Centrelink JobSeeker Payment Increase: The Centrelink JobSeeker Payment increase in January 2026 has sparked confusion and interest across Australia. With cost-of-living pressures continuing to squeeze everyday Aussies, people relying on income support need clarity: Is the JobSeeker Payment going up in January 2026? If so, by how much? And who qualifies? In this article, we’ll walk through everything you need to know — from official payment dates, current rates, and eligibility, to what’s really changing, what’s not, and how to prepare for upcoming indexation rounds. Whether you’re on Centrelink yourself or working with clients in social services or financial counselling, this guide will give you all the answers — in plain English.

Table of Contents

Centrelink JobSeeker Payment Increase

The Centrelink JobSeeker Payment Increase in January 2026 isn’t happening — and that’s okay. It’s business as usual: JobSeeker is reviewed twice a year, and the next rise is due on 20 March 2026. What matters is that you:

- Understand the schedule

- Know your eligibility

- Check your account

- Use the available tools

Even though the wait may be frustrating, the system does provide scheduled increases — and you can always advocate for more if you believe the current rate is unfair.

| Topic | Details |

|---|---|

| Is JobSeeker Increasing January 2026? | No. JobSeeker is not indexed in January. |

| Next Indexation Date for JobSeeker | 20 March 2026 |

| Current Fortnightly Rates | $793.60 to $1,027.70 (as of September 2025) |

| Who Qualifies? | Aged 22 to pension age, job-seeking or temporarily unable to work |

| How to Check Your Rate | Services Australia JobSeeker Payment |

Why the Confusion Around January 2026?

Every January, some Centrelink recipients see a payment boost through indexation. But not all payments are treated the same. While Youth Allowance, Austudy, ABSTUDY, and Carer Allowance recipients received increases from 1 January 2026, JobSeeker did not.

Why? It’s due to the indexation schedule, which for JobSeeker is fixed — updates happen on:

- 20 March

- 20 September

That means the next possible increase to JobSeeker will be on 20 March 2026, based on changes to inflation and wages.

What Is Indexation and How Does It Work?

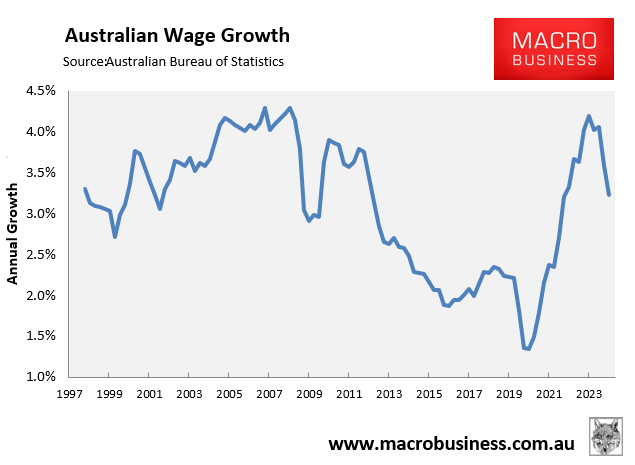

Indexation is a process where social security payments are automatically increased to match rises in the Consumer Price Index (CPI) or wage growth.

For JobSeeker, indexation helps ensure the payment doesn’t lose value over time. It reflects Australia’s inflation rate and general wage trends, which directly affect purchasing power.

The Department of Social Services (DSS) outlines the rules behind this, with indexation formulas applying depending on the payment type. For working-age payments like JobSeeker, it’s usually:

- Indexed to CPI (or the Pensioner and Beneficiary Living Cost Index, if higher)

- Benchmarked against Male Total Average Weekly Earnings (MTAWE)

This ensures payment rates keep pace with economic reality, even if only twice per year.

Current Centrelink JobSeeker Payment Rates

These rates are the most recent official figures published by Services Australia and remain current into early 2026 — unless otherwise updated in the March indexation round.

| Recipient Type | Fortnightly Base Rate |

|---|---|

| Single, no children | $793.60 |

| Single, with dependent child | $849.90 |

| Single, 55+ and on income support for 9+ months | $849.90 |

| Partnered (each) | $726.50 |

| Single Principal Carer (exempt from mutual obligations) | $1,027.70 |

Note: These base rates do not include supplements such as:

- Energy Supplement

- Rent Assistance

- Pharmaceutical Allowance

Who Is Eligible for the Centrelink JobSeeker Payment Increase?

Let’s break it down simply. To qualify for the JobSeeker Payment, you must:

1. Age Requirements

- Be at least 22 years old

- Be under Age Pension age (currently 67)

2. Residency

- Be an Australian citizen, permanent resident, or hold a qualifying visa

- Normally must have been a resident for at least 104 weeks

3. Work Status

- Be unemployed or working less than 30 hours per week

- Be actively seeking work

- Or be temporarily sick or injured and unable to work/study

4. Meet Income and Asset Tests

- The amount you earn (or your partner earns) affects how much you get

- Assets like savings, property (excluding your home), and vehicles are tested

JobSeeker and the Cost-of-Living Crisis

While indexation helps payments keep up, many experts argue that JobSeeker is still too low — especially in 2026 as inflation lingers and rents skyrocket.

A 2023 ACOSS report showed that:

- 62% of JobSeeker recipients skip meals regularly

- 78% were in housing stress, spending over 30% of income on rent

Think tanks like the Grattan Institute, Australia Institute, and BCA have all called for increases beyond indexation — arguing JobSeeker should be at least 90% of the Age Pension.

As it stands, JobSeeker is ~$240 less per fortnight than the single Age Pension.

Historical Context: JobSeeker Since COVID-19

In early 2020, during the COVID crisis, the government temporarily doubled JobSeeker through the $550 Coronavirus Supplement.

This showed what life could be like if JobSeeker were set at a livable rate. Many recipients reported:

- Being able to buy fresh food

- Keeping up with rent

- Affording internet access to search for work

Since the supplement ended, the payment has returned to pre-pandemic levels, with only modest increases.

Real-Life Examples of Centrelink JobSeeker Payment Increase

Case 1: Sam (34), single, unemployed, no children

Sam receives the base $793.60 every two weeks. He lives in Melbourne and pays $400/week in rent. After bills, he barely breaks even.

Case 2: Maria (45), single parent of one

Maria gets $849.90 + Rent Assistance. She reports her income every fortnight and is enrolled in a Work for the Dole program.

Case 3: Joel (59), long-term unemployed

Joel gets $849.90 as he’s over 55 and has been on payments for over 9 months. He also receives Energy Supplement and uses concession healthcare.

How to Prepare for the March 2026 Indexation?

Here’s what to do before the next update hits:

- Update your myGov details

Make sure your address, bank details, and income info are accurate. - Check your eligibility

Your payment may have changed due to age or new circumstances. - Use the Payment Finder

This gives you an estimate based on your living situation. - Mark your calendar

JobSeeker is updated 20 March 2026 — don’t miss it. - Seek financial counselling if needed

Free services like the National Debt Helpline (1800 007 007) can help you budget.

Australia Raises Retirement Age Again in 2026 — Here’s What It Means for You