5 State Pension Mistakes That Could Stop Your Payments Cold: If you’re planning to claim your UK State Pension, here’s a cold, hard truth: even a small mistake can delay your payments or stop them completely. We’re not talking pennies here — we’re talking tens of thousands of pounds over your retirement years. These are benefits you worked hard for, and yet every year, thousands of Brits lose out by missing deadlines, failing to track contributions, or not understanding the rules.

So let’s break down the 5 State Pension mistakes that could stop your payments cold, and we’ll throw in extra warnings and insights that even savvy professionals can overlook. Whether you’re 25 and planning ahead or 64 and ready to claim — this guide is for you. It’s written in a Native American-style tone — conversational, warm, and honest, with USA-style clarity and friendliness, and it’s loaded with expert advice.

Table of Contents

5 State Pension Mistakes That Could Stop Your Payments Cold

Avoiding the 5 State Pension mistakes that could stop your payments cold isn’t about luck — it’s about being informed and proactive. Whether it’s checking your NI record, updating your details, or claiming on time, the steps are simple — but ignoring them could cost you dearly. Don’t leave your retirement income to chance. Plan early. Check your records. Talk to a pensions advisor if you’re unsure. And above all — claim what you’ve earned.

| Mistake | Impact | How to Avoid It |

|---|---|---|

| Not enough NI years | Reduces or blocks pension payments | Check your National Insurance record and pay gaps |

| Not claiming pension | Pension is not paid automatically | Claim 4 months before State Pension age |

| Outdated info | Misunderstanding eligibility and payment age | Use official State Pension forecast tool |

| Not updating DWP/HMRC | Leads to payment delays or cancellations | Report address, marital or bank detail changes |

| Ignoring life changes | Overpayments, legal issues, or suspensions | Inform DWP of moves, new benefits or status changes |

What Is the State Pension?

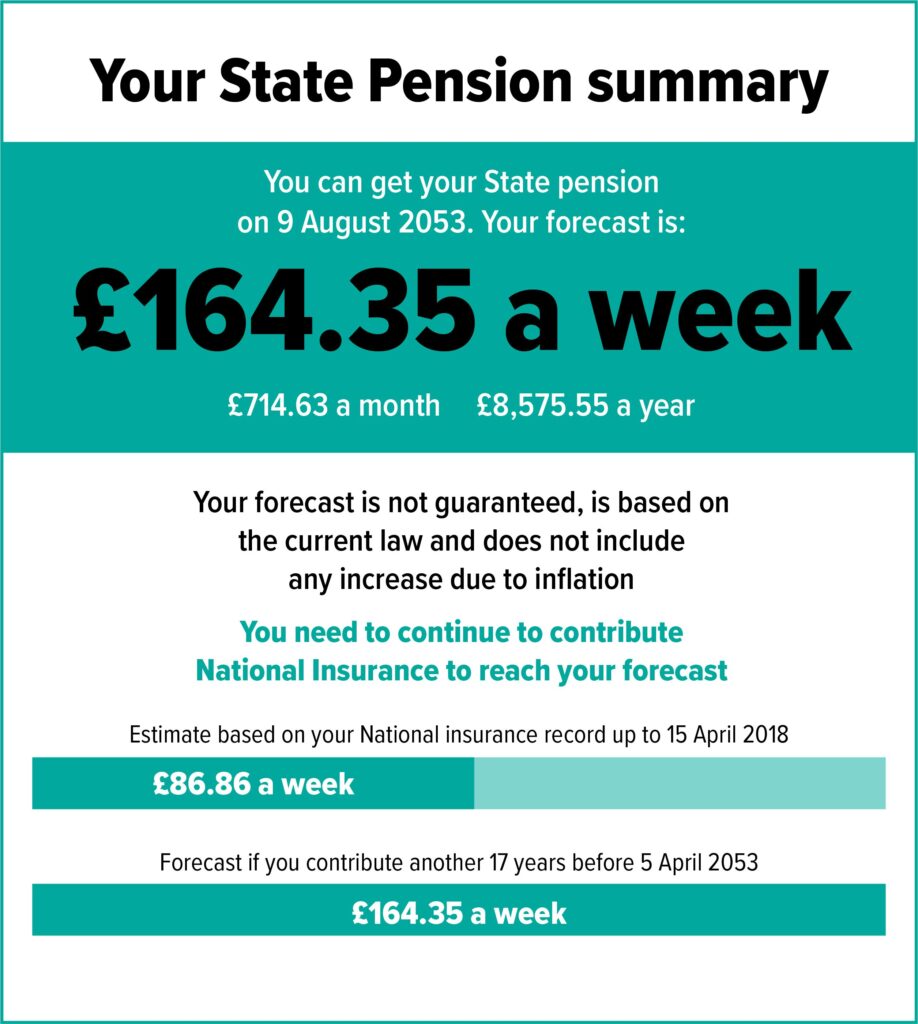

The UK State Pension is a government benefit paid weekly to people who have reached the State Pension age and have made enough National Insurance (NI) contributions during their working lives. It forms the foundation of retirement income for millions of people — but unlike workplace or private pensions, it’s backed by the state and tied directly to your NI record.

As of 2025, the full New State Pension pays approximately £230.25 per week, or about £11,974 annually, but only if you meet all the eligibility requirements.

Yet here’s the kicker: it’s not automatic, and there are many ways you could end up underpaid, overpaid, or completely blocked from getting what’s yours.

![State Pension Age Review]=](https://seaplanesandais.com/wp-content/uploads/2025/12/State-Pension-Age-Review-1024x541.jpg)

State Pension Mistake #1: Not Having Enough Qualifying National Insurance Contributions

Your eligibility — and the amount you receive — depends on how many qualifying years of NI contributions you’ve built up.

The Numbers You Need to Know:

- 10 qualifying years to receive any pension.

- 35 qualifying years for the full New State Pension.

- Less than 35 = reduced pension amount.

Common Ways People Miss Out:

- Taking long career breaks (especially for childcare).

- Working abroad without paying voluntary NI.

- Self-employed people skipping or underpaying Class 2 NI contributions.

- Low-income part-time jobs below the earnings threshold.

Example:

Sarah, a 58-year-old part-time cleaner, discovers she only has 18 qualifying years. Unless she fills the gaps, she’ll receive just half the State Pension — around £115 per week instead of £230.

Action Plan:

- Check your record: gov.uk/check-national-insurance-record

- Fill gaps: You can buy up to 6 years’ worth of missing contributions (up to 10 in special extensions like the one active until April 2025).

State Pension Mistake #2: Not Claiming Your Pension

Unlike some other benefits, the State Pension isn’t automatic. If you don’t claim it, you won’t get it — even if you’re eligible.

When to Claim:

You can claim up to 4 months before reaching State Pension age.

How to Claim:

- Online at gov.uk

- By phone

- By post (less recommended due to slower processing)

What Happens If You Don’t Claim?

Your payments simply don’t start. There’s no backdating unless you claim within 12 months of becoming eligible — and even then, only limited backpay applies.

Tip:

Set a reminder on your phone or calendar at age 64 to apply at least 4 months ahead.

State Pension Mistake #3: Relying on Outdated or Incorrect Information

State Pension rules changed massively in 2016. If you’re still going by what your parents told you or what you read 15 years ago — don’t.

Key Misconceptions:

- “Pension age is 65 for everyone” – Not anymore. It’s 66 now and rising to 67 and possibly 68.

- “Everyone gets the same amount” – Only if you have 35 full NI years.

- “Women get paid earlier” – That was true, but not since reforms equalised retirement ages.

Check Your Forecast:

Get a clear estimate based on your real contributions, age, and current policy.

State Pension Mistake #4: Not Updating Your Details with HMRC or DWP

It might sound like small stuff, but incorrect or outdated details can stop your pension dead in its tracks.

Details You Must Keep Updated:

- Your current address

- Your bank or building society account

- Your name (if changed due to marriage/divorce)

- Whether you’ve moved abroad

- Email and phone contacts

Real-World Example:

George moved from Birmingham to Manchester but forgot to update DWP. His pension was delayed 2 months because his letters and payments went to the wrong address.

State Pension Mistake #5: Not Reporting Life Changes That Affect Eligibility

Certain life events can affect your pension eligibility or payments. Failing to report them can lead to overpayments, which DWP may reclaim with penalties.

Events You Must Report:

- You’ve moved abroad

- You’ve started or stopped getting benefits (e.g. Universal Credit)

- You’re admitted to hospital or care long-term

- You’ve changed marital status

- You’ve started work again after retirement

Why It Matters:

DWP uses this info to calculate your entitlement. If they overpay due to your failure to report changes, you may need to repay it — and in some cases, you could be penalised.

Bonus Pitfall: Missed NI Credits (Especially for Carers & Parents)

Here’s a little-known fact: you might be entitled to NI credits even if you weren’t working.

You May Be Eligible If You:

- Were a stay-at-home parent (Child Benefit claims can provide credits up to 12 years old)

- Were caring for someone at least 20 hours a week

- Received certain benefits (like Jobseeker’s Allowance or ESA)

These credits count as qualifying years, but not all are applied automatically.

Should You Defer Your Pension?

Deferring your pension — that is, delaying your claim — can actually make you more money.

How It Works:

For every 9 weeks you defer, your pension increases by 1%. That’s about 5.8% per year.

This can be a good strategy if:

- You don’t need the money immediately

- You plan to live a long time (more years = more gains)

- You want to boost income later in life

What If You Move Abroad? (Frozen Pensions Warning)

Many UK retirees move to places like Australia, Canada, or the Caribbean. But here’s the rub: in over 100 countries, your pension will be “frozen” — meaning it won’t rise with inflation.

Example:

If you moved to Canada in 2005 and got £90 per week, you’re still getting £90 today, while UK-based pensioners now get £230+.