$2,000 Refunds Coming: In 2026, U.S. businesses could be receiving significant refunds thanks to the Visa-Mastercard class action settlement. After years of legal battles, businesses that processed credit card payments between 2004 and 2019 through Visa or Mastercard are eligible to receive a portion of a $5.54 billion settlement. These refunds, which could reach as much as $2,000 or more, come as a result of a class action lawsuit claiming Visa and Mastercard colluded to keep interchange fees — or swipe fees — too high. So, if you’re a business owner who accepted Visa or Mastercard payments during this period, there’s a good chance you might be eligible for a refund. But before you get too excited about the potential for a $2,000 check, there are some key things to understand about how this settlement works, who qualifies, and how to claim your share. Let’s dive into all the details so that you can take full advantage of this opportunity.

Table of Contents

$2,000 Refunds Coming

The Visa-Mastercard class action settlement provides a significant opportunity for eligible U.S. businesses to claim a share of $5.54 billion in refunds. With potential payouts of up to $2,000 or more for smaller businesses, it’s essential that you act quickly, gather the right documents, and submit your claim before the February 2025 deadline. This could be a chance to recover some of the fees that Visa and Mastercard charged over the years. Don’t miss out!

| Key Data & Information | Details |

|---|---|

| Settlement Amount | $5.54 billion |

| Eligible Parties | U.S. businesses that accepted Visa or Mastercard payments from 2004–2019 |

| Claim Period | Claims must be filed by February 4, 2025 |

| Refund Estimates | Up to $2,000 for some small and medium-sized businesses |

| Refund Distribution Date | Initial payments expected in February 2026 |

| Official Source | Payment Card Settlement |

What’s the Visa-Mastercard Settlement All About?

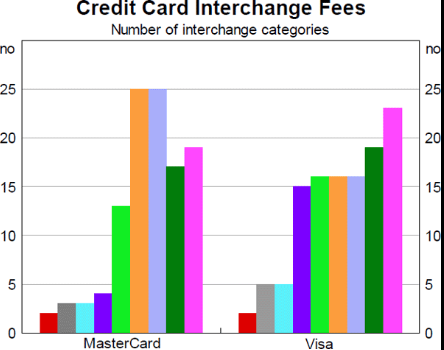

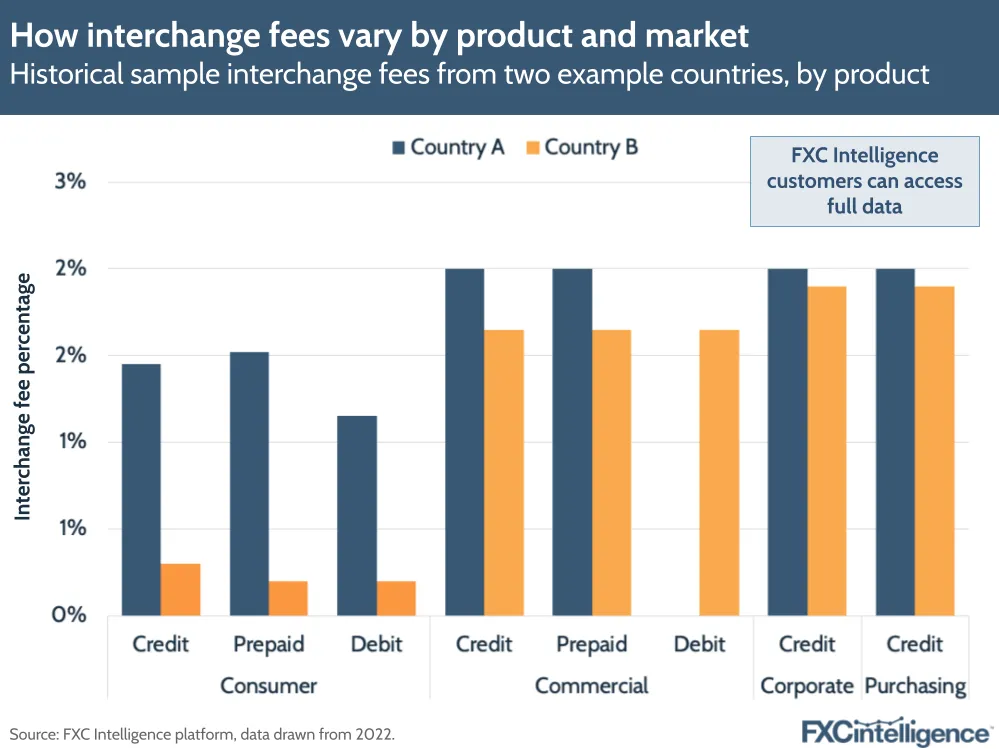

The settlement stems from a class action lawsuit filed by U.S. merchants against Visa, Mastercard, and several banks in 2012. The merchants accused these companies of collaborating to fix interchange fees, which are the fees businesses pay when processing credit card transactions. Essentially, the lawsuit argued that Visa and Mastercard had been illegally inflating the swipe fees over the years, ultimately costing businesses — especially small ones — more money.

Visa and Mastercard are major players in the global payments market, processing billions of transactions every year. Because they control so much of the payment infrastructure, merchants are left with little choice but to accept their terms, including the high swipe fees. According to the lawsuit, these fees were set at artificially high levels, leaving businesses with no competitive options to lower their costs.

In 2019, the parties involved reached a $5.54 billion settlement. However, the process to actually distribute the funds to eligible businesses has taken several more years, with the claims process set to conclude in 2026.

The Legal Journey: Why Did $2,000 Refunds Coming Take So Long?

While a billion-dollar settlement sounds straightforward, the process was far from quick. Class action lawsuits like this one often take years to resolve due to several factors, including lengthy legal battles, appeals, and settlement negotiations. The sheer complexity of the case, involving multiple large corporations and thousands of small businesses, meant that it would take time to reach a fair settlement.

The settlement reached in 2019 was the result of years of negotiation and court proceedings, and the distribution process itself was designed to ensure that only businesses that were truly affected would be able to participate. For that reason, businesses had to wait through a multi-step process, including claims verification and legal challenges, before funds would actually be distributed.

Now, as we head into 2026, businesses can start receiving payouts, but the process is still ongoing, and it’s crucial for eligible businesses to act before the February 2025 deadline.

Who’s Getting Paid and How Much?

The $5.54 billion settlement is not a flat payout for all businesses. The amount each eligible business receives depends on how much card processing volume it had between 2004 and 2019. The general rule of thumb is: the higher the card processing volume, the larger the potential payout.

For example, a large retailer that processed millions of dollars in Visa and Mastercard transactions will likely receive a larger refund than a small coffee shop that only processed a few thousand dollars in credit card transactions.

Some businesses could receive as much as $2,000 or more, while others may receive a smaller amount based on their individual processing history. According to official settlement information, the payout is intended to compensate businesses for the fees they paid over the years, but the distribution will vary based on the overall transaction volume each business processed.

How Much Can Your Business Expect?

To help illustrate this, let’s look at a few examples:

- A large national retailer: If your business was a large retailer that processed millions of dollars annually in Visa and Mastercard payments, your business might receive a payout close to the maximum amount, possibly in the $10,000 or more range, depending on the total number of claimants and the total settlement amount.

- A small service provider: A small service business, like a local mechanic or a hair salon, that processed fewer card payments may receive anywhere between $500 to $2,000.

The exact amount depends on how many other businesses file claims, so if fewer businesses file, the payouts could be slightly higher for those that do. The important thing is that businesses must submit their claims by February 4, 2025, to be eligible for the distribution.

How the $2,000 Refunds Coming Were Calculated?

The $5.54 billion settlement is divided among businesses based on their card processing volume during the class period (2004-2019). The process is complex, but the main idea is that the more you processed, the higher the payout.

Each business’s share of the settlement is calculated by comparing its processing volume to the total processing volume of all the businesses that file claims. For instance, if your business processed $100,000 in card transactions during the settlement period and the total claims volume across all businesses is $1 billion, your business might receive 0.01% of the total settlement pool.

However, the actual percentage or payout calculation is not publicly available, and only businesses that file a claim will know their exact payout once the claims process is complete.

How to File a $2,000 Refunds Coming Claim: A Step-by-Step Guide

If you think your business qualifies for a refund, follow these steps to file your claim:

Step 1: Check Eligibility

Before you start the claims process, ensure that your business accepted Visa or Mastercard payments during the class period (2004-2019). If your business did, you might be eligible for a payout.

Step 2: Gather Transaction Records

You’ll need to provide records showing your business’s card processing volume during the class period. This may include bank statements, payment processor records, or transaction logs. If you used a third-party processor, reach out to them for the relevant information.

Step 3: Submit Your Claim

Go to the official Payment Card Settlement website and fill out the claim form. Include all the necessary details, including your business’s processing volume, contact information, and any supporting documentation.

Step 4: Double-Check for Accuracy

Before submitting your claim, review it carefully to make sure that all information is accurate and complete. Missing or incorrect information could delay your claim or lead to its rejection.

Step 5: Wait for the Distribution

After submitting your claim, it will be reviewed by the settlement administrators. Once it’s processed and approved, you’ll receive your payout. The initial payments are expected to begin in February 2026.

Potential Challenges and Pitfalls to Watch Out For

As with any large settlement, there are potential challenges businesses should be aware of when filing a claim:

- Missed Deadlines: If you miss the February 4, 2025 deadline, your business will likely not receive any payment. Don’t delay — make sure your claim is submitted on time!

- Incomplete Claims: Be thorough when filling out your claim. If your submission is incomplete or missing important documentation, it could be delayed or rejected.

- Ineligible Businesses: If your business didn’t accept Visa or Mastercard payments during the settlement period, you won’t be eligible for the settlement. Be sure to double-check your transaction history to confirm your eligibility.

$33 Million Wells Fargo Settlement: Who Qualifies for the Subscription Billing Payout?

Cash App $12.5M Settlement: $147 Payments and Eligibility Details

23andMe Data Breach Class Action Settlement – Apply to Claim $100-$10,000, Check Eligibility