibility: Who Gets the Payment Hike for Pensioners?

To claim any part of the State Pension, you must meet:

- Minimum of 10 years of National Insurance contributions to qualify

- 35 years for the full New State Pension

- You must be at least 66 years old (rising to 67 by 2028)

Planning Ahead: What This Means for Private Pension Holders

If you’re receiving both a State Pension and a private pension — or planning to — the State Pension increase still matters.

Here’s why:

- It allows you to draw down less from your private pension, preserving savings

- Helps you better plan your monthly income against inflation

- Useful in calculating tax-free thresholds, especially for marginal taxpayers

Real-Life Examples of Payment Hike for Pensioners

Michael (Age 67):

Receives the full New State Pension.

His pension goes from £230.25 → £241.30/week = +£572/year.

Anita (Age 74):

Gets Basic State Pension and Pension Credit.

Receives £176.45/week → £184.90/week = +£438/year

Also qualifies for a £250 Winter Fuel Payment.

James & Sandra (Couple):

Retired after 2016. Combined increase = over £1,200/year in extra income.

That’s more than enough to cover their annual energy bills.