IRS Confirms $2,000 Direct Deposit: If you’ve recently seen claims like “The IRS has officially confirmed a $2,000 direct deposit for all Americans starting January 1, 2026” — you’re not alone. The internet has been buzzing with posts, memes, and even TikToks suggesting a new wave of stimulus-style payments is coming right around the corner. But before you start making plans to spend that money, let’s hit pause and look at what’s really going on. Spoiler alert: There is no official IRS confirmation of a $2,000 direct deposit to all Americans. This article is your full guide to breaking down the rumor, reviewing real IRS statements, understanding what payments may actually be coming in 2026, and how you can protect yourself from misinformation and scams.

Table of Contents

IRS Confirms $2,000 Direct Deposit

Despite what you’ve read online or seen on social media, there is no official $2,000 IRS direct deposit starting January 1, 2026. The IRS has not confirmed any such payment, and no new law has been passed to approve one. That doesn’t mean you won’t get money back from the IRS — tax refunds, credits, and benefits still exist and are often substantial, especially for families. But it’s important to separate fact from fiction. The best way to stay informed is to use official channels, file your taxes properly, and ignore misleading claims.

| Topic | Fact / Data |

|---|---|

| $2,000 direct deposit confirmed? | No such payment has been confirmed or scheduled |

| Latest stimulus legislation passed | None since 2021’s American Rescue Plan |

| Average 2023 tax refund | $2,753 |

| “Tariff dividend” payments? | Proposal only — not law |

| Where to verify real IRS payments | https://www.irs.gov/newsroom |

What’s Really Happening With the IRS Confirms $2,000 Direct Deposit Rumor?

Let’s start by making it crystal clear: There is currently no $2,000 stimulus or relief check officially approved or scheduled by the U.S. government or the IRS.

The IRS is a federal tax agency — it does not have the authority to create or send out mass payments without Congress passing a law to allow it. Every major stimulus payment issued since 2020 has come directly from legislation:

- CARES Act (2020): $1,200 checks

- Consolidated Appropriations Act (2020): $600 checks

- American Rescue Plan (2021): $1,400 checks

Since then, no new stimulus bills have passed, and no official agency statement has indicated a new round of payments.

Where Did This Rumor Come From?

This particular wave of misinformation seems to have started from:

- Clickbait blog posts and viral social media content

- Titles like “$2,000 IRS Check Coming Jan 1!” catch eyes and clicks.

- Misinterpretation of tax refunds

- Many Americans receive tax refunds around that amount — but this is based on personal filings, not a stimulus.

- Confusion around “tariff dividend” proposals

- A political concept suggesting families could receive a $2,000 check from tariff proceeds — but it’s just a proposal, not law.

Understanding the “Tariff Dividend” Idea

The term “tariff dividend” was popularized during recent political speeches, particularly by former President Donald Trump. The idea is that tariffs (taxes on imported goods from other countries) could fund direct payments to American families — essentially returning part of the revenue collected back to taxpayers.

Here’s the catch: This hasn’t happened yet. It’s merely a proposal, and no legislation has been introduced or passed to make it a reality. Without a passed law, the IRS cannot distribute such payments.

How Real IRS Payments Actually Work?

Many people genuinely do receive around $2,000 early in the year — but this usually comes in the form of tax refunds, earned credits, or other benefits that vary based on your income, dependents, and tax situation.

Let’s break it down:

1. Tax Refunds

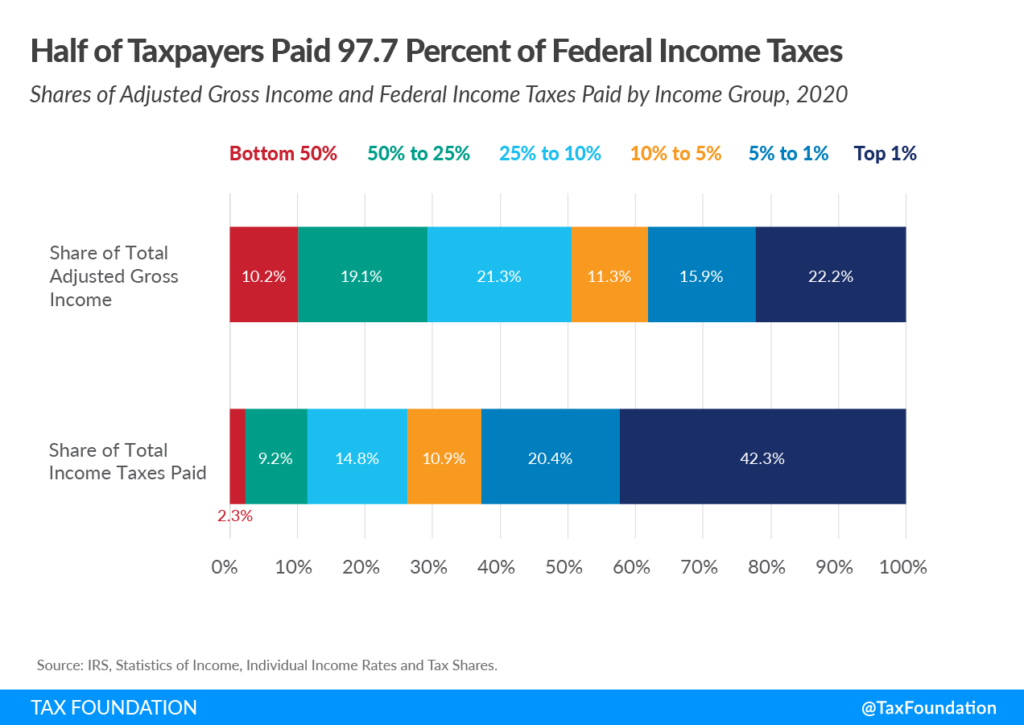

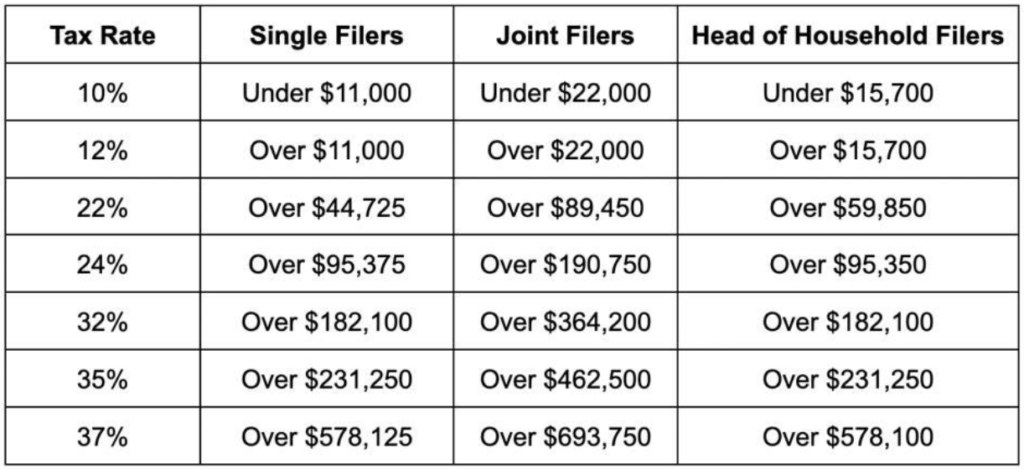

In 2023, the average tax refund was $2,753. This number varies significantly depending on your income level, with many low- and middle-income households receiving refunds near or above $2,000.

2. Earned Income Tax Credit (EITC)

This credit benefits low- to moderate-income workers. In 2025 (for the 2026 filing season), qualifying families with three or more children could receive up to $7,430.

3. Child Tax Credit (CTC)

Families may be eligible for up to $2,000 per qualifying child under the current CTC law. The refundable portion (up to $1,500 per child) is called the Additional Child Tax Credit (ACTC)

How to Spot Fake $2,000 Direct Deposit Claims?

Here are some common warning signs:

- Claims that “everyone gets paid” without qualification

- Misuse of official-sounding websites (e.g., irsreliefnow2026.com)

- Messages asking for your Social Security Number, bank details, or promising “early access”

- Fake social media “IRS representatives” offering help

Tip: The IRS will never email, text, or DM you for payment information. They use official mail only for communication unless you’ve initiated contact through your IRS online account.

Legit Ways You Could Receive IRS Money in 2026

Even though the $2,000 direct deposit rumor is false, here are legitimate ways the IRS may still send money to taxpayers in 2026:

- Recovery Rebate Credit: For those who missed prior stimulus checks

- Tax Refunds: Based on overpayment or eligible deductions

- Credits: EITC, Child Tax Credit, Education Credits (like American Opportunity Credit)

- State Refunds: Some states, like California or Alaska, may issue independent payments

Steps to Maximize Your 2026 IRS Refund (The Legal Way)

- File Early: The earlier you file, the sooner you receive your refund — especially if you use e-file and direct deposit.

- Keep Updated Records: Save your W-2s, 1099s, and receipts.

- Use Tax Software or a Professional: Don’t miss out on credits or deductions.

- Set Up an IRS Online Account: Manage payments, view transcripts, and track deposits. Create one here

$1,800 IRS Direct Deposit in January 2026 – Who Is Eligible This Time

U.S. Minimum Wage Rises In 2026: Updated Hourly Pay From January 1

IRS Confirms $1,390 Direct Deposit Relief Payments – Check Eligibility Now