Australia raises retirement age again in 2026: that’s the headline making waves across social media and retirement forums. But is it really true? And what does it actually mean for everyday Australians — from tradies and teachers to accountants and casual workers? If you’ve been wondering when you’ll qualify for the Age Pension, what age you can really retire, and how to financially prepare, this is your all-in-one guide. Written with clarity, authority, and a touch of American-style straight talk, it breaks down the details in simple, actionable steps — backed by facts.

Table of Contents

Australia Raises Retirement Age Again

Australia’s Age Pension age is 67 in 2026 — and no changes have been legislated beyond that. While future increases are possible, there’s no immediate action required from retirees or pre-retirees. What matters more is preparing for the retirement lifestyle you want. Build your super, know the rules, and plan your financial and personal transition with care. Retirement isn’t just about stopping work — it’s about living well, with purpose, security, and peace of mind.

| Topic | Details & Stats |

|---|---|

| Current Age Pension Age (2026) | 67 years — no official increase beyond this age. |

| Who Does This Affect? | Anyone born on or after Jan 1, 1957 |

| Pension Rate (2025–26) | Up to $1,178.70/fortnight (single); $1,777.00 (couples) |

| Residency Rules | Must have lived in Australia for at least 10 years (5 continuous) |

| Official Retirement Planning Tools | servicesaustralia.gov.au, ATO Super Calculator |

| Future Speculation | Possible increase to 68–70 by 2050, not legislated yet |

| International Comparison | U.S. = 67 (Social Security), UK = 66 (State Pension), Canada = 65 |

What’s Actually Changing in 2026?

Here’s the truth: there is no new increase to the Age Pension age in 2026.

The current retirement age for the Age Pension is 67, and that’s been in place since 1 July 2023. This was the final step in a gradual increase from age 65, which began back in 2017.

If you were born after January 1, 1957, you’ll need to wait until 67 years old to apply for the government Age Pension — and that’s still the rule in 2026.

Despite headlines or viral Facebook posts, the federal government has not announced or legislated any new increase to 68 or 70 in 2026. So, if you’re planning for retirement, rest easy — the rules haven’t changed again (yet).

A Short History of Australia’s Retirement Age

Australia’s Age Pension system has been around since 1909, when the pension age was set at 65. That stayed the same for nearly 100 years.

In 2009, the federal government announced plans to gradually raise the pension age to 67 by 2023 — largely in response to people living longer, healthier lives and putting more pressure on the retirement system.

| Period | Pension Age |

|---|---|

| Before 2017 | 65 years |

| 2017–2019 | 65.5 years |

| 2019–2021 | 66 years |

| 2021–2023 | 66.5 years |

| July 2023 onward | 67 years |

And in 2026? It’s still 67.

How Australia Compares to Other Countries?

This retirement age issue isn’t just happening down under. Many Western countries are grappling with the same challenge: people living longer and needing income for more years.

| Country | Retirement Age | System |

|---|---|---|

| Australia | 67 (Age Pension) | Means-tested |

| United States | 66–67 (Social Security) | Based on birth year |

| United Kingdom | 66 now, rising to 67 by 2028 | State Pension |

| Canada | 65 (OAS), 60 (CPP early) | Flexible |

Australia’s Age Pension is means-tested — meaning not everyone gets it, and your income and assets can reduce how much you receive. This differs from some other systems (like Social Security in the U.S.), which are more automatic.

Retirement Age vs. Pension Age — What’s the Difference?

A lot of folks confuse the two, so let’s clear it up:

- Retirement age = when you personally decide to stop working. This could be 60, 62, 65 — totally up to you.

- Age Pension age = when the government says you’re old enough to start receiving Age Pension payments (currently 67).

You can retire earlier, but you won’t get Age Pension benefits until you hit 67. That means you’ll need to rely on:

- Your superannuation

- Personal savings

- Investments or part-time income

Australia Raises Retirement Age Again Eligibility Requirements

To qualify for the Age Pension in 2026, you must:

- Be 67 years old or older

- Be an Australian resident for at least 10 years (with 5 continuous years)

- Pass the income test

- Pass the assets test

Even if you hit 67, you won’t qualify if your assets or income are too high.

For example:

- If you’re single, your pension starts reducing once your assets exceed $301,750 (homeowner).

- If you’re earning more than $204 a fortnight from other income (like rental or dividends), your pension may also be reduced.

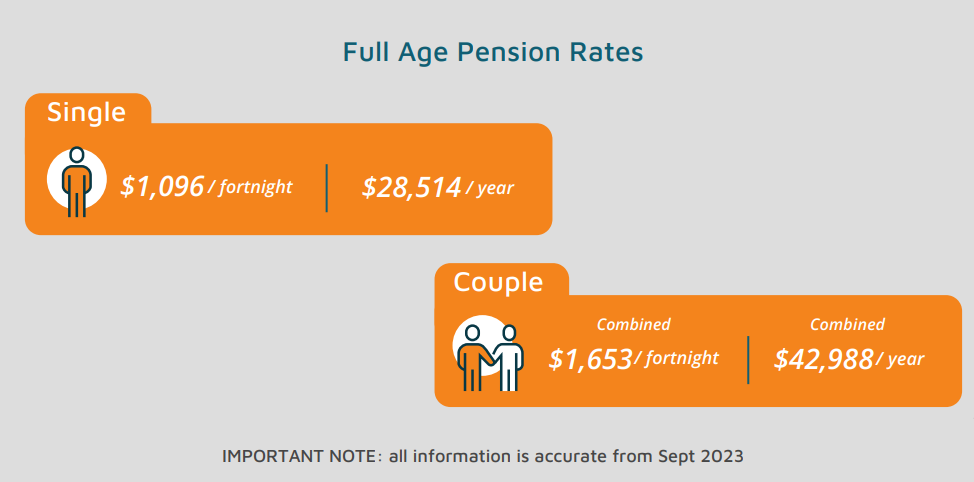

How Much Will You Get?

Pension rates as of mid-2025:

| Recipient Type | Max Fortnightly Payment |

|---|---|

| Single person | $1,178.70 |

| Couple (each) | $888.50 |

| Couple (combined) | $1,777.00 |

You may also qualify for supplementary payments, like:

- Energy Supplement

- Rent Assistance

- Pensioner Concession Card

Australia Raises Retirement Age Again: Practical Retirement Planning Tips

Whether you’re a Gen X’er planning 10 years ahead or someone in your 60s thinking of calling it quits, here’s how to get ready:

1. Know Your Timeline

Check when you turn 67 and how long your savings need to last.

2. Build Up Superannuation

The more you contribute now, the less you’ll depend on Age Pension later.

3. Bridge the Gap

If you retire before 67, you’ll need other income to bridge that period.

Example:

Mary retires at 62. She needs five years’ worth of income from super, savings, or part-time work before she qualifies for Age Pension.

4. Reduce Assets Strategically

If you’re just over the asset test threshold, small changes (like gifting, renovating your home) might help you qualify.

5. Use Government Tools

Try these free calculators:

- Age Pension Estimator

- ATO Super Calculator

Real-Life Retirement Scenarios

Greg, 66 – Laborer with Health Issues

Greg’s back isn’t what it used to be. He’s worked since age 17. He’s struggling to keep going but knows he won’t qualify for the Age Pension until 67. He explores disability support and uses his super early to help bridge the year.

Janet, 59 – High-Income Executive

Janet plans to retire at 60, but her property portfolio disqualifies her from the Age Pension. She’s working with a financial adviser to restructure her assets and ensure she can retire comfortably using her super, shares, and rental income.

Will Australia Raise Retirement Age Again?

Possibly — but not yet.

Economists have warned that to keep the pension system sustainable, the government may need to raise the Age Pension age to:

- 68 by 2035

- 70 by 2050

But it’s a hot-button political issue. Many Australians, especially those in physically demanding jobs, oppose raising the retirement age further.

Any future increase would need to pass through Parliament, and nothing has been formally proposed at this time.

Retirement Isn’t Just About Money

The Age Pension is just one piece of your retirement puzzle.

Don’t forget to plan for:

- Mental health: Retirement can feel lonely if you’re not socially connected.

- Purpose: Hobbies, travel, volunteering, or starting a small business can bring fulfillment.

- Healthcare: Plan for rising medical costs — even with Medicare and bulk billing.