Nations Direct Mortgage Data Breach Class Action Settlement: In December 2023, Nations Direct Mortgage, LLC (NDM), a prominent home loan provider operating across the United States, experienced a massive data breach that exposed the personal information of over 284,000 individuals. Now, a class action settlement has been reached—and if you were affected, you could be entitled to claim up to $2,750, plus free credit monitoring. This article explains everything you need to know, including who’s eligible, how to file, and why it’s critical to act. Whether you’re a homeowner, financial advisor, or just someone concerned about digital privacy, this guide is written for you.

Table of Contents

Nations Direct Mortgage Data Breach Class Action Settlement

If you were affected by the Nations Direct Mortgage data breach, this is your chance to get real compensation and long-term identity protection. You don’t have to pay a lawyer, and you don’t need to jump through hoops. But you do need to act—and soon. This isn’t just about a few bucks. It’s about telling corporations: If you mishandle private data, there are consequences. Don’t let your slice of justice slip away.

| Topic | Details |

|---|---|

| What Happened | December 2023 cyberattack exposing sensitive personal data |

| Individuals Affected | Estimated 284,000+ |

| Eligibility | Anyone who received a breach notification from NDM |

| Compensation | Up to $2,750 + $75 for California residents |

| Additional Benefits | Two years of free credit monitoring |

| Deadline | January 7, 2026 |

| Case Name | Kuhn et al. v. Nations Direct Mortgage |

| Official Settlement Website | www.ndmsettlement.com |

What Happened: The Breach That Sparked a Lawsuit

In December 2023, cybercriminals successfully infiltrated NDM’s network and accessed confidential customer data, including:

- Full names

- Dates of birth

- Social Security numbers

- Home addresses

- Driver’s license numbers

- Possibly financial account details

NDM acknowledged the breach in early 2024 and began notifying affected individuals. However, the incident had already created serious risks for consumers—identity theft, fraudulent activity, credit damage, and more.

The matter escalated quickly into a legal battle: plaintiffs accused NDM of failing to implement adequate data protection protocols, violating state and federal laws designed to protect consumer privacy.

Legal Background: Why There’s a Class Action Settlement

The lawsuit, officially titled Kuhn, et al. v. Nations Direct Mortgage, LLC, was filed in Florida. Plaintiffs argued that NDM’s negligence allowed the breach to occur and that the company failed to:

- Use industry-standard encryption and cybersecurity tools

- Notify victims in a timely manner

- Offer sufficient remedies after the breach

To avoid prolonged litigation and escalating legal fees, NDM agreed to a class-wide settlement, while denying any wrongdoing. This is a common outcome in class actions involving corporate data breaches.

The Bigger Picture: How Nations Direct Mortgage Data Breach Impact Americans

To appreciate the importance of this settlement, consider these facts:

- According to the Identity Theft Resource Center, over 422 million individuals were affected by data breaches in 2022 alone.

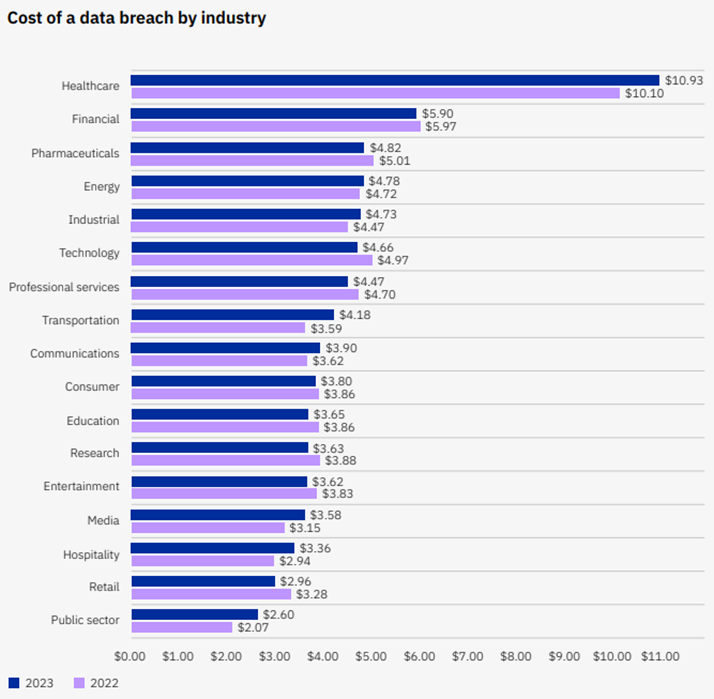

- A 2023 IBM report states the average cost of a data breach in the U.S. is $9.48 million—more than any other country globally.

- The Federal Trade Commission (FTC) has received over 1.4 million identity theft reports in recent years.

These numbers are not just statistics. For everyday Americans, a single data breach can mean:

- Wiped-out savings accounts

- Fraudulent tax filings

- Damaged credit scores

- Countless hours spent resolving identity theft

That’s why settlements like this matter—they’re not just compensation; they’re accountability.

What You Can Get: Benefits of the NDM Settlement

1. Reimbursement for Documented Expenses (Up to $2,750)

Class members who incurred losses due to the data breach can file for compensation. You’ll need to provide supporting documents—like receipts, bank statements, or credit bureau letters. Covered expenses include:

- Identity theft-related losses not covered by banks

- Credit monitoring or report purchases

- Charges for freezing/unfreezing credit

- Notary, mailing, or travel expenses tied to recovery efforts

- Up to 2 hours of lost time at $25/hour (no documentation required for time claims)

Maximum reimbursement is $2,750 per individual.

2. Free Credit Monitoring and Identity Theft Protection

Even if you didn’t suffer financial loss, you’re still eligible for:

- Two years of professional credit monitoring

- Identity theft insurance

- Alerts for suspicious credit activity

- Dark web surveillance

These services can cost over $200/year on the open market.

3. Extra $75 for California Residents

Under the California Consumer Privacy Act (CCPA), eligible California residents may receive an additional $75 payment, recognizing the state’s stricter privacy laws.

Who’s Eligible for Nations Direct Mortgage Data Breach Class Action Settlement?

You’re likely eligible if:

- You received a notice from Nations Direct Mortgage about the December 2023 breach

- You had a loan, mortgage, or application with the company before that time

- You did not opt out of the class action or settlement

Not sure? Contact the Settlement Administrator at:

- Phone: 1‑833‑417‑4946

- Email: [email protected]

Step-by-Step: How to File Nations Direct Mortgage Data Breach Class Action Settlement Claim

Filing is straightforward and free. You don’t need a lawyer. Here’s what to do:

Step 1: Visit the Official Website

Go to: www.ndmsettlement.com

Step 2: Locate the Claim Form

Click “File a Claim.” You’ll be asked for your Unique ID and PIN, which were provided in your settlement notice.

Lost those? Click the link for lost IDs or contact the administrator.

Step 3: Complete the Form

Select your claim type(s):

- Reimbursement for expenses

- Compensation for lost time

- Credit monitoring

- California statutory payment

Step 4: Upload Your Documents

If you’re claiming expenses, attach proof—receipts, screenshots, statements.

Step 5: Submit Before the Deadline

All claims must be submitted by January 7, 2026. Late claims will be rejected.

Compliance & Cybersecurity Lessons for Organizations

This case serves as a wake-up call for companies handling sensitive data. Cybersecurity isn’t optional—it’s a legal and ethical responsibility.

Best practices for companies include:

- End-to-end encryption

- Regular security audits

- Multi-factor authentication

- Vendor risk management

- Rapid incident response protocols

NDM’s failure to meet these standards cost them millions—and trust.

Organizations in finance, healthcare, and tech should treat this case as a compliance blueprint for what not to do.

Industry Impact and Consumer Trust

The mortgage industry, in particular, relies heavily on trust. When customers share sensitive financial documents, they expect bulletproof security.

Incidents like the NDM breach:

- Undermine public confidence

- Spark regulatory scrutiny

- Lead to consumer lawsuits

- Drive demand for better tech infrastructure

Professionals in lending, insurance, and fintech must reassess their data protection frameworks regularly or risk similar consequences.

$2,000 Refunds Coming? Visa-Mastercard Class Action Settlement 2026 Explained

Continuum Health Data Breach Settlement – Class Action Lawsuit Resolved, Check Eligibility Criteria

23andMe Data Breach Class Action Settlement – Apply to Claim $100-$10,000, Check Eligibility