Goodbye to Manual CPP Applications: New CPP Rule Automatically Enrolls Seniors Starting January 10, 2026 — now that’s a headline that could change retirement planning forever. If you’re a Canadian senior (or helping one), this new law makes the process of receiving retirement benefits way easier. After decades of folks needing to apply manually for their Canada Pension Plan (CPP), the government is now stepping up its game: starting in 2026, many seniors will be automatically enrolled. This shift marks a major move toward simplifying retirement for Canadians, especially for those who may not be tech-savvy or miss deadlines due to illness, confusion, or lack of access. It’s the kind of change that’s been a long time coming — and now it’s finally real.

Table of Contents

Goodbye to Manual CPP Applications

Goodbye to Manual CPP Applications; New CPP Rule Automatically Enrolls Seniors Starting January 10, 2026 is more than a policy tweak — it’s a milestone in retirement accessibility. For seniors across Canada, especially those without digital skills or family support, this rule can mean the difference between financial comfort and hardship. Automatic enrolment simplifies life, reduces missed benefits, and restores dignity to retirement. Still, being informed and proactive is key to getting the most out of CPP.

| Feature | Details |

|---|---|

| Policy Change | Seniors will be automatically enrolled for CPP at age 65 |

| Effective Date | January 10, 2026 |

| Applies To | Seniors reaching age 65 with sufficient CPP contributions |

| Manual Application | No longer required (for most cases) |

| Average CPP Payment (2025) | ~$899.67/month at age 65 |

| Maximum CPP (2026) | ~$1,507.65/month (estimated) |

| Official Resource | Canada Pension Plan (CPP) |

Understanding the Canada Pension Plan (CPP)

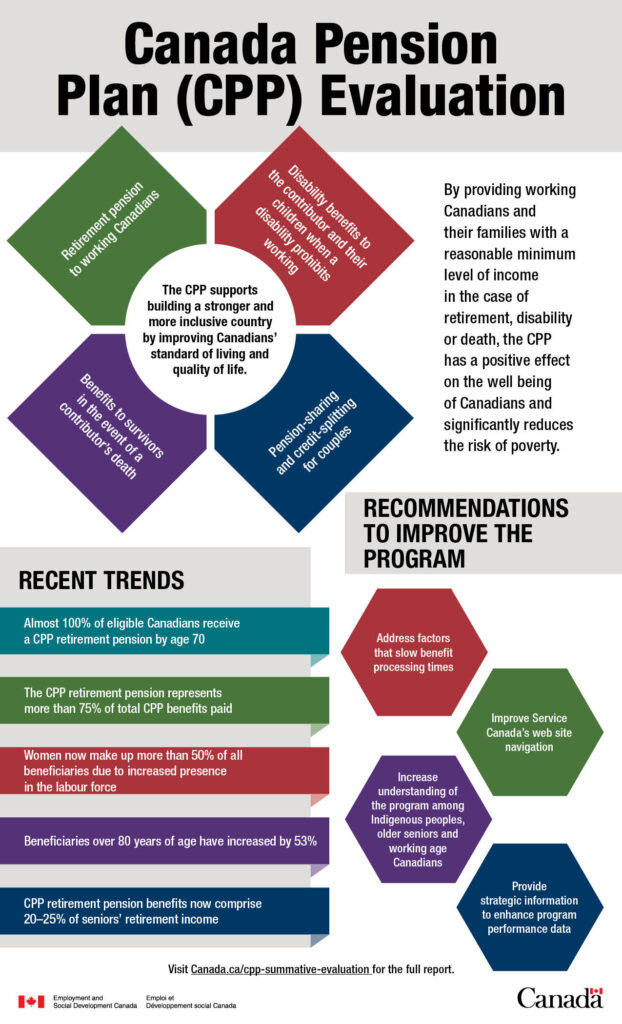

The Canada Pension Plan is one of three major retirement income programs in Canada, alongside Old Age Security (OAS) and the Guaranteed Income Supplement (GIS). CPP is designed to replace a portion of your income once you stop working — and it’s based on how much you contributed during your working years.

You start contributing once you earn more than $3,500 per year, and your contributions are matched by your employer. Self-employed folks pay both portions. Contributions stop after your income hits the maximum annual pensionable earnings — which is $68,500 in 2024 and expected to increase in 2026.

What’s New: Goodbye to Manual CPP Applications

Before now, seniors had to apply manually through their My Service Canada Account (MSCA) or with paper forms. If you forgot or didn’t realize you had to apply, you could miss months — or even years — of income.

Starting January 10, 2026, that’s no longer the case for most seniors turning 65.

Here’s what changes:

- Automatic enrolment kicks in when you turn 65, assuming you’ve paid into CPP.

- No manual application is needed unless you choose a different start date.

- You still control when to start CPP — the system just sets age 65 as the default unless you request otherwise.

This is especially helpful for seniors who may not be comfortable with online forms or who live in rural/remote areas.

Who Qualifies for Automatic Enrollment?

You’ll be automatically enrolled if:

- You’re turning 65 on or after January 10, 2026

- You have a valid Social Insurance Number (SIN)

- You’ve made at least one valid CPP contribution

- You live in Canada or meet the eligibility rules if living abroad

If you’ve already applied for CPP early (starting at age 60–64), the automatic enrolment doesn’t apply. Likewise, if you delay CPP beyond 65, you can still request a later start date.

Goodbye to Manual CPP Applications: Why Age 65?

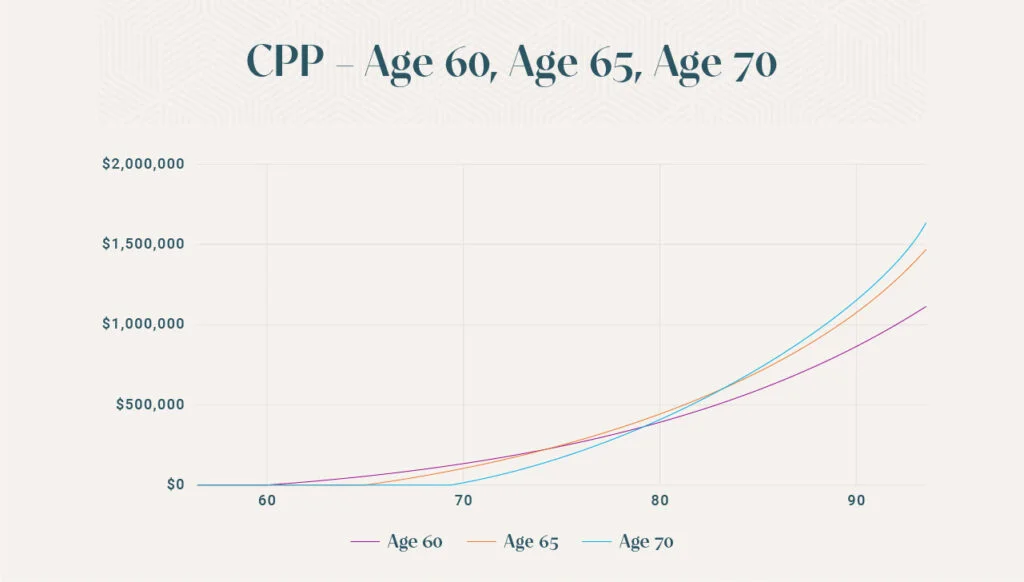

Age 65 is the standard age to begin receiving the full CPP benefit. While you can start as early as 60 or delay until 70, starting at 65 gives you the baseline, unreduced monthly amount. Every month you delay beyond 65 increases your payments by 0.7%, up to a max 42% increase at age 70.

Old System vs. New System

| Aspect | Old (Manual) | New (Automatic, 2026) |

|---|---|---|

| Application | Required | Not required |

| Start Date | Chosen during application | Set at 65 (default), can change |

| Risk of Delay | High | Low |

| Access | Online or paper form | Automatic via Service Canada |

Why This Matters — Real-World Examples

Let’s say Mary, a retired teacher in Alberta, turns 65 on January 12, 2026. She’s paid into CPP her whole life but doesn’t check her email or mail regularly. Before, if she didn’t apply, she’d get nothing until she remembered. Now, she’ll start receiving CPP automatically around her birthday — no stress, no lost income.

John, however, is still working at 65 and wants to delay CPP until he retires at 68. He can still log in to his MSCA account and request a delay. Auto-enrolment respects that choice — it’s not forced.

How Much Will You Get?

The average monthly CPP in 2025 was $899.67, but this varies widely. The maximum monthly CPP benefit for someone starting at age 65 in 2026 is estimated at $1,507.65.

Your actual amount depends on:

- How long you contributed

- How much you earned

- When you start receiving payments

Planning Tips for Retirement

- Review your MSCA account regularly to make sure your contributions are accurate.

- Consider delaying CPP if you’re still earning income. Each month you wait boosts your payout.

- Coordinate with OAS and GIS — those programs may also auto-enroll, but not always.

- Work with a financial planner if you have private pensions, RRSPs, or are self-employed.

- CPP is taxable income. Plan ahead for potential income taxes in retirement.

Canadians Living Abroad: What You Need to Know

Even if you live outside Canada, you may still be eligible for CPP, but you may not be auto-enrolled. You’ll likely need to:

- Have contributed enough to CPP while in Canada

- Live in a country that has a social security agreement with Canada

- Submit additional paperwork to verify identity, residence, and banking info

How This Aligns with Broader Trends?

This move aligns with Canada’s push toward automatic enrolment in many federal benefits, including:

- OAS – Some seniors are now automatically enrolled at 65

- GIS – May auto-enroll based on your income and OAS records

- Registered Retirement Income Funds (RRIFs) – Required withdrawals automatically start at 71

It’s part of a long-term effort to modernize benefits, reduce poverty, and increase access for vulnerable Canadians.

$530 CPP Increase Confirmed for January 2026: Check Eligibility & Payment Date

$1,350 CRA Payment Dropping January 2026 — Eligibility Details Just Released

4 CRA Benefits Payments in January 2026 – Check Eligibility Criteria & Payment Date