$2,000 Stimulus Check Proposal: The $2,000 Stimulus Check Proposal – What Trump Promised and What’s Still Uncertain continues to spark debate across the United States, especially as families feel the squeeze from higher prices, interest rates, and everyday expenses. From social media posts to cable news segments, the idea of another stimulus-style payment has caught attention fast. The big question remains: Is this real, or just political talk? The proposal stems from public comments made by Donald Trump, who has discussed the possibility of issuing payments funded by tariff revenue, sometimes referred to as a “tariff dividend.” While the concept sounds straightforward, the reality behind federal payments is far more complex. As someone who has closely followed stimulus programs, tax policy, and economic relief efforts for years, I can tell you this clearly: no checks are currently approved, scheduled, or guaranteed. This article breaks everything down step by step—how the proposal works, what’s missing, how it compares to past stimulus checks, and what Americans should realistically expect moving forward.

Table of Contents

$2,000 Stimulus Check Proposal

The $2,000 Stimulus Check Proposal – What Trump Promised and What’s Still Uncertain remains a political idea rather than a government program. While the concept of sharing tariff revenue with Americans may sound appealing, the reality is clear: no law has been passed, no funding has been approved, and no IRS plan exists. Until Congress takes action, Americans should remain cautious, informed, and focused on verified sources.

| Topic | Key Details |

|---|---|

| Proposed Payment Amount | Up to $2,000 per person (proposal only) |

| Who Discussed the Idea | Donald Trump |

| Funding Concept | Import tariffs collected by the federal government |

| Legal Status | No bill passed, no law enacted |

| Eligibility (Speculated) | Low- and middle-income households |

| Official Legislative Source | Congress.gov – https://www.congress.gov |

| Potential Distribution Agency | IRS – https://www.irs.gov |

What Is the $2,000 Stimulus Check Proposal?

At its simplest, the $2,000 stimulus check proposal is an idea, not a program. It has not been introduced as legislation, debated in Congress, or approved by any federal agency.

The proposal suggests:

- The U.S. government collects revenue from tariffs on imported goods

- Some of that revenue could be redistributed to Americans

- Payments could reach $2,000 per eligible person

That’s the full scope of what exists right now. There is no bill number, no funding allocation, and no payment timeline.

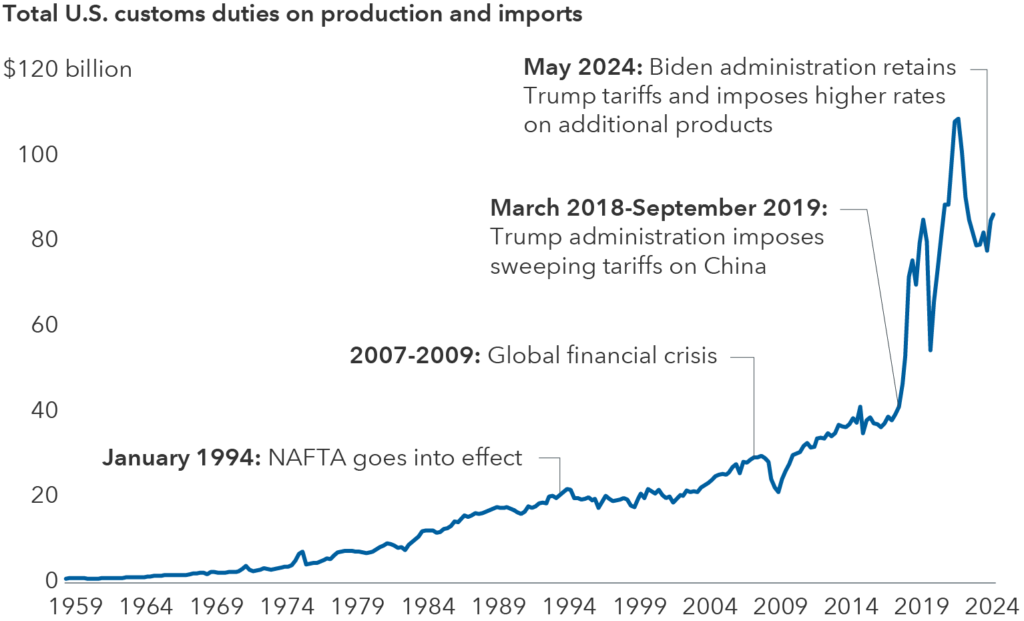

How Tariffs Actually Work in the Real World?

To understand why this proposal is complicated, you need to understand tariffs.

A tariff is a tax placed on imported goods. When a company brings products into the U.S. from another country, it may have to pay a tariff at the border. According to the U.S. International Trade Commission, tariffs can generate tens of billions of dollars annually.

However, here’s the part many people miss:

- Companies usually pass tariff costs to consumers

- Prices on everyday goods often rise

- Shoppers end up paying more over time

This is why economists often say tariffs act like a hidden tax on consumers.

What Trump Has Promised Versus What Exists in Law?

Public Statements and Messaging

Trump has:

- Mentioned payments of around $2,000

- Framed them as relief for working Americans

- Suggested tariffs as a funding source

What Has Not Happened

- No bill introduced in the House or Senate

- No congressional hearings on the proposal

- No funding approved in the federal budget

- No IRS guidance or preparation

In legal terms, nothing has moved beyond discussion.

Why Congress Controls Whether Checks Go Out?

In the United States, spending money requires congressional approval. Even if a president strongly supports an idea, it cannot happen without legislation.

Every major stimulus payment in U.S. history followed this path:

- A bill introduced in Congress

- Debate and committee review

- Passage by both chambers

- Presidential signature

- Agency implementation

You can review all active and past federal bills directly on Congress.gov, the official source for U.S. legislation.

Comparing $2,000 Stimulus Check Proposal Proposal to Past Stimulus Checks

Looking at history helps put things into perspective.

COVID-19 Stimulus Payments

Americans received:

- $1,200 in 2020

- $600 in early 2021

- $1,400 later in 2021

These payments were:

- Passed during a national emergency

- Approved by Congress

- Funded largely through federal borrowing

- Distributed by the IRS

The $2,000 tariff proposal does not currently meet any of those conditions.

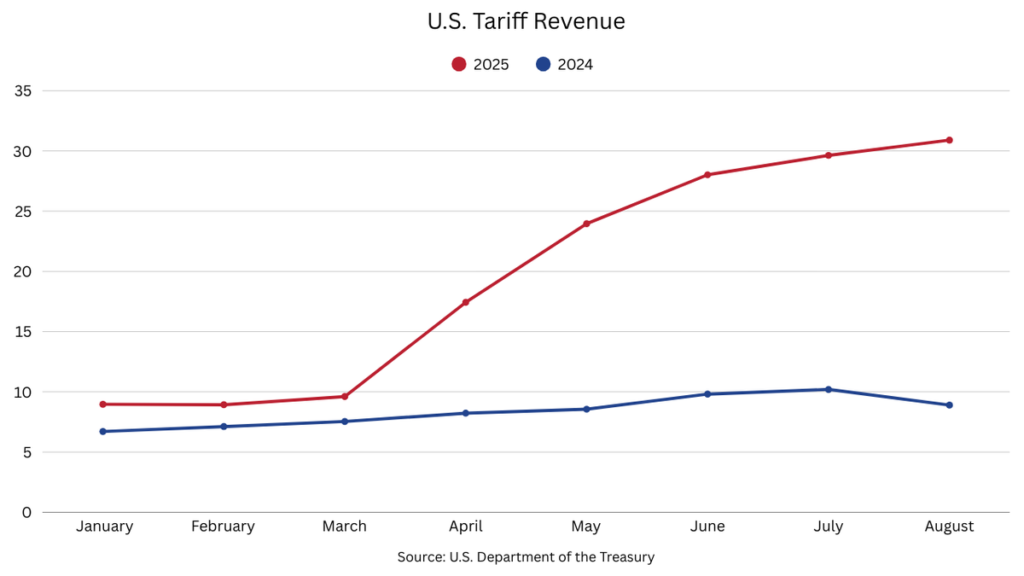

Can Tariff Revenue Realistically Fund $2,000 Stimulus Check Proposal?

Let’s look at the numbers.

- Roughly 250 million adults live in the U.S.

- $2,000 per person equals $500 billion

According to the Congressional Budget Office, total annual tariff revenue typically falls well below that amount, often under $100 billion.

This means:

- Tariffs alone would not cover the cost

- Other funding sources would be required

- The national debt could increase

Inflation and Cost-of-Living Concerns

One reason economists raise concerns about tariff-funded payments is inflation.

Higher tariffs often lead to:

- Increased prices on imported goods

- Higher costs for manufacturers

- Rising consumer prices

Even if Americans received a $2,000 check, they could lose some of that benefit through higher prices at the grocery store, gas pump, or electronics counter.

Legal Challenges and Tariff Authority

Another layer of uncertainty comes from the courts. Some broad uses of tariff authority are being challenged legally, and the Supreme Court of the United States could eventually influence how much power the executive branch has to impose tariffs.

If tariff authority is limited:

- Revenue projections could drop

- Funding for any dividend-style payment could disappear

Who Might Qualify If This Became Law?

While no eligibility rules exist, past stimulus programs provide clues.

Previous checks generally required:

- U.S. residency

- A valid Social Security number

- Income below certain thresholds

For reference, prior payments phased out around:

- $75,000 for single filers

- $150,000 for married couples

Impact on Small Businesses and Employers

Small businesses often feel tariff impacts first.

Tariffs can:

- Increase supply costs

- Reduce profit margins

- Force price increases or layoffs

While a $2,000 payment might boost short-term consumer spending, long-term tariff pressure can hurt small businesses that rely on imported materials or equipment.

A Realistic Timeline if Congress Took Action

If lawmakers decided to act tomorrow, a realistic timeline would still look like this:

- Several weeks or months of debate

- Budget negotiations

- IRS system preparation

- Payment distribution

Historically, even emergency payments take months to roll out.

What Professionals and Financial Planners Should Watch

Professionals should pay attention to:

- New bill introductions in Congress

- Federal budget resolutions

- Trade and tariff court rulings

- IRS funding changes

Policy movement—not campaign speeches—drives outcomes.

How to Avoid Scams and False Claims?

Misinformation spreads quickly around stimulus payments.

Be cautious of:

- Claims of “guaranteed” checks

- Requests for personal information

- Emails or texts claiming early access

$2000 Stimulus Check in January 2026: Check Eligibility, and Payment Status

Federal $2000 Deposits Coming in January 2026: Guide for Eligible Beneficiaries

$2,000 Direct Deposits Are Official — IRS Sets Start Date for Massive Payouts