$530 CPP Increase Confirmed for January 2026: Check Eligibility & Payment Date is more than a news headline — it’s a financial reality for millions of Canadians planning their retirement. Whether you’re already receiving your CPP benefits or nearing retirement, understanding what this increase means, who qualifies, how much it could be, and how to prepare is crucial. The Canada Pension Plan (CPP) has always been a backbone of retirement income for working Canadians. And with the rising cost of living, every dollar counts. In 2026, CPP is set to increase — and some retirees could see up to $530 more per year in their benefits. This article breaks down what you need to know in a clear, practical, and professional tone, helping you make smart decisions with your retirement income.

Table of Contents

$530 CPP Increase Confirmed

The $530 CPP Increase Confirmed for January 2026 isn’t just a nice headline — it’s real money going into the pockets of retirees across Canada. Whether you’re receiving the full amount or a smaller portion, it reflects the government’s ongoing effort to protect retirees against inflation. But don’t stop at the increase. Understanding your full CPP entitlement, optimizing when you start collecting it, and integrating it with other retirement income streams are all part of building a secure financial future.

| Topic | Details |

|---|---|

| CPP Increase Effective | CPP benefits are indexed to inflation — new rates take effect January 1, 2026; first payment lands on January 28, 2026 |

| Reported Increase | Maximum annual CPP benefit may increase by approximately $530 in 2026 |

| Consumer Price Index (CPI) | CPP benefits are adjusted annually based on CPI; if CPI increases, CPP benefits rise accordingly |

| Maximum CPP Amount (2026) | Estimated maximum: $1,507.65 per month at age 65 for new beneficiaries |

| Average CPP Amount | ~$803.76 per month as of 2025; exact amounts vary by contribution history |

| Eligibility | Canadians who contributed to CPP and are currently receiving retirement pension benefits |

| Official CPP Information | https://www.canada.ca/en/services/benefits/publicpensions/cpp.html |

What Is the Canada Pension Plan (CPP)?

The CPP is a government-managed retirement pension designed to replace a portion of your income after you stop working. Throughout your working life in Canada, you and your employer contribute a percentage of your income to this plan. If you’re self-employed, you pay both shares yourself.

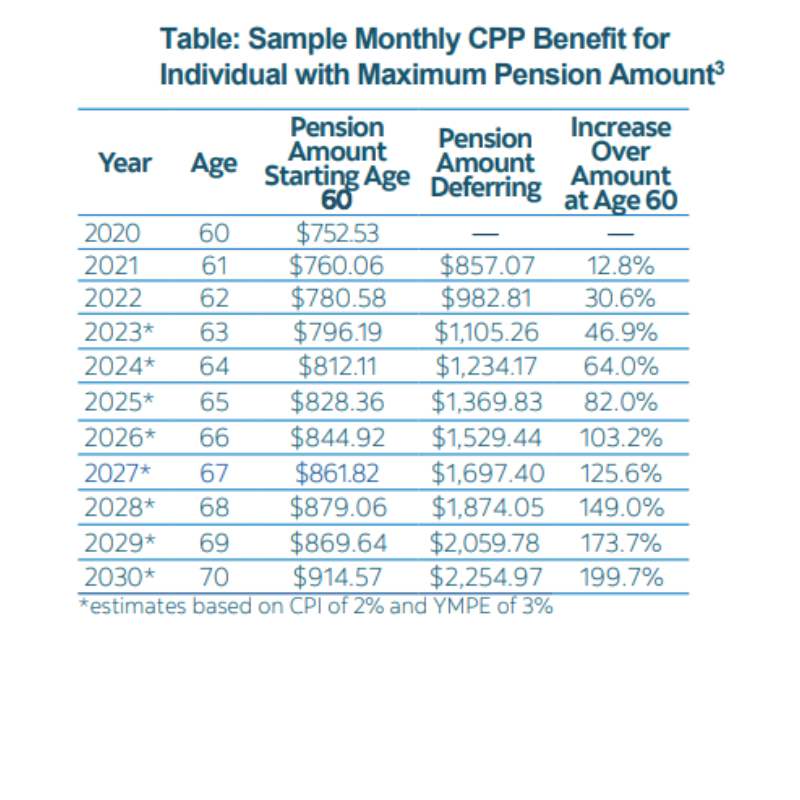

Once you turn 60 (or later), you can apply to receive monthly payments based on how much and how long you’ve contributed. This benefit is not just for retirees — it also includes provisions for disability, death, and survivor benefits.

The plan was created to ensure Canadians have a stable source of income after retirement, particularly for those without significant private savings. Over time, it’s evolved to adapt to changing economic conditions, including cost-of-living increases — like the one coming in January 2026.

Why the $530 CPP Increase Confirmed in 2026 Matters?

In recent years, inflation has significantly impacted the cost of housing, food, transportation, and healthcare. For those living on fixed incomes, like retirees, these rising costs can lead to real financial pressure. That’s why the annual CPP adjustment based on the Consumer Price Index (CPI) is so important.

In 2026, this adjustment could mean a yearly increase of approximately $530 for those receiving the maximum benefit. While not everyone will see this full amount, all eligible recipients will benefit from an increase, helping to preserve their purchasing power in a changing economy.

This increase is especially vital given the broader financial environment. Interest rates have been rising, but savings interest and low-risk investments still don’t fully offset inflation for most seniors. A guaranteed increase in CPP benefits acts as a stable, inflation-protected income source.

How the $530 CPP Increase Confirmed Is Calculated?

The figure of $530 refers to an estimated annual increase based on adjustments to the maximum retirement benefit, not a flat increase given to everyone.

Here’s how it works:

- CPP benefits are adjusted every January using the Consumer Price Index (CPI) from the previous year.

- If the CPI increases by 2%, then your monthly CPP payment rises by that same percentage.

- For someone receiving the maximum CPP benefit — currently around $1,480/month — a 2% increase would be about $29.60 more each month, or roughly $355 annually.

- Combined with CPP enhancement contributions from recent years, some recipients may see total increases of up to $530 annually.

It’s important to remember: not everyone receives the maximum benefit. Your actual increase will reflect your individual contribution history.

Eligibility: Who Qualifies for the CPP Increase?

To be eligible for the increase, you must meet these two main conditions:

1. You Must Have Contributed to the CPP

If you’ve worked in Canada and earned more than the basic exemption (around $3,500/year), you’ve contributed to the CPP. Contributions are mandatory for workers aged 18 to 69.

2. You Must Be Receiving the CPP Retirement Pension

Only those who have applied for and are currently receiving their CPP pension will see the 2026 increase applied automatically. If you haven’t yet applied but plan to do so soon, your first payment will reflect the updated rate if it’s issued after January 1, 2026.

There’s no need to reapply or take any additional steps if you’re already receiving benefits — the increase is built into the system.

How Much Will You Actually Get?

CPP is personalized. It’s not a one-size-fits-all program. Your actual benefit depends on:

- Your total number of contributory years

- Your average earnings throughout your career

- The age at which you begin collecting CPP

Let’s break it down by example:

Example A: Full Contributor

- Retired at age 65

- Contributed maximum amount for 39+ years

- Receives close to maximum CPP: ~$1,507/month in 2026

- Annual increase: ~2% = $360/year or $30/month

Example B: Moderate Contributor

- Retired at age 63

- Worked part-time for many years

- Receives: ~$800/month

- Annual increase: ~$16/month = $192/year

Even modest increases matter. An extra $15–$30 per month can help cover transit passes, medication, or utility bills. That’s money retirees won’t have to pull from savings or credit.

When Will You See the $530 CPP Increase Confirmed?

The new CPP rates go into effect on January 1, 2026, but the first actual payment reflecting the increase will be made on January 28, 2026. After that, payments continue monthly on the scheduled government pay dates.

2026 CPP Payment Schedule

Here’s the full payment calendar for 2026. Payments are issued once per month:

- January 28

- February 25

- March 27

- April 28

- May 27

- June 26

- July 29

- August 27

- September 25

- October 28

- November 26

- December 22

If you receive CPP via direct deposit, you should see the funds appear in your account on these dates. If you still receive payment by mail, allow extra time for delivery.

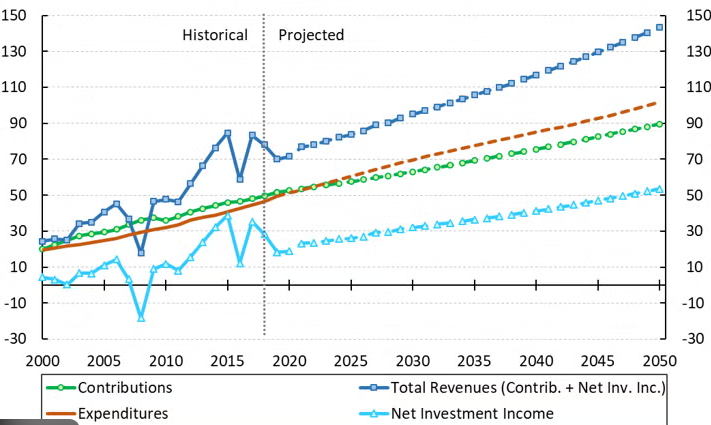

CPP Enhancement Explained

Since 2019, CPP has undergone gradual enhancements, designed to increase the amount of retirement income it replaces.

Before, CPP replaced 25% of your average lifetime pensionable earnings. After full implementation of the enhancement (for people who contribute fully over their careers), the CPP will replace up to 33.33% of those earnings.

In plain terms, the more you contribute under the enhanced system, the more you’ll receive when you retire — and those newer contributions stack with existing CPP amounts. This is part of what’s behind the reported $530 boost in 2026.

How to Prepare for the $530 CPP Increase Confirmed?

Here are a few practical steps to make sure you’re ready:

- Review your CPP contributions

- Check your statement via My Service Canada Account.

- Confirm that your earnings history is accurate.

- Set up direct deposit

- It ensures your payment arrives quickly and securely.

- Plan around payment dates

- Use the 2026 schedule to organize your bill payments or savings transfers.

- Reassess your retirement income strategy

- Now’s a good time to look at how CPP fits with OAS, RRSPs, and TFSAs.

- Talk to a financial advisor

- If you’re unsure about when to start taking CPP or how to optimize your benefits, get professional advice tailored to your situation.