IRS Confirms $2,000 Direct Deposit: You’ve probably seen the headlines and viral TikToks by now: “$2,000 coming from the IRS in January 2026!” Folks are lighting up group chats and Facebook feeds asking, “Is this real? Am I getting a check?” Here’s the deal: while some taxpayers may indeed see a $2,000 direct deposit hit their accounts early in the 2026 tax season, this is not a new stimulus check or universal relief payment. The $2,000 figure comes from estimated tax refunds, refundable credits, and withholding adjustments — all part of your normal tax return process. In this complete guide, we’ll walk you through who qualifies, how to claim your money, and what deadlines to watch, using a down-to-earth, clear approach with expert advice baked in.

Table of Contents

IRS Confirms $2,000 Direct Deposit

The buzz around the IRS sending $2,000 in January 2026 is rooted in truth — but it’s not a new federal payment program. Instead, it’s the result of existing tax refunds and credits that many Americans are entitled to — if they file early, claim all eligible credits, and choose direct deposit. Don’t miss out. This tax season could be one of your biggest refund years if you plan right, use the right tools, and stay ahead of the deadline.

| Feature | Details |

|---|---|

| Payment Amount | Up to $2,000 (based on tax refund and refundable credits) |

| Type of Deposit | Tax refund, not stimulus or new program |

| IRS Filing Season Start | Estimated Jan 20–27, 2026 |

| Refund Delivery | Within 21 days of filing (with e-file + direct deposit) |

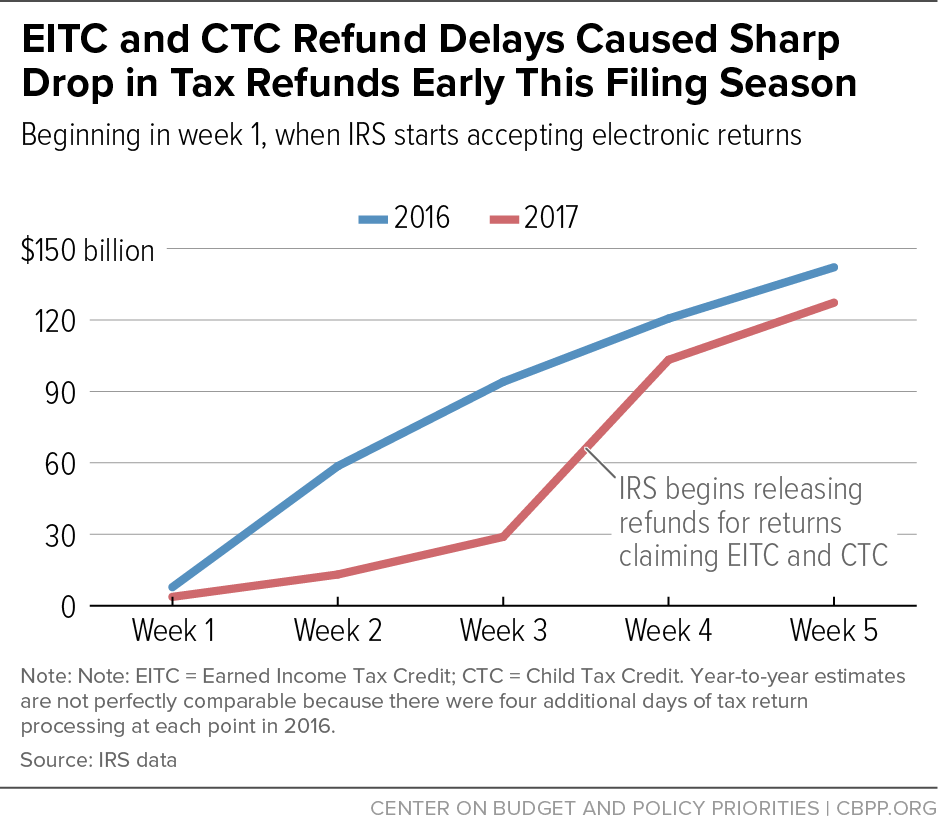

| Refund Delay Warning | Returns claiming EITC/CTC may be delayed to mid-February |

| Who Qualifies? | Low to moderate-income earners, families with children, overpaying taxpayers |

| Official IRS Resource | irs.gov |

What Is the IRS Confirms $2,000 Direct Deposit All About?

Let’s clear the air right up front. The IRS has not announced any special $2,000 payment or relief initiative for January 2026. However, what is true is that the average tax refund in recent years has hovered around $2,000–$3,100, depending on income level and tax credits.

According to official IRS statistics, the average refund during the 2023 tax season was $3,145. That means many filers will absolutely see $2,000 or more hit their bank account — but it’s based on their specific tax situation, not a one-size-fits-all payment.

This incoming “$2,000 deposit” is most commonly tied to:

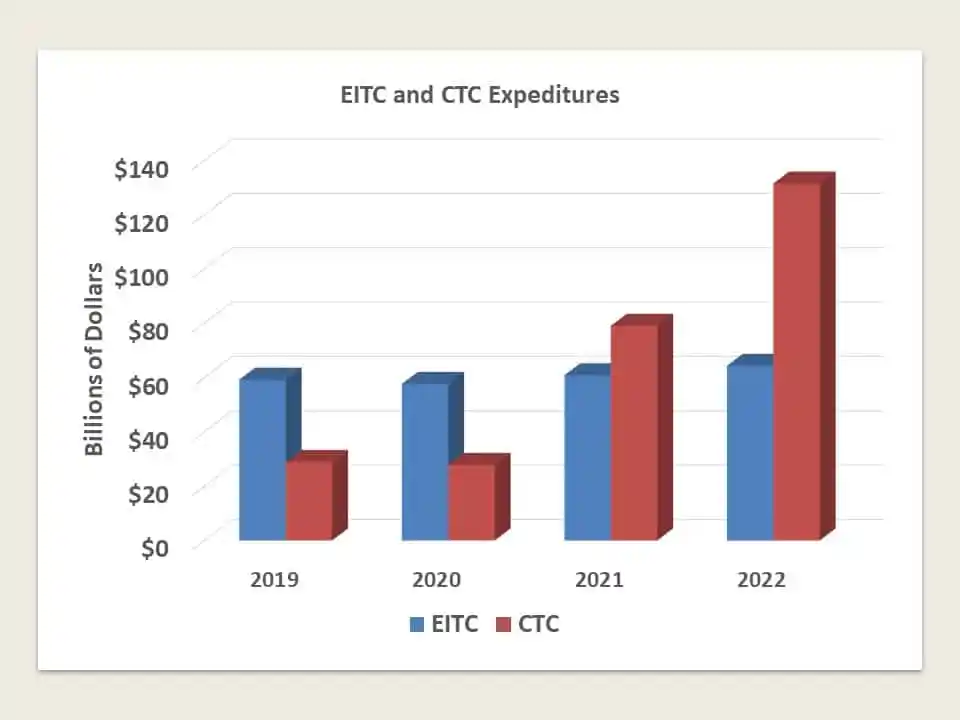

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Overpayment of taxes

- Education credits or other refundable amounts

Who Can Expect a $2,000 Direct Deposit? (Examples Included)

Let’s look at a few example scenarios so you can see how different people might receive a $2,000 refund in 2026:

Example 1: A Single Parent with Two Kids

- Files Head of Household

- Earns $28,000/year

- Claims the EITC (up to $6,960) and Child Tax Credit ($2,000 per child)

- No other deductions

Estimated Refund: $4,000 – $6,500 (after tax liability is reduced)

Example 2: A Young Couple with One Child

- Joint income: $45,000/year

- Eligible for CTC and some EITC

- No tax owed due to withholdings

Estimated Refund: $2,000 – $3,500

Example 3: Single Self-Employed Freelancer

- Income: $38,000

- Paid estimated taxes throughout the year

- No dependents, but qualifies for Saver’s Credit

Estimated Refund: $1,500 – $2,500 (based on overpayment + credits)

As you can see, $2,000 refunds are not automatic, but they’re common for qualifying filers who file early and claim their full benefits.

Who Is Eligible for $2,000 Direct Deposit?

Not everyone will see a $2,000 refund. To break it down:

Most Likely to Get $2,000+

- Working families with children (qualify for CTC and EITC)

- Households with income under $60,000/year

- People who had federal taxes withheld

- Those who overpaid via estimated quarterly tax payments

- Taxpayers who qualify for education, retirement, or childcare credits

Less Likely to Get That Much

- High earners with no dependents or deductions

- Those who owe back taxes or federal debts (refunds may be offset)

- Individuals who file late or without full documentation

- Retirees without taxable income (unless they qualify for credits)

Filing Deadlines and Refund Timeline (Important Dates)

| Filing Event | Estimated Date (2026) |

|---|---|

| IRS opens tax season | January 20–27 |

| First refunds issued (e-file + direct deposit) | January 31 – February 7 |

| Delayed refunds with EITC/CTC | February 15–20 |

| Paper check refunds | Mid-February onward |

| Final tax deadline | April 15, 2026 |

If you’re hoping to see that refund land fast, the secret is simple: file early and use direct deposit.

Understanding Refundable vs. Non-Refundable Tax Credits

This is where a lot of confusion happens, especially in tribal and rural communities. So let’s clear this up.

- Refundable credits give you money even if you owe no taxes. Example: EITC, part of the Child Tax Credit.

- Non-refundable credits only reduce your tax liability. If you don’t owe taxes, you don’t get cash back. Example: Retirement Saver’s Credit (partially non-refundable).

So if you hear someone say, “I don’t owe taxes, so I won’t get a refund,” they may still qualify for cash back via refundable credits. That’s free money left on the table if they don’t file!

Maximize Your Refund: Smart Filing Tips

Want to ensure you get every penny you’re owed?

File Early

The IRS operates on a first-in, first-out basis. The sooner you file, the sooner you get your refund — and the lower your risk of fraud.

Use a Tax Pro or IRS VITA Program

If you’re unsure about what credits you qualify for, visit a Volunteer Income Tax Assistance (VITA) site — especially in Native or rural communities.

Double-Check for Missing Credits

Each year, 1 in 5 people eligible for EITC fail to claim it. Many self-employed workers and part-time gig workers don’t realize they qualify.

Avoid Refund Anticipation Loans

Some tax shops offer “fast money” in exchange for a chunk of your refund. Be careful — you could lose hundreds in fees just to get your refund a few days early.

Native American Filers: Don’t Leave Money on the Table

Many tribal community members don’t realize they can get a refund even if they don’t owe taxes. Others mistakenly believe per capita payments or tribal land income disqualify them. Not true!

Look for:

- Local Native-led VITA sites

- Outreach from your tribal government

- IRS tribal consultation events or webinars

IRS Myths You Shouldn’t Fall For

| Myth | Truth |

|---|---|

| “The $2,000 is guaranteed.” | It depends on your income, dependents, and credits. |

| “You don’t need to file if you don’t owe.” | You must file a return to get refundable credits. |

| “Stimulus checks are back.” | Not true. This is based on regular tax refunds, not new federal aid. |

| “You’ll get it by default.” | Only if you file correctly and on time. |

USAA VA Disability Direct Deposit January 2026 – Expected Payment Dates and What to Know

$2000 Stimulus Check in January 2026: Check Eligibility, and Payment Status

Federal $2000 Deposits Coming in January 2026: Guide for Eligible Beneficiaries