$2,500+ Payments Coming for Canadians: $2,500+ payments coming for Canadians in January 2026 is a headline that has been making the rounds across social media, blogs, and even private Facebook groups. With inflation still squeezing household budgets and people watching every dollar, it’s no surprise this claim caught attention fast. But here’s the real talk: there is no brand‑new, one‑time $2,500 government payment officially announced for January 2026. Still, that doesn’t mean the story ends there. In reality, many Canadians will receive $2,500 or more in January 2026—not from one big check, but from multiple legitimate federal and provincial benefit payments arriving in the same month. This article breaks everything down in plain language, no fluff, no hype—just facts, examples, and practical steps to help you understand what money is coming, who qualifies, and how to make sure you don’t miss out.

Table of Contents

$2,500+ Payments Coming for Canadians

The idea of a surprise $2,500 government payment makes for a catchy headline, but the real story is more grounded—and more reliable. January 2026 will bring real money to millions of Canadians, not through a new stimulus program, but through existing benefits that already support families, workers, and seniors. If you want to see that money, the formula is simple: file your taxes, keep your information current, and understand the programs you qualify for. No hype required.

| Topic | Details |

|---|---|

| Viral $2,500 Claim | No single $2,500 one‑time payment announced |

| Real January Payments | CCB, GST/HST Credit, ACWB, CPP, OAS, GIS, OTB |

| Possible Monthly Total | $2,500+ when benefits are combined |

| Payment Window | January 5 to January 28, 2026 |

| Eligibility Basis | Income, age, family size, residency, tax filing |

| Official Reference | https://www.canada.ca/en/services/benefits.html |

Why the $2,500+ Payments Coming for Canadians Rumor Keeps Coming Back?

To understand why this rumor won’t die, you have to look at recent history.

During the pandemic, Canadians received large emergency payments like CERB and CRB, sometimes totaling thousands of dollars per month. That set a mental expectation that when times are tough, the government might roll out another big check.

Add to that:

- Rising rent and grocery costs

- Interest rate pressure

- End‑of‑year benefit adjustments

- Multiple January payments landing close together

Suddenly, people see $2,000 to $3,000 hit their bank account in January, and the rumor mill kicks into high gear.

The truth is simpler and less dramatic—but still important.

The Reality: No New One‑Time $2,500+ Payments Coming for Canadians

As of now, the Government of Canada and the Canada Revenue Agency (CRA) have made no announcement of a universal or special $2,500 stimulus or relief payment for January 2026.

What is happening is the regular release of scheduled benefit payments, some of which are monthly, some quarterly, and some provincial. When these line up in January, the total can look impressive.

That’s where the confusion comes from.

Confirmed Government Payments Coming in January 2026

Below are the real, official payments Canadians may receive in January 2026.

GST/HST Credit – January 5, 2026

The GST/HST Credit is a tax‑free quarterly payment designed to help lower‑ and modest‑income Canadians offset sales taxes.

Key details:

- Based on 2024 tax return

- Paid automatically if you’re eligible

- No application required

Maximum annual amounts (approximate):

- Single adult: about $496

- Couple: about $650

- Additional amount per child

Many people forget about this benefit because it’s automatic—but missing a tax return means missing the payment.

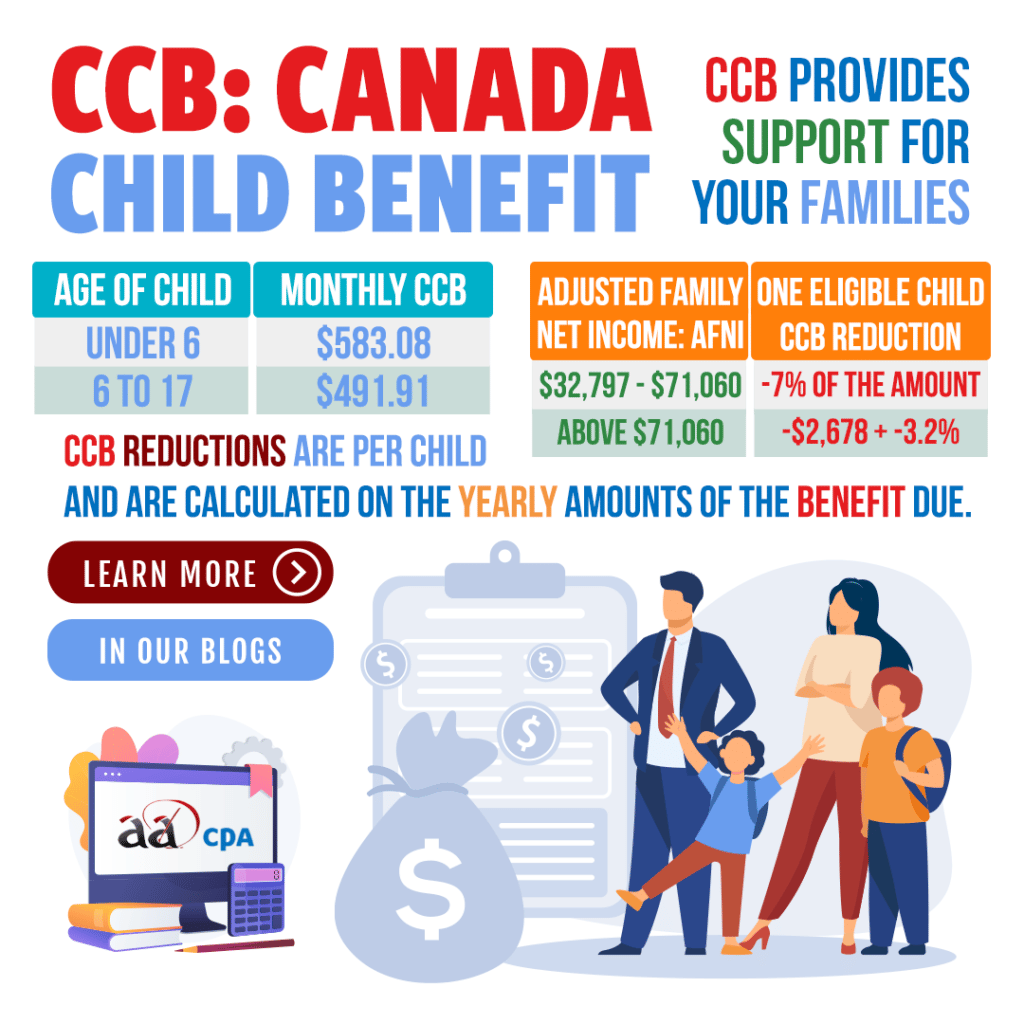

Canada Child Benefit (CCB) – January 20, 2026

The Canada Child Benefit is one of the largest and most impactful benefits in the country.

It is:

- Monthly

- Tax‑free

- Based on family income and number of children

Maximum annual amounts:

- Children under 6: up to $7,437 per year

- Children 6 to 17: up to $6,275 per year

That means a family with two young children can easily receive over $1,200 in January alone.

For many households, the CCB is the single biggest reason January totals jump past $2,500.

Advanced Canada Workers Benefit (ACWB) – January 12, 2026

The Canada Workers Benefit supports people who are working but earning a low income. The advanced version pays part of the benefit before tax time.

Key points:

- Paid quarterly

- Based on earned income

- Automatically issued if eligible

Maximum annual benefit:

- Single individual: up to $1,518

- Families: up to $2,616

The January ACWB payment alone can be several hundred dollars.

CPP and OAS – January 28, 2026

For seniors and retirees, January is a major payment month.

Canada Pension Plan (CPP)

CPP is based on your contributions during working years.

- Average monthly payment: around $758

- Maximum monthly payment: over $1,300

Old Age Security (OAS)

OAS is based on age and residency, not work history.

- Maximum monthly OAS: over $700

- Seniors with low income may also receive Guaranteed Income Supplement (GIS)

A senior receiving CPP, OAS, and GIS can see well over $1,500 deposited at the end of January.

Ontario Trillium Benefit (OTB) – January 9, 2026

For Ontario residents, the Ontario Trillium Benefit combines several provincial credits into one monthly payment.

It may include:

- Ontario Sales Tax Credit

- Energy and Property Tax Credit

Annual maximums can exceed $1,100, depending on housing costs and income.

How $2,500+ Happens Without a Special Payment?

Here’s a realistic scenario showing how totals add up.

Example Household

Single parent in Ontario with two children under 6, working part‑time, also receiving a survivor CPP benefit.

| Benefit | January Amount |

|---|---|

| Canada Child Benefit | $1,239 |

| ACWB Advance | $300 |

| GST/HST Credit | $170 |

| Ontario Trillium Benefit | $110 |

| CPP Survivor Benefit | $800 |

| Total | $2,619 |

No new program. No special stimulus. Just stacked benefits landing in the same month.

Important Warning: Scams and Fake Payment Claims

Whenever benefit rumors go viral, scammers move fast.

Common red flags:

- Emails or texts claiming “$2,500 approved”

- Messages asking for SIN, banking details, or login codes

- Urgent threats like “act now or lose payment”

- Fake websites mimicking government pages

The CRA does not:

- Text payment links

- Ask for personal info by email

- Threaten arrest or immediate penalties

If it doesn’t come from a secure canada.ca page, assume it’s fake.

Step‑by‑Step Checklist to Maximize January Payments

Step 1: File Your 2024 Tax Return

Even if you earned little or no income, filing is essential.

Step 2: Confirm Your Information

- Marital status

- Number of children

- Address and residency

Outdated info can delay or reduce benefits.

Step 3: Set Up Direct Deposit

Direct deposit is faster and safer than mailed checks.

Step 4: Use the Government Benefits Finder

Many Canadians qualify for benefits they’ve never heard of.

Step 5: Check Provincial Programs

Each province offers different credits and supplements.

Professional Insight: Why January Is a High‑Payment Month

From a financial planning perspective, January is unique because:

- Quarterly benefits reset

- Income thresholds adjust annually

- Multiple programs pay early in the year

- Year‑end recalculations settle

Professionals often advise clients to budget carefully in January, because high deposits early in the year can create cash‑flow issues later if spending spikes too fast.

Canada Quietly Raises Medical Inadmissibility Cost Threshold for 2026

4 CRA Benefits Payments in January 2026 – Check Eligibility Criteria & Payment Date