New 2026 TFSA Limit: When it comes to building wealth in Canada, few tools offer as much flexibility and potential as the Tax-Free Savings Account (TFSA). And here’s the scoop for 2026: The Canada Revenue Agency (CRA) has confirmed that the TFSA contribution limit for 2026 is $7,000. No, that’s not a typo. It’s the same limit as 2025 and 2024, and while some Canadians were expecting a bump due to inflation, the CRA’s indexation rules didn’t warrant an increase this time around. Still, don’t sleep on the TFSA just because the number didn’t change. It remains one of the most powerful wealth-building tools Canadians have, and if used properly, can save you thousands—if not hundreds of thousands—of dollars in taxes over your lifetime.

Table of Contents

New 2026 TFSA Limit

The 2026 TFSA limit of $7,000 offers Canadians another chance to grow their money completely tax-free. With a total cumulative limit of $109,000 for long-time eligible users, this account is more than a savings tool—it’s a financial engine. Used wisely, your TFSA can help you reach virtually any savings or investment goal—while avoiding tax headaches and keeping more money in your pocket. Whether you’re just getting started or refining your long-term strategy, the TFSA remains one of the most accessible and powerful tools in Canadian personal finance.

| Topic | Details |

|---|---|

| Annual TFSA Limit (2026) | $7,000 — unchanged from 2024 & 2025 |

| Total Lifetime Room (2026) | Up to $109,000 for someone eligible since 2009 with no prior contributions |

| Age Requirement | 18+ with valid Canadian SIN |

| Contribution Room Resets | January 1 each year |

| Penalty for Over-Contribution | 1% per month on excess |

| Eligible Investments | Cash, ETFs, mutual funds, stocks, GICs, bonds |

| Official Source | CRA TFSA Page |

What Is a TFSA and Why Should You Care?

The TFSA was introduced in 2009 as a way for Canadians to save and invest without paying tax on any growth or withdrawals. Unlike an RRSP, where contributions are tax-deductible but withdrawals are taxed, a TFSA uses after-tax dollars up front, and then lets your money grow tax-free for life.

You can use your TFSA to:

- Save for a home down payment

- Invest for retirement

- Build an emergency fund

- Stash away money for a dream vacation

- Save for your kids’ education

And the best part? There are no penalties or taxes on withdrawals, and whatever you take out, you can put back in the next year.

Understanding the New 2026 TFSA Limit

The annual contribution limit is the maximum amount you can add to your TFSA in a single calendar year. For 2026, this is officially set at $7,000.

This limit is set by the federal government and is indexed to inflation. However, the CRA only adjusts the limit when inflation causes it to hit a $500 increment threshold. So even if inflation is 2.4%, you may not see a change unless it rounds up to a $500 increase. That’s why we’ve seen the same $7,000 limit for three consecutive years.

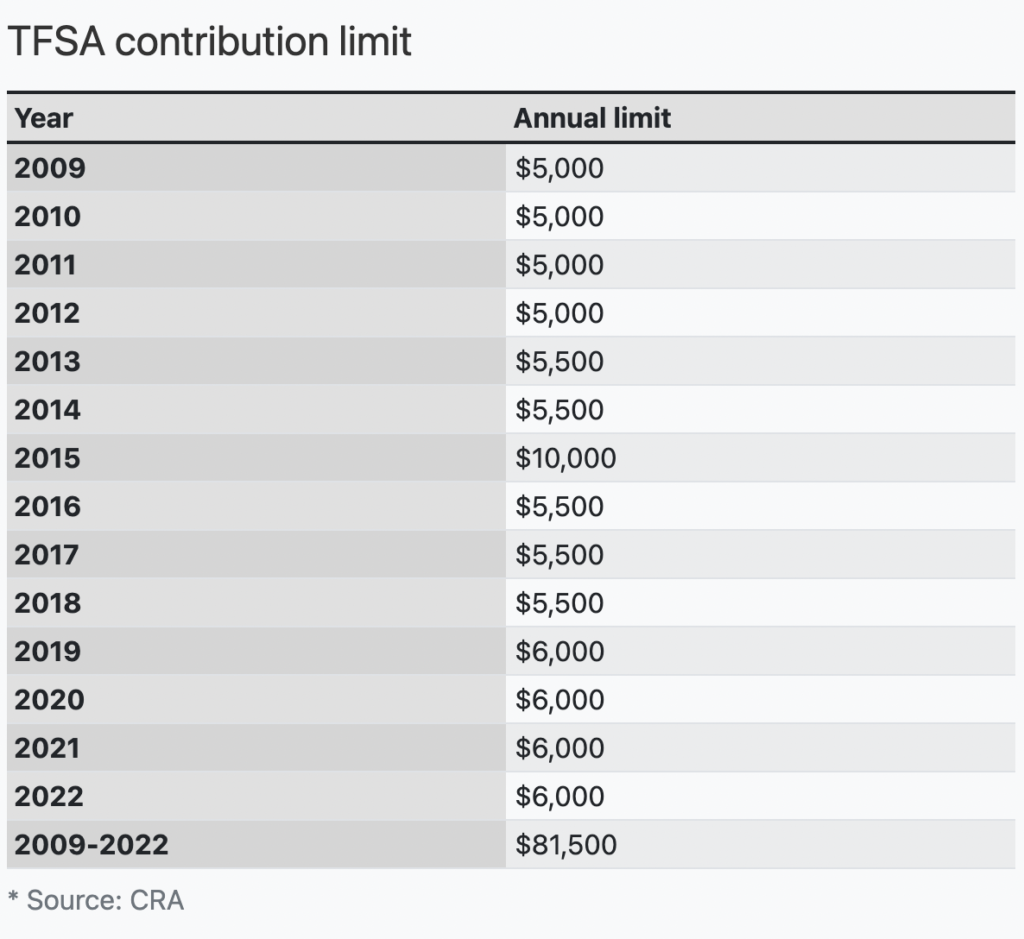

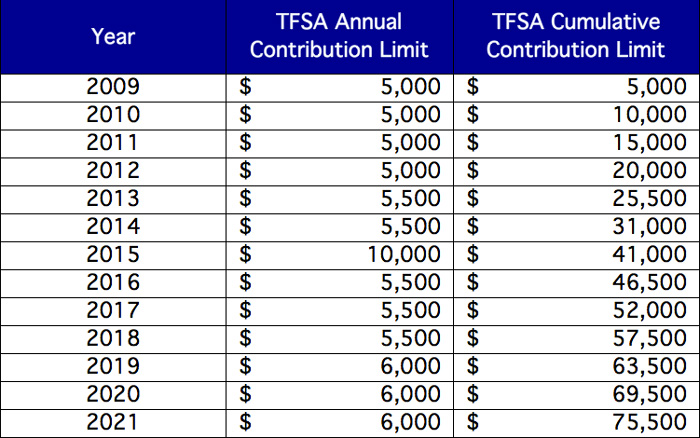

TFSA Contribution Limits Over Time

Here’s a quick breakdown of how the TFSA limit has evolved since 2009:

| Year | Contribution Limit |

|---|---|

| 2009-2012 | $5,000 |

| 2013-2014 | $5,500 |

| 2015 | $10,000 (one-time increase) |

| 2016-2018 | $5,500 |

| 2019-2022 | $6,000 |

| 2023 | $6,500 |

| 2024 | $7,000 |

| 2025 | $7,000 |

| 2026 | $7,000 |

If you’ve never contributed and were eligible since 2009, your total available room in 2026 would be $109,000.

How to Calculate Your TFSA Contribution Room?

Understanding your personal TFSA contribution room is key to avoiding penalties. Here’s how it works:

- Start with the current year’s limit (e.g. $7,000 in 2026).

- Add any unused contribution room from previous years.

- Add any withdrawals you made in the previous year.

Example:

- You had $5,000 of unused room going into 2026.

- You withdrew $3,000 in 2025.

- Add this year’s limit of $7,000.

Total 2026 room = $5,000 (unused) + $3,000 (withdrawals) + $7,000 = $15,000

To get an official number, log into your CRA MyAccount or refer to your latest Notice of Assessment.

What Happens If You Over-Contribute?

TFSA penalties are real—and they’re costly.

If you over-contribute, you’ll be hit with a 1% penalty per month on the excess amount. That’s 12% annually, which can eat away at your returns quickly.

Example:

If you accidentally go over your limit by $2,000, you’ll owe $20 per month until it’s corrected.

Unlike some tax situations, CRA won’t always waive this fee unless you can show it was a genuine mistake and you acted quickly to fix it.

Avoid this by:

- Tracking contributions across multiple accounts

- Checking your CRA account before making large deposits

- Avoiding “same-year” re-contributions after withdrawals

New 2026 TFSA Limit: Common TFSA Mistakes to Avoid

- Re-contributing in the same year:

If you take out $5,000 in May, don’t put it back in October unless you have unused room. That withdrawal doesn’t create new room until the next calendar year. - Treating TFSA as a regular savings account:

It’s called a “savings account,” but it’s really a powerful investment account. Leaving your money in low-interest cash savings means you’re missing out on potential growth. - Ignoring your spouse’s TFSA:

You and your spouse each have your own TFSA room. Consider splitting savings across both accounts for maximum efficiency. - Thinking TFSAs are only for the wealthy:

TFSAs are for everyone. Even if you can only save $50 a month, the compound interest adds up, especially when you invest that money tax-free.

What Can You Hold in a TFSA?

A TFSA can hold much more than just cash. You can use it to invest in:

- Mutual funds

- ETFs (exchange-traded funds)

- Individual stocks (Canadian or U.S.)

- Government or corporate bonds

- GICs (guaranteed investment certificates)

Tip: If you’re holding U.S. dividend-paying stocks, be aware that U.S. withholding tax applies inside a TFSA. That same tax doesn’t apply inside an RRSP.

Using a TFSA at Different Life Stages

| Life Stage | TFSA Strategy |

|---|---|

| Teens/20s | Use TFSA to build emergency fund or invest in low-cost ETFs. |

| 30s | Save for a home, wedding, or children while investing for the long haul. |

| 40s–50s | Focus on long-term investing—diversified equity portfolios work well here. |

| 60s+ | Use the TFSA for tax-free income or to supplement pensions without OAS clawback. |

TFSAs are particularly helpful for seniors who want to continue growing their money without triggering income-tested benefits like Old Age Security (OAS).

TFSA vs. RRSP: What’s the Difference?

| Feature | TFSA | RRSP |

|---|---|---|

| Contributions | Not tax-deductible | Tax-deductible |

| Withdrawals | Tax-free | Taxed as income |

| Contribution Room | Unused room carries forward | Unused room carries forward |

| Withdrawal Impact | Adds back room next year | No room added back |

| Best For | Short- or long-term goals, flexibility | Retirement, high-income earners |

Use RRSPs if you’re in a high tax bracket and want a deduction now. Use TFSAs for flexibility, tax-free growth, and anytime withdrawals.

Canada Quietly Raises Medical Inadmissibility Cost Threshold for 2026

$530 CPP Increase Confirmed for January 2026: Check Eligibility & Payment Date

How to Maximize the New 2026 TFSA Limit?

- Automate Your Savings:

Set up automatic monthly contributions—$7,000 divided by 12 is about $583/month. - Invest Long-Term:

Don’t leave cash sitting in your TFSA unless it’s for a short-term goal. Use low-cost index ETFs or mutual funds for long-term growth. - Track All Contributions:

Especially if you have multiple TFSA accounts or switch banks. - Use Withdrawals Strategically:

Plan larger withdrawals near year-end so your room is replenished sooner. - Coordinate with a Spouse:

Maximize household TFSA usage for double the tax-free growth potential.