Goodbye Retirement at 67: When headlines scream “Goodbye retirement at 67!” it’s no surprise that millions of Americans sit up and take notice — especially those nearing retirement age. For generations, 65 was the magic number. But now? The full retirement age for Social Security is 67 for people born in 1960 or later — and that’s leaving folks scratching their heads and rethinking their futures. Whether you’re in your early 60s planning your exit strategy, or in your 30s wondering if Social Security will still be there, you deserve the truth: clear, factual, and easy to act on. In this article, we’ll walk you through exactly what’s changed, what hasn’t, and how to make the best moves for your financial future. From timelines and benefit strategies to legal updates and work rules — this guide covers it all.

Table of Contents

Goodbye Retirement at 67

Let’s be clear: Retirement at 67 hasn’t been canceled — it’s been cemented.

- For millions of Americans, age 67 is now the full retirement age.

- You can still retire early at 62, but you’ll get less.

- Wait until 70? You’ll get more.

- Future changes might push retirement ages even higher — but nothing’s final yet.

The smartest move you can make is to plan ahead, know your options, and build other income streams. Whether you’re two years or two decades from retirement, now’s the time to prepare.

| Topic | Details |

|---|---|

| Full Retirement Age (FRA) | 67 for those born 1960 or later |

| Early Retirement | Available at 62 (with reduced benefits) |

| Max Retirement Age | 70 (higher monthly benefits) |

| 2026 Cost-of-Living Adjustment | ~2.8% increase in benefits |

| Work & Earnings Limits | $24,480 for under-FRA; $65,160 in year of FRA |

| Future Proposals | FRA increases to 68–70 under discussion |

What “Goodbye Retirement at 67” Actually Means?

This headline doesn’t mean you can’t retire at 67 anymore. Quite the opposite — it means 67 is now the full retirement age (FRA) for anyone born in 1960 or later. It’s the new normal.

Here’s a quick refresher:

- Full Retirement Age (FRA) is when you’re entitled to 100% of your earned Social Security benefit.

- Before recent changes, FRA used to be 65. Then 66. Now it’s 67 for most future retirees.

- This shift was planned long ago, but 2026 is the first full year it applies across the board to everyone born 1960+.

This change is not a sudden reform — it’s the final rollout of a phased policy that began with the Social Security Amendments of 1983. The government anticipated longer life expectancies and adjusted accordingly.

Goodbye Retirement at 67: A Closer Look at the Claiming Options

1. Early Retirement at 62

Can you still retire early? Yes.

You can claim Social Security benefits at age 62, but your benefit is permanently reduced. For someone whose FRA is 67:

- Claiming at 62 slashes your monthly benefit by about 30%.

- For example, if you’re entitled to $2,000/month at 67, you’ll get around $1,400/month at 62.

So while early retirement is still on the table, it comes at a long-term cost.

2. Full Retirement Age at 67

This is now the standard age for full benefits if you were born in 1960 or later. Waiting until 67 means:

- You avoid penalties.

- You collect your full benefit based on your lifetime earnings.

For someone earning the national average, this might be between $1,800 and $2,500 per month, depending on their work history and contribution record.

3. Delayed Retirement to Age 70

If you wait past 67, you get delayed retirement credits:

- About 8% more per year for each year you delay, up to age 70.

- That’s roughly a 24% increase in benefits if you wait from 67 to 70.

For high earners or those with longer life expectancy, this strategy can maximize lifetime benefits.

Why Goodbye Retirement at 67?

The big question: Why mess with retirement at all?

Here’s the reality:

- When Social Security began in 1935, life expectancy was 61.

- Today, it’s 76 for men and 81 for women.

- More people are living longer and drawing benefits for decades.

That’s good news — but it puts pressure on the system. In 2024, the Social Security Trustees Report warned the trust fund could be depleted by 2034 without action.

Raising the retirement age was part of a longer-term fix to help balance inflows and outflows. It doesn’t eliminate benefits — but adjusts expectations to match demographic reality.

How Retirement Strategies Differ by Generation?

Baby Boomers (Born 1946–1964)

- Most already retired or retiring soon.

- Their FRA is either 66 or 67.

- They’re mostly unaffected by future increases but must manage income alongside Medicare and rising health costs.

Generation X (Born 1965–1980)

- Will retire under the 67 FRA.

- Need to plan for a longer retirement horizon — possibly 30+ years.

- Should explore spousal benefits, work credits, and private savings.

Millennials & Gen Z (Born 1981–2000)

- Could face a future FRA of 68–70 if proposed policies become law.

- Must build private retirement plans early — Roth IRAs, 401(k)s, HSAs.

- Should track changes in Social Security policy over the next 10–20 years.

Planning Tips: Maximize Your Benefits

Here’s how to keep more of what you’ve earned.

1. Know Your Break-Even Point

If you delay claiming, you’ll get more per month — but fewer months of benefits. Your break-even age (usually around age 80) helps you determine if waiting makes financial sense.

Example:

- Claim at 62: $1,400/month

- Claim at 67: $2,000/month

- If you live past 80, waiting might net you more overall.

2. Combine with Spousal Benefits

Married couples can strategize:

- One spouse claims early; the other delays.

- The lower earner may claim 50% of the higher earner’s benefit at FRA.

- Widows and widowers may be eligible for survivor benefits.

3. Watch the Earnings Limit

If you’re working and collecting before FRA:

- In 2026, earn more than $24,480, and $1 is withheld for every $2 above the limit.

- In the year you reach FRA, the earnings limit is $65,160, and the reduction is $1 for every $3 earned.

Once you reach FRA, there’s no penalty for working. Your full benefit is restored.

The Role of Private Retirement Accounts

Social Security isn’t meant to be your only retirement income. It was designed to replace about 40% of your pre-retirement income.

That’s why planners stress the “three-legged stool” of retirement:

- Social Security

- Employer-sponsored savings (401(k), pensions)

- Personal savings (IRAs, brokerage accounts)

With pensions becoming rare, maxing out your 401(k) and Roth IRA is more important than ever. Use catch-up contributions if you’re over 50, and review your investment mix yearly.

Future Policy Changes: What Could Happen?

While the FRA is now 67, policymakers are still considering:

- Raising it gradually to 68 or 69

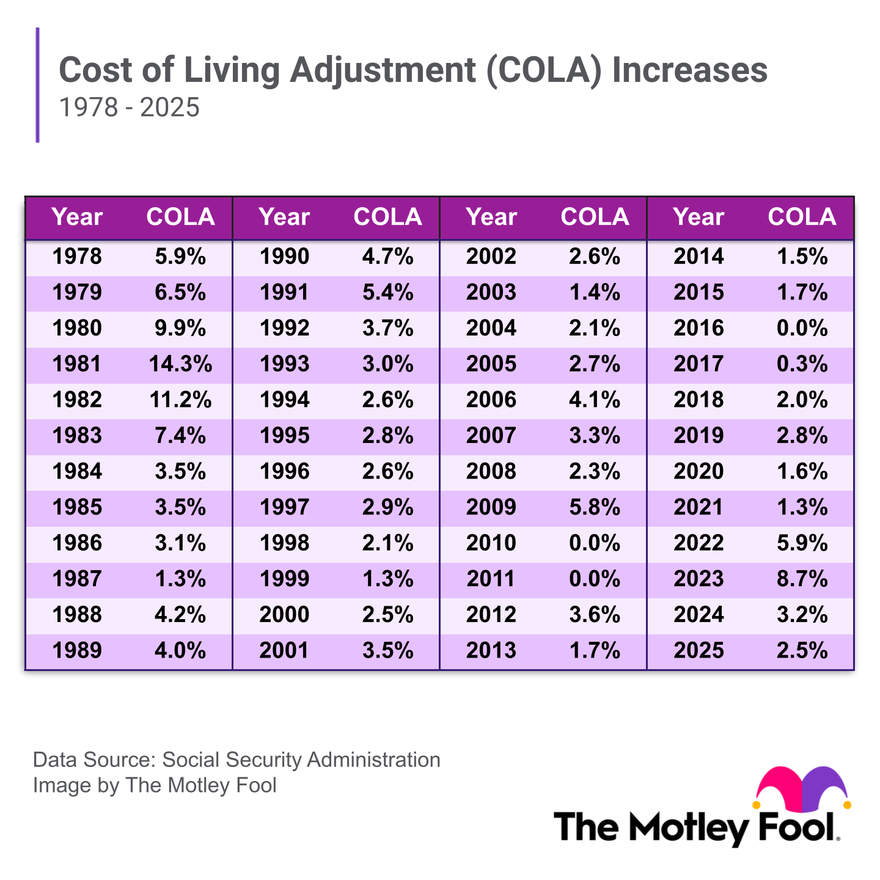

- Adjusting COLAs to reflect inflation more accurately

- Means-testing benefits based on income

The Republican Study Committee has floated a plan to raise the FRA to 69, sparking debate. Critics argue this could unfairly impact blue-collar workers with shorter life expectancies. Supporters say it’s necessary for solvency.

Bottom line: Stay informed, but don’t panic. Any changes will likely be phased in over decades, not months.

$2000 Stimulus Check in January 2026: Check Eligibility, and Payment Status

Stimulus Payment January 2026, IRS direct deposit relief payment & tariff dividend fact check

Social Security Payment Pause January 2026 – Why No Checks Are Being Sent This Week