Retired Americans Can Get an Average $9,108 Extra: If you’ve seen the headline “Retired Americans Can Get an Average $9,108 Extra Each Year,” you might be wondering if the government is suddenly offering new benefits or cutting checks to older adults. Let’s get real: there’s no new program dropping surprise money into your account — but there is an important story behind that number. This article dives into what that $9,108 surplus figure actually means, how Social Security benefits work in 2026, what retirees can expect going forward, and what you can do to make sure you’re getting the most out of your benefits. Whether you’re planning your retirement, helping a loved one, or just curious, we’ll break this down in clear steps, backed by official data, real‑world tips, and links to trusted resources.

Table of Contents

Retired Americans Can Get an Average $9,108 Extra

The idea that “retired Americans can get $9,108 extra each year” is more than a catchy headline — it reflects a broader truth: for many Americans, Social Security is adequate enough to cover basic costs with money left over. But for millions more, especially those in high-cost areas or with limited work history, Social Security alone isn’t enough. With benefits rising modestly in 2026, and potential changes looming over the next decade, now is the time to get serious about understanding your options. From claiming strategies to tax planning and supplemental savings, there’s a lot you can do to protect your retirement. Social Security isn’t just a government program — it’s a cornerstone of American retirement. And with the right planning, you can make the most of it.

| Topic | Key Info / Stat |

|---|---|

| Average Monthly Benefit (2026) | ~$2,071 per month (~$24,850/year) |

| Cost of Living Adjustment (COLA) | 2.8% in 2026 |

| Study-Based Surplus Estimate | ~$9,108/year after essential costs |

| Highest Monthly Possible Benefit | ~$5,430/month (for high earners who delay) |

| Taxable Earnings Cap (2026) | $184,500 |

| Trust Fund Solvency Outlook | May pay ~77% of benefits by 2033 if not reformed |

| SSA Website | www.ssa.gov |

What Does the “Retired Americans Can Get an Average $9,108 Extra” Actually Represent?

Let’s start with the truth: that $9,108 figure is not a one-time bonus or government windfall. It’s not new legislation or a secret rebate.

Instead, it comes from an economic study comparing Social Security retirement income against average retiree spending needs — like housing, groceries, transportation, and medical bills. Based on that data, some retirees may have a yearly surplus of $9,108 after their basic needs are covered.

That doesn’t mean everyone sees that surplus, and it’s certainly not a payout. It’s more of a general benchmark that shows how some Social Security recipients are living comfortably within their means.

Important caveats:

- This is based on averages and general costs.

- It doesn’t reflect inflation, lifestyle costs, taxes, or healthcare variation.

- Not all retirees live in low-cost areas or own homes free and clear.

How Social Security Benefits Are Calculated in 2026?

To understand how you might end up with more or less than that $9,108 “surplus,” you need to know how benefits are calculated.

1. Work History and Earnings

Your benefits depend on your highest 35 years of earnings. The Social Security Administration uses a formula based on your average indexed monthly earnings (AIME) to determine your primary insurance amount (PIA) — the monthly benefit you’ll get at your full retirement age.

2. Claiming Age

- Claim at 62: You’ll get less — up to 30% less than if you waited.

- Claim at full retirement age (66–67): You get your full benefit.

- Delay until 70: You’ll get the maximum — up to 32% more than your full retirement age.

In 2026, the maximum monthly benefit for someone who earned at or above the taxable maximum and claimed at 70 is around $5,430 per month.

Social Security Updates for 2026

Let’s look at what’s changed in 2026 and how that might affect you or a loved one.

Cost-of-Living Adjustment (COLA)

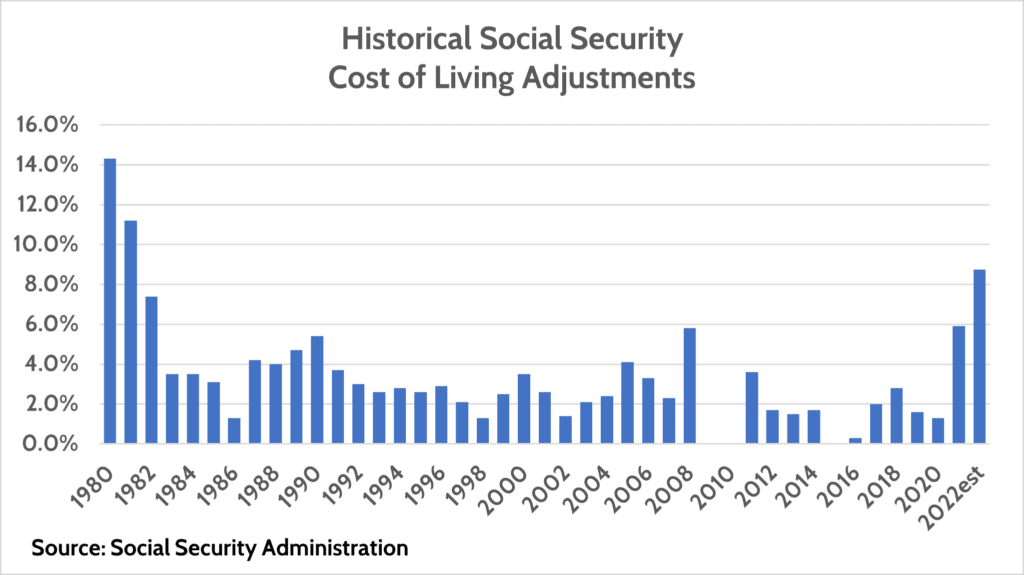

The COLA for 2026 is 2.8%, giving retirees about $56 more per month on average. That helps benefits keep pace with inflation, especially with rising costs for food, rent, and healthcare.

Earnings Cap Raised

In 2026, workers pay Social Security taxes on income up to $184,500. This means high earners will contribute more into the system — a move that helps delay trust fund depletion.

Working While Retired

If you claim early benefits (before full retirement age) and keep working, you’re subject to an earnings test. If you make more than $22,320, $1 in benefits is withheld for every $2 earned over the limit. Once you hit full retirement age, though, this doesn’t apply.

Is Retired Americans Can Get an Average $9,108 Really “Extra”? A Real-Life Breakdown

Let’s say a retiree in 2026 receives $2,071/month, or about $24,850/year. According to recent data:

- Average basic costs (housing, food, Medicare, utilities): ~$15,700/year

- Surplus left after needs: $9,150/year

That “extra” money may go toward:

- Travel

- Helping family or grandkids

- Emergency savings

- Hobbies or home projects

But not everyone fits this model. Many seniors pay rent or carry mortgage debt. Healthcare costs can spike. So this “surplus” can evaporate quickly depending on personal circumstances.

Understanding Solvency: Will Social Security Last?

This is one of the most common and important questions. Here’s the truth:

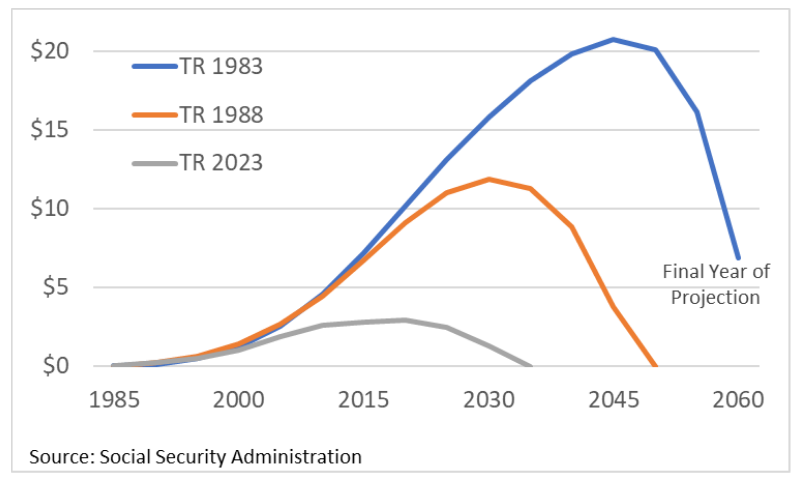

- The Social Security Trust Fund will likely be depleted by 2033, based on current projections.

- If that happens, Social Security will still be funded by payroll taxes — but only about 77–81% of scheduled benefits could be paid out.

- Congress has a few ways to fix this, including:

- Raising the payroll tax rate (currently 6.2% each from worker and employer)

- Lifting or eliminating the income cap

- Adjusting full retirement age again

- Means-testing benefits

Retirement Planning Tips: Get the Most From Your Benefits

Whether you’re retiring soon or already collecting, here’s how to maximize your Social Security benefits and avoid surprises:

1. Use the SSA’s Benefit Estimator

Go to SSA.gov and create a free account. You’ll see your actual earnings record and personalized benefit estimate.

2. Delay if You Can

Waiting to claim can significantly boost your lifetime benefit. Someone who waits from 62 to 70 can receive up to 76% more monthly.

3. Understand Spousal and Survivor Benefits

Married or widowed individuals may qualify for additional benefits based on their spouse’s or ex-spouse’s earnings. If you’ve been married at least 10 years and are unmarried, you may claim on an ex-spouse’s record.

4. Consider Taxes

Yes — your Social Security benefits can be taxed. If your total income (including pensions, IRA withdrawals, etc.) exceeds a certain threshold, up to 85% of your benefits may be taxable.

5. Think About Medicare Premiums

Most retirees are enrolled in Medicare Part B, and premiums are deducted from your Social Security check. For 2026, the average Part B premium is about $178.80/month — reducing your net monthly payment.

More Than Retirement: Other Social Security Benefits

Remember, retirement is just one part of the Social Security system. It also includes:

- Disability Insurance (SSDI) for workers who become disabled before retirement.

- Survivor Benefits for spouses and children of deceased workers.

- Family Benefits for dependents if the primary earner receives retirement or disability payments.

This wide reach is why nearly 1 in every 5 Americans receives some form of Social Security benefit.

$1,660 Monthly Benefit Plan for Retirees – Flat Social Security Proposal: Check Details

Goodbye Retirement at 67: Social Security’s New Age Requirement Shocks Millions

Federal $2000 Deposits Coming in January 2026: Guide for Eligible Beneficiaries