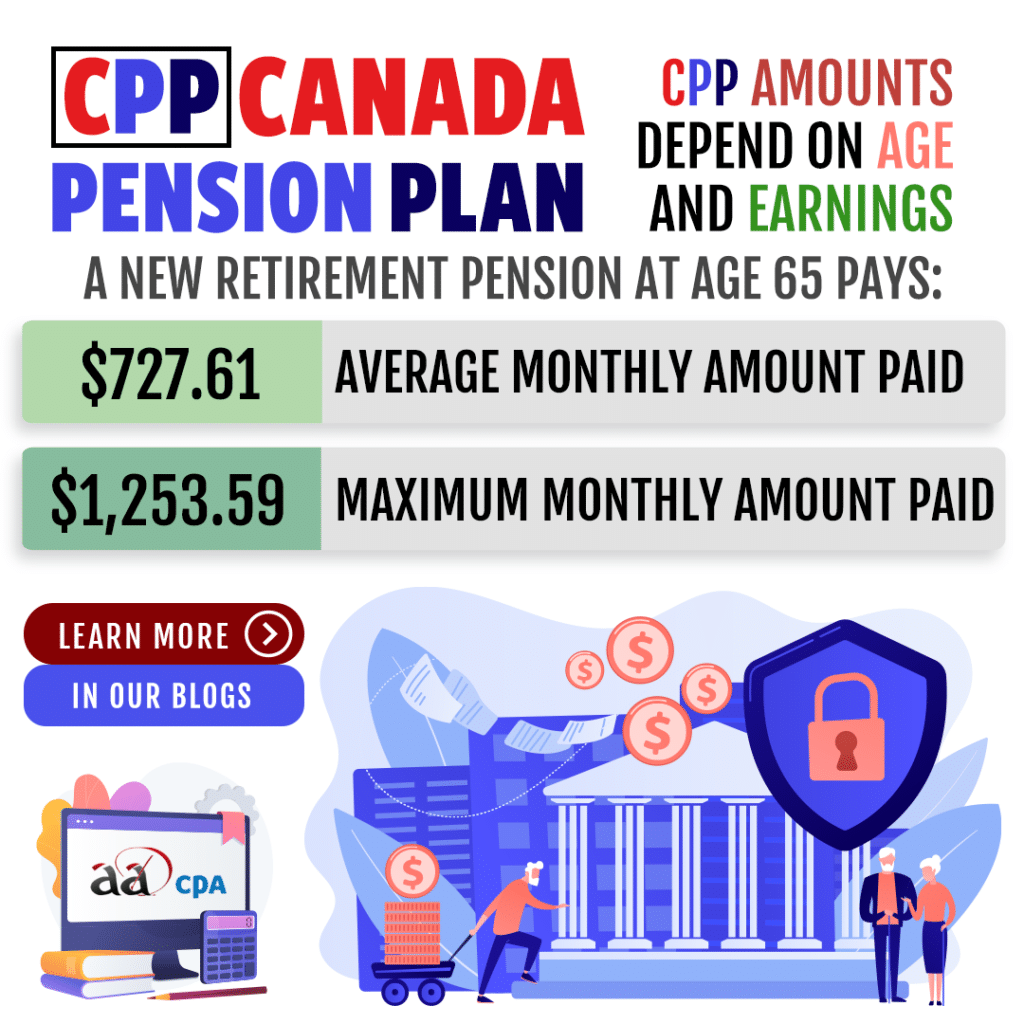

CPP Payments Compared: The Canada Pension Plan (CPP) is a major part of retirement income for Canadians. But here’s something not everyone realizes: when you choose to start your CPP payments can significantly change how much money you’ll get each month — and over your lifetime. In this guide, we’ll break down how delaying your CPP payments — all the way to age 70 — can boost your monthly income by as much as 42%, helping you earn up to $1,760/month or more, depending on your earnings and contribution history. This article is written in plain English, with expert insight, clear steps, and real examples so that it’s easy to understand — whether you’re a 10-year-old or a finance professional.

Table of Contents

CPP Payments Compared

There’s no one-size-fits-all answer. But here’s what we know:

- Delaying CPP can significantly boost your monthly income — up to $1,760–$2,130/month in some cases.

- It’s a smart move if you’re healthy, have other income, and want inflation-protected, guaranteed payments for life.

- On the flip side, starting early may help if you need cash sooner or have health issues.

Either way, understanding your CPP options and timing can be one of the most powerful retirement decisions you’ll ever make.

| Topic | Data/Stats |

|---|---|

| Standard age to start CPP | 65 |

| Earliest start age | 60 |

| Latest start age | 70 |

| Monthly reduction (starting early) | 0.6% per month before 65 |

| Monthly increase (starting late) | 0.7% per month after 65 |

| Maximum CPP at 65 (2026 est.) | ~$1,507.65/month |

| Enhanced maximum by delaying | ~$2,130/month |

| CPP Benefit Calculator | CPP Calculator |

What Is CPP and How Does It Work?

The Canada Pension Plan is a government-run retirement program that provides monthly income to individuals who contributed during their working years. Almost every employed Canadian pays into the CPP automatically through payroll deductions.

The more you earn and the longer you work (especially between ages 18 to 65), the higher your CPP benefit in retirement. But there’s a twist: when you choose to start collecting affects how much you receive.

CPP Payments Compared: Start Early, On Time, or Delay?

CPP can be started at any time between age 60 and 70. Here’s how the timing affects your benefit:

- Start at 60 → Reduced benefit (up to 36% less than at age 65)

- Start at 65 → Full standard benefit

- Start at 70 → Increased benefit (up to 42% more than at age 65)

Each month you delay CPP after age 65, your payment grows by 0.7%. That’s 8.4% more per year, for a total bonus of 42% if you wait until age 70.

Example:

If your CPP at age 65 would be $1,500/month, delaying until 70 would give you about $2,130/month.

Why the Age You Start CPP Matters?

It’s not just about how much money you get each month — it’s also about how long you’re going to live and how much total income you’ll receive over time.

Let’s say two people have the same CPP entitlement at 65:

- One starts at 60 and gets $960/month

- The other delays to 70 and gets $2,130/month

Yes, the person who starts at 60 gets money earlier — but the person who waits earns much more per month and can end up ahead if they live long enough.

This is where break-even analysis comes in.

Break-Even Analysis: When Does Delaying Pay Off?

The break-even point is the age at which the total amount of CPP received by delaying catches up to the amount you would have received by starting earlier.

Here’s a simplified scenario:

- Start at 60: $960/month = $11,520/year

- Start at 70: $2,130/month = $25,560/year

It would take about 10-12 years to break even, meaning that by age 80–82, the person who delayed to 70 would have received more total income.

So if you’re in good health and expect to live into your 80s or 90s, delaying CPP could pay off big time.

CPP Enhancements After 2019

In recent years, the federal government has introduced CPP enhancements that improve long-term benefits for future retirees.

Key enhancements include:

- Higher contribution rates (gradually increased from 2019 to 2023)

- Increased income replacement from 25% to 33% of your average lifetime earnings

- Additional benefits for working after age 65

These enhancements mean that younger workers today will receive more in retirement than previous generations — especially if they delay CPP to maximize returns.

CPP Payments Compared: Real-Life Scenarios

Linda, 62 – Early Retiree

Linda took CPP at 60 because she stopped working and didn’t have enough savings. She receives $960/month, but it’s locked in at that rate — adjusted only for inflation.

Raj, 65 – Still Working

Raj is still earning part-time income and doesn’t need CPP right away. He delays it until age 68, collecting $1,875/month, giving him stronger income later in retirement.

Mary, 70 – Delayed Strategically

Mary had strong savings and waited until 70. She now collects $2,130/month — enough to cover all her essentials without dipping into investments.

These examples show that your lifestyle, health, income needs, and life expectancy should guide your CPP timing decision.

Tax Implications of CPP Timing

CPP is considered taxable income, so when and how much you receive affects your tax bracket.

Delaying CPP:

- Reduces taxable income in early retirement

- Helps avoid Old Age Security (OAS) clawbacks

- Allows tax-efficient RRSP withdrawals first, saving CPP for later when other income is lower

Starting CPP early:

- Can push you into a higher bracket if you’re still working

- Might reduce GIS eligibility if income exceeds limits

For higher earners or professionals with RRSPs or defined benefit pensions, delaying CPP can be part of a smart tax strategy.

How to Estimate Your CPP Benefit?

To know exactly how much you’re entitled to, visit the official My Service Canada Account.

There, you can:

- View your contribution history

- Get an official CPP estimate

- See how your amount changes by age

CPP Payments Compared: Tips Before Deciding

1. Consider your health.

If you’re in poor health or have a shorter life expectancy, it might make sense to take CPP early.

2. Check your other income sources.

Do you have RRSPs, employer pensions, or rental income? If yes, delaying CPP might work better.

3. Don’t just copy friends.

Everyone’s situation is unique — what worked for your cousin or neighbor might not work for you.

4. Consult a financial planner.

A certified financial planner can help you build a tax-efficient withdrawal strategy.

$530 CPP Increase Confirmed for January 2026: Check Eligibility & Payment Date

Canada Quietly Raises Medical Inadmissibility Cost Threshold for 2026