Costco Is No Longer for Bargain Hunters: Costco is no longer just a place for bulk deals and $1.50 hot dogs. In 2026, it’s evolved into a treasure trove of surprise luxury finds — think Rolex watches, 10-carat diamonds, and even 24-karat gold bars. Yep, you heard that right. The warehouse giant, known for its massive tubs of peanut butter and warehouse-sized savings, is now serving up luxury on the side. And people are loving it. This article explores Costco’s strategy, what luxury products are being sold, why this shift is happening, and what it means for shoppers and the retail industry at large. Whether you’re a Costco die-hard, a casual member, or a retail professional watching consumer trends, there’s something here for you.

Table of Contents

Costco Is No Longer for Bargain Hunters

Costco is proving that you can sell a 12-pack of chicken broth and a 10-carat diamond under the same roof — and make it work. The company’s ability to blend everyday essentials with high-end luxury reflects a deep understanding of its members and a forward-thinking approach to retail. As consumers demand more value — both at the low and high ends of the market — Costco’s model looks more relevant than ever. This strategy isn’t about abandoning bargains. It’s about expanding what a bargain means — from dollar hot dogs to discount gold bars.

| Topic | Details |

|---|---|

| Costco’s Strategic Shift | From bulk basics to luxury goods like Rolex watches, diamonds, and gold bars |

| Estimated Gold Sales | Up to $100M–$200M per month in gold bars |

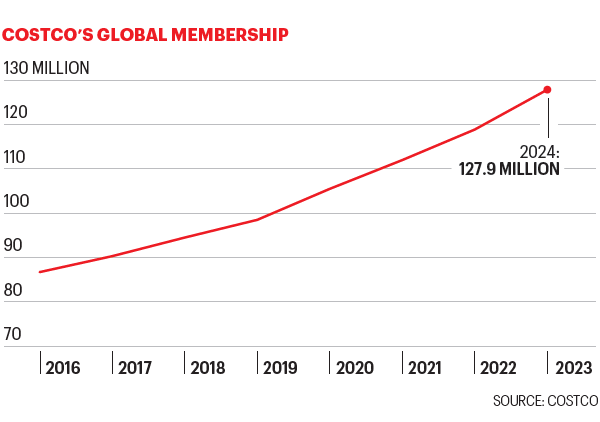

| Membership Base | 81M+ paid members globally; Executive tier = ~49% |

| Business Model | Low markups, high volume, ~3,700 SKUs vs Walmart’s 140,000 |

| Ecommerce Growth | Online sales increased by 20.5% YoY (Q1 FY2026) |

| Target Consumer Shift | Increasing focus on higher-income consumers alongside traditional base |

| Official Website | Costco.com |

Costco’s Identity Is Shifting — Here’s Why It Matters

Walk into a Costco today, and you’ll still find your usual bulk groceries and paper goods. But now, you may also stumble upon a gleaming gold bar behind a locked case or a Rolex tucked away behind the customer service desk.

What’s going on?

Simply put: Costco is evolving with its customers. While it remains a haven for cost-conscious families, the brand is also catering to more affluent shoppers who want both luxury and value. This shift isn’t a fluke — it’s a strategy. And it’s working.

According to Fast Company, Costco is embracing a hybrid identity: bargain retailer meets treasure hunt for the wealthy. The result? Higher engagement, media buzz, and massive growth in luxury sales — all without alienating its traditional customer base.

The Data Behind the Costco Is No Longer for Bargain Hunters

Let’s look at the numbers to see how serious this trend is.

- Gold Bars: Costco began offering 1-ounce 24-karat gold bars in late 2023. By early 2024, they were reportedly selling $100 million to $200 million worth of gold bars per month. These are often sold near spot price — a huge draw for both retail investors and collectors.

- Memberships: Costco had over 81 million paying members worldwide as of 2026. Nearly 49% are Executive Members, who pay more annually but receive cashback perks — making them more likely to buy high-ticket items.

- Ecommerce Sales: In Q1 FY2026, Digital Commerce 360 reported that Costco’s online sales were up 20.5% year-over-year, driven in part by increased luxury inventory visibility and a revamped online shopping experience.

- Product Scarcity Boosts Value: Luxury products are often available for a limited time and in small quantities. This scarcity plays right into Costco’s “treasure hunt” marketing model, encouraging frequent visits and impulse buys.

Costco Is No Longer for Bargain Hunters: What Luxury Items Costco Is Selling Now

Costco isn’t selling random fancy items. It’s handpicking luxury products that align with its values: high quality, solid resale value, and strong perceived value.

Rolex Watches

Rolex watches — the iconic Swiss luxury timepieces — are occasionally found in select Costco locations. While Costco does not advertise them online, when available, they sell out fast. It’s a brand that’s globally trusted, and the ability to snag one at warehouse pricing makes it a hot item.

Diamonds & Fine Jewelry

Costco has quietly become a serious player in the fine jewelry space. It sells engagement rings, some with stones as large as 10 carats, certified by the GIA (Gemological Institute of America). Prices can range from a few thousand dollars to over $300,000. Shoppers benefit from detailed certification, generous return policies, and trust in Costco’s vetting process.

Gold Bars

Offered in both PAMP Suisse and Rand Refinery options, these 1-ounce gold bars come with serial numbers and certification. They’re typically priced close to market value, and can be delivered directly to members’ homes. In a time of inflation and geopolitical uncertainty, Costco has tapped into Americans’ interest in precious metal investments.

Premium Spirits

Costco’s Kirkland Signature private label already includes premium liquor, but the chain also offers high-end Champagne like Dom Pérignon, luxury tequila brands, and aged whiskey that competes with top-shelf offerings at specialty retailers.

Costco’s Business Model Supports Luxury

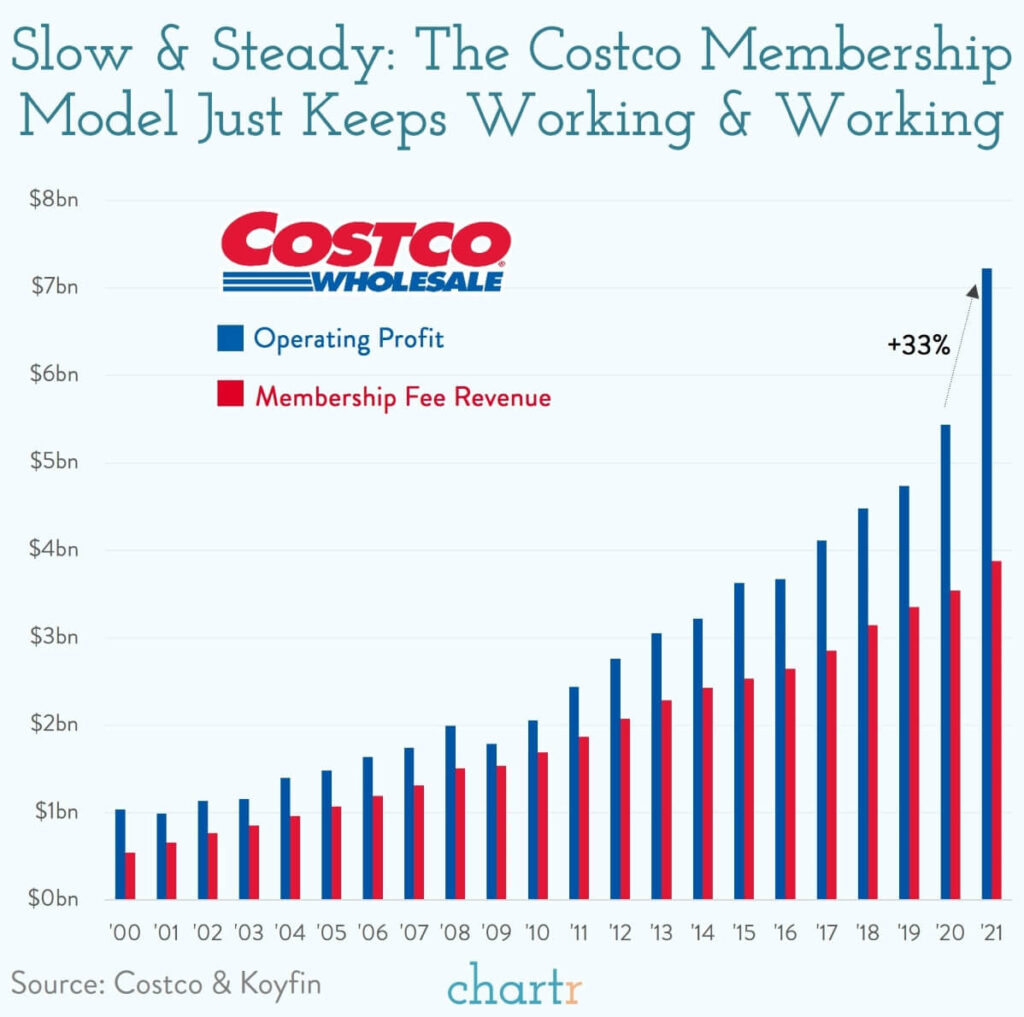

The transition into luxury makes sense when you look at the fundamentals of Costco’s business model.

Low Markup, High Trust

Unlike many retailers who operate on markups of 25%–50%, Costco caps most markups around 14%. That applies whether it’s a frozen pizza or a Rolex. The company earns most of its profits from membership fees, not product margins.

This model builds trust. Customers know that whatever they’re buying, it’s probably priced as competitively as possible.

Limited Product Range

While Walmart carries over 140,000 SKUs in many stores, Costco offers just around 3,700 unique items at any given time. This tight curation allows Costco to focus on quality over quantity and to negotiate better deals with suppliers — including luxury brands.

Member Loyalty and Executive Tier

With a membership renewal rate above 90%, Costco has one of the most loyal customer bases in U.S. retail. Its Executive Membership tier (which includes 2% cashback rewards) encourages bigger-ticket spending. That’s exactly who Costco is targeting with its luxury lineups.

How to Score Luxury Deals at Costco?

Want to get your hands on a gold bar or Rolex? Here are some practical tips:

- Check In-Store Frequently: Luxury goods are rarely announced. Visit your local store often — especially early in the week.

- Browse Online Daily: Costco’s website lists gold bars, premium jewelry, and high-end alcohol regularly, but items often sell out within hours.

- Upgrade to Executive: If you’re planning to make big purchases, the 2% cashback can make a difference — especially for items priced in the thousands.

- Join Costco Email Alerts: Signing up for promotional emails can help you spot rare items quickly.

- Watch Reddit Threads: Communities like r/Costco track luxury item sightings and can tip you off to when and where products appear.

Why Costco Is No Longer for Bargain Hunters Matters for the Retail Industry?

Costco’s shift is more than a quirky headline — it’s a sign of retail’s future.

A Retail Case Study in Strategic Diversification

Costco has managed to expand into luxury without losing its identity. That’s rare. Many brands that pivot upscale alienate their core audience. Costco hasn’t. Instead, it’s layered new offerings on top of a rock-solid value foundation.

This hybrid approach appeals to:

- Traditional shoppers looking for savings.

- Affluent members who want trusted luxury deals.

- Retail investors interested in inflation-proof goods.

Influence on Competitors

Retailers like Sam’s Club and BJ’s Wholesale are watching closely. So are premium e-commerce players like Amazon. Costco’s success in luxury might prompt other bulk retailers to explore similar hybrid strategies.