New Social Security Payment: When the new Social Security payment arrives on Friday, January 2, 2026, many folks across the United States will notice a bit more cash in their accounts. This isn’t just any regular payout — it’s the first deposit of the year, and it kicks off with a 2.8% cost-of-living adjustment (COLA). But not everyone is getting paid that day, and there’s a lot of confusion about who gets what and when. Whether you’re already retired, living with a disability, or planning your future, this guide gives you the facts, the context, and the next steps — written in a way that’s plain, accurate, and down-to-earth. Let’s break it down in simple language with expert-backed details, so you’re ready to make smart financial decisions heading into 2026.

Table of Contents

New Social Security Payment

The January 2, 2026 Social Security payment marks the beginning of a new financial year for millions of Americans. Thanks to the 2.8% COLA, your benefits will go a bit further — helping cover essentials like rent, food, medicine, and gas. But understanding the schedule, eligibility, and program changes is crucial to staying ahead of the curve. This article is your go-to guide for making sense of the who, when, and how much. Be sure to log into your SSA account, track your payments, and plan ahead. The system isn’t perfect, but the more you know, the better you can make it work for you.

| Topic | Detail |

|---|---|

| Payment Date | Friday, January 2, 2026 |

| Who Gets Paid Early | People receiving Social Security before May 1997, and those getting both SSI and Social Security |

| 2026 COLA Rate | 2.8% increase (applies to all benefits) |

| Average Monthly Benefit (post-COLA) | $2,071 for retirees |

| Maximum SSI Benefit (2026) | $994 (individual), $1,491 (couple) |

| Reason for Early Payment | January 3 falls on a Saturday |

| Official Source | ssa.gov |

What Is New Social Security Payment and Why Should You Care?

Social Security is the largest benefit program in the U.S., designed to provide monthly income to retired workers, disabled individuals, survivors, and low-income Americans through Supplemental Security Income (SSI).

It was created in 1935 during the Great Depression — back when folks didn’t have pensions or 401(k)s. President Franklin D. Roosevelt signed it into law to make sure elderly Americans could retire with dignity. Fast forward to today, over 70 million people receive Social Security or SSI benefits every month. Source: SSA.gov

If you rely on these payments — or plan to — knowing when and how much you’ll receive is critical.

Why the January 2, 2026 Payment?

Usually, Social Security payments are sent out according to the following:

- 3rd of each month: For those who started benefits before May 1997

- Wednesdays based on your birthdate: For those who started after May 1997

- 1st of the month: For SSI recipients

But this year’s different. January 1 is a federal holiday, and January 3 falls on a Saturday — so SSA moves the payment up to Friday, January 2, 2026.

This prevents delay and ensures you get your funds on time.

Who Will Receive The New Social Security Payment on January 2?

Only specific groups will get their money on January 2, 2026:

- People who began receiving Social Security benefits before May 1997

- People who receive both SSI and Social Security benefits

Let’s look at some quick examples:

- David, 80, has been receiving retirement benefits since 1994 → Paid Jan 2

- Maria, 66, receives SSI and Social Security due to a disability → Paid Jan 2

If you don’t fall into these groups, your benefits will be paid later in the month.

Full Social Security Payment Schedule for January 2026

| Birthday Range | Payment Date |

|---|---|

| 1st–10th of month | Wednesday, January 14, 2026 |

| 11th–20th | Wednesday, January 21, 2026 |

| 21st–31st | Wednesday, January 28, 2026 |

SSI payments for January will actually be issued on December 31, 2025, since January 1 is a holiday. Yes — you’ll see your SSI before the new year begins.

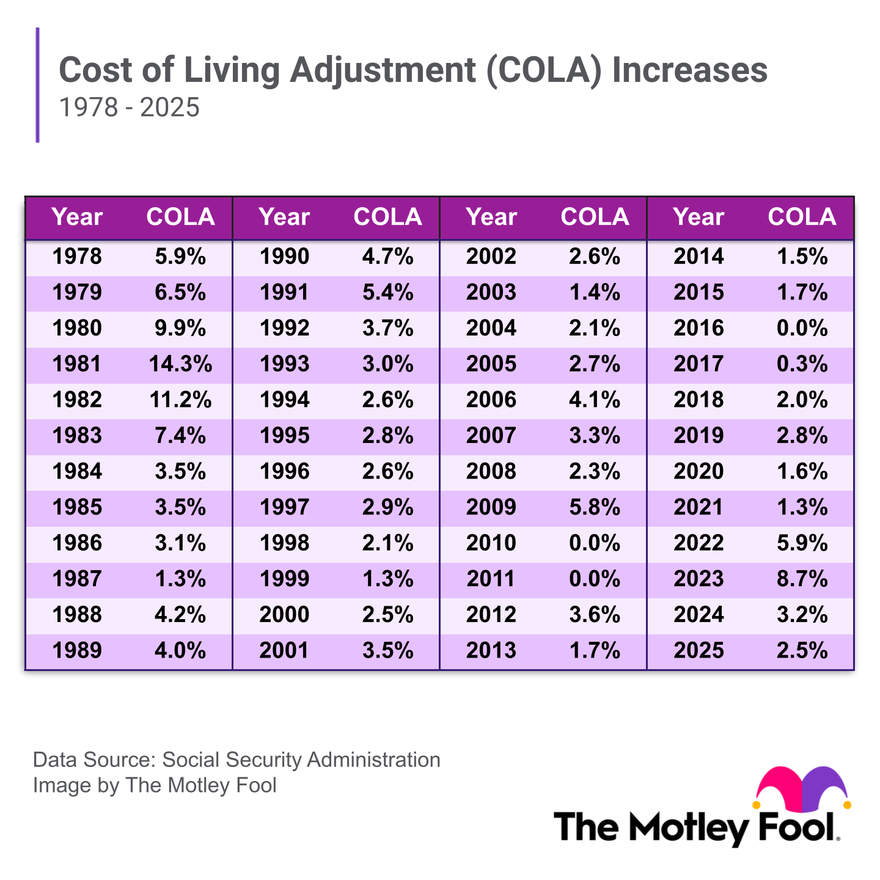

What Is COLA and Why Does It Matter?

COLA, or Cost-of-Living Adjustment, is an annual increase in benefits to match inflation. Every fall, the Social Security Administration checks prices using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

If prices go up, your benefits do too. If they stay flat — no change. For 2026, COLA is set at 2.8%. That’s better than recent years and can make a real difference.

How Much More Will You Get in 2026?

Here’s what that 2.8% COLA means in real dollars:

| Benefit Type | 2025 Amount | 2026 (After COLA) |

|---|---|---|

| Average Retired Worker | $2,015 | $2,071 |

| Aged Couple, Both Receiving | $3,121 | $3,208 |

| SSI Individual Max | $966 | $994 |

| SSI Couple Max | $1,448 | $1,491 |

| Disabled Worker | $1,489 | $1,531 |

These are average numbers. Your exact benefit depends on your work history, earnings, and age at retirement.

Eligibility Requirements for Social Security and SSI

To get Social Security benefits (retirement, disability, or survivors):

- You must have earned at least 40 work credits (10 years of work paying into Social Security taxes)

- You must meet age or disability criteria

- Spouses and dependent children may also qualify

To get Supplemental Security Income (SSI):

- You must be 65 or older, blind, or disabled

- You must have limited income and few financial resources

- You must be a U.S. citizen or lawful permanent resident

Note: SSI is funded by general tax revenues, not Social Security taxes.

Tools to Manage Your Benefits

The SSA has made it easier than ever to manage your benefits online. Here’s what you can do with a mySocialSecurity account:

- View your benefit statement

- Get your payment history

- Update your direct deposit info

- Estimate future benefits

- Get proof of income

State-Level SSI Supplements

Some states add money to your monthly SSI benefits through state supplements. These vary by where you live and your personal situation (e.g., living alone, assisted care, etc.).

States like California, New York, Massachusetts, and New Jersey offer some of the highest supplements. Others, like Arizona or Mississippi, may not offer any.

Impact of New Social Security Payment on Other Benefits

Getting a higher Social Security check can affect your eligibility for other federal or state programs, especially means-tested programs.

Here’s what might change:

- SNAP (food stamps): If your income rises, your benefits may go down

- Medicaid eligibility: Income thresholds can be affected

- Housing assistance (Section 8): Rent share may increase slightly

Before you panic — the SSA and most states account for COLA increases when recalculating these benefits. Still, check with your local office if you notice any changes.

Common Mistakes to Avoid

- Assuming your payment will always arrive on the same day — check the annual calendar.

- Not setting up direct deposit — paper checks can be lost or delayed.

- Ignoring COLA notices — always read your benefit letter in December.

- Failing to report income changes if you receive SSI. This can lead to overpayments and future penalties.

$1,800 IRS Direct Deposit in January 2026 – Who Is Eligible This Time

IRS Confirms $1,390 Direct Deposit Relief Payments – Check Eligibility Now