Canada’s CPP & OAS Rules: Canada’s CPP & OAS rules are changing in 2026, and these aren’t just routine updates. They’re a serious shake-up with long-term effects on retirement planning, monthly income, and financial decision-making for Canadians coast to coast. In a nutshell: the government is improving how much you receive, how you qualify, and how flexible your options are — especially if you’re nearing retirement or still working past age 65. Whether you’re planning your own future, supporting a loved one, or advising clients as a professional, this guide has you covered with plain-English explanations and smart strategy insights.

Table of Contents

Canada’s CPP & OAS Rules

The 2026 updates to Canada’s CPP and OAS aren’t just policy footnotes — they’re tools you can use to build a stronger, more flexible, and more secure retirement. With inflation protections, increased contribution limits, expanded retirement ages, and strategic planning opportunities, these changes can help both everyday Canadians and financial professionals make smarter, more personalized decisions. Plan ahead. Know your numbers. And take control of your retirement on your terms — because now, more than ever, the system is working with you, not just for you.

| Topic | 2026 Change |

|---|---|

| CPP Cost‑of‑Living Boost | CPP benefits rise ~2.0% in January 2026 based on CPI. |

| Higher Contribution Limits | Local contributions up to YMPE $74,600; second ceiling $85,000. |

| CPP Enhancement (CPP2) | Enhanced benefits aim to replace ~33.33% of earnings. |

| Flexible Retirement Age (60–75) | New options to claim CPP/OAS between 60 and 75. |

| OAS Quarterly Indexation | OAS adjusts every quarter with inflation. |

| OAS Age‑75 Increase | Automatic 10% bump after age 75. |

| OAS Clawback Threshold Rises | Threshold ~$95,353 before OAS repayment begins. |

| GIS & Other Supports | GIS works with OAS to help low‑income seniors. |

| Expanded payment planning | CPP/OAS paid on regular schedules; payment dates available. |

Understanding the Context: What’s Changing and Why It Matters

Let’s start with some perspective.

The Canadian retirement system is built around two foundational programs:

- Canada Pension Plan (CPP) – based on work contributions and earnings.

- Old Age Security (OAS) – based on residency and age.

Together, they help form the income base for millions of seniors. But with the cost of living rising, lifespans increasing, and job markets evolving, the government is rolling out a range of updates in 2026 that aim to boost the relevance, fairness, and financial stability of these programs.

These changes affect how much you receive, how long you can delay claiming benefits, and how to strategically plan around them.

CPP 2026: What You Need to Know

1. CPP Benefits Increase Automatically with Inflation

CPP retirement benefits are indexed every January to reflect changes in the Consumer Price Index (CPI). In 2026, this means a projected 2.0% increase to all CPP recipients. While that number might sound small, it adds up quickly — especially when compounded over years of retirement.

For example, someone receiving $1,300 a month in CPP in 2025 would start 2026 with an increase of about $26 per month, or $312 annually. That’s money you don’t have to ask for — it’s automatic.

Over a decade, that adjustment could be worth more than $3,000 in total added income.

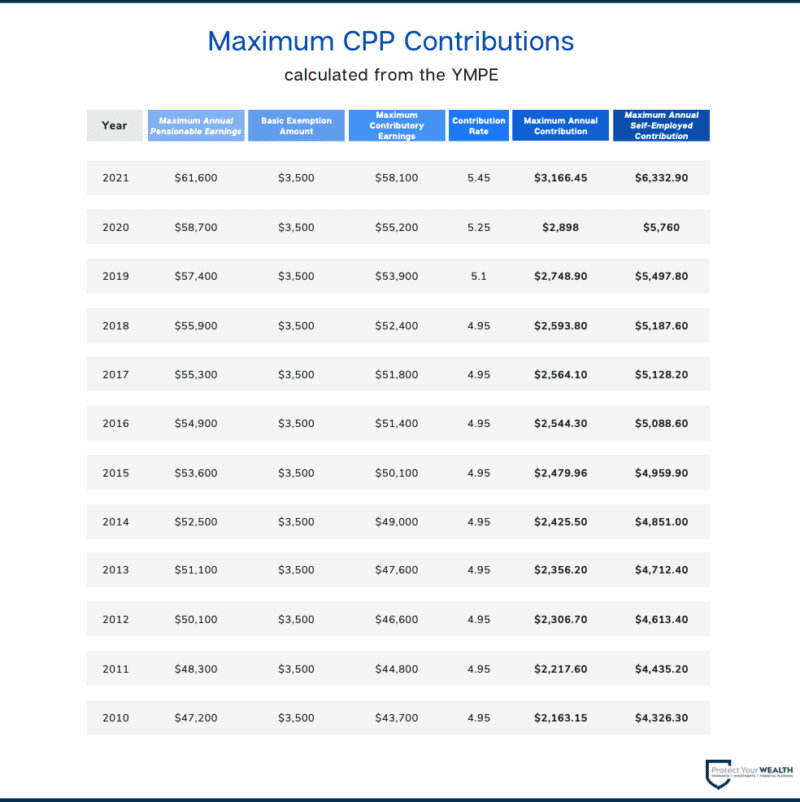

2. Contribution Ceilings Are Going Up

This is one of the biggest structural changes to CPP in decades. The government is rolling out a two-tier ceiling:

- The first ceiling will be $74,600 (up from $71,300 in 2025).

- The second ceiling will be $85,000 for higher earners.

What this means is that if you earn between $74,600 and $85,000, you’ll pay additional CPP contributions on that extra income — and in return, you’ll receive enhanced CPP benefits down the road.

This is part of the CPP Enhancement Program — designed to gradually increase retirement income for current and future contributors.

These added contributions are optional if you’re self-employed or over age 65, but recommended for anyone looking to maximize long-term retirement security.

3. Retirement Age Options Now Extend Up to 75

Historically, most Canadians claimed CPP around age 65, and delaying until 70 gave the biggest possible payout. But starting in 2026, CPP gives you the option to delay your pension all the way to age 75.

Why delay? Because every month you defer CPP past age 65 increases your benefit by about 0.7%. That means a person delaying CPP until 70 gets a 42% larger monthly payment than if they had taken it at 65. If the delay is extended to age 75, further incentives are expected — although final details on exact percentage gains are still being finalized.

This shift gives Canadians more flexibility to customize retirement plans based on health, finances, and lifestyle goals.

OAS 2026: What’s Changing and What It Means for You

1. OAS Payments Adjust Quarterly

Unlike CPP, which adjusts annually, OAS benefits are reviewed every three months and adjusted for inflation. This means your payments can rise more often, giving you more real-time protection against rising costs.

If prices spike in Q2, your benefit might adjust by Q3 — keeping your income more in step with the economy.

This change is especially valuable during periods of high inflation, when fixed incomes can lose purchasing power quickly.

2. 10% OAS Increase at Age 75

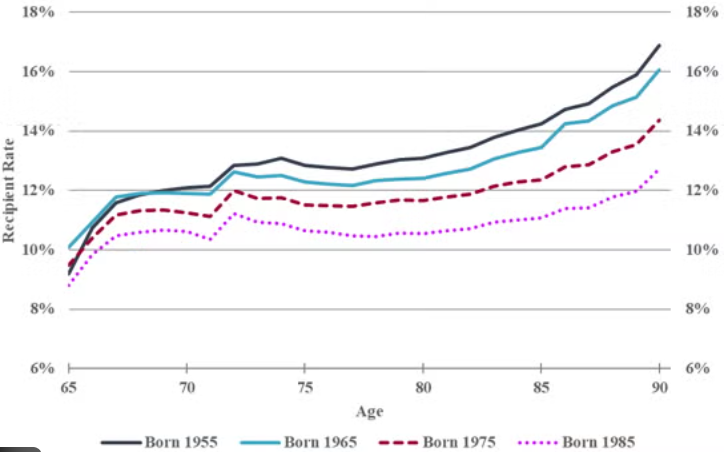

This change was introduced in 2022 but becomes more impactful in 2026 as more retirees turn 75.

At that age, your OAS pension automatically increases by 10%, permanently. This is designed to help older seniors who are more likely to face higher medical and care-related costs — and who may be outliving other forms of savings or income.

This increase is added on top of regular inflation adjustments.

3. OAS Clawback Threshold Rises

The OAS clawback, officially called the Old Age Security Pension Recovery Tax, kicks in when your income exceeds a certain threshold — projected to be around $95,353 in 2026.

For every dollar of net income above that threshold, your OAS is reduced by 15 cents. That can add up fast, especially for retirees with large RRIF withdrawals, rental income, or investment gains.

The good news? The clawback threshold increases annually with inflation, giving you more room to plan withdrawals and manage taxable income to optimize your OAS.

4. Guaranteed Income Supplement (GIS) Stays Strong

The GIS provides additional monthly income to low-income OAS recipients. While the program itself isn’t changing in 2026, it remains crucial to retirement planning — especially for seniors who don’t have large pensions or savings.

To qualify, you need to be 65 or older, receiving OAS, and fall below a certain income level.

GIS is non-taxable and doesn’t require a separate application once you’re receiving OAS and file your taxes each year.

Practical Retirement Planning Tips for Canada’s CPP & OAS Rules

Let’s turn all this into action. Here are practical moves you can make based on the new rules:

1. Consider Delaying CPP and OAS for Bigger Payouts

If you’re healthy and don’t urgently need the money, delaying benefits can lead to significantly higher monthly income for life. Delaying CPP to 70 or 75 and relying on personal savings in the short term may be a smart tradeoff.

2. Watch Your Income to Avoid OAS Clawbacks

This matters if you have multiple income sources (RRIFs, dividends, rental income). By structuring withdrawals wisely, you can stay under the OAS clawback threshold — preserving thousands in retirement income.

3. Maximize Contributions While Working

The higher contribution ceiling for CPP means higher benefits in the future. If you’re earning between $74,600 and $85,000, the extra contributions may feel steep now, but they increase your future pension.

If you’re self-employed, this is an important part of retirement planning.

4. Use Tax Shelters and Income-Splitting

Tax-efficient strategies like income-splitting with a spouse, drawing TFSA income (which doesn’t affect clawbacks), and using RRSPs strategically before 71 can help reduce your net income and maximize government benefits.

5. Revisit Your Retirement Plan Annually

With CPP and OAS changing annually through inflation adjustments, it’s smart to revisit your plan each year. Monitor thresholds, benefit increases, and payment schedules to stay informed.

Canada Quietly Raises Medical Inadmissibility Cost Threshold for 2026

4 CRA Benefits Payments in January 2026 – Check Eligibility Criteria & Payment Date