IRS Confirms $2,000 Direct Deposit: You may have seen the viral claims: “The IRS will be sending out $2,000 direct deposits to Americans in January 2026!” Sounds like free money, right? But before you start counting that cash, let’s take a clear, fact-checked look at the situation. There’s a whole lot of confusion between stimulus checks, tax refunds, and political proposals—and we’re here to sort it all out. Let’s break it down in simple language so anyone — whether you’re 10 or 60 — can understand what’s real, what’s a rumor, and what to expect from the IRS in early 2026.

Table of Contents

IRS Confirms $2,000 Direct Deposit

Despite widespread rumors and attention-grabbing headlines, there is no IRS-confirmed $2,000 direct deposit being sent to everyone in January 2026. But — millions of taxpayers may still receive tax refunds worth $2,000 or more, especially if they qualify for refundable credits like the CTC or EITC.

The truth?

- The “Tariff Dividend” is not a law.

- Tax refunds are not stimulus checks.

- Scammers are pushing fake payment alerts for their own gain.

| Topic | Details |

|---|---|

| IRS $2,000 Check Confirmed? | No — there is no approved stimulus or federal payment program as of January 2026. |

| Where Did the Rumor Come From? | Confusion around a political proposal (“Tariff Dividend”) and tax refund expectations. |

| Who Might Get a Payment? | Early tax filers with refundable credits like CTC and EITC could get refunds totaling ~$2,000. |

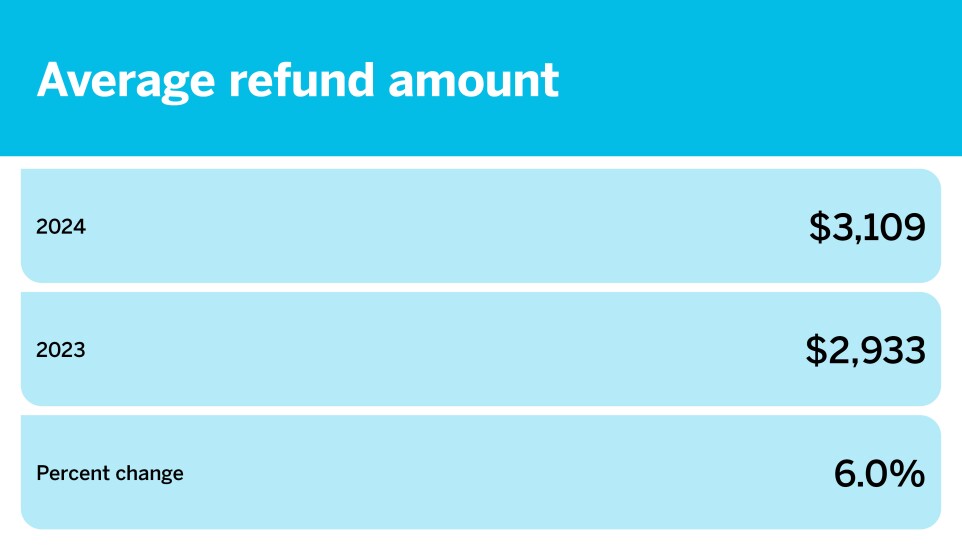

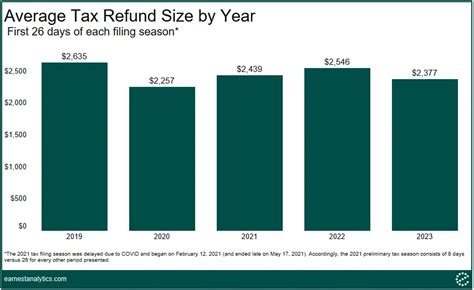

| Average Tax Refund (Recent Years) | $2,753 (2023), $2,906 (2024 estimate) |

| IRS Payment Timing | Mid-to-late February for most refunds, especially with EITC or ACTC credits. |

| Fact-Check Source | FOX 5 Atlanta Report |

A Quick Look Back: IRS Stimulus Payments and Refunds History

To understand the current buzz, let’s revisit recent U.S. economic relief efforts:

- 2020–2021: Americans received three rounds of federal stimulus payments:

- $1,200 (CARES Act – March 2020)

- $600 (December 2020 relief bill)

- $1,400 (American Rescue Plan – March 2021)

- After that, no new federal stimulus programs have been approved as of 2026.

Since 2022, many states have stepped up to offer localized rebates or “inflation relief” checks — adding to the confusion.

So when someone hears about a $2,000 check now, they might be mixing it up with:

- Tax refunds

- State rebates

- Old stimulus memories

- Political promises that haven’t become law

The “Tariff Dividend” Explained: A Political Idea, Not a Real Payment

The $2,000 check rumor in January 2026 mostly stems from a campaign proposal by Donald Trump called the Tariff Dividend.

Here’s the basic pitch: Use money collected from tariffs on foreign goods (mainly from China) and send it back to American households in the form of a one-time rebate of $2,000.

It’s a catchy idea, but here’s what’s important:

- It’s just a proposal. Congress hasn’t voted on it.

- It’s not funded. According to the Tax Foundation, 2026 tariff revenue falls short of what’s needed.

- No law has been passed. The IRS cannot issue checks without congressional authorization.

So while it’s talked about online and in political circles, it’s not real — yet.

Could You Still Receive $2,000 Direct Deposit in January 2026? Yes — Through a Tax Refund

This is where things get interesting.

Every year, millions of Americans receive tax refunds. And yes, some of those refunds can easily reach or exceed $2,000 — depending on your income, tax withholdings, dependents, and eligible credits.

Key credits that boost refunds:

- Child Tax Credit (CTC): Up to $2,000 per child

- Earned Income Tax Credit (EITC): Up to $7,430 (2023 max, varies by income and kids)

- American Opportunity Credit (education): Up to $2,500

These are not stimulus checks. They are refundable credits, meaning you can receive them even if you owe no taxes.

Example Scenarios:

- Single filer with no kids: $35,000 income

Likely refund: ~$1,000–$1,500 (depending on withholding) - Married couple with 2 kids: $50,000 income

Likely refund: ~$3,000–$5,000 (CTC + EITC + withholdings) - Self-employed contractor: $80,000 income, high deductions

Likely refund: Varies. Could owe taxes or receive refund depending on expenses and estimated payments.

How Tax Refunds Work: Step-by-Step Guide

Whether you’re self-employed, a student, or a W-2 worker, here’s how to stay ahead:

Step 1: Gather Your Documents

- W-2s or 1099s from employers or clients

- Form 1098-T (tuition), SSA-1099 (Social Security), etc.

- Last year’s return for reference

Step 2: File Early

- IRS opens e-filing in mid-January

- Early filing = faster refund (but not for everyone — more on that soon)

Step 3: Choose Direct Deposit

- Add your bank routing + account number

- Speeds up delivery by 1–2 weeks over mailed checks

Step 4: Track Your Refund

Use the Where’s My Refund? tool on IRS.gov. Updates are posted daily.

Why Your Refund Might Be Delayed Until Mid-February?

If you claim either of these:

- EITC (Earned Income Tax Credit)

- ACTC (Additional Child Tax Credit)

The IRS is legally required to delay those refunds until after February 15, due to the PATH Act (a law designed to prevent fraud and identity theft).

So even if you file on Day 1, expect your refund around late February if you claim these credits.

Don’t Confuse Federal Payments with State Rebates?

Some folks receiving state-level rebates are mistakenly thinking they’re federal IRS payments. They aren’t.

Here are a few examples:

| State | Program | Amount | Status |

|---|---|---|---|

| California | Middle-Class Tax Refund | $200–$1,050 | Sent in phases in 2023 |

| Colorado | TABOR Refund | ~$750 | Ongoing |

| New Mexico | Inflation Rebates | $500–$1,000 | Paid in 2023 & 2024 |

Always check your state’s official tax website to know whether you qualify for local payments.

Top IRS Scams to Watch For in 2026

Criminals are working overtime trying to trick people into handing over personal info — especially during tax season.

Here’s what to look out for:

- Phishing Emails: “Claim your $2,000 IRS check now!” with fake links.

- Phone Calls: Fake IRS agents demanding payment via gift cards or wire transfer.

- Text Messages: “Tap here to confirm your refund” — leads to fake login sites.

- Social Media Posts: Viral TikToks and Instagram posts with “proof” of checks landing soon.

Remember: The IRS will NEVER contact you via phone, email, text, or social media first.

$2000 Stimulus Check in January 2026: Check Eligibility, and Payment Status

Stimulus Payment January 2026, IRS direct deposit relief payment & tariff dividend fact check

Social Security Payment Pause January 2026 – Why No Checks Are Being Sent This Week