5 Viral Money Saving Challenges: 5 Viral Money Saving Challenges That Could Turn Just £1 into £5,050 by 2026 may sound like a bold claim, but it’s one that’s got millions of people talking — and saving. In an era of rising prices, economic uncertainty, and social media finance hacks, more and more people are turning to gamified, community-driven saving challenges to build wealth, develop discipline, and reach their money goals. With viral hashtags like #100EnvelopeChallenge and #SavingsTikTok trending worldwide, saving money is no longer just for the spreadsheet nerds or ultra-frugal. It’s for everyone — whether you’re a broke college student, a busy mom, or a 9-to-5’er juggling rent and side gigs. And here’s the kicker: you don’t need more than £1 to start. Let’s dive into these challenges and explore how you can realistically turn pocket change into powerful progress by 2026.

Table of Contents

5 Viral Money Saving Challenges

These viral money saving challenges are more than social media trends. They’re behavioral money tools that help you train your brain to delay gratification, take control of your spending, and build a solid financial foundation — all from as little as £1. Whether your goal is £500 or £5,050 by 2026, the journey begins with one choice: to start. So pick a challenge, set your goal, and watch how even small, intentional actions lead to big results. You don’t need to be rich to start saving — but if you save smart, you’re already on your way to wealth.

| Challenge Name | Estimated Total Saved | Timeframe | Skill Level |

|---|---|---|---|

| 100‑Envelope Challenge | £5,050 | ~100 days or weeks | Beginner-Intermediate |

| 52‑Week Challenge | £1,378 | 1 year | Beginner |

| Penny-a-Day Challenge | £667.95 | 1 year | Beginner |

| Round‑Up/Spare Change | £300-800/year avg. | Ongoing | Beginner |

| No-Spend Challenge | £100s–£1,000s | 1 week–12 months | Intermediate |

Why Are These 5 Viral Money Saving Challenges So Popular?

The reason these challenges work — and stick — is psychology. According to financial behavior experts, micro-saving (saving small amounts consistently) can have a bigger impact on your brain than making a one-time large deposit. You’re building discipline, which matters more than the amount.

Plus, these viral challenges:

- Are simple to follow and often come with visual trackers.

- Provide a sense of accomplishment with every small win.

- Can be shared with family, kids, or friends for accountability.

And let’s be honest: saving money is more fun when you turn it into a game.

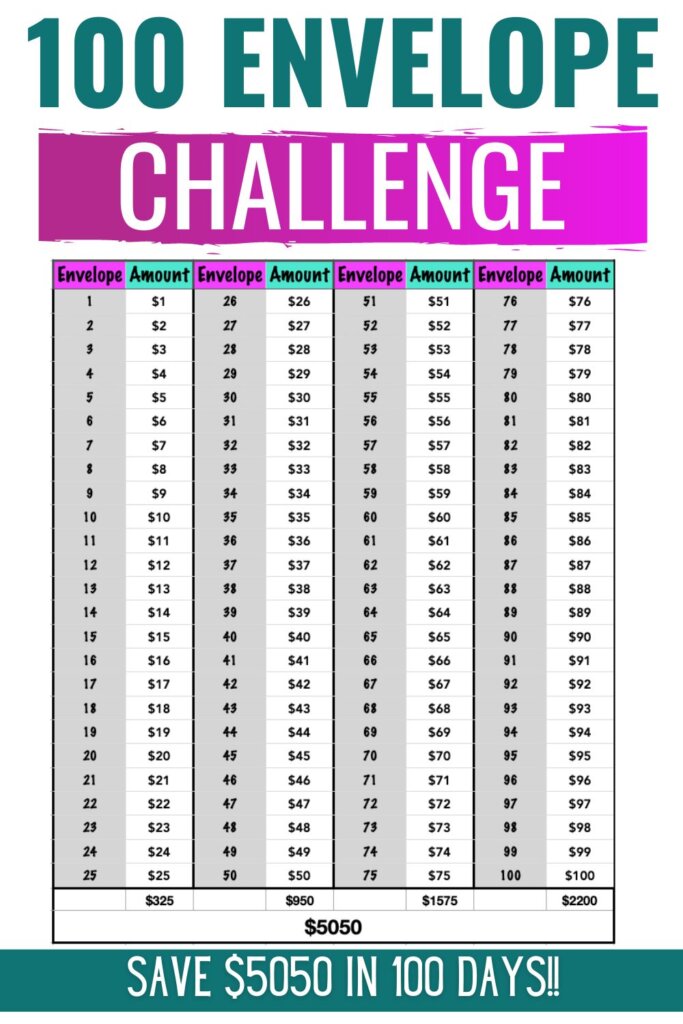

Challenge #1: The 100‑Envelope Challenge — Save £5,050

The 100‑Envelope Challenge is a viral TikTok favorite. The math is solid: numbers 1 through 100 add up to £5,050. The method is simple:

- Label 100 envelopes (physical or digital) from 1 to 100.

- Each day or week, draw an envelope and save that amount. Envelope 37 = £37, envelope 93 = £93.

- Complete all envelopes and you’ll have saved £5,050.

Options to make it easier:

- Do it over 100 weeks instead of days.

- Modify the range (e.g., 1 to 50) for a smaller savings goal.

Many savers use this to fund holidays, weddings, or an emergency cushion.

Real-world example:

Tyler, 34, from Milwaukee, started this challenge after losing his job in 2020. He completed it over 7 months and used the funds to start his own landscaping business. “It gave me confidence and a safety net,” he said.

Challenge #2: 52‑Week Money Saving Challenge

This is a slow-burn, steady plan that’s perfect for beginners. You save the pound amount that corresponds to the week number of the year.

- Week 1 = £1

- Week 2 = £2

- Week 10 = £10

- Week 52 = £52

By year-end, you’ll have £1,378 saved. Want to ramp it up? Double it and save £2, £4, £6… for a total of £2,756.

Flexible variations:

- Reverse it: start at £52 in week 1 and count down.

- Set a fixed weekly auto-transfer using your banking app.

Financial education tip: This challenge works great for teaching kids budgeting and delayed gratification. Let them check off weeks with stickers and watch their fund grow.

Challenge #3: Penny-a-Day Challenge — Big Savings from Small Coins

A favorite among minimalist savers and families with kids.

How it works:

- Day 1 = 1p

- Day 2 = 2p

- …

- Day 365 = £3.65

Total saved? £667.95

Why it works: It’s approachable. You likely won’t even feel the daily save, especially in early weeks. Many people automate this using a spreadsheet or app.

Bonus Tip: Do the challenge in reverse (start with £3.65 and go backwards) if you have more cash early in the year.

Challenge #4: Round-Up Savings — Passive Money Building

Let tech do the heavy lifting. Round-up apps or bank features automatically round up your purchases to the nearest pound and transfer the change into savings.

- Spend £3.20 → Save £0.80

- Buy lunch for £6.75 → Save £0.25

Result: You could quietly save £300–£800 a year based on spending habits. This is a great add-on to another challenge.

Challenge #5: No-Spend Challenge — Financial Detox

This behavioral challenge isn’t about how much you do save — it’s about how much you don’t spend.

Here’s how:

- Set a time frame: one week, one month, or a “no-spend weekend” rule.

- Stop buying non-essentials: coffee, takeout, subscriptions, clothes.

- Only spend on necessities like rent, bills, and groceries.

Mindset trick: Keep a “temptation log” where you write down what you wanted to buy — and how much you saved by skipping it. Then tally it at the end.

Results vary — but even a 30-day no-spend could leave you with £400–£1,000 unspent.

Tools, Trackers & Apps to Support These 5 Viral Money Saving Challenges

Apps That Make Saving Easier:

| App | Region | Purpose |

|---|---|---|

| Qapital | US | Automate rules for goal-based saving |

| Plum | UK | AI-powered automatic saving |

| Chime | US | Round-ups and auto-saves |

| Monzo Pots | UK | Create pots for challenges and goals |

| Goodbudget | Global | Digital envelope budgeting |

These tools let you set rules, track progress, and even reward yourself when milestones are hit.

Expert Tips to Maximize Your Progress

- Use visuals. Print or create digital trackers to color in every step. It motivates the brain.

- Pair savings with goals. Label your savings “Hawaii Trip” or “Emergency Fund.”

- Go public. Share your challenge online or with a friend for accountability.

- Build momentum. Start with smaller amounts to develop habit strength.

- Celebrate milestones. Hit £100? Treat yourself (modestly) to stay motivated.