$2000 Stimulus Check: As we start 2026, many Americans are wondering whether a $2,000 stimulus check is on the horizon. The past few years have been filled with uncertainty, and many people still remember the pandemic-era stimulus checks and other forms of relief that helped millions of households. With rumors and buzz circulating online, it’s important to get the facts straight and understand whether you might be eligible for a stimulus payment in January 2026 or beyond. In this article, we’ll break down everything you need to know about potential $2,000 payments — from eligibility and payment status to common misconceptions and real relief options. We’ll also highlight the sources of the rumors and provide clear guidance on how to avoid scams. Whether you’re a professional tracking economic policy or a household just hoping for some extra cash, this guide will provide clarity.

Table of Contents

$2000 Stimulus Check

To sum it up, while there are no $2,000 stimulus checks planned for January 2026, there are still several ways you could receive financial assistance. From tax refunds to state-level relief programs, it’s important to stay informed and avoid falling for scams. Remember, if you want to check your payment status or make sure you’re getting your refund on time, the IRS offers online tools to help keep you updated.

| Key Info | Details |

|---|---|

| Is there a $2,000 stimulus check in January 2026? | No, there is no federal stimulus check of $2,000 confirmed for January 2026. |

| What is the source of the rumors? | Rumors stem from proposals, tax refunds, and misleading scam claims. |

| Eligibility for any stimulus check | Tax refunds and possible future political proposals — but nothing finalized for January 2026. |

| How to check payment status | Visit the IRS website and use tools like Where’s My Refund? for updates. |

| Stay safe from scams | Do not trust unofficial emails or messages claiming you qualify for a payment or need to pay upfront fees. |

Why People Are Talking About a $2000 Stimulus Check in January 2026?

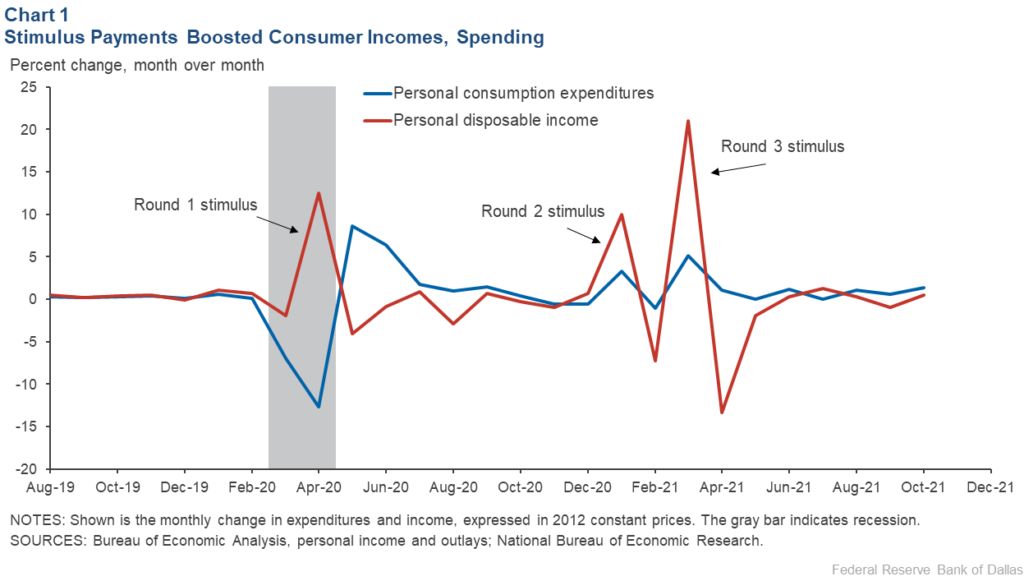

The idea of a $2,000 stimulus check has been floating around the internet since the early days of the pandemic. Back then, the federal government approved multiple rounds of direct payments to help people during the COVID-19 crisis. These checks were intended to provide immediate relief to households facing economic hardships due to lockdowns and job losses.

However, as of January 2026, there has been no official announcement or legislation passed that authorizes a $2,000 federal stimulus check. If you’ve heard rumors about one, they are most likely based on misleading claims or political proposals that haven’t yet been enacted into law.

Understanding the Sources of the $2000 Stimulus Check Rumors

One of the main sources of confusion comes from a proposal for a “tariff dividend” or similar relief programs. Some politicians have floated ideas about sending large checks to Americans based on trade policies or economic recovery plans. For instance, former President Donald Trump discussed the possibility of sending large payments, such as $2,000, in the future, but these discussions are still just proposals that need to pass through Congress before they can be made into law.

Another factor driving the rumors is the tax season. As we move into January 2026, the IRS begins processing tax returns, and many people will be receiving tax refunds. These refunds can sometimes reach around $2,000, but they are not a stimulus check — they are based on how much you overpaid in taxes throughout the year.

So, Should You Expect a $2,000 Check in January?

The simple answer is no — there is no stimulus check of $2,000 coming in January 2026. However, that doesn’t mean you should rule out all forms of financial relief. There are a few ways you might receive financial help, such as:

- Tax refunds: If you filed your taxes and are due for a refund, you could receive a payment around $2,000, depending on your tax situation.

- Tax credits: Certain tax credits, like the Earned Income Tax Credit (EITC) or Child Tax Credit, can lead to larger refunds.

- State-level relief programs: Some states may have their own relief programs in place, so check with your state’s official resources to see if any payments are coming your way.

In short, while $2,000 checks might not be coming in the form of a stimulus payment, there are other potential sources of financial help to keep in mind.

How Do Tax Refunds and Payments Work?

Tax season can be confusing, especially if you’re not sure when to expect a refund or what you’ll be paid. Here’s a breakdown of how it works:

1. File Your Taxes Early to Get Your Refund Faster

If you want to maximize your chances of receiving a tax refund quickly, it’s best to file your taxes early. The IRS typically begins accepting tax returns in January, and if you file electronically and set up direct deposit, you could see your refund within a few weeks. The earlier you file, the faster you’ll get your refund.

For example, if you’re eligible for tax credits like the Child Tax Credit or the Earned Income Tax Credit, these can increase your refund amount — potentially pushing it to $2,000 or more. Keep in mind that tax refunds are not the same as a stimulus check — they’re based on the taxes you’ve already paid or overpaid.

2. Check Your Tax Refund Status

After you file your taxes, you can check the status of your refund using the IRS tool, “Where’s My Refund?” This is a great way to stay updated on when your refund will arrive. The IRS usually processes refunds within 21 days of filing if there are no issues with your tax return. If you filed a paper return or if there are complications, it could take longer.

3. Make Sure Your Bank Info is Up to Date

To receive your refund quickly, make sure your bank details are correct. If the IRS can’t process your payment electronically, it could delay your refund. Also, keep in mind that if you owe back taxes or have other outstanding debts, the IRS may use your refund to cover those obligations.

Stimulus Payments and Demographics: Who’s Affected?

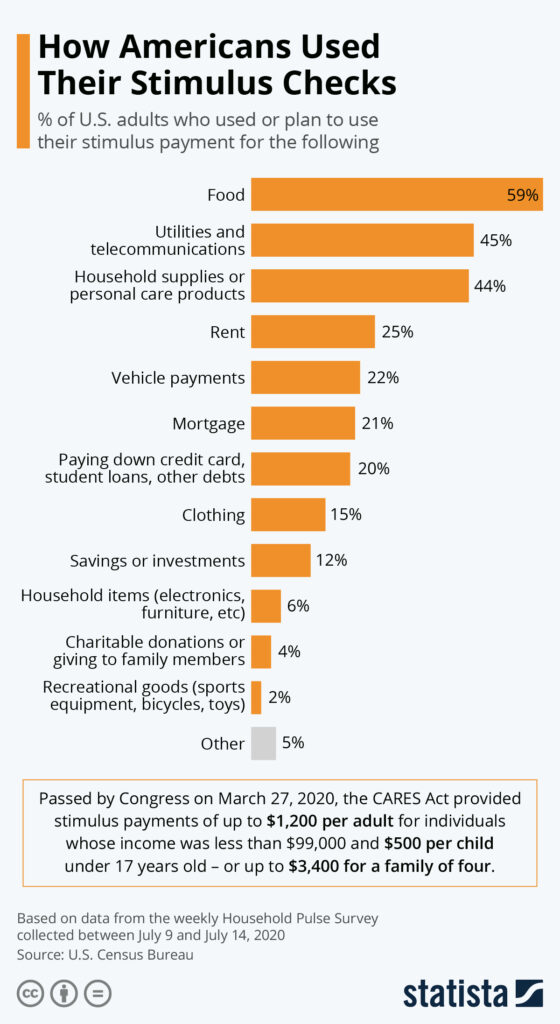

The pandemic stimulus checks weren’t just for individuals; they had ripple effects across a broad range of demographics. Here’s how the stimulus checks (and tax refunds) affected different groups:

Small Business Owners

Small business owners, especially those in sectors like hospitality and retail, received financial assistance through Paycheck Protection Program (PPP) loans and Economic Injury Disaster Loans (EIDL). These programs provided businesses with funds to keep employees on payroll and maintain operations. While these aren’t direct $2,000 checks, they were critical forms of relief for businesses facing shutdowns and reduced foot traffic.

Retirees and Social Security Recipients

Older Americans, including those receiving Social Security or Supplemental Security Income (SSI), were eligible for stimulus checks as well. These groups were eligible for the same direct payments as other Americans, but because they often live on fixed incomes, the stimulus checks were crucial in offsetting rising living costs.

Low-Income and Minority Communities

The Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) disproportionately benefited low-income families, especially those in Black and Latino communities. These credits could boost a taxpayer’s refund by thousands of dollars, making a significant impact for those in lower-income brackets.

College Students and Young Adults

While many college students were excluded from receiving the direct stimulus payments, there were provisions for dependent college students to receive money through their parents’ tax filings. This led to mixed results in terms of how young adults benefited from relief, but students who were eligible often saw financial aid or refunds during tax season.

How to File Taxes Efficiently for Larger Refunds?

Filing your taxes correctly can ensure that you get the largest refund possible. Here are some tips to help you file your taxes efficiently and take advantage of all the credits and deductions available to you:

- File Early: The earlier you file, the sooner you can get your refund. You can file as soon as the IRS starts accepting returns in January.

- Use IRS Free File: If you make under $73,000 a year, you can file for free using IRS Free File.

- Claim All Available Credits: Make sure to claim all credits for which you qualify, such as the Child Tax Credit or Earned Income Tax Credit. The more credits you claim, the larger your refund could be.

- Consult a Tax Professional: If your tax situation is complicated, consider consulting a tax professional to ensure you maximize your refund. Especially for those with investments, business income, or unique deductions, professional advice can save you money.

- Take Advantage of Deductions: Deductions for student loans, medical expenses, mortgage interest, and charitable contributions can all reduce your taxable income, potentially leading to a larger refund.

Avoiding Scams and Staying Safe Online

As with any financial situation, it’s important to be cautious and avoid scams. Many fraudulent websites and messages claim that you’re eligible for a stimulus check or refund, but they are looking to steal your personal information or money. Here’s how to stay safe:

- Don’t trust unsolicited messages: If you receive an email or text claiming that you’re eligible for a stimulus check, check it carefully. The IRS never contacts people by text or email to offer direct payments.

- Beware of fees: Don’t pay anyone to receive your stimulus or tax refund. The IRS never charges a fee to issue payments.

- Use official channels: Always visit the IRS website directly at IRS.gov or contact them through official phone numbers. Avoid clicking on links from unverified sources. Be cautious about emails or phone calls that ask for your personal information or banking details.

Federal $2000 Deposits Coming in January 2026: Guide for Eligible Beneficiaries

Stimulus Payment January 2026, IRS direct deposit relief payment & tariff dividend fact check

Tax Refunds Could Be Bigger in 2026 — Here’s When the IRS Will Start Accepting Returns