As the United States approaches the end of 2025, discussions have intensified regarding a potential one-time federal payment of $2,000 in December. This debate hasn’t emerged suddenly, but rather is a consequence of the increasing economic pressures faced by average American families over the past year. The costs of everyday necessities such as groceries, utilities, and healthcare remain persistently high. While official figures may indicate a slight slowdown in inflation, the impact on people’s wallets is still clearly visible. Against this backdrop, lawmakers are considering whether a targeted relief payment at the end of the year could provide some stability for families.

Table of Contents

How This Proposal Differs from Previous Stimulus Payments

Compared to the broad stimulus checks issued during the COVID-19 pandemic, this potential $2,000 payment in December 2025 is being approached with a different philosophy. Those previous payments reached almost all income brackets, regardless of whether they were experiencing financial hardship. This time, the proposal is more targeted, aiming to provide assistance to those most affected by the continuously rising costs. December is a particularly challenging time for senior citizens, low-income workers, veterans, and families on fixed incomes. Heating costs increase during the winter months, and the holiday season adds further pressure on household budgets. Even a one-time payment could provide much-needed relief for many families.

Why the Federal $2,000 Payment is Being Reconsidered

Throughout 2025, the prices of essential goods such as food, rent, and energy remained high. While some sectors have seen wage increases, the incomes of many retirees and those receiving government benefits have not kept pace with the rising cost of their monthly needs. This is why policymakers believe that providing limited relief in December can prevent financial stress from extending into early 2026. Medical expenses and household energy costs both increase during the winter months. If the government provides timely assistance, people may be less likely to rely on emergency loans or credit cards, and cash flow can be maintained in the local economy.

Potential Eligibility and Who Might Benefit

According to initial discussions, individuals with an annual income of up to $75,000, married couples up to $150,000, and heads of household up to $112,500 may be eligible for the full amount. The payment may be gradually reduced for those with incomes above these limits. The IRS may use 2024 tax returns to determine eligibility, so having a record of recent tax filings is considered crucial.

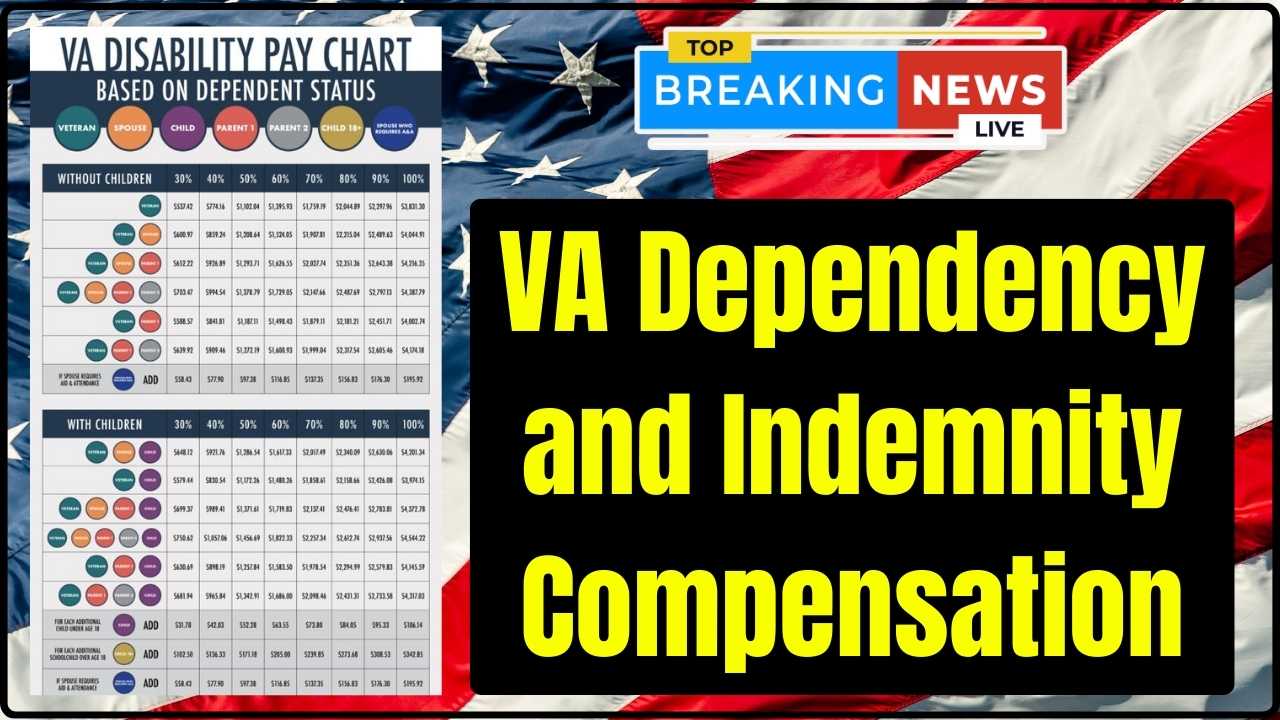

In addition, Social Security retirees, SSI and SSDI beneficiaries, and veterans receiving VA pensions or disability benefits may be among the primary recipients of this payment. Since the government already has payment information for these groups, they may not need to go through an additional application process, reducing both confusion and delays.

Payment Timing, Distribution Process, and the IRS’s Role

If Congress approves this proposal in a timely manner, the IRS could begin issuing payments in mid-December 2025. Direct deposit is considered the primary method, as it allows money to reach accounts faster and with fewer errors. Based on past experiences, it is estimated that most people could receive the payment between December 9th and December 24th, although this will depend on processing times.

Those not registered for direct deposit may receive paper checks, which could extend the distribution into early January. The IRS will likely also provide an online tracking tool so people can easily check the status of their payments.

Expert Opinions and Future Prospects

Economic experts believe that targeted relief can be effective in situations where inflation disproportionately affects certain segments of the population. However, they also caution that if there are delays in the decision-making process, the immediate impact of this assistance will diminish after December. Currently, the proposal is at the discussion stage and still needs to go through the formal legislative process of drafting a bill, debate, and approval.

Government officials are advising the public to rely only on official sources for information and to be wary of claims made on social media or unreliable websites. The legal process must be completed before any payments are issued.

Potential Broader Impact on Families and Local Economies

If this payment is implemented, its impact will not be limited to individual bank accounts. Low- and middle-income families typically spend such relief funds immediately on essential expenses—such as groceries, utility bills, and healthcare. This, in turn, supports local businesses and services, especially during the end-of-year spending season.

A one-time payment of $2,000 could help families pay for winter heating bills, reduce medical expenses, or alleviate debt burdens. While this is not a permanent solution to the long-term problem of inflation, it could provide much-needed relief. Some supporters believe that this could alleviate some of the economic pressure during the toughest winter months and provide a degree of stability for planning in the new year.

FAQs

Q1. What is the federal $2,000 deposit expected in December 2025?

It is a proposed one-time relief payment intended to help eligible Americans manage high living costs at the end of 2025.

Q2. Who may qualify for the $2,000 payment?

Eligibility may include low- and middle-income individuals, seniors, veterans, and federal benefit recipients, based on income limits.

Q3. Is the $2,000 payment officially approved?

No, the payment is still under discussion and would require congressional approval before being issued.

Q4. How would the payment be delivered if approved?

Most recipients would receive the money through direct deposit, with paper checks sent to others.

Q5. When could people receive the $2,000 deposit?

If approved in time, payments could begin arriving in mid to late December 2025.