DWP to Reclaim £300 From State Pensioners: that’s the headline stirring concern across the United Kingdom. Many retirees, financial advisors, and families supporting elderly relatives are wondering what this means and how it might affect them. The truth is, this isn’t some sudden punishment, but a result of longstanding rules being more strictly enforced, updated income thresholds, and government policy shifts.

In this in-depth guide, we’ll break down exactly what’s happening with the Winter Fuel Payment, when and why the Department for Work and Pensions (DWP) may recover up to £300 from pensioners, and what you can do to understand, prepare for, or challenge any reclaim notices. Whether you’re a retiree, a family member helping a loved one, or a financial planner advising clients — this article will guide you through every angle with clear examples, trustworthy data, and links to official sources.

Table of Contents

Reclaim £300 From State Pensioners

The bottom line is this: the DWP isn’t randomly taking money back from pensioners, but it is enforcing clear income rules, correcting system errors, and applying policy changes that affect thousands each year. If your taxable income is above £35,000, or if your circumstances change, you could be asked to repay all or part of the Winter Fuel Payment. Preparation, communication, and understanding your rights can help you avoid issues, appeal incorrect decisions, and stay on top of your retirement finances.

| Topic | Details |

|---|---|

| Benefit in question | Winter Fuel Payment |

| Reclaim amount | Up to £300 |

| Trigger points | Income over £35,000, ineligibility, overpayment, unreported changes |

| Eligibility age | State Pension age (currently 66 in the UK) |

| Taxable income threshold | £35,000+ per year |

| Key agencies involved | DWP and HM Revenue & Customs (HMRC) |

| Official source | gov.uk/winter-fuel-payment |

What Is the Winter Fuel Payment?

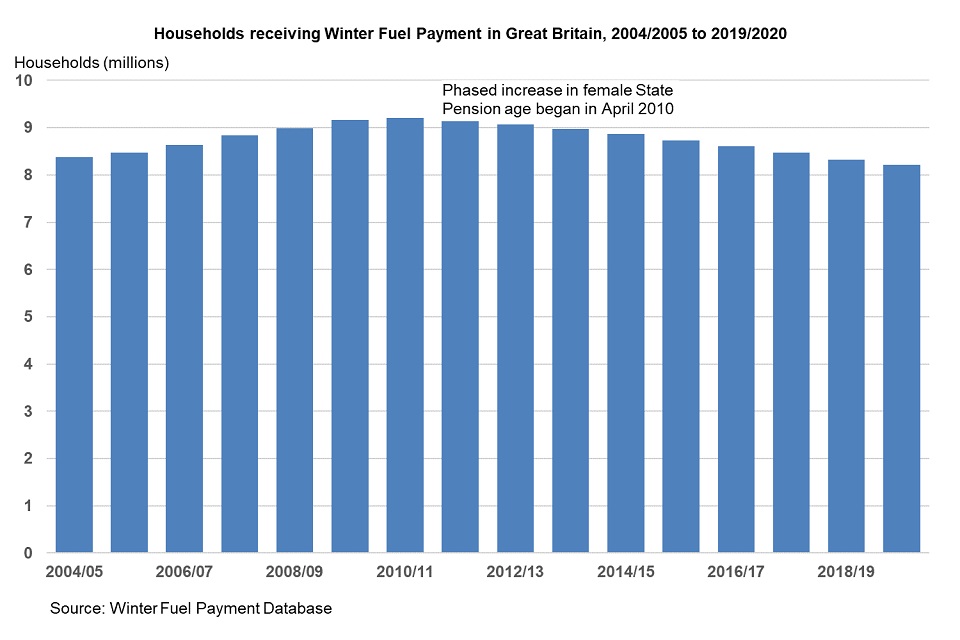

The Winter Fuel Payment is a non-taxable, yearly benefit provided to individuals who have reached the State Pension age in the UK. It is designed to help older people pay their heating bills during the cold winter months. Depending on your age and circumstances, the amount ranges from £100 to £300, and is usually paid automatically between November and January.

The Winter Fuel Payment has been a cornerstone of support for older people in the UK since it was introduced in 1997. However, as government spending continues to be scrutinized, adjustments to eligibility and reclaim processes have been introduced to ensure the benefit is targeted at those who truly need it.

Why the DWP May Reclaim £300 From State Pensioners: 4 Major Reasons

1. Income Threshold: You Earn More Than £35,000

The most common reason pensioners may have to repay the Winter Fuel Payment is because their annual taxable income exceeds £35,000. This threshold is not well-known by the general public, and it has only recently become more strictly enforced.

Taxable income includes:

- State pension

- Private or occupational pensions

- Employment or self-employment income

- Interest from savings and investments

- Rental income

This reclaim isn’t a fine or penalty. It’s part of a tax reconciliation process. You receive the Winter Fuel Payment upfront, but HMRC reviews your income at the end of the tax year. If you breach the income threshold, HMRC can recover the funds via tax code adjustment or Self Assessment.

Example:

Margaret, aged 70, received a £300 Winter Fuel Payment in December 2024. Her pension income, freelance work, and rental earnings totalled £36,800 for the year. In March 2025, HMRC adjusted her tax code, reducing her monthly pension by £25 for a year to recover the overpayment.

2. Changes in Eligibility Rules

In recent years, UK governments have shifted policies surrounding the Winter Fuel Payment. In 2024, the government considered limiting the payment to only means-tested pensioners, such as those receiving Pension Credit. Although this measure was reversed in 2025, these back-and-forth policies have created confusion and eligibility overlap.

As a result, pensioners who received the benefit while technically ineligible under interim rules may receive reclaim letters from the DWP or HMRC.

Adding to the confusion is the cost-of-living payments introduced during the pandemic and energy crises. Some retirees confuse these with the Winter Fuel Payment, not realizing different rules and income thresholds apply.

3. DWP or HMRC Overpayment Due to System Error

Another reason for reclaim is administrative error.

According to the DWP’s Benefit Overpayment Recovery Guide, if you receive a benefit payment you weren’t entitled to — even if it wasn’t your fault — the government is legally entitled to recover the money.

This might happen due to:

- Delayed processing of updated income or marital status

- System glitches causing duplicate payments

- Inaccurate personal information in HMRC or DWP systems

The good news is that in some hardship cases, pensioners can request a discretionary waiver or repayment plan. But you must act quickly when you receive a letter — time limits apply for appeals.

4. Unreported Changes in Circumstances

Failing to report key life changes can also trigger reclaim actions. The DWP relies on timely updates from recipients to ensure benefits remain correct.

Relevant changes include:

- Moving abroad for more than 4 weeks

- Starting work or earning income

- Beginning or ending a marriage or civil partnership

- Starting to receive other benefits

If you don’t notify the DWP, the payment may be classified as an overpayment, and you’ll be expected to repay it — even years later.

Tip: Keep your address, marital status, and income details up to date with both HMRC and DWP.

How the Reclaim Process Works: Step-by-Step

- Payment Made: You receive the Winter Fuel Payment — usually automatically — between November and January.

- End-of-Year Review: HMRC assesses your total taxable income after the tax year ends.

- Reclaim Decision: If your income exceeds £35,000 or you’re found ineligible, HMRC may trigger a reclaim.

- Notice Sent: You receive a letter explaining why repayment is required and how it will be collected.

- Tax Adjustment or Repayment Plan: Funds are recovered either through a tax code change (reducing future payments) or via direct repayment.

- Dispute or Appeal: You have the right to challenge the reclaim. Seek professional advice or contact Citizens Advice.

How to Prepare and Avoid Reclaim £300 From State Pensioners?

Here’s how to protect yourself or those you care for:

- Estimate your annual income in advance. If you’re close to £35,000, keep a buffer to avoid triggering recovery.

- Monitor all income sources. Include investments, annuities, rental income, or side work.

- Opt out if ineligible. You can notify the DWP before the Winter Fuel Payment is made if you believe you won’t qualify.

- Keep communication updated. Always inform HMRC and the DWP of changes in income, living situation, or other benefits.

- Keep documentation. If you receive a reclaim notice, having records helps prove your case or correct any errors.

What Financial Advisors and Planners Should Know

For professionals supporting older clients, here’s what to keep in mind:

- Include the Winter Fuel Payment in annual tax planning reviews.

- Consider the payment when assessing tax code changes and cash flow.

- Advise clients on benefit reporting responsibilities to avoid overpayments.

- Watch for duplicate benefit overlaps, especially with Cost-of-Living or Warm Home Discount payments.

Common Misconceptions (Cleared Up)

“Once I get the money, it’s mine to keep.”

False. Payments can be reclaimed through the tax system if eligibility or income changes.

“Only fraud leads to repayment.”

Incorrect. Most reclaims are due to income levels or system corrections, not fraud.

“I can ignore the reclaim letter.”

Dangerous. Ignoring letters can result in forced deductions, court orders, or legal action.