New DWP Rule: If you’ve heard the buzz — “a new DWP rule means thousands won’t get their State Pension at 66” — you’re probably wondering what’s going on. Is this a new law? A quiet policy change? Or just the media twisting the facts? Here’s the deal: there’s no sudden “trapdoor” rule blocking people from getting their pension. But the existing rules are catching thousands off guard, especially those with gaps in their National Insurance (NI) record, people who lived abroad, or folks who simply never checked their entitlements. These aren’t just headlines. They’re real problems with real consequences. This article cuts through the noise. Whether you’re a retiree, a working professional, or someone helping a loved one plan their future — you’ll find everything you need to know right here.

Table of Contents

New DWP Rule

There isn’t one dramatic new “DWP rule” blocking everyone from getting their State Pension at 66. But the real impact of existing rules — plus the upcoming 2026 changes — means thousands of people could be left with no pension, or just a fraction of what they expected. Most of this comes down to awareness. If you don’t check your NI record or State Pension forecast in time, you could miss the window to fix it. The smartest move? Take action now. Check your record. Plug any gaps. Ask for help. Don’t wait until it’s too late. Because when it comes to your retirement, it’s not just about age — it’s about preparation.

| Topic | Key Info |

|---|---|

| State Pension Age | Currently 66; rising to 67 by 2028 |

| Full Pension Requirement | 35 qualifying years of NI |

| Minimum Years for Any Pension | At least 10 years |

| 2026 Change for Expats | Tighter voluntary NI contribution rules |

| Number Receiving State Pension | Over 12.9 million in Great Britain (2024) |

What’s This “New DWP Rule” Everyone’s Talking About?

Let’s be real — the term “new DWP rule” is a bit misleading. What’s actually going on is a mix of existing eligibility requirements and a few upcoming changes that make it harder for some people to qualify for a pension — especially at age 66.

Here’s the core truth:

- You don’t automatically get the State Pension just because you turn 66.

- You need at least 10 qualifying years of National Insurance contributions (or credits) to get any pension.

- You need 35 years to get the full pension, currently worth about £230.25 per week.

- Starting April 6, 2026, people living abroad will face stricter rules on paying voluntary contributions.

So while there isn’t one single “new rule,” the impact is very real: thousands of people approaching retirement are finding out too late that they don’t qualify — or only get a fraction of what they expected.

Who’s at Risk of Missing Out?

If you fall into any of these categories, you could be affected:

1. You have fewer than 10 years of NI contributions

This is the absolute minimum to qualify for any State Pension. Even if you’ve worked most of your life but had long gaps — like raising kids, illness, or being abroad — you might fall short.

2. You lived or worked abroad

Many Brits who moved overseas don’t have enough UK-based NI years. The UK does have agreements with some countries (like Australia, the EU, and Canada), but these don’t always count toward full pension eligibility. And from 2026, you may not be able to pay to top it up anymore.

3. You assumed credits were automatic

Some people think being a stay-at-home parent or carer means you automatically get NI credits. That’s only true if you claimed Child Benefit or Carer’s Allowance — and many didn’t.

4. You delayed or skipped claiming

Unlike some benefits, the State Pension isn’t paid automatically. You must actively claim it — otherwise you’ll get nothing. Some people delay intentionally (to increase their payment), but others miss out by mistake.

5. You worked but earned under the threshold

Even if you worked part-time or full-time on low wages, you might not have paid NI if your earnings were below the Primary Threshold. That means those years don’t count.

A Real-Life Story — Janet’s Surprise

Janet, 65, worked full-time in the UK for 15 years, then moved to Spain for 20 years. She thought she’d be fine — but when she checked her State Pension forecast, it showed only 15 qualifying years.

With no NI paid while she was abroad (and no credits claimed), she found out she would not qualify for the full pension. And due to upcoming 2026 changes, she might not be able to top up her record with voluntary contributions unless she acts now.

Upcoming Change in 2026 — Why Expats Should Worry

One of the biggest policy shifts that’s been under the radar is the change affecting voluntary NI contributions for people living abroad:

- Before April 2026: If you live overseas, you may still be able to pay Class 2 or Class 3 voluntary contributions to boost your record.

- After April 2026: You’ll only be allowed to do this if you lived in the UK for 10+ years or have a close NI history. If you’ve been abroad for decades, you may not qualify anymore.

This change is expected to hit tens of thousands of UK citizens living abroad — particularly retirees and long-term migrants — who hoped to rely on a UK pension.

![State Pension Age Review]=](https://seaplanesandais.com/wp-content/uploads/2025/12/State-Pension-Age-Review-1024x541.jpg)

Why So Many Miss Out — And Don’t Realize Until It’s Too Late

The biggest tragedy here is that most people find out too late — usually around age 65 or 66 — when they’ve already retired, or are planning to. Here’s why:

- Over 50% of UK adults don’t know how much pension they’ll get.

- Many falsely assume working = automatic entitlement.

- Few check their State Pension forecast before retirement.

- Even fewer understand they can buy back missing years — and sometimes at a huge discount (for years 2006–2016, extended until 2025).

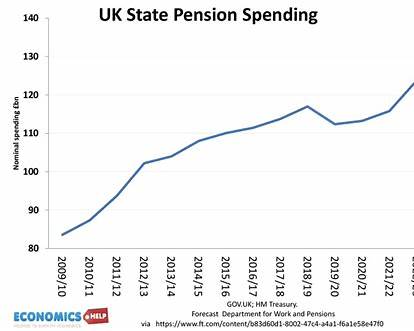

How Much State Pension Do You Get?

The full new State Pension (2025/26) is:

- £230.25 per week

- That’s about £11,974 annually

If you have fewer than 35 years, your payment is reduced proportionally. For example:

- 20 qualifying years: you’ll receive about 57% of the full amount — roughly £6,800/year.

- 10 qualifying years: that might be just £3,400/year — and that’s if you meet the minimum threshold.

These payments are often topped up with Pension Credit, but not everyone qualifies.

New DWP Rule: What You Can Do Right Now

Here’s the good news: there’s still time to fix this — if you act early.

1. Check Your State Pension Forecast

Go to Check State Pension and get a free estimate. You’ll see:

- Your projected pension age

- Number of qualifying NI years

- How much you’re forecasted to receive

- Gaps in your record

2. Review Your National Insurance Record

Find out if you’ve missed any NI years at View your NI record. Each missing year could cost you hundreds in annual pension income.

3. Fill Gaps with Voluntary Contributions

You can buy missing years if you’re eligible. This is especially useful if:

- You’re close to 10 years (to qualify at all)

- You’re short of 35 years (to max out your benefit)

Class 3 contributions cost about £907 per year — but can boost your pension by over £300/year for life. That’s a solid return on investment.

4. Claim Any Missed Credits

If you were a carer, parent, or ill and didn’t work — you may be owed NI credits. These can often be applied retroactively if you contact HMRC.

5. Seek Professional Advice

A regulated pension adviser can help you plan better and understand if voluntary contributions make sense in your case.