Canada’s $236 Grocery Rebate: Looking for information on the Canada Grocery Rebate 2026? You’re in the right place. Whether you’re a young worker hustling through inflation, a parent with a full grocery cart every week, or a senior watching every dollar, this article breaks down everything you need to know about the grocery payment program from the Canada Revenue Agency (CRA). We’re talking money in your account. No gimmicks, no complicated applications. Just straight-up facts — with expert insights, clear steps, and answers to common questions. Let’s dive into it.

Table of Contents

Canada’s $236 Grocery Rebate

The Canada Grocery Rebate 2026 is an important form of support — especially during times of stubborn grocery inflation and ongoing cost-of-living pressures. While it’s not branded as a “new program,” the CRA is expected to issue grocery-related payments up to $628 as part of its ongoing affordability efforts, tied into GST/HST credits. It’s automatic, non-taxable, and designed to help those who need it most — with no extra paperwork required. If you’ve filed your 2024 taxes and updated your CRA account, you’re good to go.

| Topic | Details |

|---|---|

| Program Name | Grocery Rebate / Grocery Payment 2026 |

| Administered By | Canada Revenue Agency (CRA) |

| Who Qualifies | Canadian residents with low/moderate income who filed 2024 taxes |

| Rebate Amount | Up to $628 (based on family size and income) |

| Application Required? | No – payment is automatic |

| Payment Method | Direct deposit or cheque |

| Estimated Payment Dates | January or April 2026 |

| CRA Account Access | CRA My Account |

| Official Info | CRA Benefit Payment Dates |

What Is the Canada Grocery Rebate and How Did It Begin?

The Grocery Rebate isn’t a random benefit — it was first introduced in the 2023 Federal Budget in response to a sharp increase in grocery and household costs across Canada. That year, the government issued a one-time payment to nearly 11 million Canadians.

The original 2023 Grocery Rebate provided:

- $234 for single individuals without children

- $467 for couples with two children

- Up to $628 for families with more dependents or lower incomes

It was distributed through the CRA’s GST/HST credit system, meaning no application was required. That approach made it quick, automatic, and efficient — which is why a similar model is expected for 2026.

Although there’s no formal government announcement as of January 2026 for a “new rebate,” several financial and policy sources have confirmed the CRA is continuing a grocery-related payment structure, particularly for vulnerable groups.

Why the Canada’s $236 Grocery Rebate Still Matters in 2026?

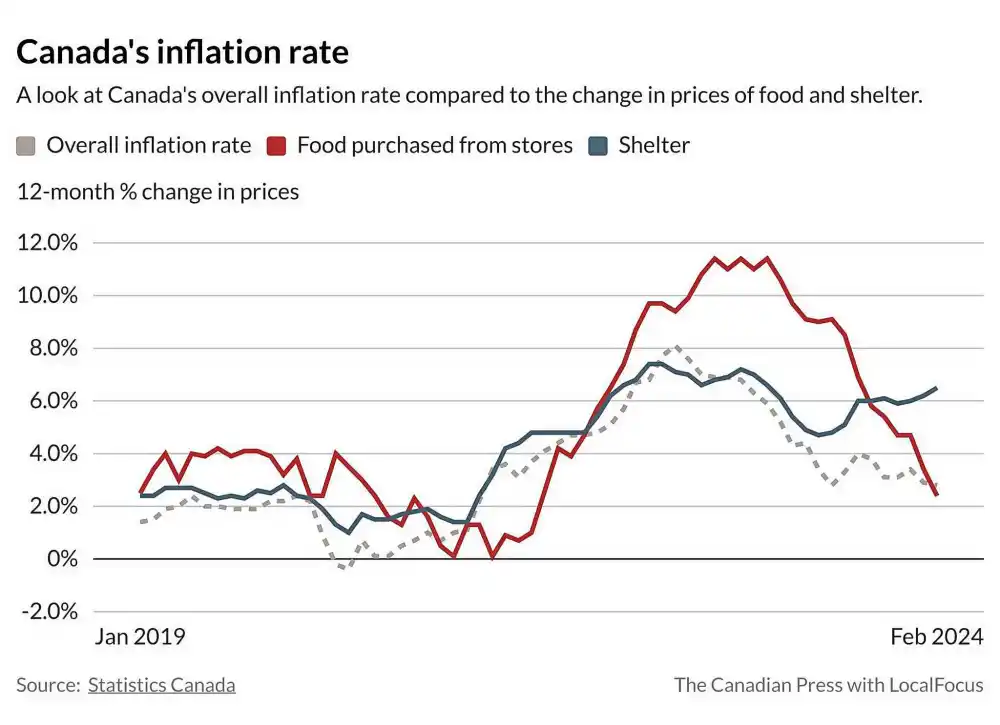

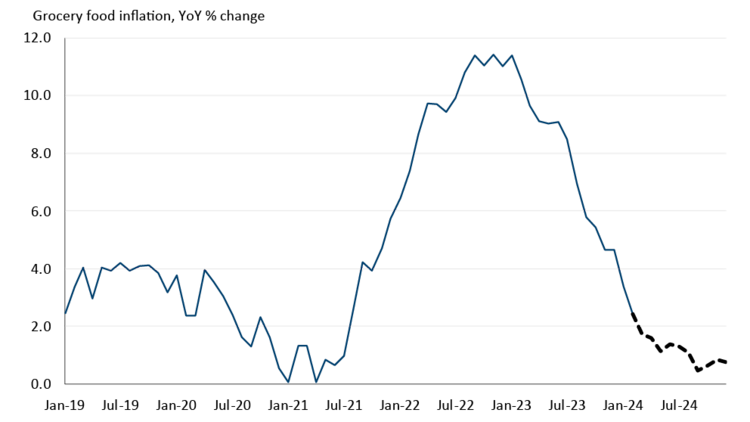

Despite interest rate adjustments and inflation controls, grocery prices remain stubbornly high.

According to Statistics Canada, the average Canadian household is now spending $300–$500 more per month on food than in 2019. Categories like bread, dairy, and vegetables have seen annual price increases of 6–12%, far outpacing wage growth.

A 2025 report from the University of Guelph’s Agri-Food Analytics Lab also found:

- Food insecurity affected 18.4% of Canadian households

- 1 in 7 Canadians were accessing community food programs like food banks

- 82% of respondents said they’ve changed shopping habits to manage inflation

The Grocery Payment isn’t just about affordability — it’s about stability, particularly for lower-income seniors, students, and families with young kids.

Who Qualifies for Canada’s $236 Grocery Rebate in 2026?

Qualification is simple — and automatic — for most Canadians. Here’s how to know if you’re eligible.

CRA Eligibility Requirements:

- You must be a Canadian resident for tax purposes as of December 31, 2024.

- You must have filed your 2024 income tax return.

- Your family income must be within low to moderate thresholds, similar to GST/HST credit rules.

- You must be 19 years or older, or living with a spouse or child.

The CRA uses your tax return to assess eligibility — no need to apply separately for the grocery rebate.

How Much Will You Receive in 2026?

Based on current reporting and historical patterns, here are estimated rebate amounts for 2026:

| Household Type | Estimated Rebate |

|---|---|

| Single individual (low income) | $234–$306 |

| Couple, no children | $400–$480 |

| Couple with one child | $487 |

| Couple with two children | $628 |

| Single parent with one child | $467–$514 |

| Senior living alone | ~$234 |

Note: These estimates are based on past rebates and media reports from sources such as Stellaris Power. The exact amount may vary depending on province and specific tax data.

How and When Are Payments Issued?

The Grocery Rebate is not a standalone benefit with its own date — it’s typically bundled with GST/HST credit payments.

Here are the CRA’s 2026 GST/HST credit payment dates:

- January 5, 2026

- April 2, 2026

- July 3, 2026

- October 5, 2026

You’ll likely receive your grocery payment during January or April, depending on when CRA completes income assessments. Canadians enrolled in direct deposit will typically receive their money faster.

How to Check Your Rebate Status and Set Up Direct Deposit?

To avoid delays, make sure your CRA account is up to date. Here’s how to check:

Step-by-Step Guide:

- Visit CRA My Account

- Sign in using your banking login or CRA credentials

- Click on Benefits and Credits

- View your GST/HST credit section

- Look for “Grocery Rebate” or equivalent language

- Click Direct Deposit and ensure your banking info is correct

If you’re still using mailed cheques, consider switching to direct deposit to avoid delays and mail disruptions.

Other Government Supports That Stack With Grocery Rebate

Many provinces have additional benefits that complement the CRA rebate.

| Province | Program | Details |

|---|---|---|

| Ontario | Ontario Trillium Benefit | Includes energy and sales tax credits |

| British Columbia | Climate Action Tax Credit | Issued quarterly, income-tested |

| Alberta | Affordability Payments | Provided for seniors, families with children |

| Quebec | Solidarity Tax Credit | Helps with housing, QST, and cost of living |

Be sure to check your provincial revenue site for local programs that may add $100–$600 more annually.

Canada Quietly Raises Medical Inadmissibility Cost Threshold for 2026

4 CRA Benefits Payments in January 2026 – Check Eligibility Criteria & Payment Date