4 CRA Benefits Payments: 4 CRA Benefits Payments in January 2026 are scheduled to support millions of Canadians as the new year begins. From families raising children to low-income workers, and residents navigating rising living costs, these benefits are not just helpful—they’re essential. Knowing when payments arrive, how much you could receive, and who qualifies is key to smart money management in 2026. Let’s unpack each benefit, how to access it, who is eligible, and what steps you should take to maximize your entitlements.

Table of Contents

4 CRA Benefits Payments

The 4 CRA Benefits Payments in January 2026—the GST/HST Credit, Ontario Trillium Benefit, Advanced Canada Workers Benefit, and Canada Child Benefit—represent vital financial support for Canadians starting the new year. To get what you’re entitled to:

- File your taxes annually

- Keep your information current

- Set up direct deposit

- Use CRA tools to manage your account

Whether you’re a parent, a low-income worker, a student, or a newcomer, these programs offer real, accessible support.

| Benefit Name | Payment Date | Who It Helps | Eligibility Summary |

|---|---|---|---|

| GST/HST Credit | January 5, 2026 | Low- and middle-income Canadians | Filed 2024 taxes; resident of Canada |

| Ontario Trillium Benefit (OTB) | January 9, 2026 | Ontario residents | Tax return filed; low-to-moderate income; rent/property tax paid |

| Advanced Canada Workers Benefit (ACWB) | January 12, 2026 | Working individuals/families with low income | Minimum work income; filed taxes with Schedule 6 |

| Canada Child Benefit (CCB) | January 20, 2026 | Parents and guardians of children under 18 | Primary caregiver; filed 2024 taxes; resident |

Understanding CRA Benefit Payments

The Canada Revenue Agency (CRA) handles both tax collection and the delivery of numerous federal and provincial benefits. These payments form a critical part of Canada’s income support framework, aimed at improving affordability and reducing poverty. The CRA distributes billions annually through programs like the Canada Child Benefit (CCB), GST/HST Credit, Canada Workers Benefit (CWB), and others.

Benefits are usually paid monthly or quarterly, depending on the program. In most cases, you don’t need to apply separately—just make sure you file your taxes annually, even if you earned no income. The CRA uses your tax return to assess eligibility and calculate payments.

Missing tax deadlines, failing to update your address, or skipping direct deposit setup can result in delays—or missing out entirely.

1. GST/HST Credit – January 5, 2026

The GST/HST Credit is a quarterly, tax-free payment issued to offset the Goods and Services Tax or Harmonized Sales Tax that low- and middle-income Canadians pay on everyday purchases.

Who’s Eligible?

To qualify for the GST/HST credit:

- You must be a resident of Canada for income tax purposes.

- You must have filed a 2024 tax return, regardless of whether you had income.

- You must be 19 or older, or have a spouse/common-law partner, or be a parent living with your child.

Eligibility is automatic once you file taxes. The CRA uses your adjusted family net income and marital status to determine your benefit amount.

How Much Can You Receive?

For the 2025–2026 benefit year (starting July 2025), approximate maximum amounts are:

- $533 for single individuals

- $698 for married/common-law couples

- $184 per child under 19

Your actual payment depends on your income level and family size. If your income rises above a certain threshold, the credit phases out.

How Is It Paid?

The credit is paid four times per year: in January, April, July, and October. For 2026, the first installment will arrive on January 5. Payments are usually sent via direct deposit or cheque.

2. Ontario Trillium Benefit (OTB) – January 9, 2026

The Ontario Trillium Benefit combines three provincial credits into a single monthly payment to help offset energy costs, property taxes, and sales tax burdens.

What’s Included in the OTB?

- Ontario Energy and Property Tax Credit (OEPTC)

- Northern Ontario Energy Credit (NOEC) (if applicable)

- Ontario Sales Tax Credit (OSTC)

You only need to qualify for one to receive the benefit.

Who Is Eligible?

You may qualify if:

- You were a resident of Ontario on December 31, 2024.

- You paid rent or property tax in Ontario.

- You had a modest income that meets the thresholds.

- You filed your 2024 tax return and completed Form ON-BEN.

Low-income seniors, families, and individuals who rent or own their homes can benefit. If you’re eligible, the CRA will determine the monthly payment amount automatically.

Payment Details

The first OTB payment for 2026 will be issued on January 9, 2026. Payments continue monthly until June, based on your 2024 tax return.

Amounts vary depending on your situation, but many Ontarians receive several hundred dollars annually.

3. Advanced Canada Workers Benefit (ACWB) – January 12, 2026

The Advanced Canada Workers Benefit provides advance quarterly payments to individuals and families with low income who are actively working. This is a prepayment of the Canada Workers Benefit (CWB)—normally claimed at tax time.

Eligibility Requirements

To qualify, you must:

- Have earned at least $3,000 in employment or self-employment income.

- Be 19 years or older, or have a spouse/common-law partner or child.

- Have filed your 2024 tax return with Schedule 6.

- Be under the income limits defined by the CRA (which adjust annually).

Eligibility is calculated based on net income and family status. The CRA automatically enrolls qualified individuals for the advanced portion if they received the CWB in the prior year.

How Much Do You Get?

The full CWB can provide:

- Up to $1,590 for individuals

- Up to $2,739 for families

The ACWB offers up to 50% of your benefit in advance, split into three payments in January, July, and October.

So in January 2026, expect your first quarterly installment—helping workers smooth their income during the post-holiday crunch

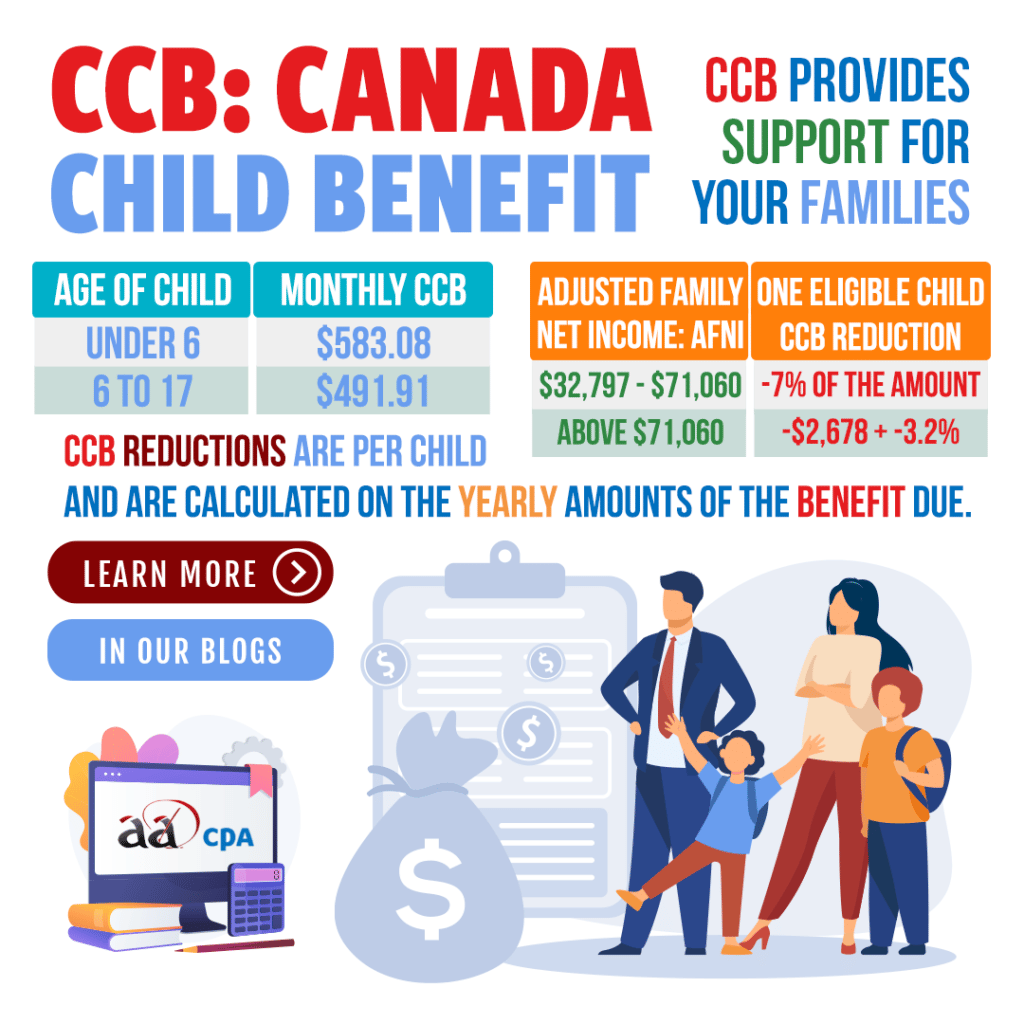

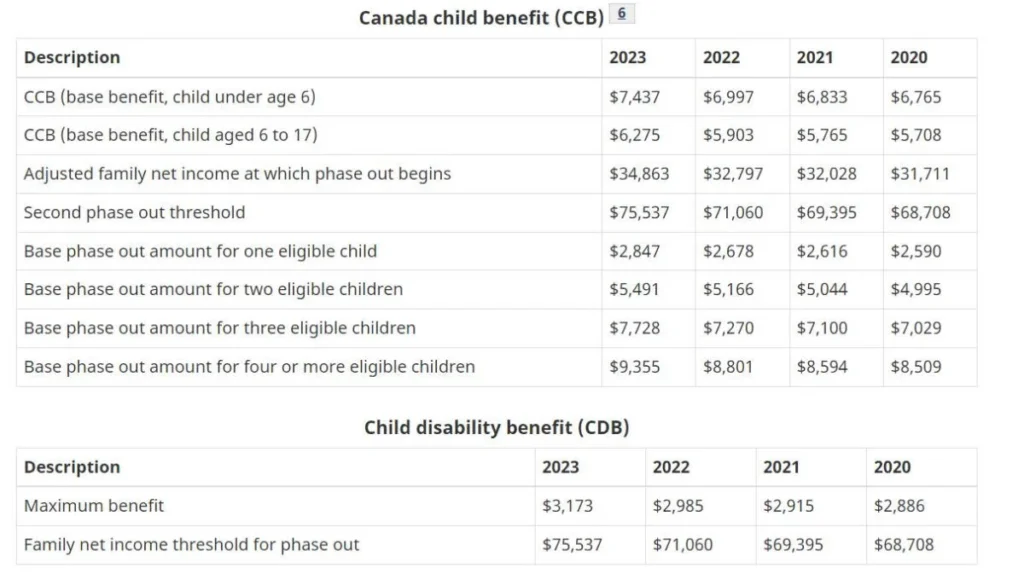

4. Canada Child Benefit (CCB) – January 20, 2026

The Canada Child Benefit is a monthly tax-free payment to families to help with the cost of raising children under age 18. It’s one of Canada’s largest and most widely received benefits.

Who’s Eligible?

To qualify, you must:

- Be the primary caregiver for a child under 18.

- Be a resident of Canada for tax purposes.

- Have filed your 2024 tax return (and your spouse/common-law partner too, if applicable).

- Live with and be responsible for your child.

Eligibility is assessed every July and is based on the previous year’s income. If you had a child in 2025, apply for the CCB as soon as possible.

Payment Date & Amount

The first payment of 2026 is scheduled for January 20, 2026. Payments continue monthly throughout the year.

Estimated maximums for July 2025–June 2026:

- $7,997 annually per child under 6

- $6,748 per child aged 6 to 17

Your amount reduces as income rises beyond $34,863 (2025 threshold).

Steps to Make Sure You Get 4 CRA Benefits Payments

It’s one thing to qualify—it’s another to receive the money on time. Here’s how to stay on track:

1. File Your Taxes Every Year

Even if your income is zero, file your return. Most benefits are calculated from your tax information.

2. Set Up Direct Deposit

This ensures you receive payments promptly and securely. Update your banking info in your CRA My Account.

3. Keep Personal Info Up-to-Date

Update your address, marital status, and number of dependents with the CRA. These details can affect your eligibility and payment amounts.

4. Use CRA Tools

Use the CRA My Account portal to:

- View upcoming payments

- Update information

- Track benefits

- Get NOAs (Notices of Assessment)

$530 CPP Increase Confirmed for January 2026: Check Eligibility & Payment Date