Canada’s CRA Is Holding $1.7B in Unclaimed Money: Have you ever moved houses, changed banks, or simply tossed out an envelope from the government without a second thought? If so, you might be among the millions of Canadians owed a slice of the $1.7 billion in unclaimed money currently held by the Canada Revenue Agency (CRA). This isn’t a scam or some viral social media myth. It’s legit. And it’s your money. According to the CRA, millions of cheques issued over the years — for things like tax refunds, GST/HST credits, child benefits, and more — were never deposited. But here’s the kicker: CRA cheques never expire, and reclaiming yours is easier than you might think. This article gives you a clear, detailed, step-by-step guide to check if the CRA owes you money, how to claim it, and how to prevent future lost payments. Whether you’re a student, a parent, or a finance pro, you’ll find all the tools you need right here.

Table of Contents

Canada’s CRA Is Holding $1.7B in Unclaimed Money

Millions of Canadians are sitting on money they don’t even know they have — and with the CRA holding over $1.7 billion in uncashed cheques, there’s a good chance you’re one of them. Don’t let your hard-earned refunds, benefits, or credits go to waste. It only takes a few minutes to check your CRA account and claim what’s yours. The bottom line:

- CRA cheques never expire

- You can check your status online

- It’s your money — go get it

| Topic | Details |

|---|---|

| Total Unclaimed Funds | Over $1.7 billion in uncashed CRA cheques |

| Types of Payments | Tax refunds, GST/HST credits, Child Benefit, Climate Action Incentive, OAS/GIS |

| How to Check | Sign into CRA “My Account” > Uncashed Cheques section |

| How to Claim | Submit Form PWGSC 535 (digitally or by mail) |

| Cheque Expiration | CRA cheques never expire |

| Replacement Timeline | 4 to 12 weeks |

| Tips to Prevent Future Loss | Use direct deposit, keep account/address updated, enable email notifications |

Why Does the Canada’s CRA holding $1.7B in Unclaimed Money Just Sitting There?

It’s a fair question.

Every year, the CRA sends out millions of payments. While many are directly deposited into bank accounts, a large chunk still goes out by physical cheque — especially for people who haven’t signed up for direct deposit or moved without updating their information.

Sometimes cheques are lost in the mail, delivered to old addresses, or even tossed out by mistake. Other times, people don’t realize they were eligible for a benefit, or they simply forget to deposit the cheque.

All those little oversights add up — and over time, they’ve snowballed into a whopping $1.7 billion in unclaimed funds.

In fact, a 2022 CRA report found that:

- The average uncashed cheque was around $158

- More than $1 billion of it had been unclaimed for over 10 years

- Some individuals had multiple uncashed cheques going back decades

And because government-issued cheques never expire, this money is still sitting there, waiting to be claimed.

What Types of CRA Payments Can Go Unclaimed?

It’s not just income tax refunds. Here are some of the payments that could be sitting unclaimed in your name:

- Income tax refunds

- GST/HST credit payments

- Canada Child Benefit (CCB)

- Working Income Tax Benefit (WITB)

- Climate Action Incentive (CAI)

- Provincial and territorial benefit payments

- Old Age Security (OAS) and Guaranteed Income Supplement (GIS)

- Disability tax credits or overpayment refunds

Even if you haven’t received a payment in years, you might still have uncashed cheques in your CRA file — especially if you were previously receiving benefits and then moved, or if you had a CRA-issued cheque sent to the wrong address.

Step-by-Step: How to Check and Claim Your $1.7B in Unclaimed Money

Step 1: Log Into “My Account” at CRA

Your first move is to sign in to the CRA My Account portal, which is the official online platform for individuals to manage their tax and benefit information.

You can sign in using:

- GCKey (CRA-issued credentials)

- Sign-In Partner (via your online banking account)

If you don’t already have an account, you can register. The process is relatively straightforward but may take a few days to fully set up if mailing verification codes are required.

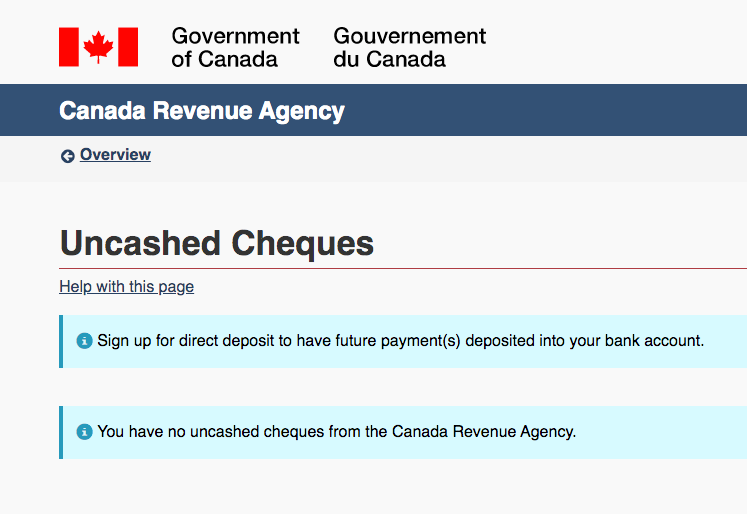

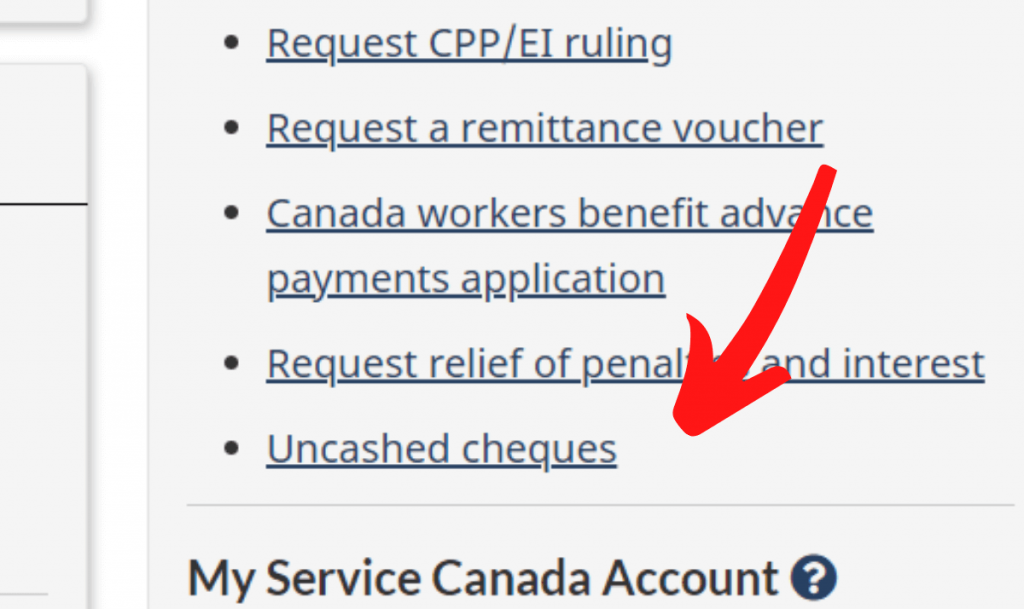

Step 2: Find the “Uncashed Cheques” Section

Once logged in, navigate to the Uncashed Cheques section.

It’s typically located under:

- “Related Services” on the right-hand side of the homepage

- Or listed under “Accounts and Payments”

Here you’ll see:

- The amount of each uncashed cheque

- Date issued

- Type of payment (e.g., Tax refund, GST credit)

If there are no uncashed cheques, the section will say so. If you do see a list — congrats! You’re eligible to reclaim that amount.

Step 3: Request a Replacement

You’ll need to submit a request to have the uncashed cheque reissued.

You can:

- Fill out the form directly on your computer

- Print it, sign it, and scan it back for upload or mailing

Step 4: Submit the Form

There are two ways to send it in:

- Upload it through your CRA “My Account”

Navigate to the “Submit documents” section and upload your completed form directly. - Mail it to the CRA Sudbury Tax Centre

Address is provided on the form and CRA’s website. Include any additional documents if requested.

Step 5: Wait for Processing

According to CRA service standards:

- You can expect a processing time of 4 to 12 weeks

- Direct deposit is faster than mailing a cheque

- CRA may contact you if more verification is needed

Real-Life Example: A Missed Cheque Worth Hundreds

Let’s take a real-world case:

Marco, a 32-year-old from Ontario, moved three times in six years. In 2023, while checking his CRA account, he found four uncashed cheques — two GST/HST credits, one refund from a 2017 reassessment, and one child benefit overpayment refund — totaling $662.

He downloaded the form, submitted it online, and had the full amount direct deposited within 6 weeks.

Tips to Avoid Missing Future Payments

Here’s how to make sure this doesn’t happen again:

Use Direct Deposit

Register for direct deposit with CRA, and payments will be sent straight to your bank.

- No more lost or stolen cheques

- Payments arrive faster

- Safer and more convenient

Update Your Contact and Bank Info

Whenever you move or change banks, update your records in My Account.

Delays in updating info are one of the leading causes of lost or uncashed cheques.

Turn On Email Notifications

You can enable notifications in CRA to receive alerts when:

- A new payment is issued

- Your account is updated

- A document is uploaded to your profile

This keeps you in the loop and helps prevent surprises.

File Your Taxes Every Year — Even If You Have No Income

A lot of CRA benefits — including GST/HST credits and child benefits — are triggered by filing a tax return. Even if you earned no income, filing ensures CRA can issue eligible payments.

Many unclaimed cheques come from years where people skipped filing, then missed backdated payments once they resumed.

4 CRA Benefits Payments in January 2026 – Check Eligibility Criteria & Payment Date

Canada Quietly Raises Medical Inadmissibility Cost Threshold for 2026