CPP Increase 2026: CPP Increase 2026 is the hot topic making the rounds among retirees, workers nearing retirement, and even younger folks eyeing their future. For many Canadians, this isn’t just a technical update — it’s a vital income lifeline. Like the U.S. Social Security COLA (Cost of Living Adjustment), the Canada Pension Plan (CPP) adjusts payments annually to keep up with inflation. And in January 2026, another increase is on deck. But how much more will retirees actually pocket? That’s what this article lays out — plain and simple. Whether you’re collecting CPP now, planning for it soon, or still contributing, here’s everything you need to know.

Table of Contents

CPP Increase 2026

To wrap it all up: the CPP Increase 2026 brings a 2.0% boost to retirement benefits — giving the average Canadian retiree a few extra hundred bucks annually. For seniors on fixed incomes, that increase helps keep pace with rising living costs. For workers, especially younger ones, the CPP enhancement program is quietly building a stronger foundation for future retirement. Even though it’s not a windfall, it’s a dependable, inflation-protected income stream — and in uncertain economic times, that stability is worth its weight in gold.

| Topic | Details (2026) |

|---|---|

| CPP Annual Increase (Indexation) | 2.0% based on CPI (Consumer Price Index) |

| Estimated Monthly Boost | $16–$50 more per month depending on benefit level |

| Max CPP Benefit (Age 65) | $1,507.65/month |

| Average CPP (as of 2025) | ~$803.76/month |

| Annual Benefit Increase | Approx. $530/year for average recipients |

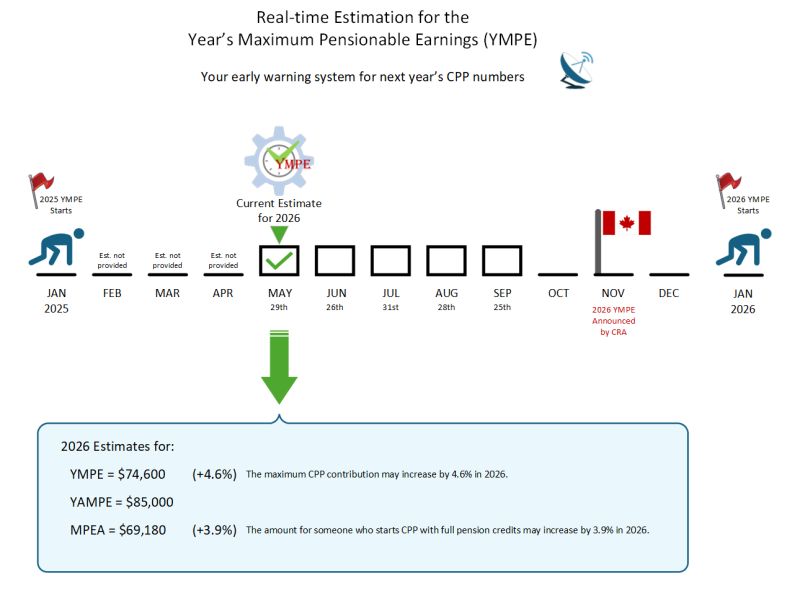

| YMPE (Contribution Ceiling) | $74,600 |

| YAMPE (2nd Ceiling for CPP Enhancement) | $85,000 |

| Automatic Adjustment | No action needed; benefit increases apply Jan 2026 |

| Official Website | canada.ca – CPP |

What’s Behind the CPP Increase 2026?

Every year, CPP retirement benefits are adjusted based on the Consumer Price Index (CPI) — which measures how much prices are going up. Food, housing, fuel, medicine — when these essentials rise in cost, your CPP benefit rises, too. The idea is to maintain purchasing power for seniors.

For 2026, the CPP benefit increase is 2.0%, according to the latest CPI figures published by Statistics Canada. That means a pensioner receiving $1,200/month in 2025 would now get about $1,224/month. Not a life-changing jump, but every dollar counts when you’re on a fixed income.

The adjustment takes effect January 2026 and applies automatically. There’s nothing you need to do to get it. Your monthly CPP payment will go up with the first deposit of the new year.

The Mechanics: How Is Your CPP Payment Calculated?

The Canada Pension Plan is a contributory system. That means your monthly benefit is based on how much you earned and contributed during your working years. You (and your employer) pay into the system throughout your career, and in return, CPP pays you back monthly once you retire.

Here’s what influences your CPP payment:

- How much you contributed during your career

- How long you contributed (number of years)

- Your average earnings over time

- Your age when you start your pension (starts at 60; maxes out at 70)

The longer you wait to start CPP (up to age 70), the larger your monthly payment. That’s because the system rewards you for deferring benefits.

CPP Enhancement: A Major Shift for the Future

Starting in 2019, the Canadian government began enhancing the CPP to offer higher retirement income down the road. This was no small change — and it’s still rolling out.

Here’s what it means:

- The replacement rate (portion of income CPP covers) is increasing from 25% to 33.33%.

- Contribution rates have gone up slightly to fund this expansion.

- A second earnings ceiling was added. In 2026, this applies to income between $74,600 and $85,000.

If you’re still working, this means you may contribute a bit more — but it also means you’re building toward a higher pension payout in the future.

And here’s the kicker: this expansion mostly benefits younger workers or those with a long time left in the workforce. The more years you contribute under the new rules, the bigger your future CPP benefit.

Monthly Examples: How Much Will You Actually Get?

Let’s break this down into real-world examples so it’s easier to see the money:

Jean – Modest Earner

- Current CPP: $800/month

- 2026 increase (2%): $16/month

- New payment: $816/month

For Jean, that $16 might help cover winter heating bills or a couple of grocery runs. It’s not huge, but over 12 months that’s $192 more.

Paul – High Earner with Max Contributions

- Current CPP: $1,480/month

- 2026 increase (2%): $29.60/month

- New payment: ~$1,509.60/month

That’s a $355 annual increase. It adds up when you’re managing prescriptions, food, and other essentials on a fixed income.

Average vs. Maximum CPP: What’s the Difference?

There’s often confusion between maximum and average CPP benefits.

- The maximum monthly CPP benefit at age 65 for 2026 is estimated to be $1,507.65.

- However, the average person actually receives around $803.76/month as of late 2025. Why? Because most Canadians don’t contribute the maximum for the full 39 years required.

To hit the max, you must:

- Work and contribute for nearly four decades

- Earn above the Year’s Maximum Pensionable Earnings (YMPE) every year

- Start your pension at age 65 exactly

Most people fall short of one or more of those conditions — which is why planning other retirement income streams is still essential.

Contribution Ceilings and What They Mean for You

In 2026, two income thresholds will affect CPP:

- YMPE (Year’s Maximum Pensionable Earnings): $74,600

- YAMPE (Year’s Additional Maximum Pensionable Earnings): $85,000

Here’s how they play out:

- Contributions are made on income between $3,500 and $74,600 (base CPP).

- For those earning more, additional contributions are made on income between $74,600 and $85,000 under the enhanced plan.

This tiered system lets higher earners build a bigger retirement income by contributing more. And those extra contributions go directly into enhancing your benefit — it’s not just a tax.

CPP Increase 2026: Planning Tips for Workers and Retirees

Whether you’re still working or already retired, here’s how you can make the most of CPP:

If You’re Still Working:

- Delay your pension if possible. Every year you wait past age 65 increases your benefit by 8.4%.

- Maximize your contributions. If you earn more and contribute more — especially under the enhanced plan — you’ll get more later.

- Use your My Service Canada Account to check your projected benefits.

If You’re Retired:

- Expect a boost. That 2% bump will come in January automatically.

- Plan for inflation. Even with the increase, CPP alone may not cover all rising costs — plan for top-ups from savings or private pensions.

What If You’re Self-Employed?

Self-employed Canadians pay both the employee and employer portions of CPP contributions — a total of 11.9% on applicable earnings up to $74,600. That’s a heavier lift, but it builds a solid base for retirement.

Starting in 2024, self-employed individuals also contribute toward the enhanced portion (on income above YMPE). This means higher future benefits, but more out-of-pocket now. The key is balancing your contributions with your long-term retirement goals.

Why Does CPP Increase 2026 Matter?

The CPP isn’t just another government program — it’s the backbone of retirement income for millions. And in a world where private pensions are getting rare, and savings are stretched thin, understanding and maximizing your CPP is more important than ever.

Think about it: if you’re getting an extra $500 or $600 per year from the 2026 increase alone, that’s money that can go toward:

- Food and essentials

- Out-of-pocket medical expenses

- Winter heating bills

- Travel to see family

- Peace of mind

And when indexed increases continue year after year, those modest gains start to stack up. It’s not flashy, but it’s reliable — and in retirement, reliable beats risky every time.