$1,000 Direct Payment: In a time when everyone is feeling the pressure of rising costs, the possibility of receiving $1,000 in direct payments is a topic that has caught the attention of many Americans. Whether it’s for inflation relief, economic recovery, or special one-time payments, these funds can make a significant difference in someone’s life. But how can you access these payments? Who qualifies, and when should you apply to ensure you don’t miss out on this opportunity? If you’re one of the many looking for answers to these questions, this article has you covered. Let’s break down everything you need to know about the $1,000 direct payment opportunity — who’s eligible, how to apply, and most importantly, the deadlines you need to be aware of. By the end of this article, you’ll know exactly what to do to ensure you get the payment you deserve.

Table of Contents

$1,000 Direct Payment

The opportunity to receive $1,000 in direct payments can offer much-needed financial relief, but it’s essential to understand the eligibility requirements and deadlines that vary by state. Whether you’re in Alaska, California, New York, or another state offering relief programs, make sure to apply on time and gather all the required documents. By following the steps outlined in this guide, you can increase your chances of receiving your payment and ensure that you’re not left behind. Remember to always check the official state websites for the most current information. These payments are designed to help, so don’t let the opportunity slip away!

| Key Information | Details |

|---|---|

| Amount of Payment | Up to $1,000 |

| Eligible Recipients | Varies by state and program |

| Deadline for Application | Deadlines vary, typically within the first quarter of the year (check local guidelines) |

| Key Eligibility | Proof of residency, income thresholds, specific state requirements |

| How to Apply | Online portals, direct applications through state websites |

| Official Reference | U.S. Government IRS official site |

What Is $1,000 Direct Payment?

The term direct payment often refers to cash payments sent directly to individuals or households by state or federal governments, typically as a relief measure in times of economic hardship. While the federal government no longer issues universal stimulus checks, some states continue to offer direct payments in the form of inflation relief checks, tax rebates, or annual dividends. These payments are designed to assist individuals and families with rising living costs, help cover expenses, or serve as a temporary income boost.

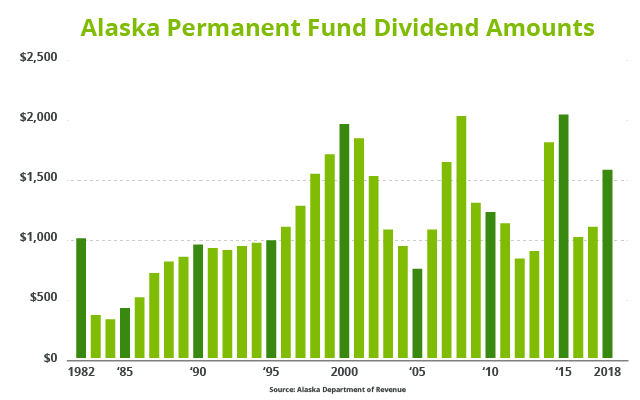

For example, Alaska offers a $1,000 Permanent Fund Dividend (PFD) annually to its residents. Similarly, states like California and New York have implemented their own stimulus checks or rebates in response to the pandemic’s economic effects. These payments can be a godsend for people facing financial strain, but it’s essential to know exactly who qualifies for these payments, how to apply, and when to do so.

How Does the $1,000 Direct Payment Work?

If you’re looking to get your hands on this direct payment, the first thing you need to know is that eligibility requirements differ by state and payment program. Some states distribute relief payments automatically to those who meet certain criteria, such as income levels, tax filings, or residency. Other states may require you to apply or meet specific deadlines.

Let’s break it down with a few examples:

Alaska’s Permanent Fund Dividend (PFD)

Each year, the state of Alaska distributes a dividend to all eligible residents, funded by the Alaska Permanent Fund (a state investment fund primarily derived from oil revenues). This payout typically ranges from $1,000 to $2,000 per person.

Who qualifies for the Alaska PFD?

- Full-year residency: To be eligible, you must have lived in Alaska for a full calendar year before the payout date and intend to remain in the state.

- Application: Residents must file their application through the official myPFD portal, available on the state’s website.

When should you apply?

- Most applications must be submitted by March 31 of each year for that year’s payout. However, if you miss the deadline, late applications may still be accepted in some cases, but you’ll need to check with the state’s guidelines.

California and New York Relief Payments

States like California and New York also provide inflation relief payments or tax rebates. These payments are often issued automatically, but you may still need to meet certain income eligibility thresholds or file your state tax return.

For instance:

- California’s Middle-Class Tax Refund: In 2022, Californians who met income criteria received payments between $200 and $1,050.

- New York’s Inflation Relief Payment: Eligible New Yorkers may receive checks based on their income and tax filing status.

Who Qualifies for the $1,000 Direct Payment?

While the exact eligibility requirements will depend on the specific program in your state, there are a few common factors that typically determine whether or not you qualify for direct payments:

1. Residency

In many cases, you must be a resident of the state offering the payment. For instance, Alaska’s PFD and California’s inflation relief check require that recipients be residents of that state for a certain amount of time before the payment is issued. This often means you must have lived in the state for a full year before the payout date.

2. Income Levels

Some states, such as California and New York, base eligibility on income levels. People who make below a certain income threshold (based on the state’s tax filings) will likely qualify for these payments. You may be asked to submit proof of income, such as your tax return or other official documents.

3. Tax Filing Status

Your tax filing status may also impact whether you receive a payment. If you’ve filed taxes in a given year and meet the state’s income guidelines, you’re more likely to qualify. Some states issue payments based on your filing status, such as single, married, or head of household.

4. Special Circumstances

Some programs may have additional eligibility requirements for seniors, disabled individuals, or low-income families. If you fall into any of these categories, you may be eligible for a higher payout or priority processing.

How to Apply for the $1,000 Direct Payment?

Now that you know who qualifies, it’s important to understand how to apply for these payments. While some states automatically issue payments, others may require that you apply through an online portal or submit documentation.

Step 1: Check Your State’s Eligibility Requirements

Start by visiting your state’s official government website. Most states will have a dedicated page for the relief payment or tax rebate program. Make sure you check eligibility criteria, deadlines, and any necessary documentation required for applying.

For instance:

- Alaska’s PFD requires you to apply through the myPFD portal. Make sure to meet all deadlines to qualify for this year’s payment.

- California and New York have automatic payments for those who qualify, but filing your state tax return is essential.

Step 2: Gather Your Documentation

Once you’ve determined you qualify, gather all the necessary documentation. This might include:

- Tax returns (for income verification)

- Proof of residency (such as a driver’s license or utility bill)

- Social Security Number (for verification)

Step 3: Submit Your Application

For states that require an application, submit your completed forms online through the state’s official portal. Make sure to double-check that you’ve entered the correct information, and keep a copy of your application for your records.

If the payment is automatic (like in California or New York), ensure that you’ve filed your taxes for the relevant year to get the payment.

Step 4: Watch for Updates

Once you’ve submitted your application, keep an eye on updates from your state’s tax authority. You’ll likely receive an email notification or status update once your payment is processed and issued.

IRS Confirms $2,000 Direct Deposit Coming in January 2026 — Check Dates, Deadlines & Who Qualifies!

$2000 Stimulus Check in January 2026: Check Eligibility, and Payment Status

USAA VA Disability Direct Deposit January 2026 – Expected Payment Dates and What to Know