Federal $2,000 Deposits Coming in January 2026: now that’s a headline that turns heads. From barbershops to coffee shops, this topic is sparking real conversations. Folks are asking: Is this legit? Is the IRS dropping $2,000 checks again? Am I eligible? Let’s clear the fog and lay down the facts in this comprehensive, easy-to-understand guide that mixes plain talk with expert knowledge. Whether you’re a retiree on Social Security, a working parent counting on your refund, or a tax pro prepping early — this article has your back.

Table of Contents

Federal $2000 Deposits Coming

Despite what you may have heard online, there is no official $2,000 federal deposit scheduled for January 2026. The rumors are based on confusion, past stimulus memory, and future proposals that haven’t become law.

What is happening?

- IRS is sending out delayed Recovery Rebate Credits (up to $1,400)

- Tax refunds will go out starting in February for early filers

- SSA, SSI, VA, and RRB benefits will be paid on their regular monthly schedules

Your best path to getting the money you deserve? Stay informed, use IRS tools, and file early.

| Topic | Summary |

|---|---|

| Federal $2,000 Deposits January 2026 | No official federal stimulus or IRS payment confirmed |

| IRS Recovery Rebate Credit | Up to $1,400 still being disbursed to late filers |

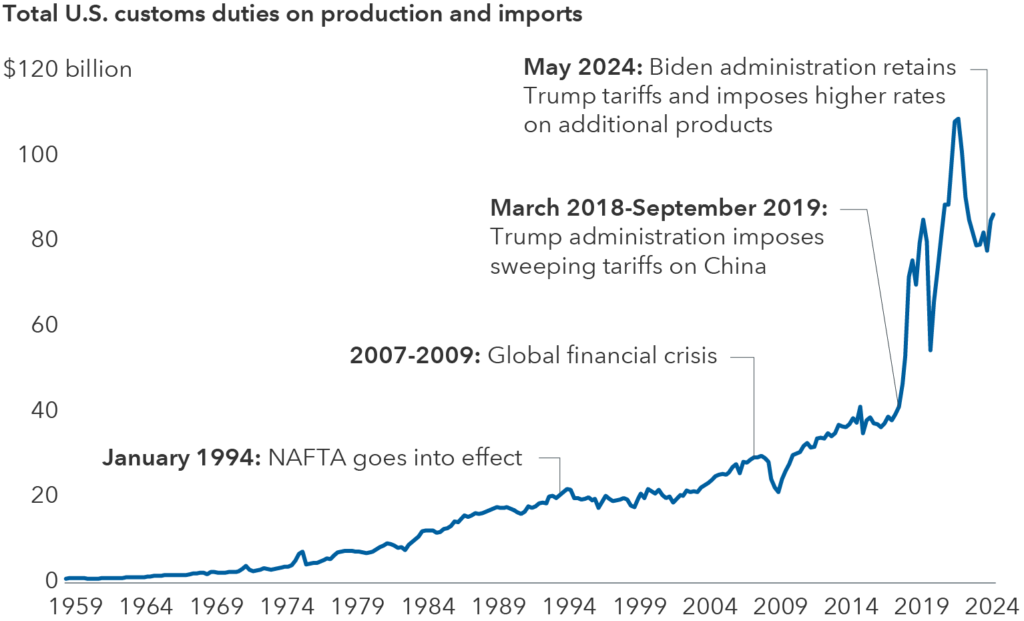

| Proposed “Tariff Dividend” | ❗Political idea, not yet passed into law |

| Who gets money | Taxpayers due refunds, SSA, SSI, VA recipients |

| IRS Tools | IRS Refund Tool |

The Buzz: Why Is Everyone Talking About Federal $2000 Deposits Coming?

The internet — and especially social media — has a way of making hope go viral. Here’s why:

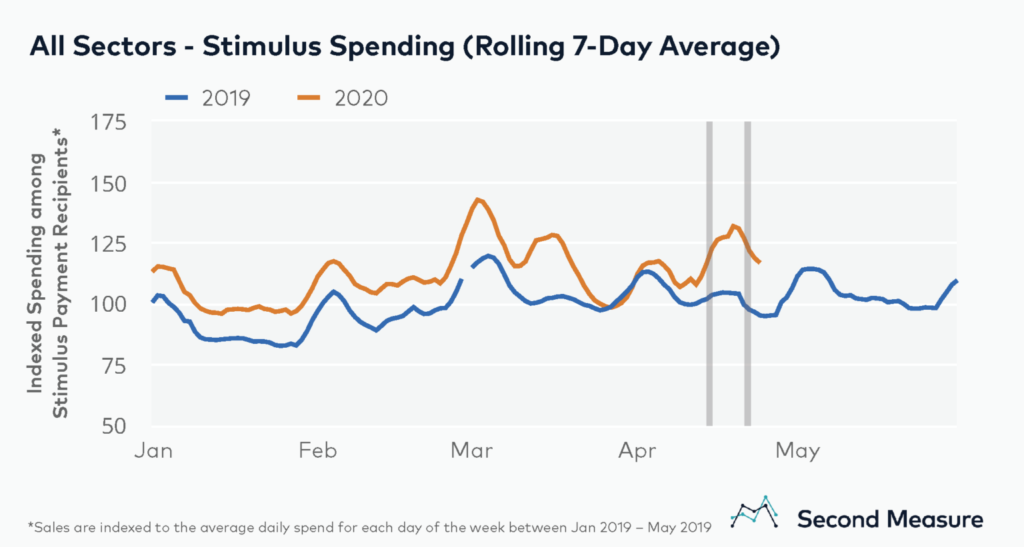

- People remember COVID stimulus checks (2020–2021), including those $1,200 and $1,400 payments.

- Politicians have floated fresh proposals, like the “Trump Tariff Dividend” of $2,000 per person from collected tariffs.

- Misinformation gets amplified online. One misleading headline can spark millions of reposts, many without context.

The bottom line? As of now, no legislation has passed guaranteeing a $2,000 direct deposit from the IRS or Treasury in January 2026.

What the IRS Is Actually Doing in Early 2026?

Although no $2,000 check is scheduled, there are still real payments going out — just not in the way the viral posts claim.

1. Unclaimed Recovery Rebate Credit Payments (Up to $1,400)

The IRS estimates that hundreds of thousands of taxpayers either never received, or didn’t claim, their third stimulus check from 2021. If you were eligible but didn’t get it, you can still file a Recovery Rebate Credit.

- Available to low-income households, students, new filers, or people who didn’t file in 2021–2022.

- Can be claimed by filing a late 2021 return or amended return.

- Payments are processed and may appear in early 2026, especially if filed in late 2024.

This is the only federal check remotely close to $1,400–$2,000 still going out today.

2. Tax Refunds for Early Filers

If you’re due a refund, filing as soon as IRS opens the gate could result in a deposit in your account by February.

- File electronically with direct deposit = fastest turnaround.

- Some refunds (EITC, ACTC) are delayed by law until mid-February.

3. Monthly Benefit Deposits: SSA, SSI, VA, RR

Millions of Americans receive scheduled monthly deposits from benefit programs including:

- Social Security (SSA) – for retirees and disability recipients.

- Supplemental Security Income (SSI) – for low-income individuals and disabled.

- Veterans Affairs (VA) Benefits – for disabled veterans and survivors.

- Railroad Retirement (RRB) – for railroad retirees.

These are not new stimulus payments, but legitimate, ongoing federal disbursements that may show up in January like any other month.

What’s the Deal With the Federal $2000 Deposits Coming Proposal?

This is where things get tricky.

A few candidates have proposed using U.S. tariffs on foreign goods to fund a universal dividend — up to $2,000 per adult — which would be sent out annually. In theory, this “tariff dividend” would reward American consumers for buying domestic.

BUT…

- It has not passed Congress.

- The IRS has no mechanism in place to issue such checks.

- No official implementation timeline has been set.

Until something is written into law, this remains political speculation, not policy.

Real Examples of Payments That Are Happening

Let’s put a face on this with a few real-world scenarios.

- Terrell, 28, Baltimore, MD: Missed his 2021 tax return. Filed late in 2024, received a $1,400 Recovery Rebate in January.

- Mary & Jeff, retirees in Georgia: Expecting their regular SSA check of $2,278 around January 10.

- Kiana, single mom of 2 in Fresno, CA: Filed on January 30. Received her $2,350 refund by direct deposit February 14.

None of them received “new” $2,000 checks — but they received legit deposits via existing programs and timely filings.

How to Track IRS Payments and Refunds?

If you’re ever unsure about what’s coming your way, use these official tools — not third-party sites.

IRS “Where’s My Refund?” Tool

Check your refund status online in seconds. You’ll need your:

- SSN or ITIN

- Filing status

- Refund amount

IRS Account Login

This lets you:

- See prior notices and tax balance

- View your economic impact payments (stimulus)

- Get transcripts

Top Ways to Protect Yourself from Federal $2000 Deposits Scams

Any time big money rumors hit the internet, scammers follow close behind. Here’s how to stay safe:

Red Flags:

- “Click here to claim your $2,000 check!”

- “Update your direct deposit to receive your government payout.”

- “Pay a small fee to unlock your federal funds.”

Smart Moves:

- Never click payment links in email or text — especially if it’s not from .gov.

- Only trust official government domains:

.govor.mil. - Use Multi-Factor Authentication (MFA) when logging into IRS or SSA portals.

- Report IRS impersonation scams: Report to TIGTA

Expert Quote: Real Talk from a Tax Pro

“Every year people ask me, ‘Is this $2,000 thing real?’ My advice is always the same: unless it’s on IRS.gov or signed into law, don’t believe it. You’re more likely to get what you’re owed by filing right and filing early than chasing rumors.”

— Juanita Marks, EA, Tax Advisor in Dallas, TX

$1,800 IRS Direct Deposit in January 2026 – Who Is Eligible This Time

Tax Refunds Could Be Bigger in 2026 — Here’s When the IRS Will Start Accepting Returns

IRS Confirms $1,390 Direct Deposit Relief Payments – Check Eligibility Now