Major Pension Rule Change: The Department for Work and Pensions (DWP) confirms 256,000 people to benefit from a major pension rule change—and it’s about time. For years, thousands of pensioners had quietly been losing out on inflation protection for a chunk of their hard-earned retirement income. This wasn’t a glitch. It was baked into the system due to outdated rules. But thanks to new action by the UK Government, pensioners covered under certain schemes will finally see pre-1997 benefits increase with inflation. This long-anticipated fix is expected to improve financial security for a generation of retirees who were unintentionally left behind. Whether you’re nearing retirement, advising clients, or just keeping tabs on economic justice — this guide walks you through everything you need to know.

Table of Contents

Major Pension Rule Change

This change may not grab big headlines, but it’s a major step forward for fairness, dignity, and economic security. For too long, a generation of retirees quietly endured eroding incomes, even after giving decades of service to their employers. With this reform, the DWP and the UK government are correcting a decades-old flaw — and giving 256,000 people a better shot at a comfortable, secure retirement. Whether you’re one of them or advising someone who is, now’s the time to understand, prepare, and plan for what’s coming. Inflation isn’t slowing down — but now, at least, your pension won’t stay stuck in the past.

| Feature | Details |

|---|---|

| Who’s Affected | 256,000 people in total |

| Breakdown | 165,000 PPF members, 91,000 FAS members |

| Policy Change | Pre-1997 pension benefits will now receive inflation protection (indexation) |

| New Indexation Rate | Up to 2.5% per year |

| Implementation Target | January 2027 (pending legislation) |

| Official Resources | PPF Official Site |

| Announced By | HM Treasury & DWP |

Why the DWP Major Pension Rule Change Matters?

To really understand this, you need a bit of context.

When an employer’s defined benefit pension scheme collapses — often due to insolvency — the UK’s Pension Protection Fund (PPF) or Financial Assistance Scheme (FAS) steps in to make sure pensioners still get most of what they were promised.

But there was a catch.

Only benefits earned after April 6, 1997 were legally required to increase each year to keep up with inflation. Everything earned before that date could be frozen — forever.

That means people with a long career before 1997 were stuck with flat payouts that didn’t change — even as grocery prices, utility bills, and rent soared.

For many, this led to real hardship over the years, especially during inflation spikes like the one experienced after 2020. Retirees watched their purchasing power shrink while their bills got bigger.

Who Is This Helping?

The DWP’s update will help an estimated 256,000 individuals who are members of:

- The Pension Protection Fund (PPF) – a safety net for collapsed employer pension schemes.

- The Financial Assistance Scheme (FAS) – which supports pensioners from schemes that were underfunded and failed before the PPF existed.

Breakdown of Those Affected:

- 165,000 people under the PPF

- 91,000 under the FAS

This is no small population. Most of these pensioners are older, many well into retirement, and have been managing on incomes that haven’t kept pace with real-world costs. This rule change could help them stay financially afloat in the face of rising living costs.

What’s Actually Changing?

Here’s a plain-English breakdown.

Before:

- Pre-6 April 1997 benefits didn’t receive automatic inflation increases under PPF/FAS rules.

- Pensioners lost purchasing power over time.

- Even if their original employer scheme offered indexation, it was removed when the PPF/FAS stepped in.

After:

- All eligible pre-1997 pension benefits will now receive annual inflation increases, capped at 2.5%.

- This matches how post-1997 benefits are already treated.

- The change is universal for eligible members—no application necessary.

- First payments with the increase are expected in January 2027, pending legislative approval.

This brings consistency, fairness, and financial relief to pensioners who were previously left behind.

What Does Indexation Really Mean?

Let’s say you retired with a pension that paid £10,000 annually, most of which was earned before 1997. Without indexation, that amount stays the same, no matter what inflation does.

With this change, if inflation is 2.5%, your £10,000 would become £10,250 the next year. It may not sound like much, but over time, that adds up — especially if you live another 20+ years in retirement.

This is especially important in an economy where energy prices, rent, and essentials can spike quickly. Indexation is what keeps pensions meaningful.

Why Was This Rule Ever a Thing?

Before 1997, there was no legal requirement in the UK for pension schemes to provide inflation-linked increases. While some did it voluntarily, many didn’t. When the PPF or FAS took over collapsed schemes, they followed the law strictly — indexing only post-1997 benefits.

The result? Pensioners lost out on inflation protection they may have expected — or even had in their original contracts.

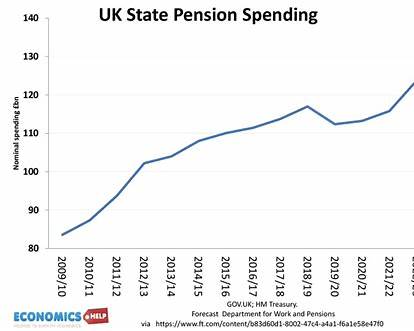

For years, this has been a sore point, especially as PPF surpluses grew and inflation began to eat away at fixed incomes. Critics called the rule unfair, and several industry voices urged the government to act.

How Much Money Are We Talking?

This depends on the person — but let’s do a rough example:

Example Pensioner:

- Retired with a total pension of £12,000 annually

- £9,000 of it was earned before 1997

- Under the old rules: £9,000 stayed flat

- Under the new rule: That £9,000 can increase by up to 2.5% a year

That’s an extra £225 per year, growing every year — potentially thousands more over their lifetime.

If you’re working with hundreds of thousands of pensioners like this, the numbers are significant — both in individual lives and in national pension planning.

Is the PPF Financially Able to Do This?

Yes. In fact, that’s part of why the change was possible now.

As of the latest reports:

- The PPF held over £39 billion in assets.

- It had a surplus of £12 billion, meaning it’s financially secure.

- Their investment strategies have outperformed projections.

In other words, the fund is healthy enough to handle the increased outflows. There’s room to make pensions fairer without risking the system.

The PPF has supported this change and welcomed the government’s announcement.

Major Pension Rule Change: What Should Pensioners Do Now?

This change will be applied automatically — but that doesn’t mean you should sit back completely.

Here’s what you should do:

- Check your membership — Are you part of the PPF or FAS?

- Review your statement — See how much of your pension was earned before April 1997.

- Sign up for updates — Use the PPF website or the GOV.UK portal to stay informed.

- Talk to an adviser — If you’re unsure how this affects you long-term, a regulated financial adviser can help.

- Plan ahead — Consider how extra indexation might help with inflation or budgeting.

What If You’re Not Covered by the PPF or FAS?

If you’re in a private or corporate pension scheme that hasn’t entered the PPF, this change doesn’t apply to you. However, some private schemes do voluntarily offer inflation protection on all benefits, including pre-97.

It’s best to check with your pension provider and review your scheme’s rules to understand your own situation.

Why January 2027?

The government needs time to draft legislation, consult industry stakeholders, and adjust systems to make this work. While 2027 feels far off, the delay ensures the change is sustainable and legally sound.

Watch for updates in official DWP or PPF press releases — and expect new legislation to be debated in Parliament within the next 12–18 months.