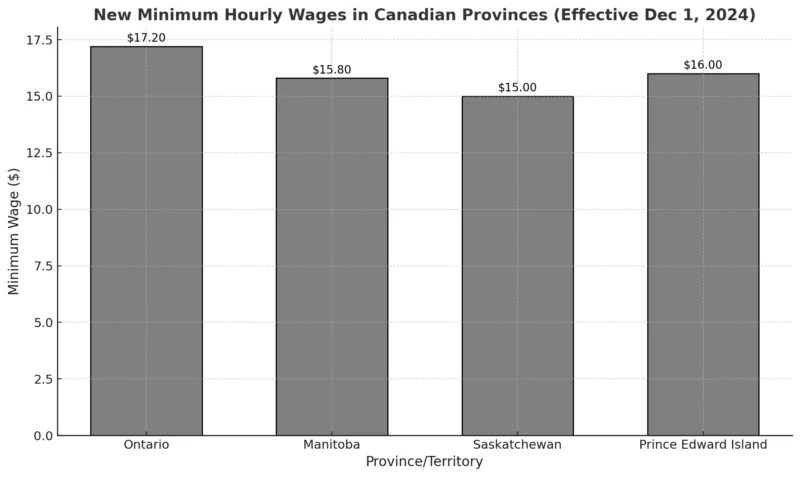

Canada Just Raised Minimum Wages Again: Canada just raised minimum wages again in 2026, and if you’re earning a paycheck, hiring employees, or just watching your budget, this news matters. With inflation still running hot and living costs continuing to climb, provinces across the country are stepping up to give their lowest-paid workers a better shot at affording everyday life. This year, five provinces and territories are taking the lead with significant wage increases. These updates aim to protect workers, boost consumer spending, and ease the burden on families. For employers, this also means adjusting payroll, reviewing compliance, and preparing for a more competitive job market. Let’s break it all down—from the numbers to the why, and everything in between. Whether you’re a small business owner, student worker, or policy wonk, we’ve got you covered.

Table of Contents

Canada Just Raised Minimum Wages Again

Canada’s 2026 minimum wage hikes are more than just policy—they’re a lifeline for millions. As inflation eats away at budgets and housing prices continue to rise, these adjustments help hourly workers keep up and stay afloat. Provinces like Nova Scotia and Yukon are leading the charge with significant increases, while others are slowly catching up. For workers, this means better paydays. For employers, it means planning ahead and adapting. For policymakers, it’s a reminder that wages must match real-world needs—not just economic theory. Whether you’re earning a paycheck or cutting them, staying informed is the first step to staying ahead.

| Province/Territory | New 2026 Wage | Effective Date | Notes |

|---|---|---|---|

| Nova Scotia | $16.75 → $17.00 | Apr 1 & Oct 1, 2026 | Two increases: spring and fall, CPI + 1% method |

| Prince Edward Island (PEI) | $17.00 | Apr 1, 2026 | Based on board recommendation |

| New Brunswick | ~$16.00 (estimated) | Apr 1, 2026 | CPI-linked estimate |

| Newfoundland & Labrador | ~$16.32 (estimated) | Apr 1, 2026 | Based on inflation projections |

| Yukon | ~$18.37 (estimated) | Apr 1, 2026 | Among highest in Canada, tied to Whitehorse CPI |

| Ontario | ~$18.00 (projected) | Oct 1, 2026 | CPI-based increase; current rate $17.60/hr |

| Federal (Canada-wide) | ~$18.10 (projected) | Apr 1, 2026 | For federally regulated sectors |

Understanding Why Canada Just Raised Minimum Wages Again Matters?

Minimum wage isn’t just a labor policy—it’s a social and economic lifeline. Set too low, it leaves families struggling. Set too high, and it can challenge small businesses. The 2026 increases are designed to strike a better balance by tying most changes to the Consumer Price Index (CPI) and considering regional cost-of-living realities.

But let’s be real: minimum wage isn’t the same as a living wage. A living wage reflects what people actually need to survive and thrive—covering food, shelter, transportation, childcare, and more. In cities like Vancouver or Toronto, the living wage is closer to $24–$27/hour, well above the minimum in any province.

That gap between minimum wage and living wage is one reason why these 2026 changes are critical. They don’t close the gap entirely, but they do move the needle.

Federal vs Provincial Wages: Who’s Covered?

Canada has two wage structures:

- Federal minimum wage applies to workers in federally regulated industries—like banking, interprovincial transport, telecom, and postal services.

- Provincial/territorial minimum wage applies to nearly everyone else.

Most Canadians are covered under their province’s rules. If a province sets a higher rate than the federal one, the higher rate applies. This year, both the federal and many provincial rates are rising.

The Top 5 Provinces Leading the Charge in 2026

Let’s walk through the provinces making the biggest waves in minimum wage reform this year.

1. Nova Scotia – Double Dose of Pay Raises

Nova Scotia isn’t playing small ball. The province is implementing two increases this year:

- April 1: $16.75/hour

- October 1: $17.00/hour

These changes are part of a formula that includes the CPI plus an additional 1%, making Nova Scotia one of the more aggressive provinces when it comes to wage growth.

For full-time workers, this equals an annual income of:

$17/hour × 40 hours/week × 52 weeks = $35,360/year (before taxes)

That’s a meaningful increase for workers in sectors like retail, food service, and caregiving—industries that often rely on minimum-wage labor.

2. Prince Edward Island – Strong Step Forward

PEI is going from $16.50 to $17.00/hour as of April 1, 2026. That $0.50/hour bump may not sound like a lot, but for someone working 30 hours a week, that’s an extra $780/year.

And PEI’s rate is now tied with Nova Scotia’s for the highest in Atlantic Canada.

3. New Brunswick – Following Inflation Closely

New Brunswick’s 2026 minimum wage will be adjusted based on the Consumer Price Index, which places it at an estimated $16.00/hour. Final numbers will land once inflation data is finalized.

While not the biggest jump in the country, this keeps pace with price increases, offering stability for businesses and predictability for workers.

4. Newfoundland & Labrador – Cost-of-Living Catch-Up

Newfoundland and Labrador’s minimum wage is also inflation-adjusted and is expected to rise to about $16.32/hour in April.

The province has faced higher-than-average increases in grocery and utility costs in recent years, making this change especially important for rural and remote communities.

5. Yukon – The Northern Leader

Yukon consistently offers some of the highest minimum wages in Canada due to its high cost of living. In 2026, its wage will increase to around $18.37/hour, tied to the Whitehorse CPI.

This ensures workers in the north—where housing and food costs can be 20-30% higher—aren’t left behind.

What About Ontario, BC, Alberta and Quebec?

While not in the “top 5 changemakers” for early 2026, these provinces still have notable moves.

Ontario

Ontario already increased its minimum wage to $17.60/hour in October 2025. Another CPI-based increase is expected in October 2026, bringing the projected rate to around $18.00/hour.

Ontario’s approach is part of a long-term wage adjustment plan that aims to avoid political delays and give employers notice.

British Columbia

BC raised its wage to $17.85/hour in June 2025, currently the highest among all provinces. Adjustments tied to inflation are expected again in June 2026.

Alberta

Alberta’s rate remains stuck at $15.00/hour, unchanged since 2018. This has sparked criticism from labor advocates, especially as inflation has significantly eroded purchasing power.

Quebec

Quebec’s rate is $16.10/hour as of May 2025. The province adjusts wages annually, and another raise is expected in spring 2026, though exact figures are pending.

Economic Impact of Canada Just Raised Minimum Wages Again: What This Means for Canadians

For Workers

- Increased Buying Power: Higher wages help workers afford essentials like food, rent, and utilities.

- Reduced Stress: More money can lead to fewer financial emergencies.

- Better Job Retention: People are more likely to stick with jobs that pay fairly.

For Businesses

- Budget Adjustments: Payroll costs go up, especially for small and medium-sized businesses.

- Increased Productivity: Studies show that better-paid workers are more motivated and have lower turnover.

- Competitive Hiring: Higher minimums help employers attract and retain talent in tight labor markets.

Real-World Example: The Cost-of-Living Crunch

In cities like Toronto, average rent for a 1-bedroom apartment now exceeds $2,400/month. Even at $18/hour, a full-time worker earns roughly $2,880/month (before tax) — barely enough to cover rent, let alone food, utilities, and transportation.

This is why many advocates argue that even $18/hour isn’t enough in major urban centers. Nonetheless, these 2026 increases are seen as crucial steps in the right direction.

Compliance Tips for Employers

- Update Payroll Software: Make sure systems reflect new rates.

- Review Employment Contracts: Check for wage clauses that may need amending.

- Communicate Early: Notify staff of changes to avoid confusion or complaints.

- Stay Informed: Wage rates may differ by role (e.g., liquor servers, students), so consult provincial standards.

$530 CPP Increase Confirmed for January 2026: Check Eligibility & Payment Date

Canada Quietly Raises Medical Inadmissibility Cost Threshold for 2026