$1,350 CRA Payment Dropping: If you’ve been anywhere near the internet lately, you’ve likely seen this headline pop up: “$1,350 CRA Payment Dropping January 2026.” Sounds like a big win, especially with rising grocery bills, power costs, and rent stress. But is it real? Is it a one-time bonus? Is it taxable? And most importantly — can you get it? This article breaks down everything Canadians need to know about the rumored $1,350 CRA payment in January 2026, separating fact from fiction while helping you prepare for what’s actually coming. Whether you’re a student, single parent, senior, or low-income worker — read on for real insights, eligibility guidelines, practical tips, and CRA payment breakdowns.

Table of Contents

$1,350 CRA Payment Dropping

There’s no doubt — January 2026 will be a heavy payment month for millions of Canadians. But don’t be misled: the $1,350 CRA payment is not a one-time bonus, it’s a sum total of recurring, scheduled benefits. Still, that’s real money in the bank for those who qualify. So whether you’re working two jobs, living on a pension, or raising a family — this is your sign to file early, stay updated, and keep your info accurate. Don’t leave a dime on the table.

| Feature | Details |

|---|---|

| Claimed Amount | $1,350 (not a lump sum, but combined benefits) |

| Payment Timeline | January 5 – January 20, 2026 |

| Benefit Programs | GST/HST Credit, CCB, ACWB, Trillium, Provincial Rebates |

| Official Status | Not a standalone payment — combined deposits from scheduled programs |

| Eligibility | Low/moderate income Canadians who filed a 2024 tax return |

| Application Needed? | No — benefits are issued automatically based on tax data |

| Taxable? | No — most CRA benefits are tax-free |

| Estimated Income Limits | <$45,000 individual / <$65,000 family (varies by program and province) |

| CRA Account Required? | Strongly recommended (for tracking and direct deposit setup) |

| Direct Deposit? | Yes — preferred method for faster payments |

| Official CRA Website | canada.ca/revenue-agency |

Understanding the $1,350 CRA Payment Dropping — What It Is (and Isn’t)

Let’s clear the air: the CRA has not announced a special $1,350 one-time cheque for January 2026. This figure is likely the result of combined benefit payments being distributed throughout the month for qualifying Canadians — not one giant lump sum.

News outlets like SVNEdu and BSEBScrutiny have reported that low- and middle-income earners may receive CRA deposits totaling around $1,350 in January, depending on eligibility for multiple programs.

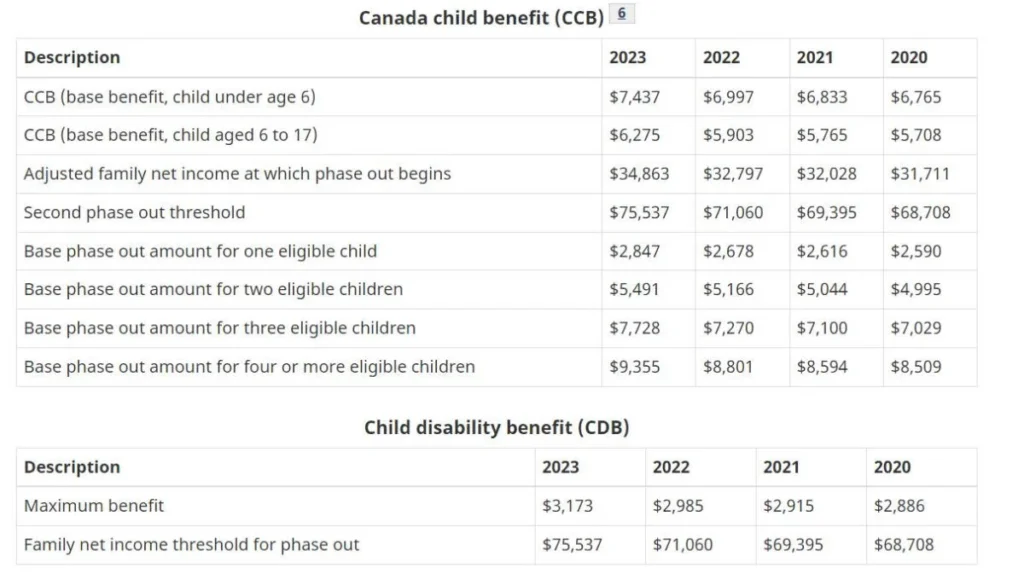

Breakdown of Where the $1,350 Comes From:

If you qualify for multiple CRA benefit programs, your January payments could look something like this:

| Program | Estimated Payment (Jan 2026) |

|---|---|

| GST/HST Credit | $275 |

| Canada Child Benefit (CCB) | $600+ (for 2+ kids) |

| Advance Canada Workers Benefit | $300–400 |

| Ontario Trillium Benefit | ~$200 |

| Estimated Total | $1,350+ |

These amounts vary based on your income, province, family size, and tax filing history.

CRA Benefit Payment Dates – January 2026

Here’s when these benefits are expected to hit your account:

| Date | Benefit |

|---|---|

| Jan 5, 2026 | GST/HST Credit |

| Jan 9, 2026 | Ontario Trillium Benefit |

| Jan 12, 2026 | Advance Canada Workers Benefit |

| Jan 20, 2026 | Canada Child Benefit (CCB) |

Each benefit is paid out separately by direct deposit or mailed cheque, depending on how your CRA account is set up.

Who’s Eligible for $1,350 CRA Payment Dropping?

While there’s no “one-size-fits-all” eligibility, the following groups are most likely to benefit from CRA payments in January 2026:

1. Low- to Moderate-Income Individuals

Income thresholds vary by program, but generally:

- Individual: <$45,000/year

- Families: <$65,000/year

2. Parents with Children

For the Canada Child Benefit (CCB), you must:

- Live with a child under 18

- Be primarily responsible for their care

- File taxes annually (even with $0 income)

3. Working Canadians (Low-Wage Earners)

The Canada Workers Benefit (CWB) provides up to $1,428 annually for singles or $2,461 for families. In 2026, 50% of this is paid in advance, spread across January, July, and October.

4. Seniors or Individuals with Disabilities

Programs like:

- Guaranteed Income Supplement (GIS)

- Old Age Security (OAS)

- Disability Tax Credit (DTC)

also continue to deliver monthly support, though not part of the $1,350 pool directly.

5. Residents of Provinces with Rebates

Programs like the Ontario Trillium Benefit, BC Climate Action Tax Credit, or Alberta Affordability Payments may add up in the same month.

You don’t have to apply separately — CRA automatically assesses eligibility based on your most recent tax return.

How to Prepare and Ensure You Get $1,350 CRA Payment Dropping?

Want your share of the January 2026 benefits? Follow this plan now:

Step 1: File Your 2024 Tax Return (by April 30, 2025)

Your 2024 income return is the key to unlocking all benefits in 2026. Even if you made zero income — file it. CRA needs it to assess eligibility.

Step 2: Enroll in Direct Deposit

Sign up at your bank or directly through CRA to avoid delays and get paid faster.

Step 3: Update CRA My Account

Make sure your address, banking info, marital status, and dependents are accurate.

Step 4: Check Your Provincial Program Eligibility

Visit your province’s tax site or Service Canada to check for:

- Rent/utility rebates

- Climate credits

- Child assistance top-ups

Real-Life Example: How a Family Reaches $1,350+

Meet Linda, a 34-year-old single mom with two kids in Winnipeg. She earned $39,000 in 2024. In January 2026, she receives:

- $600 from CCB

- $275 from GST/HST

- $325 from ACWB advance

- $200 Manitoba Family Affordability Credit

Total: $1,400 — and all tax-free.

Linda didn’t apply for anything extra. She just filed taxes, updated CRA My Account, and kept her info current.

Is This a One-Time CRA Payment?

Short answer: no. It’s not a new emergency relief like CERB or the 2023 Grocery Rebate.

Rather, it’s:

- A convergence of recurring federal/provincial benefits in one calendar month

- Based on 2024 income

- Scheduled and distributed through existing CRA benefit infrastructure

This model is consistent with how the CRA has delivered support post-pandemic: not through lump sums, but through enhanced or stacked regular benefits.

What About Seniors and Fixed-Income Canadians?

Seniors won’t get the $1,350 combo unless they qualify through dependents or ACWB. However, they still benefit from:

- OAS (Old Age Security): Up to $713/month

- GIS (Guaranteed Income Supplement): Up to $1,065/month extra

- CPP Enhancements: Based on contributions and age

Is the $1,350 CRA Payment Taxable?

Nope. The CRA benefits in question — GST/HST, CCB, CWB, Trillium — are 100% tax-free. They won’t reduce your refund or increase your tax bill.

Even better? You don’t report these as income on your return.

The only catch: you must file taxes yearly to keep the benefits flowing.

Canada Quietly Raises Medical Inadmissibility Cost Threshold for 2026

4 CRA Benefits Payments in January 2026 – Check Eligibility Criteria & Payment Date