£562 One‑Time Support For Pensioners: There’s been a lot of buzz lately about the UK government confirming a £562 one-time support for pensioners. It’s been shared on social media, highlighted on YouTube, and whispered in bingo halls. But before you chalk it up as a surprise payday, let’s take a closer look at what this £562 figure actually means. Is it real money in your hand, or just a technical increase dressed up in confusing language? This article gives you the complete lowdown — what’s true, what’s not, and what to expect in the years ahead. Whether you’re a pensioner yourself, supporting one, or just want to plan for retirement, you’ll walk away with facts, not fluff.

Table of Contents

£562 One‑Time Support For Pensioners

The £562 pension boost confirmed by the UK government is a result of the Triple Lock mechanism and reflects an annual rise in the State Pension — not a separate, one-off payment. The increase will be paid automatically from April 2026 to all eligible pensioners, ensuring retirement incomes rise in line with inflation or earnings. With pensioners facing rising living costs, this boost offers relief and predictability. By staying informed, checking your eligibility, and tapping into other benefits, you can make the most of what’s available.

| Feature | Details |

|---|---|

| What is it? | An annual State Pension increase of approx. £562, starting April 2026 |

| Common Misconception | It is not a separate, one-time bonus payment |

| Who Qualifies | Pensioners receiving State Pension by April 2026 |

| Payment Method | Automatically added to your monthly/4-week pension |

| Estimated Weekly Increase | +£10.75/week for New State Pension recipients |

| Official Source | GOV.UK: State Pension |

What Is the £562 One‑Time Support For Pensioners Really About?

Let’s be clear: The £562 payment is not a bonus or lump-sum handout. It’s the estimated annual increase to your State Pension — beginning in April 2026 — based on the government’s Triple Lock Guarantee.

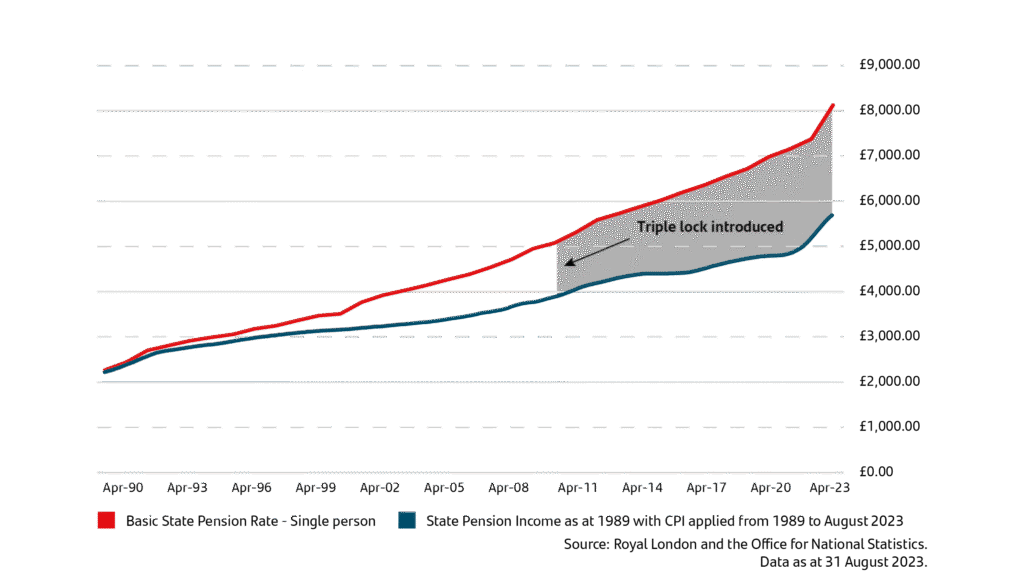

What’s the Triple Lock?

Introduced in 2010, the Triple Lock ensures that the value of the State Pension keeps pace with the cost of living. Each April, pensions are increased by whichever of the following is highest:

- Average UK wage growth

- Consumer Price Index (CPI) inflation

- 2.5% minimum

In 2023, wages grew by 8.5%, resulting in one of the biggest pension hikes in years. That strong growth influences pension values moving forward, especially for the 2026–27 financial year, which is where the £562 figure comes from.

How Much Will Your Pension Increase?

This annual increase adds around £10.75 per week to your State Pension if you’re on the new system, which launched in April 2016. That totals approximately £562 per year.

Detailed Pension Breakdown

| Pension Type | Current Weekly Rate (2024/25) | Projected Weekly Rate (2026/27) | Annual Increase |

|---|---|---|---|

| New State Pension | £221.20 | ~£232.00 | £562 |

| Basic State Pension | £169.50 | ~£177.50 | ~£416 |

Who Qualifies for the £562 One‑Time Support For Pensioners?

All individuals receiving the State Pension by April 2026 will benefit from the increase. No strings attached. No forms to fill.

You’re Eligible If:

- You currently receive the State Pension

- You reach pension age and start receiving it before April 2026

You’re Not Eligible If:

- You’re not of State Pension age by April 2026

- You live in a country where UK pension uprating doesn’t apply

Note: If you’ve deferred your pension, your increase will apply once you begin drawing it.

How the UK State Pension Is Calculated?

Understanding how pensions are built helps make sense of how increases work. Your State Pension amount depends on your National Insurance (NI) record:

- To get the full New State Pension, you need 35 qualifying years of NI contributions.

- If you have fewer years, you’ll get a reduced amount.

- You can still receive some pension with at least 10 qualifying years.

Common Myths & Misunderstandings

There’s a lot of confusion out there, so let’s set the record straight.

“The £562 is a one-off bonus payment”

Not true. It’s a cumulative annual increase spread out in your weekly/monthly pension. There’s no separate lump sum.

“You need to apply for the payment”

Nope! This isn’t a grant. It’s a legally mandated pension adjustment under the Triple Lock. If you’re eligible, it’ll be added automatically.

“Only people born before 1961 will get it”

This claim is floating around Facebook groups and isn’t based on policy. Your date of birth doesn’t affect your eligibility beyond State Pension age requirements.

Payment Schedule: When Will You See the Money?

The new pension rates are expected to kick in from April 6, 2026, the beginning of the UK’s financial year.

Pensions are typically paid:

- Every 4 weeks

- On a weekday assigned by your NI number

You’ll receive a notification letter in early 2026 confirming your new rate.

How £562 One‑Time Support For Pensioners Compares to Past Increases?

The 2026 pension increase is one of the most generous in recent years — but not unprecedented.

Historical Uplift Comparison:

| Year | Triple Lock Metric | Increase % | Weekly Boost |

|---|---|---|---|

| 2021 | 2.5% (default) | +2.5% | ~£4.40 |

| 2022 | CPI (lock suspended) | +3.1% | ~£5.55 |

| 2023 | Inflation (CPI) | +10.1% | ~£18.70 |

| 2024 | Wage Growth | +8.5% | ~£17.35 |

| 2026 | Projected (CPI/wages) | +4.9%–5.5% | ~£10.75 |

International Comparison: How Does the UK Stack Up?

In raw numbers, the UK’s State Pension is lower than many OECD countries, but the Triple Lock system makes it one of the most reliably indexed.

| Country | Avg. Monthly Pension | Annual Adjustments? |

|---|---|---|

| UK | ~£884 | Yes (Triple Lock) |

| USA | ~£1,460 | Yes (COLA Index) |

| Canada | ~£455 | Yes (CPI-indexed) |

| Germany | ~£820 | Yes (Wage-linked) |

While UK pensioners receive less on average, annual guaranteed increases provide long-term security.

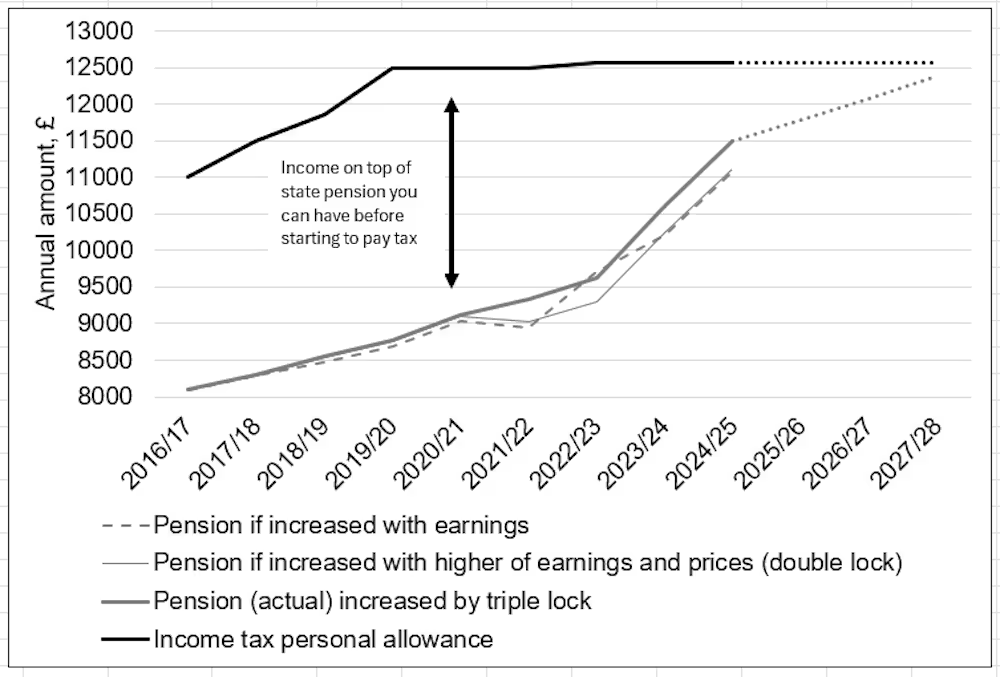

Political Debate: Is the Triple Lock Safe?

The Triple Lock is popular with voters but expensive for the government. The Office for Budget Responsibility (OBR) estimates it adds billions to public spending each year.

Concerns Raised:

- Fiscal sustainability: Can the government afford this as the population ages?

- Intergenerational fairness: Younger workers may pay more to fund rising pensions.

- Policy review: Some political parties have hinted at replacing the triple lock with a “double lock” (removing the 2.5% floor).

For now, the triple lock is guaranteed through 2026, but elections could influence what happens next.

Other Support Available to Pensioners

Even with the pension increase, many retirees need more help. Here are some other programs:

1. Winter Fuel Payment

- Between £250–£600 depending on age and household situation

- Paid automatically if eligible

- Includes Cost-of-Living supplements

2. Pension Credit

- A top-up for those on low incomes

- Could add £3,900/year or more in support

- Opens doors to free NHS dental, heating bill support, and more

3. Christmas Bonus

- A small, automatic £10 payment each December for those on State Pension and some benefits

Real Pensioners Weigh In

“I first saw a post saying we’d all get a £562 cheque. It was misleading. But a £10 raise a week? That’s meaningful. That’s my milk, bread, and heating for a few days.”

— Ruth E., 74, Bristol

“Honestly, I was ready to ignore it. But now I know it’s a proper increase, I’ll factor it into my budget planning.”

— Ken B., 67, Newcastle

These voices reflect a common theme: clarity matters, especially when money is involved.

Final Thoughts: What Should You Do Now?

- Stay informed: Follow official sources like GOV.UK

- Check your forecast: Use your Government Gateway account to see your exact pension plan

- Avoid scams: No legit source will ask you to “register” for the £562

- Share this info: Friends and family may still be confused

The bottom line? The £562 increase is real, but it’s part of your pension plan — not a bonus gift. It’s still good news, especially for folks budgeting carefully in retirement.

11 discounts and freebies coming for state pensioners in 2026 worth £7,849

DWP Benefit and Pension Payments – Check Eligibility & Payment Dates for January 2026

State Pension Age Row: One Group May Be Spared After DWP Faces Fresh Demands