$1,660 Monthly Benefit Plan for Retirees: The $1,660 Monthly Benefit Plan for Retirees – Flat Social Security Proposal is generating serious conversations across retirement circles, Washington policy briefings, and even kitchen tables. If you’re wondering what it is, how it works, and whether it could affect your future or that of your loved ones, you’re in the right place. This plan is part of a broader conversation about how to save Social Security from long-term insolvency and make it fairer, simpler, and more predictable. In this article, we’ll walk you through everything you need to know in plain English — with enough professional insight and data to satisfy even the most seasoned financial planners.

Table of Contents

$1,660 Monthly Benefit Plan for Retirees

The $1,660 Monthly Benefit Plan for Retirees, based on a Flat Social Security Proposal, is a serious suggestion aimed at restructuring one of the most vital retirement programs in the U.S. While it’s not yet law, it signals a growing urgency to address Social Security’s fiscal future—and to consider new ways to make the system fair, solvent, and simple. Whether this plan moves forward or not, one thing is certain: change is coming. The best move? Stay informed, diversify your income sources, and work with a retirement advisor to plan for any scenario.

| Feature | Details |

|---|---|

| Monthly Benefit | ~$1,660 for individuals; ~$2,250 for couples |

| Based On | 125% of the Federal Poverty Level (FPL) in 2026 |

| Affected Group | New retirees only |

| Replaces | Traditional earnings-based Social Security formula |

| Financial Impact | Could increase benefits for 25% of future retirees, decrease for 75% |

| Goal | Improve long-term solvency of the Social Security system |

| Official Resources | CBO.gov, SSA.gov |

What Is the $1,660 Monthly Benefit Plan for Retirees?

Currently, Social Security benefits are calculated using a complex formula that considers your 35 highest-earning years, your average indexed monthly earnings (AIME), and certain bend points. In other words, your benefit depends heavily on how much you earned over your lifetime and when you retire.

But this proposal—analyzed by the Congressional Budget Office (CBO)—would simplify all of that. It suggests paying every new retiree a flat monthly benefit of approximately $1,660, which equates to 125% of the federal poverty level in 2026. Married couples would receive about $2,250 per month.

It’s a major shift from an income-replacement model to a basic income model for seniors. This idea isn’t law yet, but it’s one of several being considered as Social Security faces mounting financial pressure.

Why Is $1,660 Monthly Benefit Plan for Retirees Being Proposed?

Social Security isn’t going broke—but it is facing a big funding shortfall.

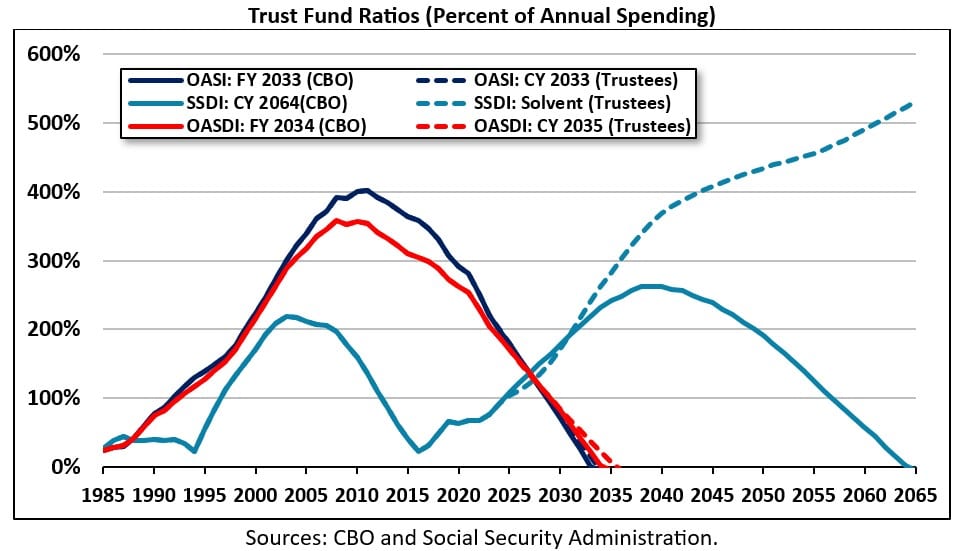

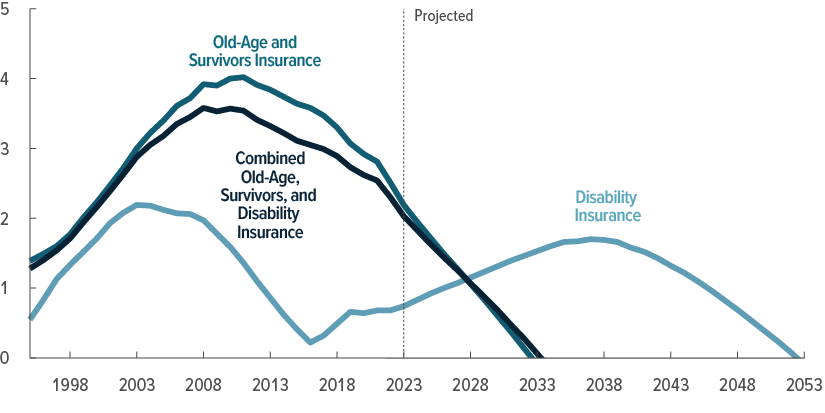

According to the 2024 Social Security Trustees Report, the Old-Age and Survivors Insurance (OASI) Trust Fund will only be able to pay about 77% of scheduled benefits starting in 2033, unless changes are made. That means younger workers today could see significant cuts in their retirement years if Congress doesn’t act.

The $1,660 flat benefit proposal is one way to:

- Reduce overall program costs

- Simplify the benefit structure

- Guarantee a minimum income to all retirees

- Preserve the system for future generations

How the Flat Benefit Would Work (Step-by-Step)?

Here’s a simple breakdown of how this plan could work if passed into law:

1. Uniform Monthly Payment

Each new retiree would receive:

- $1,660/month (individual)

- $2,250/month (married couple)

These numbers are tied to 125% of the federal poverty level, which changes annually with inflation.

2. Applies to New Beneficiaries Only

This plan would not affect current retirees. It would only apply to future Social Security recipients—likely those retiring after a certain implementation year (e.g., 2026 or later).

3. No Earnings History Required

Your benefit wouldn’t be tied to how long you worked or how much you earned. Whether you worked 10 years or 40 years, you’d receive the same monthly amount.

4. Adjusted for Inflation

Just like current Social Security benefits, the flat benefit would likely be subject to annual cost-of-living adjustments (COLAs). This ensures the value of the benefit keeps pace with inflation.

How It Compares to the Current System?

| Category | Current System | Flat Benefit Proposal |

|---|---|---|

| Based on Earnings? | Yes | No |

| Average Monthly Payout | ~$1,900 (2024 average) | $1,660 for everyone |

| Variance by Worker? | High-earners get more, low-earners get less | Everyone gets the same |

| Calculation Formula | Complex; based on AIME and bend points | Fixed dollar amount tied to poverty level |

| Applies To | All retirees | New retirees only |

This could benefit low-wage workers who currently receive less than $1,660. On the flip side, it could penalize those with high-paying careers who’d otherwise receive significantly more under the current system.

Who Would Benefit from the Flat Plan?

- Low-income workers: Those who worked minimum wage or inconsistent jobs may receive more than under current law.

- Workers with interrupted careers: Stay-at-home parents or part-time caregivers who didn’t rack up 35 high-earning years.

- Gig economy workers: Freelancers and contractors who often pay self-employment taxes but earn less predictably.

- Retirees in high-cost areas: A flat benefit could offer more financial certainty in regions where public assistance is limited.

Who Could Lose Out?

- High-income professionals: Those who contributed large amounts to Social Security over decades may receive less than expected.

- Dual-income couples: Households that would normally earn two full benefits may be capped at the couple’s flat benefit level.

- Workers with long tenures: If you’ve worked 40 years in a stable, well-paying job, the flat amount might feel like a downgrade.

Real-Life Examples

Let’s look at two hypothetical retirees:

Case 1 – Maria (Retail Worker)

- Worked 25 years at minimum wage

- Under current system: ~$1,200/month

- Under flat benefit: $1,660/month

Maria gains $460/month.

Case 2 – James (Engineer)

- Worked 40 years earning $100,000+

- Under current system: ~$3,000/month

- Under flat benefit: $1,660/month

James loses $1,340/month.

Retirement Planning Tips (For a Changing System)

Whether this proposal becomes law or not, it’s smart to future-proof your retirement.

1. Max Out Other Savings Vehicles

- Contribute to 401(k), IRA, Roth IRA, or SEP IRA if self-employed

- Consider after-tax brokerage accounts for long-term growth

2. Diversify Income Streams

- Consider real estate income, annuities, or part-time consulting

- Explore dividend-producing investments to supplement monthly income

3. Delay Social Security (If Possible)

Even under current rules, delaying benefits until age 70 boosts your monthly payment by up to 8% per year.

4. Get Your Social Security Statement

Check your work history and earnings record via:

- SSA.gov My Account

What Experts Say About $1,660 Monthly Benefit Plan for Retirees?

“A flat benefit is simple and budget-friendly, but it breaks the historic link between work and reward in Social Security.”

— Jason Fichtner, former SSA economist

“The proposal is a shift toward social insurance as a floor rather than a wage replacement. It’s efficient, but politically risky.”

— Urban Institute Policy Analyst

The Committee for a Responsible Federal Budget (CRFB) also supports exploring flat benefit models to close the program’s deficit

Impact on Different Populations

| Demographic Group | Potential Impact |

|---|---|

| Women | May benefit due to wage inequality and caregiving gaps |

| Minorities | Could see improved outcomes based on historical disparities |

| Disabled Workers | May not be affected unless SSDI is also restructured |

| Veterans | Could benefit if their civilian earnings were lower |

| Immigrants | If they worked shorter periods in the U.S., a flat benefit may offer more equity |

Federal $2000 Deposits Coming in January 2026: Guide for Eligible Beneficiaries

Stimulus Payment January 2026, IRS direct deposit relief payment & tariff dividend fact check

Tax Refunds Could Be Bigger in 2026 — Here’s When the IRS Will Start Accepting Returns