$2,000 Direct Deposits Are Official: If you’ve been scrolling through TikTok, Facebook, or YouTube lately, you may have come across some flashy headlines like: “$2,000 Direct Deposits Are Official — IRS Sets Start Date for Massive Payouts!” Sounds great, right? But let’s be clear: there is currently no official IRS program that sends a $2,000 direct deposit to all Americans. That’s a rumor. It’s not real. There’s no law backing it, and the IRS has made no official announcement on any such payment. That might be disappointing if you were counting on a little extra cash — especially with inflation still biting hard. But instead of chasing rumors, let’s get the facts straight, understand what’s really happening, and talk about what you can do right now to get legitimate financial help.

Table of Contents

$2,000 Direct Deposits Are Official

We all want a break. And seeing posts about the IRS sending out $2,000 checks can feel like a breath of fresh air. But as it stands today, there is no official $2,000 direct deposit from the IRS. No law, no official date, and no approved funding. Here’s what you can do:

- Stay informed through official .gov sources

- File your taxes to claim legitimate refunds and credits

- Tap into state/local resources if you’re in need

- Don’t give your info to scammers who prey on hope

When in doubt, trust the facts, not the feed.

| Topic | Current Status |

|---|---|

| Official $2,000 IRS Program? | No — Not announced or passed into law |

| Congressional Approval? | No — No stimulus or relief package includes this |

| IRS Confirmation? | No — IRS newsroom has no update on this |

| Real IRS Payments Still Happening? | Yes — Refunds, tax credits, benefits |

| Tariff Dividend Proposal? | Yes — Proposed by Donald Trump, but not law |

| Where to Get Reliable Updates | https://www.irs.gov/newsroom |

Where Did This $2,000 Direct Deposits Claim Come From?

Let’s get into the weeds. The rumor began circulating in late 2025, fueled by:

- Social media posts promising “relief checks”

- Clickbait blog articles with misleading titles

- A proposal floated by former President Donald Trump about a potential “tariff dividend” — a concept where tariff revenues collected from foreign imports would be distributed to American citizens

While the idea of a tariff dividend sounds great, there are three major problems:

- It hasn’t been passed into law.

- It lacks funding or administrative infrastructure.

- There is no published timeline.

In short, it’s a political talking point, not a real government-backed relief plan.

History of IRS Direct Deposit Relief Payments

To understand the confusion, let’s rewind the clock.

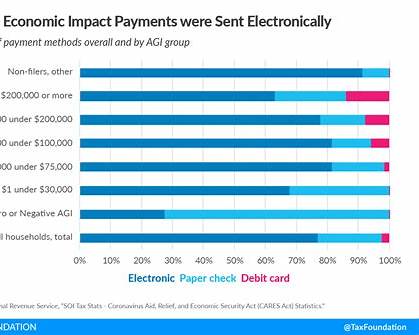

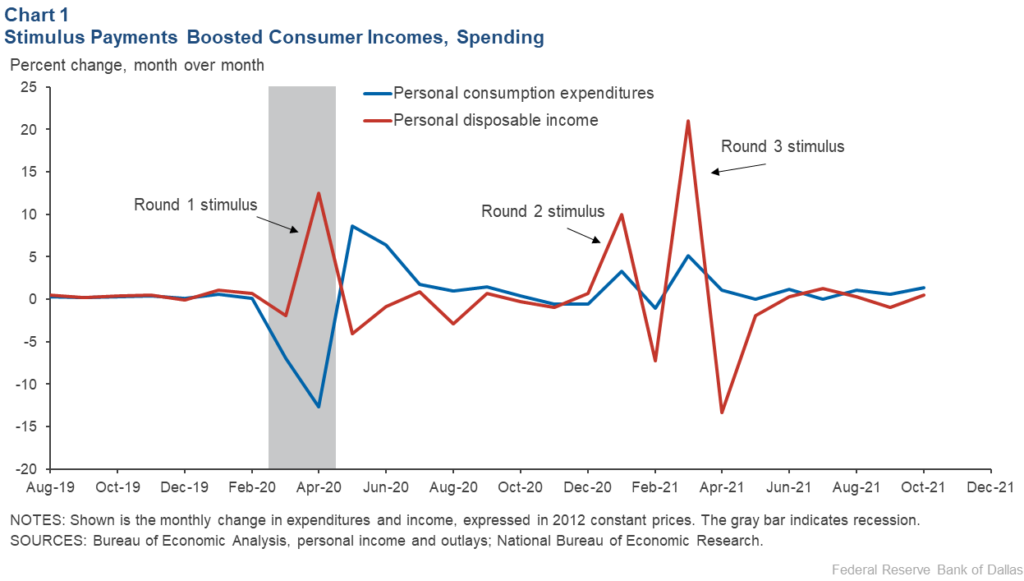

During the COVID-19 pandemic, the U.S. government approved three rounds of Economic Impact Payments (stimulus checks):

- CARES Act (March 2020): $1,200 per adult + $500 per child

- Relief Bill (December 2020): $600 per adult

- American Rescue Plan (March 2021): $1,400 per adult + more for dependents

These were real payments, backed by law, sent out by the IRS primarily through direct deposit. Americans saw this money hit their accounts quickly — and it created a lasting expectation.

But unlike then, there is no such program active today. No law, no payout, no schedule.

What the IRS Is Actually Sending Right Now?

Just because the $2,000 deposit rumor isn’t real doesn’t mean the IRS isn’t doing anything. In fact, the IRS is constantly disbursing legitimate funds to millions of Americans through:

1. Federal Tax Refunds

Every year, over 160 million Americans file tax returns. According to the IRS, the average refund in 2023 was around $2,753.

If you’re owed money, and you’ve set up direct deposit, the IRS will send it directly to your bank account — often within 21 days of filing.

2. Earned Income Tax Credit (EITC)

Low-to-moderate income workers may qualify for the EITC, which can be worth up to:

- $600 for childless workers

- Over $7,000 for families with multiple kids

3. Child Tax Credit (CTC)

Families can receive up to $2,000 per qualifying child, some of which may be refundable as a lump sum.

4. Recovery Rebate Credits (2021 tax catch-up)

If you didn’t receive your stimulus checks from 2020 or 2021, you can still claim them via your tax return using the Recovery Rebate Credit.

The Real Danger: Scams & Misinformation

Scammers love viral rumors. Once people start believing in “free money,” phishing emails and fake text messages aren’t far behind.

They often look like:

- “You’ve been approved for your $2,000 stimulus! Click here.”

- “IRS needs to verify your account info to deposit your payment.”

- “Act fast to claim your relief fund!”

The IRS does NOT email, text, or DM you on social media. All legitimate communication comes by mail or secure IRS portals.

How to Fact-Check $2,000 Direct Deposits Claims?

Here’s your quick cheat sheet to avoid getting duped:

1. Go Directly to the IRS

Always verify news through https://www.irs.gov

2. Check Recent News Releases

Use the IRS newsroom to see actual updates

3. Watch for .GOV Domains

Only trust .gov sites — they are official government resources.

4. Follow Reputable Media Outlets

Check real news coverage from:

- Reuters

- Associated Press

- USA Today Fact Check

What If You Really Need Help Right Now?

While there’s no $2,000 check coming your way (yet), there are ways to get financial support today.

Federal Resources

- Benefits.gov: Explore housing, food, unemployment, and energy assistance

- LIHEAP: Energy bill assistance

- SNAP: Food assistance

State-Level Help

Most states offer rental relief, food banks, or grant programs. Search “[Your State] + relief programs” on Google or go to your state’s official government website.

Nonprofits

Organizations like United Way (dial 2-1-1) can connect you with:

- Emergency cash assistance

- Utility payment help

- Job training programs

$1,800 IRS Direct Deposit in January 2026 – Who Is Eligible This Time

Tax Refunds Could Be Bigger in 2026 — Here’s When the IRS Will Start Accepting Returns

Stimulus Payment January 2026, IRS direct deposit relief payment & tariff dividend fact check